MileValue is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

Note: Some of the offers mentioned below may have changed or are no longer be available. You can view current offers here.

Avianca has a co-branded credit card issued by Banco Popular called the Avianca Vuela Visa that comes with 40,000 Avianca LifeMiles after your first purchase on the card and a $149 annual fee. There’s a lower annual fee Avianca card called the Avianca Vida Visa with a 20,000 LifeMiles bonus after your first purchase and payment of the $59 annual fee.

I’m going to go over the Avianca Vuela Visa below as I think that is the better deal between the two cards.

Quick Facts

- Sign Up Bonus:

- 40,000 bonus LifeMiles after using your card once

- Category Bonuses:

- 3 LifeMiles for every dollar spent on Avianca purchases

- 2 LifeMiles for every dollar spent at gas stations and grocery stores

- 15% discount when purchasing miles via Multiply Your Miles

- Two 50% discounts on award tickets redeemed after meeting further spending thresholds

- one applicable for travel to Central America or Colombia from the United States after spending $12,000 on the card in a year

- another also applicable for travel Central America or Colombia from the United States after spending $24,000 on the card in a year

- Free additional piece of baggage for travel between the United States and Central America

- No foreign transaction fees

- Annual Fee: $149

Eligibility

We don’t have a crystal clear idea as to Banco Popular’s application rules or standards. It is probably a good thing that this card isn’t issued by a bank you or I recognize. Those of cut off by the Chase 5/24 rule, Citi’s sign up bonus rule, or Amex’s one bonus per product per lifetime policy may have better luck with a new bank. But it also means we don’t have a ton of data points to form generalizations.

As reader Jeff G commented on a prior iteration of this post, applications with the Vuela Visa seem hit or miss. From what I’ve read, some in the past have had issues with Banco Popular requesting physical documents to prove income (like tax documents), while others have no issue at all and no questions asked from the bank. I’ve also read of some way over the Chase 5/24 limit getting instantly approved, and some with excellent credit scores getting instantly denied. It’s hard to draw any solid conclusions.

Pro Tip: Reader Rod W reached out to let me know he was told by Banco Popular that in order to be eligible for a repeat Vuela Visa card, one needs to first cancel the existing card and wait three years from the prior application date. Thanks for the intel, Rod!

Feasibility

The ability to get approved is one thing. The ability to use the miles you’re taking a hard credit pull for is another. My impression is that over time, LifeMiles have gotten easier to use in the sense that the phone representatives are getting better/more helpful. Seems like the site’s functionality has also improved.

I still hear complaints, and you can see some in the comments below. But remember that the internet is an echo chamber and many people don’t take the time to report their experience unless it’s an extreme one (whether that be negative or positive).

Please share your data points applying for the Avianca cards and/or actually using LifeMiles in the comments. If you are denied or given a decision pending response, try calling Banco Popular’s reconsideration line: 844-343-1010.

Sign Up Bonus

You will earn 40,000 Avianca LifeMiles after your first purchase on the Avianca Vuela Visa. I value LifeMiles at 1.6 cents each, making this sign up bonus worth approximately $640.

LifeMiles are great for booking well priced award flights on Star Alliance carriers without fuel surcharges…and it tends to be Star Alliance carriers that have the most premium cabin award space to Europe. For example, one of our stellar new team members Kevin just booked two award booking service clients for only 51,000 ThankYou Points each–transferred to LifeMiles last month during a 25% transfer bonus period–flying Swiss Air Boeing 777 Business Class between Rome and Los Angeles.

For more tips on what LifeMiles are good for, read Maximizing Avianca LifeMiles. That post is a bit outdated but I plan on updating it soon.

Category Bonuses

Category bonuses included 3 LifeMiles per dollar spent on Avianca purchases and 2 miles per dollar spent on gas and at grocery stores.

What merchants are included in the category of gas and grocery stores? Looks like pretty much every gas station and grocery store except places like Sam’s Club and Costco. The following is from the card offer’s terms & conditions:

“You’ll earn 2 LifeMiles for every $1 in Net Purchases spent at qualifying gas stations and grocery stores, which are those categorized by the merchant or its processor as gas stations and grocery stores using the merchant category code. Large warehouse-type stores are generally not categorized as grocery stores.”

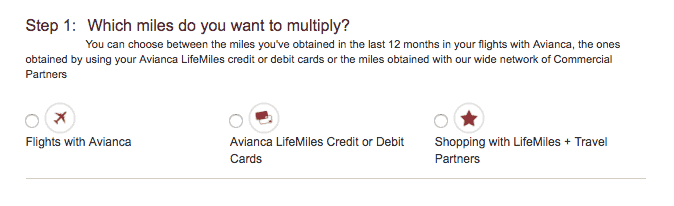

15% Discount When Purchasing Miles via Multiply Your Miles

Multiply Your Miles allows you to earn more LifeMiles when either Flying with Avianca, via spending on Avianca credit cards, or via traveling on partner airlines/other partner activity. It doesn’t mean you get 15% off when purchasing miles directly from Avianca, which is a bummer.

This is how Multiply Your Miles works: You can double the miles you’ve already earned (price per double mile is 1.85 cents each before the 15% discount, 1.57 cents each after) or triple them (price per triple miles is 1.71 cents each before the 15% discount, 1.45 cents each after). You can read more about the specific terms and conditions behind Multiply Your Miles here.

This is how Multiply Your Miles works: You can double the miles you’ve already earned (price per double mile is 1.85 cents each before the 15% discount, 1.57 cents each after) or triple them (price per triple miles is 1.71 cents each before the 15% discount, 1.45 cents each after). You can read more about the specific terms and conditions behind Multiply Your Miles here.

But is buying LifeMiles for 1.45 cents each a good deal? It’s decent… not good enough to buy speculatively but could definitely be worth it if you have an immediate high value use in mind.

Free Bag

The following is from the card offers’ terms and conditions:

“Non Elite LifeMiles members that are primary cardholders may check a second bag free of charge when traveling on Avianca flights from United States to Central America and vice versa (“Qualifying Trip”), except on trips where Avianca provides the second bag free as standard benefit. The second checked bag must be less than or equal to 50 pounds’ weight and dimensions up to 158 linear centimeters considering height, width and length. Others restrictions apply.”

Bottom Line

The Avianca Vuela Visa‘s annual fee of $149 is a touch on the pricey side, but 40k LifeMiles are valuable for booking Star Alliance flights and you don’t have to meet any minimum spending requirement aside from one purchase. That adds value to this sign up offer because there’s almost no opportunity cost–you can put spending towards meeting other minimum spending requirements for more big returns.

If you apply for this card, please share your experiences below, particularly because this card is issued by a relatively unfamiliar bank. You will be helping your fellow miles/points enthusiasts decide whether or not this is worth a hard inquiry. And please, report your experience even if it wasn’t particularly awesome or particularly terrible, so we can get form a well-rounded perspective.

Just getting started in the world of points and miles? The Chase Sapphire Preferred is the best card for you to start with.

With a bonus of 60,000 points after $4,000 spend in the first 3 months, 5x points on travel booked through the Chase Travel Portal and 3x points on restaurants, streaming services, and online groceries (excluding Target, Walmart, and wholesale clubs), this card truly cannot be beat for getting started!

Editorial Disclaimer: The editorial content is not provided or commissioned by the credit card issuers. Opinions expressed here are the author’s alone, not those of the credit card issuers, and have not been reviewed, approved or otherwise endorsed by the credit card issuers.

The comments section below is not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser’s responsibility to ensure all questions are answered.

Looks good, anybody know this bank?

Sweet, you can use it in CUBA!

http://fintechist.com/cuba-now-welcomes-banco-popular-de-puerto-rico-mastercard-holders/

Just applied and instantly approved after answering several security questions. I believe this card can also be used in Cuba (with certain restrictions).

I just verified with Avianca Visa that it’s not possible to use this CC in Cuba. Only the Banco Popular’s Mastercard will work in Cuba. Avianca is unfortunately a Visa. https://www.popularcommunitybank.com/services-for-me/credit-cards/mastercard-in-cuba/

Trying to decide if I want to spend the credit pull on this card. It sounds like a great offer, but how usable are the miles? I’ve never had Lifemiles, for those who have, what do you think of their booking process, online or via phone?

It sounds like there are some annoyances with the application process, are there similar annoyances with the booking process?

I need 3 business class tickets to catch up with a cruise next November for business class Chicago – Rome or business class Nice – Chicago. I joined LifeMiles and was able to check availability even with no miles in the account. LifeMiles requires 63,000 miles so the 60,000 bonus is pretty sweet. Since we found space, we each decided to apply – myself, my wife and her friend. 3 instant approvals (and I took screen shots of the promo code that I entered, just in case). One caveat: I read on FlyerTalk that some people were asked to upload a pay stub to verify income, so don’t fudge! Also, I am familiar with this bank as they have a few branches in Chicago.

Thanks for the valuable data points!

[…] Information section of the application. You can read the rest of the details of the Avianca Vuela Visa’s offer here. I double checked to see if the code is still working to garner the 60k bonus, and this […]

signed up for this card. was approved quickly online. approval note said I would get the card in 7-10 business days. at 11 business days I received PIN letter for the credit card but no card yet. I waited 4 weeks and still no card. I called the customer service number and waited on hold for 45 minutes. after an answer finally was told I was being connected to another department. other department was not told why I was being transferred to them so I had to explain the entire story again. after the operator asked me verification questions he told me the computer was down and I needed to call back the next morning after 8 am. seriously I have to call them back? I am paying $149 to buy a card from them and I have to call them back? why would they tell me we are sorry you have not received your card we want you to be out customer and we will follow up with you as soon as our system is back up and working. this is how backwards companies are these days.

Maybe this will help you. I had to call them a few times, because even though I activated the card online, I wasn’t able to use it without calling them and straightening it out. (This happened with my wife’s card, too). Anyway, the rep told me NOT to call the number on the back of the card, but to try (844) 343-1010. I did, and it WORKED! (And, yes, what kind of company puts the wrong number on the back of their own credit card?).

Instant approval. I had read in other places that if you put in Household income it asked you to verify. I just entered my income and it was smooth sailing. Also I am at 13/12, so that did not seem to be an issue.

Now we will see when I get the card and how hard it is to activate it…..

Great! Thanks for the info. Would love an update once you receive the bonus.

Just got the card this week, so it took 10 days to arrive. Arrived faster than some of my Chase and Amex cards.

Spending my $5 today, will let you know when it posts.

Thank you!

Miles posted today 2/22. Made the purchase on 2/18.

So a total of 16 days from approval, receiving card, making one purchase and points showing up.

Not bad.

Fantastic!

Seems to be very hit and miss with this card. I seem to have gotten lucky, too.

I guess I lucked out. When I received my card, I went to the website to set up my online account. Once it was setup, I then called the activation number, and it was pretty quick and painless. I used the card to pay a medical bill, and probably about a month later, I got my 60K Avianca miles.

Out of curiosity, any new data points on this card? I see on Flyertalk that some people have had trouble with the application process…

My application process was smooth, no issues at all. Cards arrived quick, points posted quick. Smoother than Chase, AmEx, etc.

[…] co-branded credit card called the Avianca Vuela Visa. You can read details about the card in New Avianca Vuela Visa: 60k LifeMiles After Just One Purchase. I’m not sure if it’s still possible to get the 60k bonus however, as I don’t see a […]

[…] The new Avianca card issued by Banco Popular comes with 40,000 Avianca LifeMiles after your first purchase on the card and a $149 annual fee. This FlyerTalk thread says the bonus code to bump the bonus to 60,000 miles is no longer working. You can read the rest of the details of the Avianca Vuela Visa’s offer here. […]

Well, when you snooze you lose. That happened to me and there was no place to put the bonus code.

The offer is back with a new promo code, Byron!

@Kenny, I personally have had a terrible time using the miles. Time and again I see seats on United and Aeroplan, only to go to LifeMiles and find nothing available. Just as an experiment right now, I checked ORD-MAD for the month of April in economy. At united.com I found 25 dates with availability. With LifeMiles no seats whatsoever for the entire month. If somebody has insights as to when and where the program actually makes seats available, please let me know, because I would like to drain my account. They sell miles all the time, but if you can’t use them, it’s a scam, isn’t it?

LifeMiles have become difficult to use. Used to be good, but they changed the online booking, which has really messed it up.

Even if you find the space online 50/50 chance you’ll get an error at some point in the process and that’s it.

Calling in is useless, you can follow some steps and email in the info, etc and people claim they get tickets booked and issued.

Sounds like a lot of work!!

If you find non-stop flights, you have a better chance then looking at connections or mixed class bookings.

I’ve stoped purchasing miles, since these troubles began.

Also, I’ve never had luck using the LifeMiles credit card on the LifeMiles site. Good luck trying to multiplying your miles.

I’m going to cancel my LifeMiles credit card in July, I hope that isn’t a long drawn out process.

It takes a few minutes to send them the screenshots. Their response is to be expected usually within 1 day. Outside of the web site glitches, I had very good customer service experience every time. I booked, re-booked, or cancelled a few flights. Nowadays the web site works for me without any glitches, so making reservation is very easy. Cancelling the card is a quick few minutes phone call. The only problem with LifeMiles are the newish change and refund fee. LifeMiles is one of the best transfer partners of TYP (of course it is Star Alliance). Applying for a second card will result in a deny message.

I will have to try the screen shot procedure.

Customer service has improved, used to take 1-2 hours, to cancel a ticket, now it only takes 10 minutes or so.

Tho the fee went from $50 to $200….

If anyone has had a recent experience applying for this card, I’d be interested in how the process went and whether or not you were approved. Thanks!

I moved Citi TY points over to Avianca instantly. Then booked 2 bus. class tickets from JFK-ANN-DXB without any issue. A day later I moved Amex points over intantly and booked 2 bus. class tickets for the return flights with the same routing. Everything worked just fine.

I was approved for their card a year or two ago. I used those points mainly for use on United here in the US. Once I booked a ticket, got the record locator, only to find they had cancelled the ticket without telling me. Otherwise all has been well with Avianca in my experience.

I got a card each for me and my wife about a year ago…..same promotion as now. Got my 60K miles each after making the first purchase. NEVER AGAIN! This card is issued by a bank in Puerto Rico and it is almost impossible to use the miles. The customer service is non-existent. The online flight search engine is very difficult to use and its almost impossible to book a flight….even when seats are available as commented by another person in the above comments. The phone wait time is unbelievable. I timed it once and gave up after 90 minutes. When you do connect you are speaking to a person somewhere in Central America who barely speaks English. Due to their incompetence I lost 60 K miles in trying to purchase a RT ticket from the US to Europe. Word to the wise: if a deal sounds too good to be true….there’s probably a good reason for it.

I applied for this card and was approved. I received the card and tried to use it for a $35 charge. The charge was rejected. When I called the bank they said that they cancelled the card but would not tell me why. Two weeks later I received a letter saying the card was cancelled with no reason. I have a Fico score of 840 with perfect credit. Don’t waste a hard pull for this card.