MileValue is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

There are many ways to earn travel miles and points, but none is as easy, quick, and cheap as opening up travel rewards cards. In particular, earning welcome bonuses on travel rewards cards is the number one way to rack up points and miles.

In this article, we’re covering the basics of travel rewards credit cards. We’ll look at key considerations to keep in mind when selecting a card, as well as how opening and closing credit cards can affect your credit score.

Don’t Get a Credit Card If…

Points and miles can fund your jet-setter dreams of first class flights, airport lounge access and complimentary hotel member status. Travel rewards credit cards are the bridge between you and these dreams.

However, there are some basic principles you need to follow to avoid some of the common pitfalls rookie credit card users experience.

Here are five principles to follow for a successful credit card strategy:

- Don’t get a credit card if you will spend more than you normally would in cash or with a debit card.

- Don’t get a credit card if you can’t earn the welcome bonus.

- Don’t get a credit card if you will not pay off your balance in full each month.

- Don’t get a credit card if you will need a major loan in the next 24 months (since the credit pull from opening a card stays on your credit report for up to 24 months).

- Don’t get a credit card if its bonus categories don’t align with your spending habits.

To sum up, you need to treat your credit card exactly like a debit card, ensuring you never pay interest and never overspend in pursuit of bonus points. Additionally, you need to pick a card that aligns with your spending habits, lifestyle and travel goals.

By adhering to these principles, you’ll accumulate points and protect and build your credit score, while offsetting annual fees with greater ease.

Credit Card Basics

If you’re set on getting a foothold in the world of miles and points, opening a credit card is your first step.

Before opening a card, you’ll first want to check your credit score. Experian can give you a quick rundown of your FICO score.

Checking your score enables you to determine what your options are. Most premium travel rewards credit cards require a minimum score of 700+.

If your score happens to fall below that, you should focus on beginner credit cards that aim to build your credit history by reporting your punctual balance payments to the major credit agencies.

Briefly speaking, there are four main factors to consider when selecting a card:

- The welcome bonus

- The bonus category spending rates

- Cardmember perks

- Annual fees

Notice what isn’t on the list: APR (annual percentage rate).

If you carry a balance, you’ll be charged APR. This is the cost of borrowing. The best strategy is to never want to carry a balance, so you’ll never end up paying APR.

Welcome Bonus

Travel rewards cards offer limited-time welcome bonuses with a minimum spend requirement. For example, a typical welcome bonus could be as follows: Earn 50,000 points for spending $1,000 on the card in the first three months after opening an account.

Welcome bonuses are one of the key ways to earn massive amounts of points. For instance, if spending $1,000 on a new card gets you 50,000 points, then you’re effectively earning 50X points per dollar. One of the keys to becoming a points-and-miles millionaire is earning a variety of welcome bonuses.

This means that you need to prioritize cards that offer lucrative welcome bonuses with minimum spending requirements that you can meet realistically, without having to overspend. Remember: overspending defeats the benefits (i.e. points and miles) earned in return.

The best strategy is to open a new credit card when you know that large expenses are coming up in the following months. Whether that’s capital for your business, college tuition fees, or insurance policy plans, timing card applications to align with periods of organic high expenditure is key for maximizing welcome bonuses.

Category Bonuses

After welcome bonuses, category bonuses are the next important consideration.

After all, once you’ve earned the welcome bonus, category bonuses will play a key role in determining the value of holding onto the card.

Category bonuses are simply the spending categories in which you will receive accelerated point earning. For example, a card may offer 4X points on grocery shopping, 2X points on gas and 1.5X points on all other purchases.

When selecting a card, it’s crucial that you select one with bonus categories that align with your spending habits.

For example, if grocery shopping, takeout and delivery purchases account for a considerable chunk of your monthly expenditure, selecting a card that offers these as bonus categories will increase your point-earning ability significantly.

Cards normally offer bonus category rewards in the form of points and miles or as cash back. Points can also be redeemed in the form of cash back toward your balance. Generally speaking, cash back helps to offset the cost of your spending, while points and miles can be leveraged to make travel cheaper.

Perks

Cardmember perks are another point for consideration.

Most travel rewards cards come with cardmember exclusive perks. This can range anywhere from special guest status at participating hotels to access to specific airport lounges and travel and consumer insurance protections.

Just as with category bonuses, ensure that the perks align with your lifestyle and travel goals.

For example, if you’re a frequent flyer, complimentary airport lounge access could be a massive benefit that would justify any annual fees on the card. In contrast, if car rental plays a frequent (and expensive) role in your vacations, card perks that give you free upgrades or certain discounts on car rental companies could be of significant value to you.

Annual Fees

We get it: nobody likes fees. This is often all the more so when it comes to travel rewards card beginners.

However, you shouldn’t be immediately put off by annual fees.

In fact, we can go as far to say that annual fee cards are always justified, as long as the return value of the card—in terms of points and perks—is greater than the annual fee.

Take The Platinum Card® from American Express, for example. It has one of the highest annual fees among premium travel rewards cards, standing at $695 (see rates & fees).

However, if you combine the value of statement credits the card offers, you’ll realize that you’re getting more than double the annual fee back—assuming you use all of these credits. Likewise, the Platinum card comes with complimentary access to the American Express Global Lounge Collection, as well as Marriott Bonvoy Gold Elite and Hilton Honors status (enrollment required).

So as long as you make the benefits and perks work for you, you can easily get far more back in value than you’ll lose on the annual fee.

Business Cards

Most travel credit cards have a near-identical business version. If you can open business cards, you can often double your points- and miles-earning opportunities.

Contrary to popular belief, you don’t have to have a huge, profitable or even incorporated business to open a business card. Often, your side gig will suffice to allow you to open a business card.

If you qualify as a sole proprietor, you can substitute your personal details for business details when applying for a business credit card.

In many cases, the ability to open a business credit card can help you in meeting minimum point thresholds that earn you special tiers and exclusive perks. For instance, opening a Southwest Rapid Rewards business card alongside a personal card, and earning welcome bonuses on both cards, can make earning a Southwest Companion Pass much easier.

Just keep in mind that business cards should be reserved for business related purchases only. Charging personal expenses on a business card makes separating your personal and business expenditures more difficult come tax season. It also puts you at greater risk, as many consumer protections don’t apply on business card transactions.

Card Application and Eligibility Rules

Depending on the card issuer, the application processes may differ as well as the rules for eligibility.

The most important rule to understand is the 5/24 rule from Chase. The rule stipulates that your card application will be denied if you’ve opened five or more consumer credit cards with any bank within the last 24 months.

Given that Chase offers some of the most lucrative cards as well as one of the most valuable point currencies, it makes sense to prioritize Chase cards in the beginning.

This is an example of a card issuer rule that massively influences your wider credit card strategy.

Chase is not alone in having its own rules.

For example, American Express applies the five-card rule, limiting you to holding a maximum of five personal and/or business credit cards at the same time (excluding cards without a preset limit.) It also has the 2-in-90 rule, which means you can be approved for a maximum of two American Express cards every 90 days. Likewise, Capital One, another premium travel rewards card issuer, limits you to holding a maximum of two Capital One cards simultaneously.

While this wide range of rules may feel overwhelming in the beginning, having a solid credit card strategy mitigates this and ensures you don’t get played by an application or eligibility rule.

How Credit Cards Affect Your Credit Score

Your credit score is a measure of your creditworthiness. Put simply, your credit score indicates your reliability and the likelihood that you’ll pay back your balance on time.

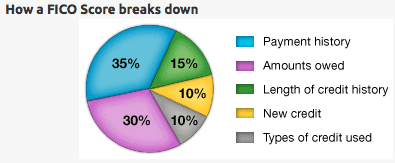

The three major credit bureaus in the United States—Equifax, Experian and Transunion—use either the FICO® model or the VantageScore® model when calculating your credit score.

Your credit score is expressed as a number between 300 to 850, whereby the higher your score is, the more likely you are to be approved for premium travel rewards credit cards—as well as loans and higher credit limits.

Applying for a Credit Card

Opening a credit card and using it responsibly is one of the best ways to boost your credit score. Punctual recurring payments indicate your financial reliability, building your credit score.

However, when you apply for a new credit card, it’s likely that your credit score will experience a temporary decrease. This is for two reasons:

- When you apply for a credit card, the card issuer will make a hard inquiry, requesting your credit report from one or more of the major credit bureaus. This causes a small drop to your credit score, normally anywhere between two to five points (in extreme cases, up to 10 points). The hard inquiry will stay on your credit report for up to 24 months, although the effect on your credit score should dissipate after 12 months.

- Your credit score is calculated using multiple factors, one of these being the overall average age of your accounts and lines of credit (15% for FICO). When you open a new credit card, the overall age of your accounts drops, which in turn can cause your credit score to decrease.

Luckily, these two effects cause only a short-term decrease to your credit score.

The positive long-term effect of paying off your balance in full consistently will offset the negative short-term effects of opening a new credit card.

On top of this, opening a new credit card increases your aggregate credit limit. Assuming your expenditure stays the same, this means your credit utilization ratio will decrease, boosting your credit score further.

For example, if your overall credit limit across all cards totaled $2,000, with a balance of $500, your credit utilization ratio would be 25%. If you applied and successfully opened a new card, boosting your overall credit limit to $3,000, your credit utilization ratio would drop to 16.7%. The lower your credit utilization ratio, the better the effect will be on your credit score. Generally speaking, it’s advisable to keep your utilization ratio to a maximum of 30% to protect your credit score.

Canceling a Credit Card

Broadly speaking, if it’s not absolutely necessary, you should always avoid canceling a credit card.

Canceling an existing credit card has two important implications:

- The overall age of your accounts will drop, causing your credit score to decrease. According to FICO, a canceled card will remain on your report for up to 10 years if it was positive, and up to seven years if it was negative. This means your credit score will be impacted after this time period passes, rather than immediately upon cancellation. In contrast, VantageScore doesn’t always include canceled accounts on your credit report, meaning the hit to your score could come earlier.

- Your aggregate credit limit across all cards will decrease, meaning your credit utilization will increase. The effect of this can be mitigated by ensuring you pay off all of your balances before canceling your card.

The older your card is, the greater the effect will be on your credit score when you cancel it. Likewise, the fewer accounts you have open, the greater the hit will be.

That being said, there are times when canceling a card is the most rational option.

Specifically, when the annual fee of the card costs you more than you receive in cardmember benefits, then it’s time to consider canceling your card. However, there are some options to consider before parting ways with your card, such as asking for a retention offer (fee waiver or reduction).

Check out our article about when to cancel a credit card for a deeper discussion of the pros, cons and safest way to go about canceling a credit card.

Final Thoughts

Overall, travel rewards credit cards are hugely rewarding. They allow you to build credit history while earning you points, miles and membership perks.

However, large rewards come only with a solid card strategy that takes application rules and restrictions into consideration, and which prioritizes cards that align with your current spending habits, lifestyle and travel goals.

When selecting a card, finding a lucrative welcome offer that you can realistically earn without overspending is key to amassing a large number of points.

Second to welcome offers are bonus categories. Selecting cards with bonus categories that suit your spending habits is crucial in making the card valuable in the long term and enabling you to accumulate points on everyday spending.

Analyzing the value of cardholder perks is the final step, as they will play a key role in offsetting the cost of the annual fee.

To learn more about getting started with credit card points and miles, check out our beginner’s first year plan and our best credit cards list.

Just getting started in the world of points and miles? The Chase Sapphire Preferred is the best card for you to start with.

With a bonus of 60,000 points after $4,000 spend in the first 3 months, 5x points on travel booked through the Chase Travel Portal and 3x points on restaurants, streaming services, and online groceries (excluding Target, Walmart, and wholesale clubs), this card truly cannot be beat for getting started!

Editorial Disclaimer: The editorial content is not provided or commissioned by the credit card issuers. Opinions expressed here are the author’s alone, not those of the credit card issuers, and have not been reviewed, approved or otherwise endorsed by the credit card issuers.

The comments section below is not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser’s responsibility to ensure all questions are answered.