MileValue is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

Note: Some of the offers mentioned below may have changed or are no longer be available. You can view current offers here.

Prepaids are All the Rage–Add Another to the List (if You Live in New England)

Word on the street is that miles and points aficionados may be interested in prepaid debit cards. See How Much is Bluebird Really Worth? and my Bluebird Calculator.

The players involved have included the NetSpend card, Mio card, Wells Fargo prepaid card, US Bank and Nationwide Visa Buxx cards, and the American Express Prepaid card. And of course, this week’s newest entry, the American Express Blurbird.

According to this FlyerTalk thread, if you live in New England–specifically Connecticut, Massachusetts, or Rhode Island–and if you are a member of the Southern New England AAA, your AAA membership card can be activated to become an American Express Prepaid card. The terms of use are almost identical to those of the American Express Prepaid card available to the general public:

- A maximum of $2,500 can be loaded onto the card per month (or $10,000 if you have set up direct deposit of a part of your salary to the card)

- The card can be used to withdraw $400 cash daily from an ATM

- The first ATM withdrawal of the month is free and each subsequent withdrawal costs $2, in addition to any fees charged by the owner of ATM

- There are no foreign transaction fees

This AAA prepaid card differs from both the Bluebird and the American Express Prepaid in that you can load it with an American Express credit card:

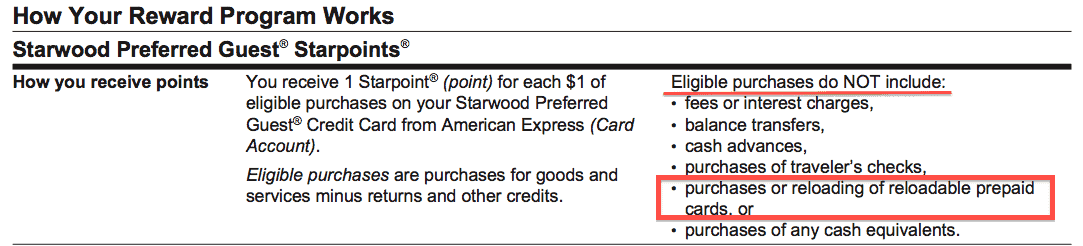

So yes, you could load this card with an SPG American Express card without being charged a cash advance fee. Will you earn SPG points? According to the terms and conditions of that particular card, it seems unlikely:

Based on my personal experience with another AAA prepaid card, some AAA offices will code a credit-card reload as a standard purchase if the reload is done in person. However, if you reload the prepaid card online with your SPG card, American Express is likely to recognize the transaction and you will not earn points.

The activation of the AAA American Express prepaid card is free, saving you $4.95 compared to buying a reloadable AMEX Prepaid at Office Depot. And for a limited time, if you activate your AAA card to release its prepaid powers and load it with at least $200 before 1/31/13, American Express will reward you with a $25 gift card:

If I have or can manufacture an address in CT, RI, or MA should I bother with this?

If you really need to diversify your prepaid card portfolio, have a spending requirement to meet on an American Express card, and have a friendly AAA agent who will reload your card in the branch with your AMEX so that the transaction codes as a standard purchase so you get your points or miles, then knock yourself out.

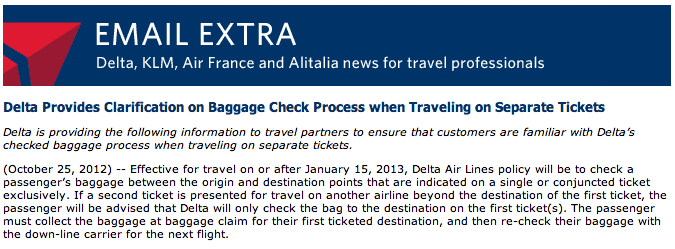

Delta No Longer Checking Bags to Your Destination on Multiple Tickets

The bitterness is strong in this FlyerTalk thread, where it was revealed that Delta will be imposing some new baggage rules as of January 15, 2013. The airline will only check baggage to the final destination if the itinerary is on a single ticket–not multiple tickets.

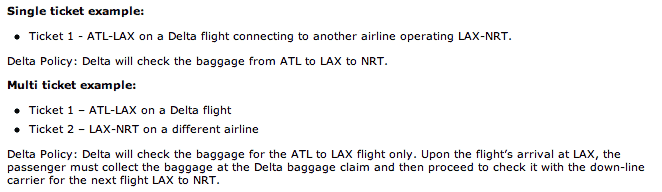

Here are the examples they give:

Here are the examples they give:

Bottom line–travel light. As I’ve said before, I am a one-bag evangelist. Not having checked bags will make this change less painful.

Recap

If you meet some very specific criteria–you live or can appear to live in CT, RI, or MA, need to diversify your prepaid-card portfolio, have a spending requirement to meet on an American Express card, and have a friendly AAA agent who will reload your card in the branch so that the transaction codes as a standard purchase–it may be worthwhile adding the AAA American Express prepaid card to your wallet. If you activate the card by 1/31/13, you will get a $25 American Express gift card. The terms and conditions can be found here.

As of January 15, 2013 Delta will no longer be facilitating your tight connection to another airline booked on a separate ticket. Take some of the sting out of the inconvenience by not checking any bags. If you must check a bag and will be using multiple tickets, consider your connection times carefully while planning your trip so that you have time to get your bag, check in to your next flight, and clear security.

Just getting started in the world of points and miles? The Chase Sapphire Preferred is the best card for you to start with.

With a bonus of 60,000 points after $4,000 spend in the first 3 months, 5x points on travel booked through the Chase Travel Portal and 3x points on restaurants, streaming services, and online groceries (excluding Target, Walmart, and wholesale clubs), this card truly cannot be beat for getting started!

Editorial Disclaimer: The editorial content is not provided or commissioned by the credit card issuers. Opinions expressed here are the author’s alone, not those of the credit card issuers, and have not been reviewed, approved or otherwise endorsed by the credit card issuers.

The comments section below is not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser’s responsibility to ensure all questions are answered.

Just got a Gold Delta SkyMiles credit card in 2 mins ..$500 in 3 months ..That will be 1 day of charging for me and no fee 30k points .Like a RT in the US…That will work !!!

Thanks Scott

Cj

This is a new one chated online with Ax and they appoved me in 2 mins now I got 2 cards in 10 days good for 55k points and I can transfer points to Delta ..

Thanks Scott and Folks

Power of the internet