MileValue is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

Note: Some of the offers mentioned below may have changed or are no longer be available. You can view current offers here.

Registration is open for IHG’s 2016 Share Forever promotion, which offers bonuses for stays from May 1 to September 5, 2016. The promotion is only open to IHG Rewards Club members whose address on file is in North America or South America.

The promotion is being offered in partnership with Coca-Cola–see the bottle on the left side of the picture above?–and each member’s offer is targeted like all recent IHG promotions.

The promotion’s name, “Share Forever,” refers to the fact that in addition to your own rewards for making stays, you earn points or free nights to give away to other people. You can, however, share those extra rewards with yourself.

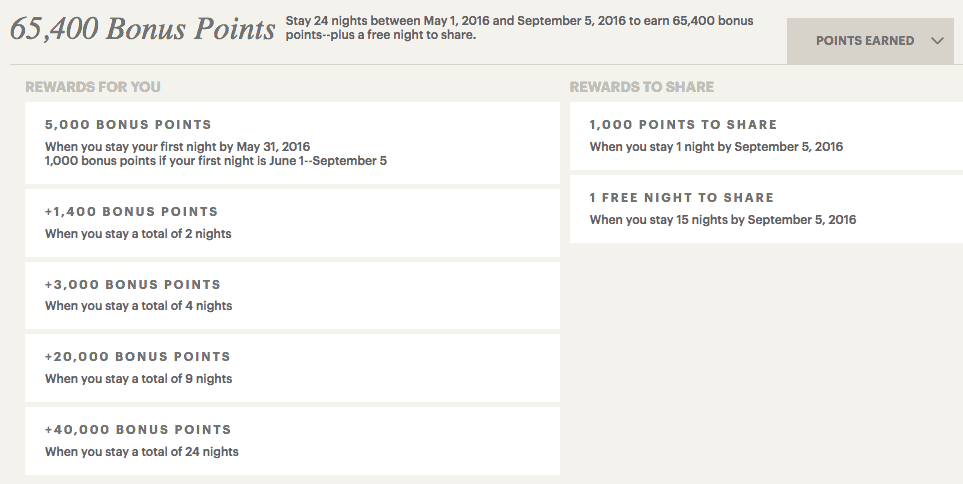

Here’s my targeted offer:

I can earn:

- 5,000 bonus points after 1 night from May 1 to May 31, 2016 (only 1,000 points if it’s completed between June 1 and September 5, 2016)

- 1,400 bonus points after 2 nights from May 1 to September 5, 2016

- 3,000 bonus points after 4 nights from May 1 to September 5, 2016

- 20,000 bonus points after 9 nights from May 1 to September 5, 2016

- 40,000 bonus points after 24 nights from May 1 to September 5, 2016

Plus I can share (including with myself):

- 1,000 bonus points to share after 1 night from May 1 to September 5, 2016

- 1 free night to share after 15 nights from May 1 to September 5, 2016 (stay by February 28, 2017 within the Americas)

If I stay 24 nights at IHG properties from May 1 to September 5, 2016 (one of which is by May 31), I’ll earn 70,400 bonus IHG points, plus one free night at any IHG property in the Americas. If I value the free night at 50,000 points, which is the most expensive free night on the IHG chart, that would be 120,400 bonus points for 24 nights, which is about 5,000 bonus points per night.

Spoiler alert: I am not going to stay 24 nights in hotels in the four months. I only had 15 hotel nights total in 2015, very few of which were paid nights.

But I might make a one night stay in May. That would be worth 6,000 bonus points. And another night would be worth another 1,400 bonus points.

Then I would look to use those points for PointBreaks hotels, which cost only 5,000 points per night for a free night.

Full IHG Share Forever promotion terms & conditions here

Mattress Run Worthy?

I value IHG points at 0.6 cents each. They’re offering me $36 worth of points for a one night stay and about $720 worth of points/free nights for 24 stays. Neither is worthy of a pure mattress run (ie booking a hotel when you have no use for one just because the rewards are worth more than the hotel costs), but both offer a big rebate on hotel stays you do need.

Bottom Line

Register for the Share Forever promotion to see your targeted offer. You should get 6,000 or 8,000 points for a one night stay and a lot more if you stay more nights.

What was your Share Forever offer?

Just getting started in the world of points and miles? The Chase Sapphire Preferred is the best card for you to start with.

With a bonus of 60,000 points after $4,000 spend in the first 3 months, 5x points on travel booked through the Chase Travel Portal and 3x points on restaurants, streaming services, and online groceries (excluding Target, Walmart, and wholesale clubs), this card truly cannot be beat for getting started!

Editorial Disclaimer: The editorial content is not provided or commissioned by the credit card issuers. Opinions expressed here are the author’s alone, not those of the credit card issuers, and have not been reviewed, approved or otherwise endorsed by the credit card issuers.

The comments section below is not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser’s responsibility to ensure all questions are answered.

[…] promotion is not lucrative enough to mattress run or change my behavior at all. By contrast, the current IHG promotion will probably cause me to book a one night stay at an IHG property that I would otherwise be on the […]