MileValue is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

Note: Some of the offers mentioned below may have changed or are no longer be available. You can view current offers here.

Avianca LifeMiles has introduced new (cheaper) award prices to fly shorthaul flights within the continental United States on United. Before, Avianca’s domestic award prices were market standard–12,500 miles one way from anywhere to anywhere. Now you can get from one part of the country to another for as little as 7,500 miles.

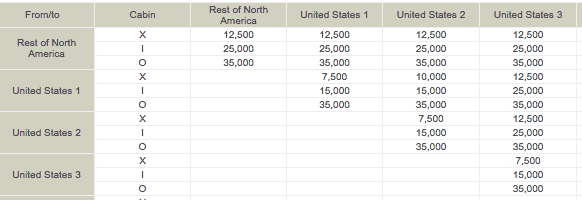

Here are Avianca’s prices to fly within the United States on United.

X = Economy, I = Business, and O = three-cabin First Class.

United States 1 is defined as:

- Connecticut

- New Jersey

- North Carolina

- New York

- South Carolina

- New Hampshire

- Delaware

- Ohio

- Kentucky

- Pensilvania

- Maine

- Rhode Island

- Maryland

- Vermont

- Massachusetts

- Virginia

- Michigan

- Washington, D.C.

United States 2 is defined as:

- Alabama

- Kansas

- Texas

- Arkansas

- Louisiana

- Wisconsin

- North Dakota

- Minnesota

- South Dakota

- Mississippi

- Florida

- Misourri

- Georgia

- Montana

- Illinois

- Nebraska

- Indiana

- Oklahoma

- Iowa

- Tennessee

United States 3 is defined as:

- Arizona

- California

- Colorado

- Idaho

- Nevada

- New Mexico

- Oregon

- Utah

- Washington

- Wyoming

You can fly within any of those regions for 7,500 LifeMiles one way in United economy. You can fly from United States 1 (mostly the northeast) to United States 2 (mostly the southeast and some of the midwest) for 10,000 LifeMiles one way in United economy.

Travel across the country (1 to 3) costs the same as it did before (12,500 LifeMiles).

What’s really cool is that, unlike domestic shorthaul awards booked with British Airways Avios, those prices don’t only apply to single segments. You can book a flight with a connection within any of the regions or between them for the price listed in the chart.

Why This News Excites Me Personally

I am cut off from earning United miles by the Chase 5/24 rule. I can use other Star Alliance miles transferred over from my various points stashes to book United flights, like Singapore for example, but no one else I’m aware of has cheap shorthaul domestic award prices like these. Avianca’s new award chart gives me the opportunity to redeem less points for trips around the US when I need to fly United.

How to Get Avianca LifeMiles

- Buy them when they’re on sale

- Transfer in from Starwood Preferred Guest

- Avianca Vuela Visa

Buy them when they’re on sale

Avianca has periodic sales of their miles for good prices. The cheapest I’ve ever seen LifeMiles was 1.32 cents each. It’s common to see LifeMiles on sale with a 125% bonus, and sometimes you’ll even get 140% bonus. The most recent 125% bonus was in September.

Depending on the circumstance, it could very well be a better deal to buy LifeMiles to redeem on shorthaul domestic flights than pay cash for them–especially last minute flights or routes that just tend to be pricier in general. We’ll give you a heads up here the next time LifeMiles are on sale.

Transfer in from Starwood Preferred Guest

You can transfer SPG points earned by the Starwood Preferred Guest American Express cards to Avianca LifeMiles 1:1. And just like with every transfer to an airline partner, you’ll get 5,000 bonus miles from SPG for every 20k increment transferred.

And the Starwood Preferred Guest Business Credit Card from American Express is out with a temporarily elevated sign up bonus. By spending $6,000 on the card within three months of opening it, you’ll earn 25,000 SPG Starpoints. Spend an additional $4,000 on the card within six months of opening it and you’ll earn an additional 10,000 SPG Starpoints, for a total of 35k bonus points.

Credit card links have been removed from posts and added to the menu bar at the top of every page of MileValue under the heading Top Travel Credit Cards

Avianca Vuela Visa

Banco Popular has a Avianca co-branded credit card called the Avianca Vuela Visa. You can read details about the card in New Avianca Vuela Visa: 60k LifeMiles After Just One Purchase. I’m not sure if it’s still possible to get the 60k bonus however, as I don’t see a promo code box on the application anymore. Flyertalkers in this thread also report having trouble finding it, not to mention trouble with using the card/getting approved to begin with, so proceed with caution.

Avianca Doesn’t Charge Close-in Booking Fees

While it’s still possible to avoid the United close-in booking fee with this trick, you don’t have to go through the process of the trick if you use LifeMiles as Avianca doesn’t charge a fee for booking an award at that last minute.

Big Caveat

Even though the new award chart has cheaper prices than what Avianca used to charge for shorthaul domestic awards, currently Avianca’s website is still returning the old price pf 12,500 miles for every domestic award (at least every time I tried). One Mile at a Time got the LifeMiles website to show the new, cheaper prices, but I’m not sure how.

This Flyertalk thread describes some issues with the LifeMiles website’s new user interface, not including the issue I had of being quoted old prices but instead with LifeMile’s blocking Star Alliance (like United) award space. So there appears to be some kinks in the system right now. Hopefully they will smooth over soon–I will keep an eye on it and update this post when I see a change. If someone else knows a workaround, please share!

Bottom Line

Avianca released new award prices for flying shorter distances within the United States. You can redeem as little as 7,500 Avianca miles between two states now (within any of the regions defined above). This is good news for a number of reasons, like:

- You can often buy Avianca miles cheaply, so this could be a cheaper way to book a United ticket than buying it out right in cash

- If you’re cut off from United miles (like me!) by Chase’s 5/24 rule, you can pay less points to travel around the United States on United than by redeeming Singapore miles (with the exception of booking transcontinental Business Class… you’d still want to use Singapore miles for that)

- You can book last minute awards sans close-in booking fee without having to jump through hoops to avoid United’s close-in booking fee

Check out the new shorthaul award chart here.

At the moment, this news is still theoretical. To me it doesn’t look like you can book the cheaper shorthaul domestic awards yet on lifemiles.com due to whatever reason–perhaps the new user interface. Hopefully these issues will clear up soon.

If you have successfully booked a new shorthaul award on United with LifeMiles,please share your experience in the comments!

Just getting started in the world of points and miles? The Chase Sapphire Preferred is the best card for you to start with.

With a bonus of 60,000 points after $4,000 spend in the first 3 months, 5x points on travel booked through the Chase Travel Portal and 3x points on restaurants, streaming services, and online groceries (excluding Target, Walmart, and wholesale clubs), this card truly cannot be beat for getting started!

Editorial Disclaimer: The editorial content is not provided or commissioned by the credit card issuers. Opinions expressed here are the author’s alone, not those of the credit card issuers, and have not been reviewed, approved or otherwise endorsed by the credit card issuers.

The comments section below is not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser’s responsibility to ensure all questions are answered.

I too had issues at first trying to get the new rates to come up. I found it you book through https://apps.lifemiles.com/book/flights the new rates appear. One thing I noticed, however, is there appears to be a $55 fee regardless of the segment booked instead of the $25 I think they usually charge. This applied to every booking I attempted, both close-in and far out.

strange, I’ve tried in multiple browsers and even incognito windows but cannot pull up that link you included