MileValue is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

Note: Some of the offers mentioned below may have changed or are no longer be available. You can view current offers here.

The Blue Business® Plus Credit Card from American Express’ appeal comes from its simple and impressive earning power. For no annual fee whatsoever, on the first $50,000 in purchases per calendar year (January 1 – December 31), it earns 2 Membership Rewards on ALL purchases. That is fantastically rewarding for a card so simple.

Who Should Open a Blue Business Plus Card

In a nutshell, if you can open a business credit card and have a lot of expenses that don’t fall in more lucrative bonus spending categories, then you should consider opening a the Blue Business® Plus Credit Card from American Express

Quick Facts

- Earn 2X Membership Rewards on all purchases, capped at $50,000 annually (January 1 – December 31), and 1 Membership Reward per dollar spent on all other purchases.

- Value of Membership Rewards earned: Points can be transferred to airline and hotel partners or used like cash toward the purchase of any flight at a rate of 1 cent per point. I value Membership Rewards around 2 cents each when transferred to airline programs, so I would not use them like cash toward the purchase of a flight.

- Global Acceptance: Chip technology

- Foreign transaction fees: 2.7%, so don’t use while traveling or to make purchases from foreign companies

- No Annual Fee

- Eligibility: American Express once in a lifetime bonus rule

Examples of Business Cards with Lucrative Category Bonuses

The cards below offer category bonuses with a better return on spending (in those specific categories) than the Blue Business Plus does. If you don’t spend in any of the categories listed below, then the The Blue Business® Plus Credit Card from American Express is a solid option for your business as you otherwise wouldn’t be getting a better return.

Chase Ink Business Preferred® Credit Card

The Chase Ink Business Preferred® Credit Card earns 3 Ultimate Rewards per dollar spent on travel, shipping purchases, internet, cable and phone services, and on advertising purchases made with social media sites and search engines.

Chase Ink Business Cash® Credit Card

The cards earns 5 Ultimate Rewards per dollar on the first $25,000 spent in combined purchases at office supply stores and on internet, cable and phone services each cardmember year. .

The Platinum Card® from American Express

The Platinum Card® from American Express earns a whopping 5 Membership Rewards per dollar spent on flights and prepaid hotels on amextravel.com.

Do I qualify for a business credit card?

You don’t need to have employees, an EIN, nor must you be profitable to qualify for a business credit card. Read more about who qualifies and how to get approved for business credit cards.

Examples of Businesses You May Not Think are Businesses

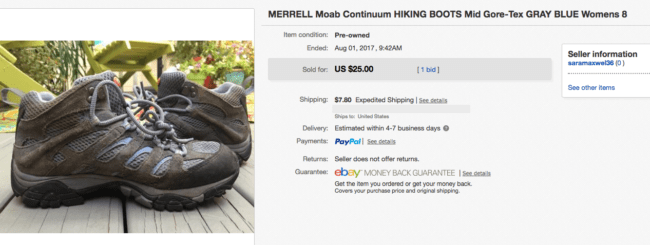

- Seller on eBay

- Seller on Amazon

- Seller on Etsy

- Seller at consignment shops

- Seller at yard sales

- Seller of baked goods

- Seller of souvenirs from your trips abroad

- Blogger

- Seller and collector of coins or stamps

Bottom Line

If you’re eligible for a business credit card and have lots of spend that wouldn’t otherwise earn a higher category bonus on another card, then the Blue Business® Plus Credit Card from American Express is a great option for your. For the first $50,000 you put on the card every year, you can earn 2 Membership Rewards per dollar spent. That’s a 100k Membership Rewards a year.

Of course there are business cards with MUCH bigger sign up bonuses that you could open and earn in three months. And there business cards with specific category bonuses that earn a higher return than 2 Membership Rewards per dollar. But this card’s straightforward earning structure is an easy answer for those who don’t want to spend time organizing various cards and various minimum spending requirements. Open it, put up to $50k of your business expenses on it each year, and earn up to 100,000 Membership Rewards for that $50k in spending in return. I value 100k Membership Rewards at about $2,000 when you transfer those points wisely to airline mileage programs for international and premium cabin award flights.

Credit card links have been removed from posts and added to the menu bar at the top of every page of MileValue under the heading Top Travel Credit Cards.

Just getting started in the world of points and miles? The Chase Sapphire Preferred is the best card for you to start with.

With a bonus of 60,000 points after $4,000 spend in the first 3 months, 5x points on travel booked through the Chase Travel Portal and 3x points on restaurants, streaming services, and online groceries (excluding Target, Walmart, and wholesale clubs), this card truly cannot be beat for getting started!

Editorial Disclaimer: The editorial content is not provided or commissioned by the credit card issuers. Opinions expressed here are the author’s alone, not those of the credit card issuers, and have not been reviewed, approved or otherwise endorsed by the credit card issuers.

The comments section below is not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser’s responsibility to ensure all questions are answered.