MileValue is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. This site may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more. All values of Membership Rewards are assigned based on the assumption, experience and opinions of the MileValue team and represent an estimate and not an actual value of points. Estimated value is not a fixed value and may not be the typical value enjoyed by card members.

Chase Ultimate Rewards is one of the leading flexible rewards programs. Its currency—called Ultimate Rewards points—can be earned and redeemed in different ways. The flexibility of Ultimate Rewards allows individuals to earn and spend points in accordance with personal preferences and specific situations.

At the highest level, Ultimate Rewards points can be earned through Chase credit cards and related Chase offers and redeemed for cash back, gift cards, shopping, exclusive experiences and travel.

Ultimate Rewards points can be used for travel in two ways:

- Booking through Chase Travel℠

- Transferring points to partner airline and hotel loyalty programs and booking through those programs

How to Earn Ultimate Rewards Points

Since Chase Bank operates the Ultimate Rewards program, credit cards are the primary way to earn Ultimate Rewards points.

The following consumer cards earn Ultimate Rewards points:

- Chase Freedom (not available to new applicants)

- Chase Freedom Flex®

- Chase Freedom Unlimited®

- Chase Freedom Rise® Credit Card

- Chase Sapphire Preferred® Card

- Chase Sapphire Reserve®

The following Chase business cards earn Ultimate Rewards points:

- Ink Business Cash® Credit Card

- Ink Business Preferred® Credit Card

- Ink Business Plus® Credit Card (not available to new applicants)

- Ink Business Premier® Credit Card

- Ink Business Unlimited® Credit Card

- Sapphire Reserve for Business℠

Credit Card Welcome Bonuses

With multiple cards that earn Ultimate Rewards points, applying for new cards and earning welcome bonuses is a significant source of Ultimate Rewards for many points and miles enthusiasts.

Welcome bonuses and associated minimum spending requirements to earn bonuses vary by card and change over time. These offers have been as high as 125,000 points for consumer cards.

Of course, Chase wants to acquire new cardholders who will hold and use their cards for regular spending, and the bank has rules that govern the number and frequency of welcome bonuses provided to cardholders. These rules aren’t always published or absolute, and they change over time.

In conjunction with major changes in the Sapphire Reserve card and the introduction of the Sapphire Reserve for Business℠ card in June 2025, Chase seems to be moving away from some of their application rules toward a more discretionary approach. Two criteria have changed are:

- Sapphire card family limitation: Under the old rules, Chase wouldn’t approve a cardholder with an open Sapphire card for another Sapphire card. For example, a Sapphire Preferred cardholder couldn’t get approved for the Sapphire Reserve card. With the elimination of this rule, it’s possible to get approved for a second Sapphire card, but you may not be eligible for a welcome bonus with the new card. If you’re not eligible for a welcome bonus, that information is shared before processing the application.

- 48-month rule for receiving a Sapphire bonus: This refers to the time between receiving a welcome bonus on one Sapphire card and the waiting period to be eligible for another welcome bonus on a Sapphire card. For example, if a cardholder received a welcome bonus for the Sapphire Preferred card in March 2023, under this rule, the individual wouldn’t be eligible for a welcome bonus on any Sapphire card until March 2027.

Changes may be advantageous for some applicants, but Chase’s unpublished, more individualized criteria may make it difficult for others to get multiple welcome bonuses over time. Prior to launching the revamped Chase Sapphire Reserve, View from the Wing reported that Chase shared the following details about changes to these rules:

- Sapphire family rule: “Beginning June 23, 2025, you will be able to have both the Sapphire Reserve and Sapphire Preferred cards. New account bonus offer eligibility for either card will be based on factors including previously earned bonus offers and the number of cards opened and closed, among others.”

- 48-month rule: “We are transitioning away from the family of cards every 48 month eligibility to a same product premium eligibility. The timeframe will be longer than 48 months, but we aren’t able to share additional details.”

Another Chase application rule to consider is commonly referred to as the 5/24 rule. It means that applicants who have opened five or more new credit cards at any bank in the past 24 months generally won’t be approved for a Chase card. Chase sometimes relaxes this rule, and many business cards issued by other banks aren’t counted toward 5/24.

Credit Card Spending

Cardholders earn Ultimate Rewards points for everyday spending on credit cards. The earning rate per dollar spent varies by credit card, and most cards have spending categories that earn more than one point per dollar spent.

Some examples of bonus categories are:

- The Sapphire Preferred Card earns 5X points for travel booked through Chase Travel℠, 3X points on dining and 2X points on travel paid directly to the provider.

- The Freedom Flex card has rotating quarterly bonus categories that earn 5X points.

If you have multiple cards that earn Ultimate Rewards points, leveraging bonus categories for specific cards provides a way to earn additional points.

Referral Bonuses

Chase has Refer-a-Friend and Refer-a-Business opportunities that allow existing cardholders to earn Ultimate Rewards points by referring other individuals or business owners. Points per referral vary and are subject to annual limitations.

Beginning Oct. 7, 2025, business card referral bonus eligibility is restricted to referring new Chase business card customers. For the referring cardholder to receive a bonus, the individual or business owner who is being referred must apply through the referrer’s personalized link and be approved for the card.

Referral opportunities can be accessed several ways on Chase’s website or app. After selecting a card and logging into your account, you’ll see a dropdown of your current cards. Depending on how you access referrals, you may see a screen to enter your last name, ZIP code and last four digits of your card number instead of the dropdown listing your cards.

After selecting one of your credit cards, you’ll see the referral offers available through that card. It’s important to note that offers vary by cardholder and specific card. For example, after selecting my Sapphire Preferred card, referral offers displayed were for referring others to the Sapphire Preferred or the Sapphire Reserve. Selecting a Freedom card showed referral offers for Freedom cards, while selecting an Ink card showed options for business cards (Sapphire Reserve for Business℠ and other Ink cards).

On the referral page, you can generate a link, copy it and send it to whomever you wish to refer.

One difference between Ultimate Rewards points earned through referral bonuses and points earned through credit card welcome bonuses or spending is that referral bonuses are taxable. Chase may or may not issue a 1099 form, depending on the total annual referral points you earn.

Other Ways to Earn Ultimate Rewards

Like several rewards programs, Chase offers cardholders bonus points for initiating online shopping transactions through Shop through Chase®. You can access the shopping portal from the Ultimate Rewards home page.

To earn bonus points, click on a participating store, product or offer from the portal, and you’ll be redirected to the entity’s website. From there, shop and check out paying with an eligible Chase card to earn bonus Ultimate Rewards points. In many cases, this is a multiplier of the amount spent.

Additionally, Chase used to offer Ultimate Rewards points for opening bank accounts or other banking offers, but recent banking bonuses have been cash bonuses. Like referral bonuses, banking bonuses are considered taxable income.

How to Redeem Ultimate Rewards Points

One major benefit of flexible reward programs is that cardholders can redeem points in multiple ways. Some methods are considered more valuable than others, but individual circumstances and preferences also are important.

Before diving into the details, let’s discuss the concept of cents per point (cpp), which is widely used as a measure of redemption value. A few examples of hypothetical uses for 25,000 Ultimate Rewards points and the redemption value with each option are:

- Pay with points for goods or services of $200 through Amazon or PayPal: The redemption value is poor at 0.8 cpp, and we don’t recommend this.

- Redeem for at least $250 in third-party gift cards: The redemption value generally is 1 cpp, so every 1,000 Ultimate Rewards points is worth $10 in gift card value.

- Redeem for at least $250 cash back: The redemption value is 1 cpp for regular cashback redemptions, but opportunities for higher value are possible through Pay Yourself Back.

- Redeem for $250 to $500 of travel through Chase Travel℠: The redemption value varies depending on which credit cards you hold and which flights or hotels you book. The range is between 1 and 2 cpp.

- Transfer 25,000 points to a partner loyalty program: Ultimate Rewards points transfer to partner programs at a 1:1 ratio, but the value when redeeming points for flights or hotels through partner programs varies. The potential for outsized redemption value is highest when transferring points to partners.

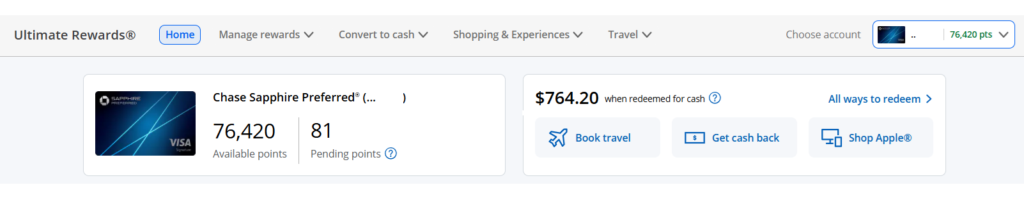

To redeem Ultimate Rewards points, begin by logging into your Chase account and navigate to the Ultimate Rewards home page.

Redeem for Cash Back

All cardholders can redeem Ultimate Rewards points for cash back at a minimum rate of 1 cent each.

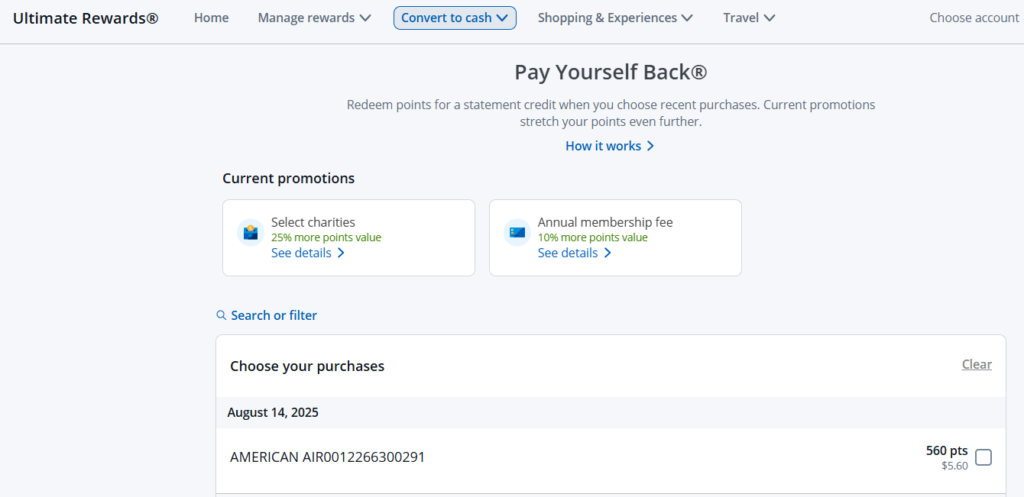

Another way of cashing out points is through Chase’s Pay Yourself Back®, which is shown on the Ultimate Rewards website under the “Convert to cash” dropdown. Through this program, you can redeem points for a statement credit to offset recent (within 90 days) eligible purchases. Purchases eligible for Pay Yourself Back and redemption rates vary by credit card and change over time.

As of October 2025, regular purchases on Sapphire Preferred cards are shown as eligible for Pay Yourself Back at a rate of 1 cpp. Redemptions for the annual membership fee receive a 10% bonus (1.1 cpp), and donations to select charities are eligible for a 25% bonus (1.25 cpp).

For select charities, the cardholder makes donations with an eligible credit card directly to the charity’s parent organization and selects the transaction for reimbursement in the list under Pay Yourself Back. Eligible charities as of September 2025 include:

- American Red Cross

- Equal Justice Initiative

- Feeding America

- GLSEN

- Habitat for Humanity

- International Medical Corps

- International Rescue Committee*

- Leadership Conference Education Fund

- Make-A-Wish America

- NAACP Legal Defense and Education Fund

- National Urban League

- Out & Equal Workplace Advocate

- SAGE

- Thurgood Marshall College Fund

- United Negro College Fund

- UNICEF USA

- United Way

- World Central Kitchen

Sapphire Reserve cards offer additional categories and sometimes higher Pay Yourself Back rates compared to other cards. Eligible spending categories and rates through Dec. 31, 2025, are:

- Select charities at 1.5 cpp

- Annual membership fee at 1.25 cpp

- Department stores at 1.25 cpp

- Gas stations at 1.25 cpp

- Grocery stores (excluding Target and Walmart) at 1.25 cpp

Redeem for Gift Cards

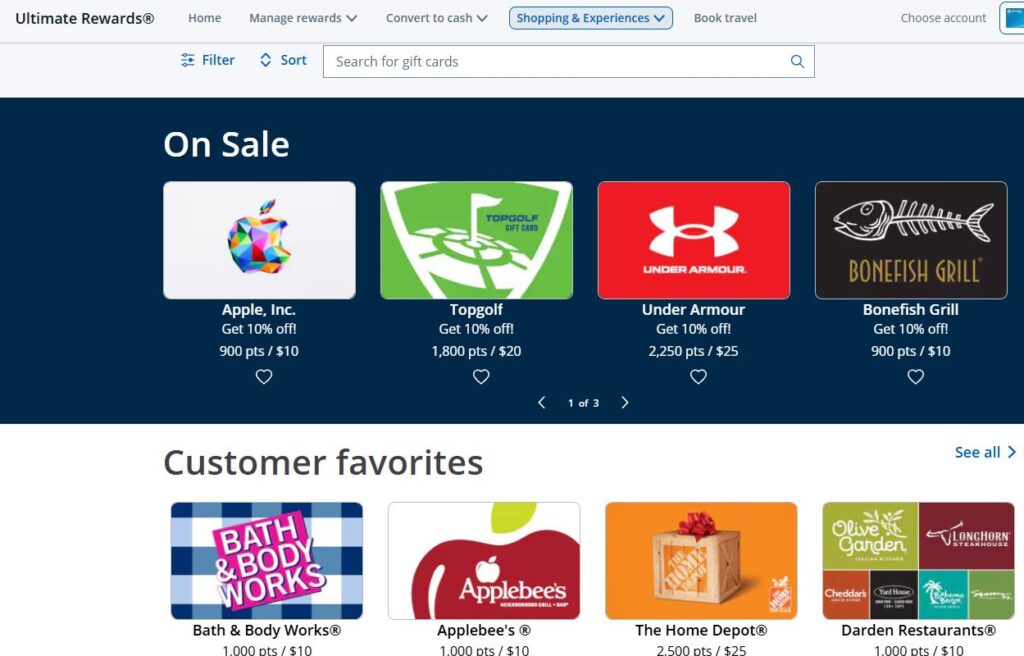

You can access options for redeeming Ultimate Rewards points for gift cards under the “Shopping & Experiences” dropdown.

Gift card purchases with Ultimate Rewards points typically provide a fixed redemption rate of 1 cent each, so 1,000 Ultimate Rewards points are required for a $10 gift card. Many popular merchant (including Amazon, Target and Home Depot), dining and travel gift cards are available. You can search for desired gift card brands or select categories to see relevant gift cards. Selected gift cards sometimes are on sale at a discount, typically 10%.

Redeem Through Chase Travel℠

If you’re interested in booking travel with Ultimate Reward points, Chase Travel℠ provides significant flexibility. Chase Travel℠ operates like other online travel agencies and allows cardholders to book accommodations, flights, cars, activities, tours and cruises. More accommodation and flight options are available compared to transferring to and booking through Chase’s partner loyalty programs.

Redemption Rates with Chase Travel℠

With changes made in June 2025, it’s complicated to describe how much Ultimate Rewards points are worth when redeeming them through Chase Travel℠.

Before June 2025 changes, Chase Travel℠ redemptions were straightforward because the rate was based solely on the credit card account through which points were redeemed. Values were 1.5 cents each through the Sapphire Reserve card; 1.25 cents through the Sapphire Preferred, the Ink Plus and the Ink Preferred cards; and 1 cent for all other cards.

Under these rules, Ultimate Rewards points required to book a $300 flight would be 20,000 Sapphire Reserve points, 24,000 Sapphire Preferred (or Ink cards at same rate) points and 30,000 points with other Ultimate Rewards-earning cards.

The wording about redeeming points through a specific account is intentional. For example, if you have a Freedom card and the Sapphire Preferred card, you should:

- Combine points earned through the Freedom card into the Sapphire Preferred account (we’ll discuss how to do this below).

- Use points from your Sapphire Preferred account when booking through Chase Travel℠ to get better value.

Beginning June 23, 2025, multiple factors determine how many points are required for booking through Chase Travel℠:

- The credit card account used for the redemption: In general, cards with higher annual fees provide better redemption rates.

- The specific travel purchase through Chase Travel℠: Certain flights provide higher redemption rates through Points Boost, and some accommodations also have better redemption rates.

- When credit cards were opened: Points associated with cards held before June 23, 2025, can be used at the old rates or new rates for a limited time. Sapphire Reserve cards opened beginning June 23, 2025, and Sapphire Reserve for Business℠ cards (first available June 23, 2025) follow the new redemption rate structure immediately.

- When points were earned: Points earned or combined into an existing account (that was opened before June 23, 2025) by October 26, 2025, can be used at the old rates until October 26, 2027.

The value of Ultimate Rewards used through Chase Travel℠ is summarized below.

| Credit card(s) | Redemption value | ||

| Points Boost travel* | Other travel for points earned before Oct. 26, 2025, and redeemed by Oct. 26, 2027** | Other travel for points earned beginning Oct. 26, 2025, or redeemed beginning Oct. 26, 2027** | |

| Sapphire Reserve | Up to 2 cents | 1.5 cents | 1 cent |

| Sapphire Reserve for Business | Up to 2 cents | 1 cent | 1 cent |

| Sapphire Preferred, Ink Preferred, Ink Plus | Up to 1.75 cents on premium cabin flights and up to 1.5 cents on other travel | 1.25 cents | 1 cent |

| All Freedom cards, other Ink and Sapphire cards | Not applicable | 1 cent | 1 cent |

Notes:

* Points Boost rates apply to selected flights (eligible cards), hotel bookings with The Edit by Chase Travel℠ (Sapphire Reserve cards only) and other selected hotels (eligible cards).

** Other travel applies to everything except Points Boost. Rewards in accounts opened on or after June 23, 2025, can be redeemed at 1 cent each.

Points Boost

Points Boost was implemented in June 2025, and it provides a way of getting higher redemption value for selected Chase Travel℠ bookings. The maximum redemption value with Points Boost is 2 cents per point, based on specific offers and credit cards. Sapphire Reserve consumer and business cards are eligible for up to 2 cpp, while the Sapphire Preferred, the Ink Preferred and the Ink Plus cards are eligible for up to 1.75 for business- or first-class flights and up to 1.5 cpp for other travel.

Flight Examples

There are different ways to access Chase Travel℠. The example below with a link to Travel is from an account that includes business and consumer credit cards.

The dropdown option for “Travel” on the Ultimate Rewards home page also has a “Book Travel” option, which redirects to Chase Travel℠, and some accounts have a button for “Book Travel” on the same page.

You can select the credit card account to use—we recommend using the account with the best redemption rate—from the dropdown near the top right corner of the screen.

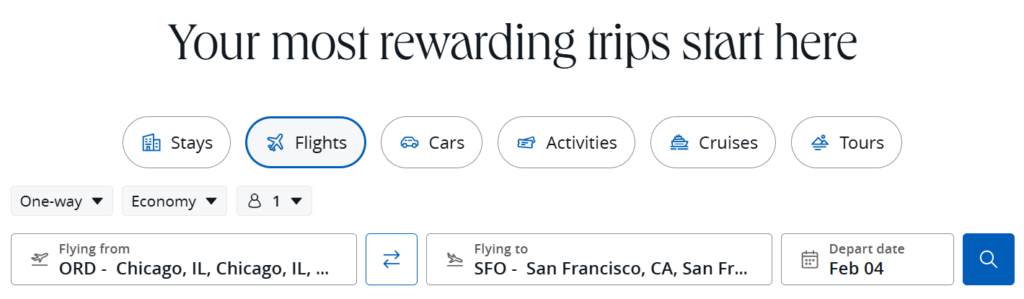

On the travel home page, scroll down and select the type of travel to book—we chose flights—and enter search criteria.

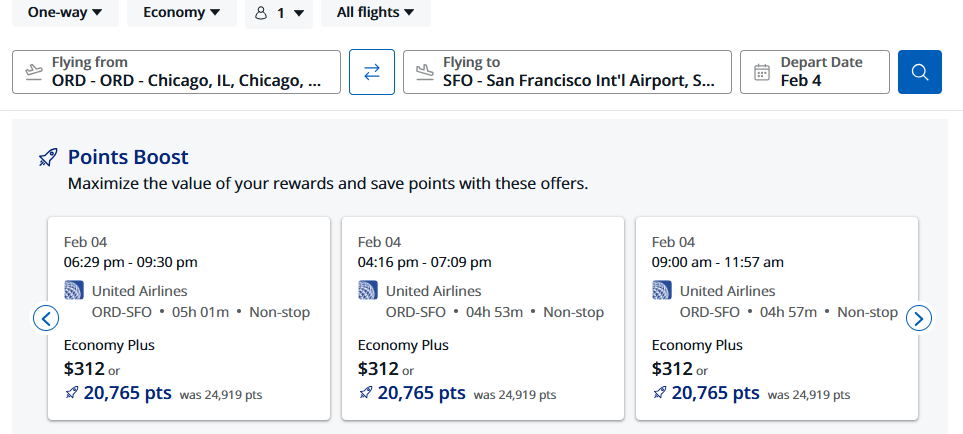

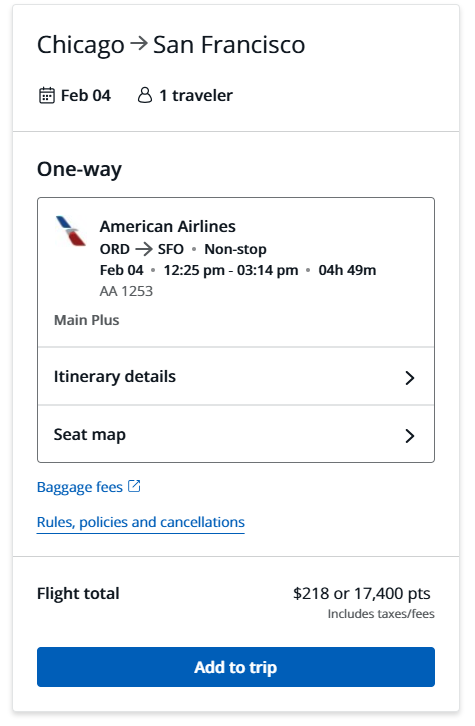

Results can be filtered and sorted, and Points Boost options are shown first. The example below from a Sapphire Preferred account shows United Airlines flights in Economy Plus that are available as Points Boost redemptions.

Let’s take a closer look at redemption values, which are calculated by dividing the cash rate by the points rate. All redemption values reflect the situation as of September 2025. Key findings are:

- The Points Boost rate is 20,765 points, which is a redemption rate of 1.5 cpp ($312 x 100 / 20,765).

- The note “was 24,919” refers to points required at the old redemption rate of 1.25 cpp ($312 x 100 / 24,919).

- Chase automatically gives cardholders the better redemption value, which in this case is through Points Boost.

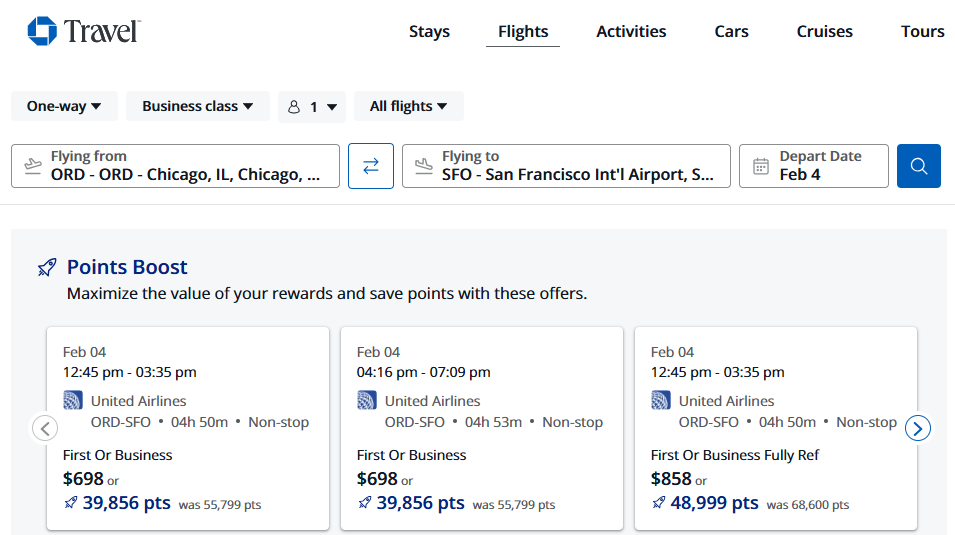

Options for the same route and date for business- and first-class cabins follow. In this case, points are worth 1.75 cents each through a Sapphire Preferred account for flights eligible for Points Boost.

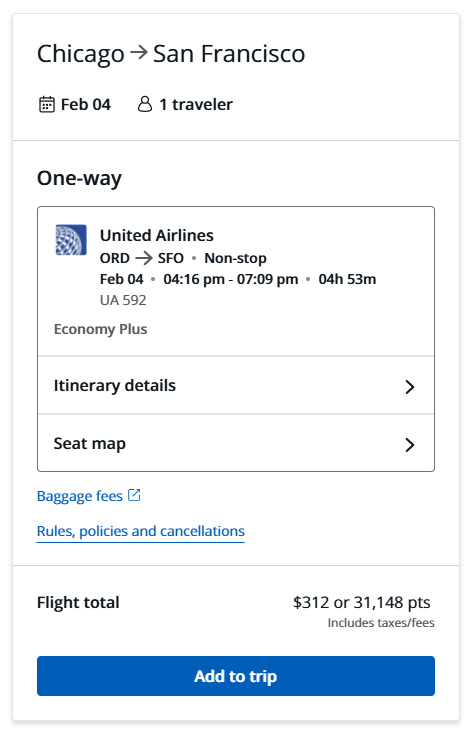

When Points Boost isn’t available, as is the case with the American Airlines flight shown below, a Sapphire Preferred cardholder would be able to redeem Ultimate Rewards for 1.25 cents each ($218 x 100 / 17,400).

As of September 2025, Points Boost is limited to premium cards referenced above, and points redeemed through other cards are worth 1 cent per point. Point requirements displayed below are for a Freedom card for one of the same United flights discussed above that offered Points Boost with premium cards.

Transfer to Partners and Redeem in Partner Programs

This redemption option is different from others because there are two distinct steps:

- Transfer Ultimate Rewards points to the desired partner program.

- Book flights or hotel stays through airline or hotel loyalty programs.

Many points and miles enthusiasts identify award availability in a partner program first and then transfer Ultimate Rewards points to enable booking the award, but there are situations in which cardholders may choose to transfer Ultimate Rewards points to a partner without having a specific redemption planned.

Two popular reasons for speculative points transfers are to take advantage of a transfer bonus or to move points before closing a credit card that allows transfers.

It’s important to know the basic rules related to transferring Ultimate Rewards points to partner programs:

- Transfers can be initiated from specific cards that earn Ultimate Rewards and have an annual fee. Current options are the Sapphire Preferred, the Sapphire Reserve, the Sapphire Reserve for Business and the Ink Preferred.

- You can earn Ultimate Rewards points with other Chase cards and combine them (as discussed below) into accounts that allow transfers to partners.

- You can transfer Ultimate Rewards points to loyalty programs in the name of the primary Chase cardholder, one additional household member who is listed on your account as an authorized user (consumer cards) or an owner of the company who is listed as an authorized user (business cards).

- You can’t transfer points earned through the Ink Business Premier card to partners.

- The standard transfer ratio is 1:1, which means that every 1,000 Ultimate Rewards points become 1,000 airline or hotel program points. Ultimate Rewards transfers must be in 1,000-point increments.

Details about how to transfer points to partners are provided below.

Ultimate Rewards Transfer Partners

Current airline transfer partners are:

- Aer Lingus AerClub

- Air Canada Aeroplan

- Air France-KLM Flying Blue

- British Airways Club

- Iberia Club

- JetBlue TrueBlue

- Singapore Airlines KrisFlyer

- Southwest Airlines Rapid Rewards

- United MileagePlus

- Virgin Atlantic Flying Club

Current hotel transfer partners are:

- IHG One Rewards

- Marriott Bonvoy

- World of Hyatt

Because the scale and value of each loyalty program currency varies, it’s important to consider the relative value of different loyalty program points when making decisions about transferring Ultimate Rewards to specific programs. More specifically:

- IHG and Marriott points generally are considered to have average redemption values under 1 cent each. This is less than value possible through other transfer partners or by redeeming Ultimate Rewards points through other methods for between 1 and 2 cents each.

- Transferring Ultimate Rewards points to airline programs and World of Hyatt provides the opportunity to obtain outsized value for specific redemptions, as shown in examples below.

Transfer Bonuses

Chase sometimes offers limited-time transfer bonuses to specific programs, which makes Ultimate Rewards points more valuable. Transfer bonus math is pretty straightforward. If there’s a 20% transfer bonus to a particular partner program, that means transferring 1,000 Ultimate Rewards points translates to 1,200 points or miles in that partner’s loyalty program.

Hyatt Example

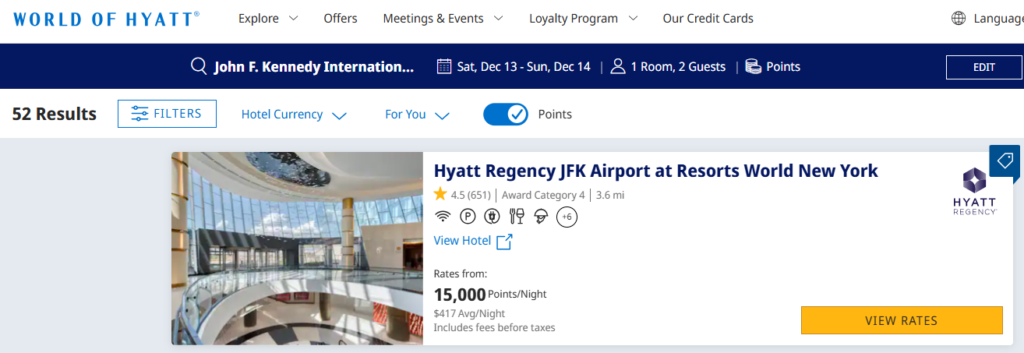

Let’s consider a hotel stay at a Hyatt property. If you plan to use Ultimate Rewards points to pay for the hotel, you could either book the stay through Chase Travel℠ or transfer points to and book through your World of Hyatt account.

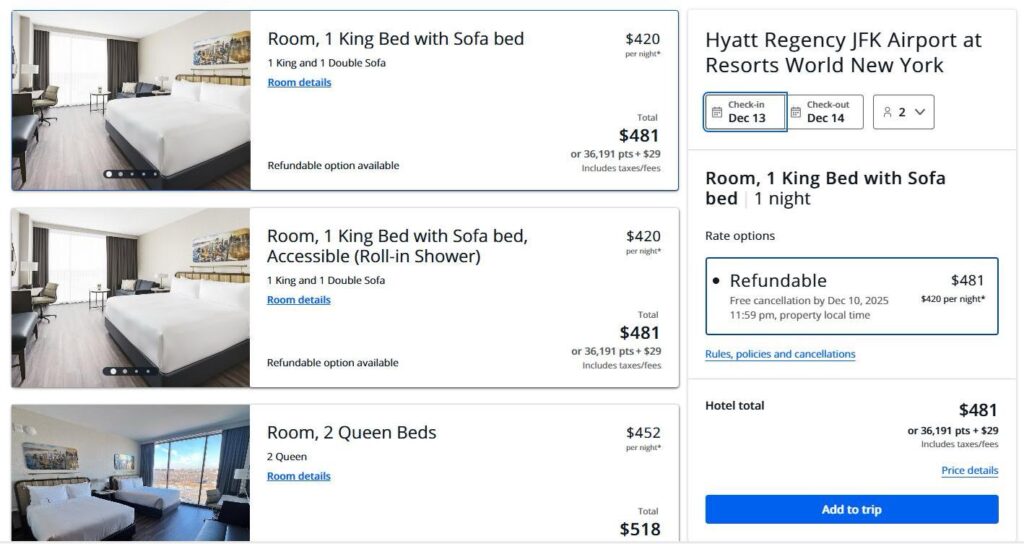

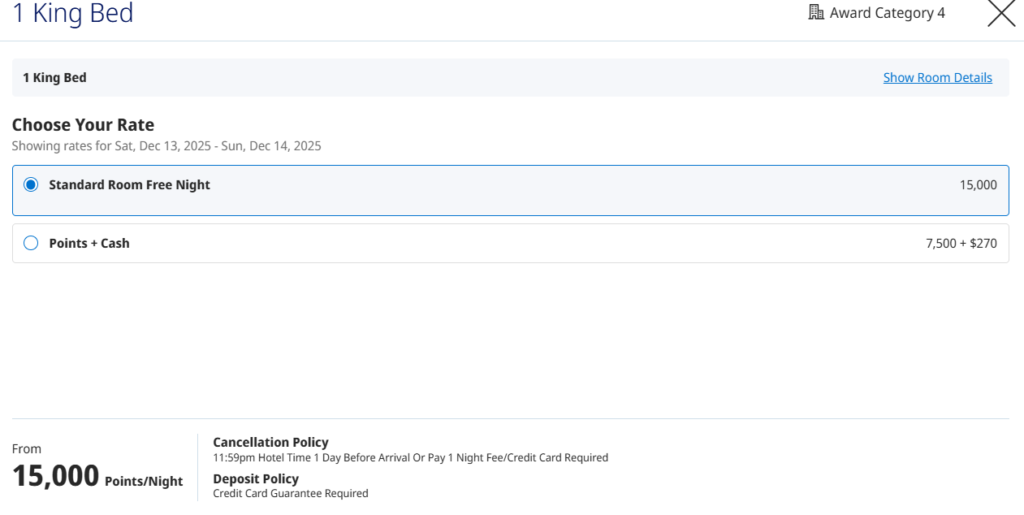

For a one-night stay on Dec. 13, 2025, at the Hyatt Regency JFK Airport at Resorts World New York, the lowest refundable cash rate for a king bed room through Chase Travel℠ is $481 including taxes and fees. This hotel charges a destination fee plus associated taxes of about $29.

Rates using Ultimate Rewards points through Chase Travel℠ vary.

- Sapphire Preferred, Ink Preferred and Ink Plus card redemptions: The rate is 36,191 points plus $29 (shown above). Each Ultimate Rewards point earned before Oct. 26, 2025, is worth 1.25 cents, calculated as ($481 – $29) x 100 / 36,191.

- Other card redemptions: Sapphire Reserve cardholders eligible to redeem points at 1.5 cpp would need about 30,100 points + $29, while cardholders redeeming points at 1 cent each would need about 45,300 points + $29.

In this case, transferring points to World of Hyatt provides much better value. The same room type at this Hyatt Category 4 property is available for 15,000 points.

Given that Ultimate Rewards can be transferred at a ratio of 1:1 to Hyatt, the redemption value is 3.2 cents per point. The calculation is $481 x 100 / 15,000 (the destination fee is included because it’s part of the cost with a cash or Chase Travel℠ booking).

Additional benefits of booking with Hyatt points include:

- The destination fee isn’t charged on award stays.

- The cancellation policy (in this example) is more flexible.

- World of Hyatt elite members receive elite benefits and stay credit.

Business-Class Flight Example

Business- and first-class international flights are preferred by many points and miles enthusiasts to use flexible currency for high value.

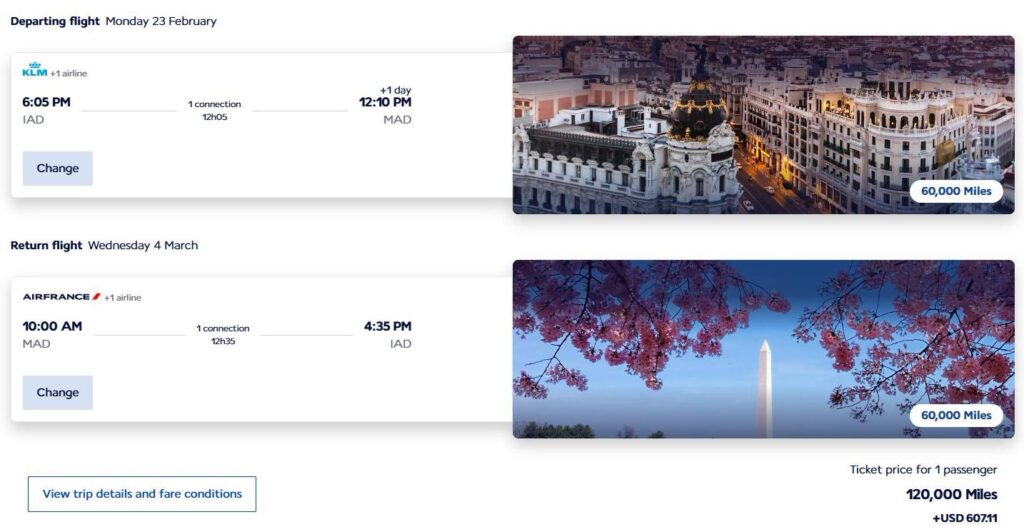

For international flights, one-way cash rates often are significantly more than half the round-trip fare, so you may want to compare round-trip cash and award rates. We found Air France-KLM Flying Blue business-class awards between Washington (IAD) and Madrid (MAD) for 60,000 Flying Blue miles in each direction.

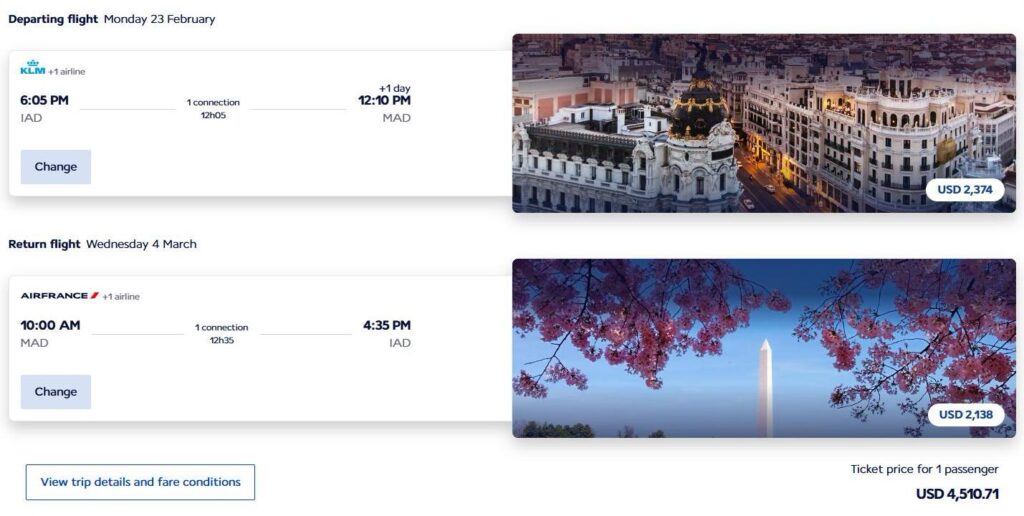

Cash rates for the same flights are shown below.

Air France and KLM are Ultimate Rewards transfer partners, so if you transferred 120,000 Ultimate Rewards points to Flying Blue and booked the round-trip itinerary, the redemption value based on the cash rate would be ($4,511 – $607) x 100 / 120,000 = 3.25 cpp. This redemption value exceeds the maximum redemption rate possible when booking flights with points through Chase Travel℠.

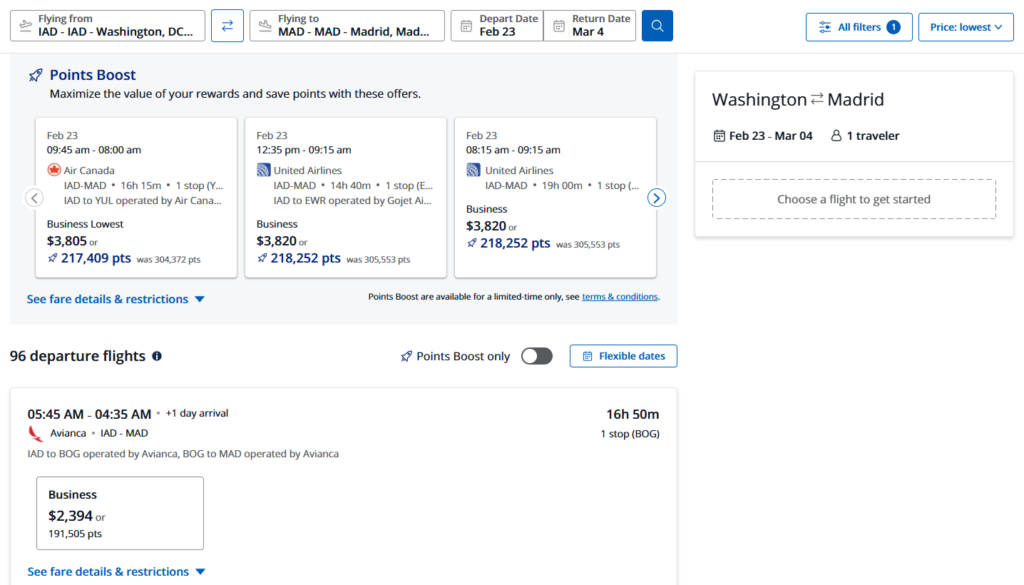

Many travelers would check other airlines and routes. A few options through Chase Travel℠ for other round-trip one-stop itineraries on the same dates between Washington and Madrid are shown below.

The lowest round-trip rate is on Avianca at $2,394. This isn’t a Points Boost fare, so Ultimate Rewards points required range from about 159,600 (at 1.5 cpp) to 239,400 (at 1 cpp).

The lowest Points Boost eligible round-trip rate is on Air Canada at $3,805. Points required range from approximately 190,250 (at 2 cpp) to 380,500 (at 1 cpp).

The exact Air France and KLM flights shown above aren’t available through Chase Travel℠, but other flights on these airlines on these dates had similar rates for Business Flex tickets. Using the round-trip fare of $4,511, points required range from about 300,700 (at 1.5 cpp without Points Boost options) to 451,100 (at 1 cpp).

To answer the question about whether it’s better to book through Chase Travel℠ or transfer 120,000 Ultimate Rewards points to Air France-KLM Flying Blue and book through Flying Blue for 120,000 miles + $607.11, the following approach can be used:

- Convert the cash outlay for taxes and fees to points: This is done by dividing the tax and fee amount by the value you assign to points: At 1.5 cpp, out-of-pocket fees of $607.11 are equivalent to using 40,474 more points.

- Add the additional points to the award rate: This makes the effective cost for the Flying Blue award 160,474 Ultimate Rewards points.

- Compare options: The adjusted award rate through Flying Blue is slightly more than booking the Avianca flight for 159,600 points, which is the rate available for booking through Sapphire Reserve accounts opened before June 23, 2025. Otherwise, transferring Ultimate Rewards to Flying Blue and booking for 120,000 miles + $607.11 provides better value compared to booking any of the flights above through Chase Travel℠.

How to Manage Ultimate Rewards Points

Unlike some airline and hotel program points and miles, Ultimate Rewards points don’t expire.

The only requirement to preserve points is to hold at least one credit card that earns Ultimate Rewards. It’s fairly easy to ensure that you don’t lose points when closing a credit card. Two options to consider if you have an Ultimate Rewards-earning credit card that you no longer want are:

- Combine Ultimate Rewards points from the credit card you’re planning to close to another credit card in the Ultimate Rewards ecosystem before closing the card.

- Product change from a credit card with an annual fee to a $0 annual fee credit card in the Ultimate Rewards ecosystem.

Combine Points

Combining points refers to moving Ultimate Rewards points from one credit card account to another credit card account. There are variations for combining points:

- Between credit cards held by the same primary cardholder

- Between credit cards held by different cardholders

Strategy for Combining Points

Before discussing how to combine points, let’s discuss why to do this and some strategic considerations. Cards with higher annual fees generally have better rates for redeeming points through Pay Yourself Back or Chase Travel℠, and only certain cards allow points to be transferred to partners. This is the reason that we recommend moving points earned through $0 annual fee cards to other cards that allow transfers and have better redemption rates.

The decision about moving points to a Sapphire Reserve (consumer or business) card opened on or after June 23, 2025, or a Sapphire Preferred (or Ink Plus or Ink Preferred) card aren’t as straightforward because of different rates for Chase Travel℠ redemptions from October 2025 to October 2027. In this situation, it’s important to consider if and how you’re likely to redeem points through Chase Travel℠ because:

- Travel that isn’t eligible for Points Boost provides a redemption value of 1.25 cpp for Sapphire Preferred cards and noted Ink cards but only 1 cpp for new Sapphire Reserve cards.

- Points Boost options provide better redemption value through a Sapphire Reserve account.

Combining Points for Same Cardholder

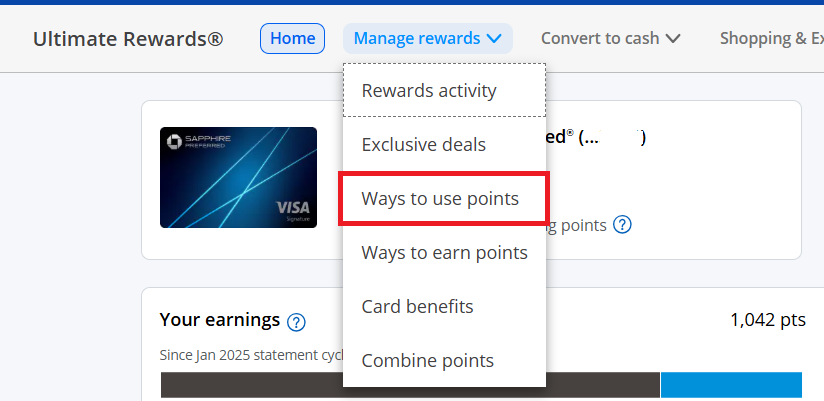

Beginning from the Ultimate Rewards home page, select “Combine points” from the “Manage Rewards” dropdown.

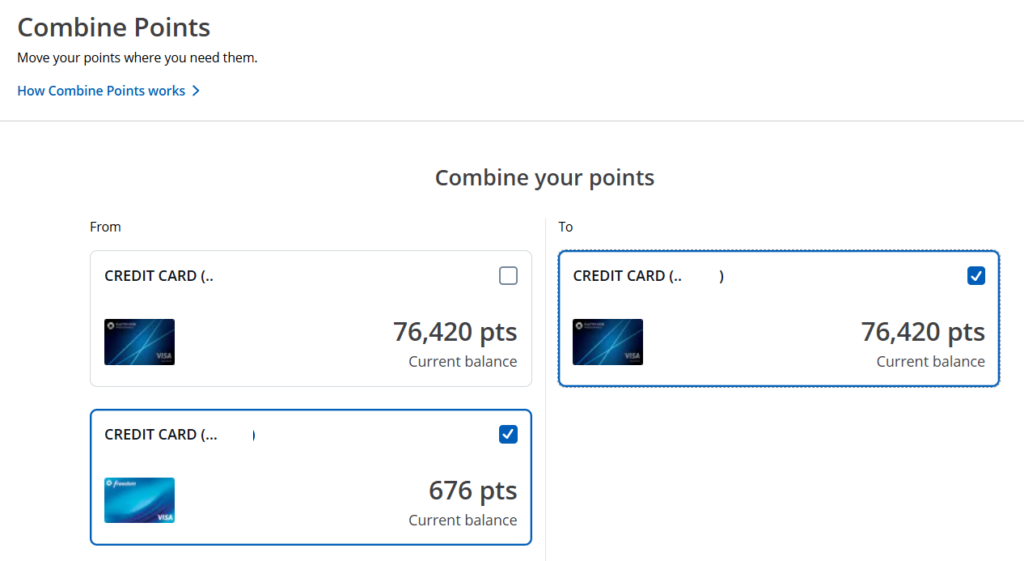

This action displays your credit cards and number of Ultimate Rewards points in each account. Account details are obscured below, but the cardholder’s name and partial card number are provided. Select the account to transfer from (on the left) and to (on the right).

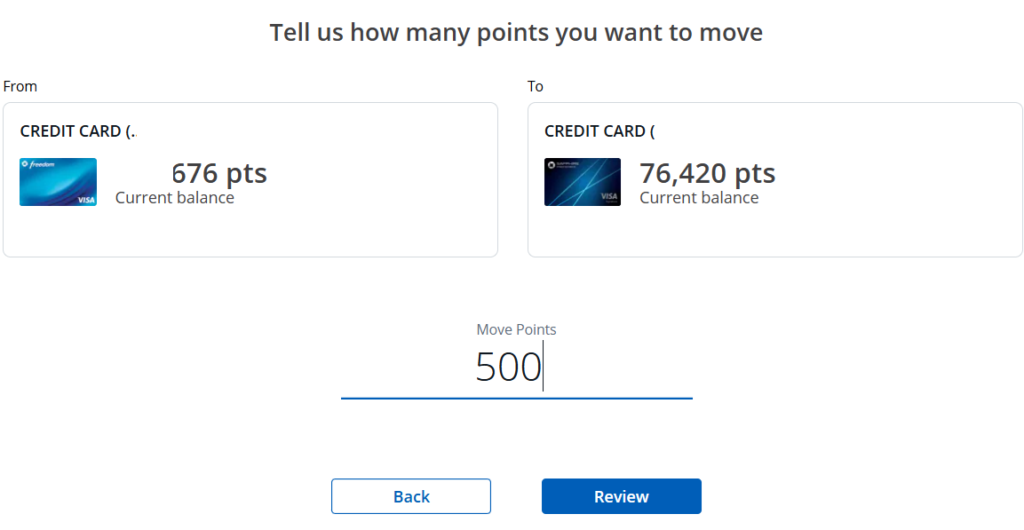

The next screen is where you enter the number of points to move. There is no minimum or maximum.

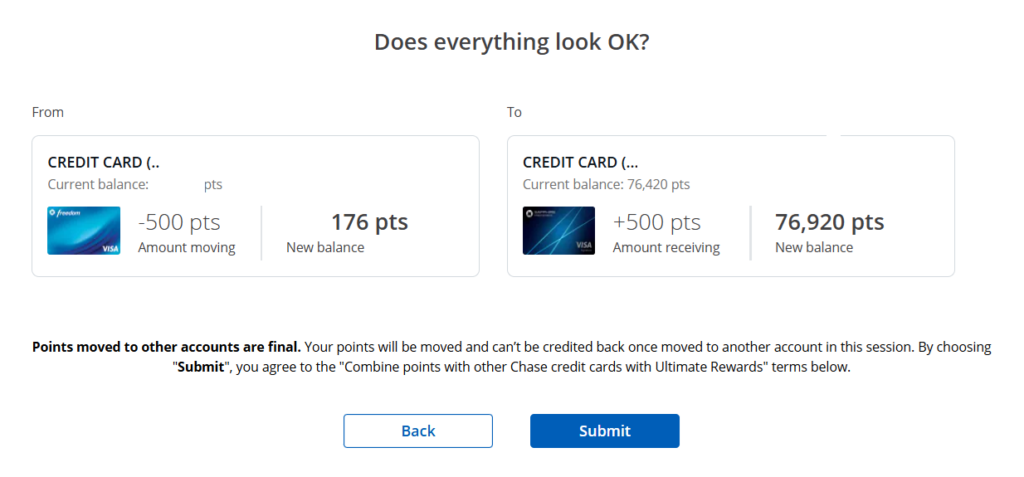

The confirmation screen shows both accounts and the balances before and after the transfer.

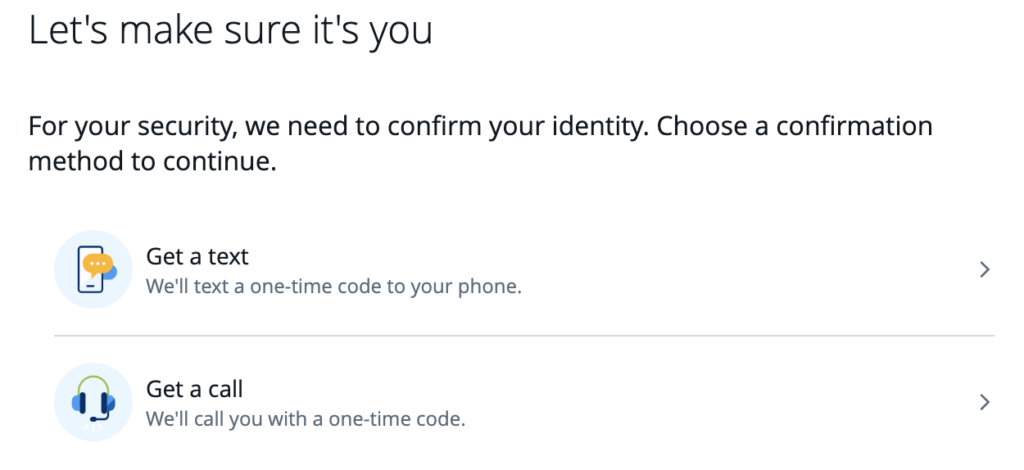

After submitting information on the previous screen, there may be a verification step. Verification methods vary by account and may include logging into the mobile app, receiving a code via email or phone number on the account, scanning a QR code or calling Chase.

Using the option to log into the app, the app displays a question about confirming the request to redeem rewards. After answering the question, the response is acknowledged in the app, and a confirmation that points were moved is displayed in the web browser.

The confirmation screen also displays an order number, the number of points moved and Ultimate Rewards balances in each account after combining points.

Combining Points Different Cardholders

If you want to combine points between cardholders, Chase has specific rules for this as detailed in specific credit card terms. High-level rules are:

- For consumer cards, the primary cardholder can combine points with one member of their household. The two individuals must share the same address, but there aren’t any other requirements. In other words, individuals don’t need to be married or have any familial relationship.

- For business cards, points can be combined between the business owner and other cardholders.

Before combining Ultimate Rewards points between different cardholders’ accounts for the first time, you’ll have to call Chase customer service and let the agent know that you want to combine points with a household member or business owner and provide the account number and cardholder’s name.

After the accounts are connected, you’ll be able to combine points online between your account and the other cardholder’s account, as discussed above.

Transfer Points

Let’s look at the process for transferring points to partners.

After logging into your account and navigating to the Ultimate Rewards home page, select “Ways to use points” from the “Manage Rewards” dropdown.

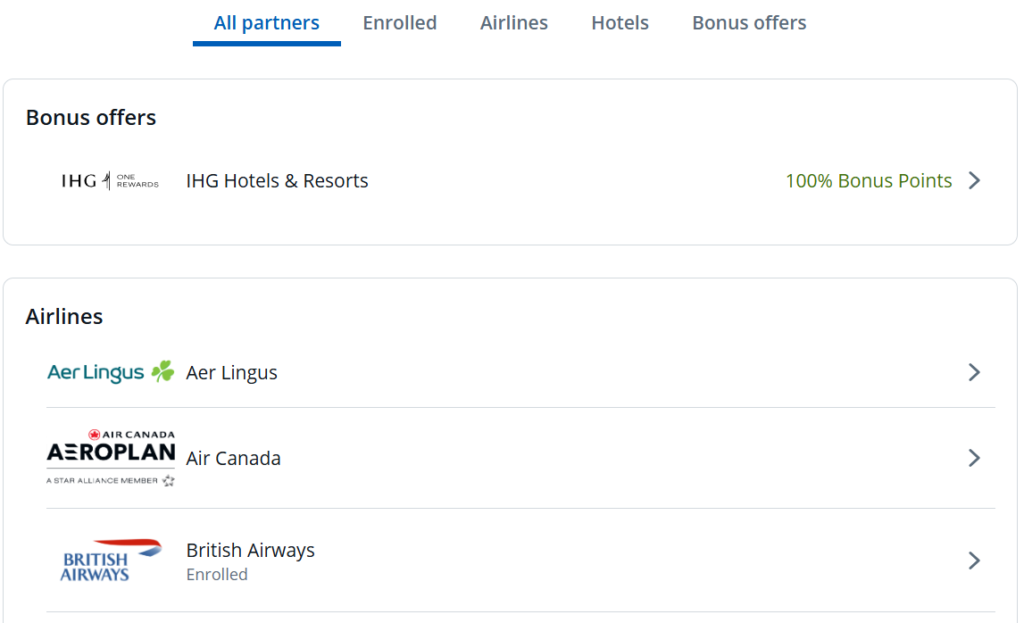

Choose “Transfer points” on the next screen and scroll down (or use filters) to find the desired partner program. Programs with transfer bonus offers are shown at the top. In the example below, there’s a 100% bonus for transferring points to IHG.

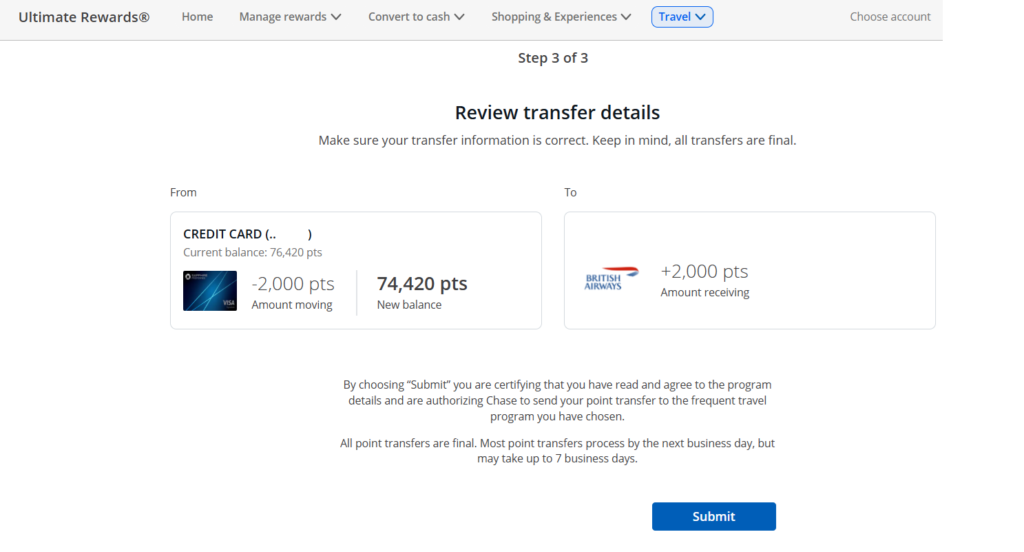

Select the desired partner and enter (if first time transferring to a program) or confirm the name and loyalty program number. For this example, we’re transferring points to the primary cardholder’s British Airways Club account.

Enter the number of points to transfer to the partner program, confirm details of the transfer on the next screen and select “Submit” to initiate the transfer.

Follow prompts, as discussed above for combining points, if applicable to verify the redemption request.

Chase sends an email indicating that the Ultimate Rewards points transfer is in progress, and you’ll receive a second email once the transfer is complete.

Final Thoughts

While June 2025 changes increase complexity and reduce the value of Ultimate Rewards points for some Chase Travel℠ redemptions, Chase Ultimate Rewards remain one of the best programs for earning and redeeming points.

The program provides strong earning potential along with flexibility and value on the redemption side. Most points and miles enthusiasts use Ultimate Rewards points for travel, but having options to redeem points for 1 to 1.5 cents each through cash back and Pay Yourself Back can be useful in some situations.

For travel redemptions, it’s worth considering redeeming points through Chase Travel℠ and transferring points to partner programs. Transferring Ultimate Rewards points to and booking travel through partner loyalty programs provides better value in many situations. However, Chase Travel℠ provides more booking options, an easier process and redemption rates of 1 to 2 cents per point.