MileValue is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

Note: Some of the offers mentioned below may have changed or are no longer be available. You can view current offers here.

Delta got rid of its award chart two weeks ago. For awards starting and ending in the United States, I still know what Saver awards cost from memory and from these saved charts.

But now that Delta allows one way award bookings, I’d occasionally like to know the price of awards from Australia to Southeast Asia, Europe to Africa, or the Middle East to India. I don’t have those memorized, and I don’t have every set of Delta award charts for departures from every region saved anywhere. (Do you? Let me know in the comments.)

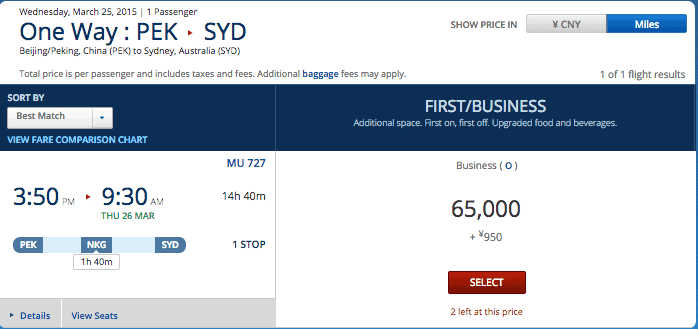

In fact, yesterday I was working on a booking for a client, and I wanted to know how many Delta miles a one way Business Class award from Beijing to Sydney would be. (By the way, the answer is apparently 65,000 miles based on the China Eastern award space online.)

The Problem

When you want to know how many miles a trip costs, but there is no award chart and the partner that flies the route isn’t online, how do you find out the number of miles you need? I asked @DeltaAssist.

.@DeltaAssist, I want to know how many miles an award on China Southern costs, but you don't have award chart, & they aren't on the calendar

— MileValue (@MileValue) February 15, 2015

Delta’s Answer

I didn’t quite understand the response.

https://twitter.com/DeltaAssist/status/567018007910957056

Maybe “CA” means that I can price the ticket by going through the initial steps of a purchase. Since the only way to purchase a China Southern award flight with Delta miles is to call Delta, I guess that’s what he’s suggesting.

I followed up to clarify, but I didn’t get a response.

@DeltaAssist ?? How? It's not on the award calendar and there is no award chart.

— MileValue (@MileValue) February 15, 2015

If Delta Assist really is suggesting that you call Delta to figure out these award prices, that’s very strange. In every other context, airlines discourage you from calling them–going so far as to impose fees of up to $40 for calling instead of handling a task online. When you call Delta, that costs Delta money in staffing costs, so it’s a bit perplexing that Delta wants you to call and run up its costs. The only way that makes business sense is if removing the award chart from the internet is somehow more profitable than those phone staffing costs are costly.

Not Much of a Solution

I don’t care about Delta’s perspective as much as I care about ours. For us, it stinks to have to call Delta to get the price of these awards. I’ll have to find award space, wait on hold, deal with a (possibly) incompetent agent, and finally get the price of the award. Then I’ll have to hang up, compare that price to the price on the American and United award charts (and possibly many other airlines’ charts.) Then I’ll either have to decide to book the Delta award and call back or decide to book another airline’s award and go through that process.

The true solution of course is for Delta to put its award chart back online. That seems very unlikely, but I would have said it was impossible that an airline would pull its award chart off the internet in the first place, so stranger things have happened.

Just getting started in the world of points and miles? The Chase Sapphire Preferred is the best card for you to start with.

With a bonus of 60,000 points after $4,000 spend in the first 3 months, 5x points on travel booked through the Chase Travel Portal and 3x points on restaurants, streaming services, and online groceries (excluding Target, Walmart, and wholesale clubs), this card truly cannot be beat for getting started!

Editorial Disclaimer: The editorial content is not provided or commissioned by the credit card issuers. Opinions expressed here are the author’s alone, not those of the credit card issuers, and have not been reviewed, approved or otherwise endorsed by the credit card issuers.

The comments section below is not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser’s responsibility to ensure all questions are answered.

here is a link to all delta charts

http://www.dansdeals.com/archives/61118

Thanks!

here is a link to all delta charts

http://www.dansdeals.com/archives/61118

Thanks!

dansdeals saved all the screenshots in a recent post

dansdeals saved all the screenshots in a recent post

Delta- Assist sounds like Comcast.net (cable) Chat line which is 2 hrs better then a phone call . What’s is the NORMAL $$$ TOTAL in 2 months not this month with the changes ???? After 5 try’s she got it right AND I hope she’s correct ..Total means TOTAL not plus fees or another ect. It’s means TOTAL COST per month.. . I don’t think any of the airlines have ever used their website or called it because it would change big time .

Delta- Assist sounds like Comcast.net (cable) Chat line which is 2 hrs better then a phone call . What’s is the NORMAL $$$ TOTAL in 2 months not this month with the changes ???? After 5 try’s she got it right AND I hope she’s correct ..Total means TOTAL not plus fees or another ect. It’s means TOTAL COST per month.. . I don’t think any of the airlines have ever used their website or called it because it would change big time .