MileValue is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

Note: Some of the offers mentioned below may have changed or are no longer be available. You can view current offers here.

The AT&T Access More Card from Citi comes with a $650 credit toward the purchase of a new smartphone after $2,000 in purchases in the first three months and 3x points on online purchases at retail and travel sites.

The $650 credit is enough to get a brand new iPhone 6 for free, and the 3x points on online purchases can turn into 4.8% back toward the purchase of American Airlines flights.

Quick Facts

- Sign Up Bonus: A free phone (up to $650) after spending $2,000 in the first three months

- Category Bonuses: 3x ThankYou Points on purchases made online at retail and travel websites, 3x ThankYou Points on products and services purchased directly from AT&T

- Anniversary Bonus: 10,000 bonus ThankYou Points after spending $10,000 in the previous cardmember year

- Value of ThankYou Points: Worth 1 cents toward the travel expenses. However, you can combine these ThankYou Points into an account associated with a Citi Prestige, which would make them worth 1.33 cents toward the purchase of flights OR allow them to be transferred to 12 airlines‘ miles. If you don’t have a Prestige, combine them with points from a Citi ThankYou® Premier Card to make them worth 1.25 cents toward any flight, hotel, car rental, or cruise or transferable to those 12 airlines.

- Global Acceptance: Chip technology but a 3% foreign transaction fee, so avoid using it abroad

- Annual Fee: $95

Sign Up Bonus

To earn your AT&T Access More Card from Citi Phone Offer credit, you must make $2,000 in purchases in the first 3 months of account opening, which can include your eligible phone purchase. Phone offer is not available if you have had an AT&T Access More Card from Citi account that was opened or closed in the past 18 months. Balance transfers, cash advances, account fees, interest and items returned for credit are not purchases.

Eligible Phones

Only phones purchased from AT&T at full retail price (no annual contract) through the link provided to you by Citi are eligible. You must activate the phone with qualifying AT&T postpaid wireless service (including voice and data as applicable) and keep the phone, and remain active and in good-standing, for at least 15 days.

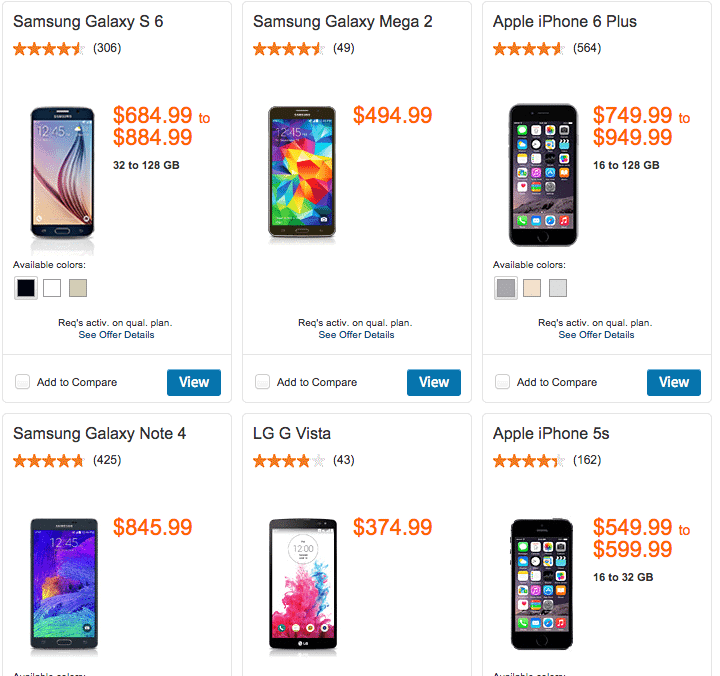

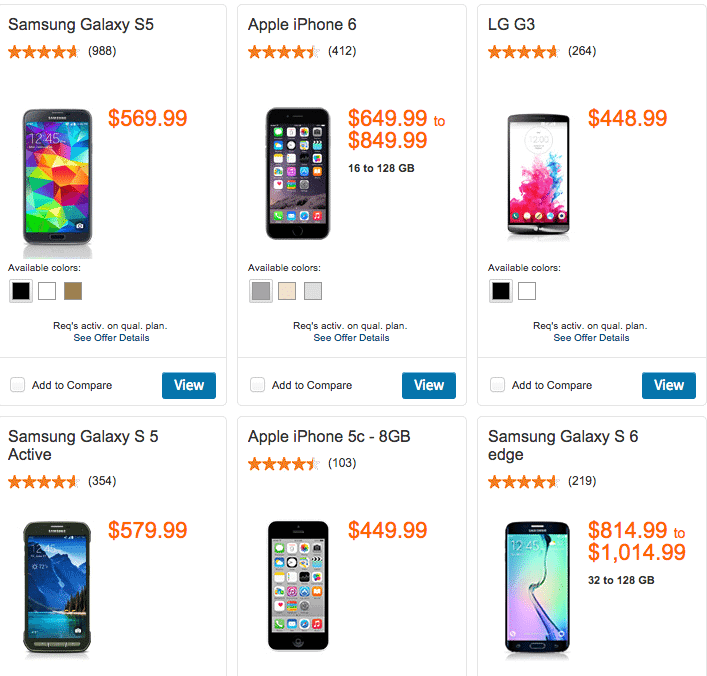

User lakeshoredrive was the first to provide the link that shows which phones are eligible for the up-to-$650 credit. There’s no trickery. All the top models are being offered.

The credit is enough to get a free-except-taxes iPhone 6. After the $650 credit, an iPhone 6 Plus starts at $100, and a Galaxy S6 at $35.

Offer Redemption

You must purchase an eligible phone from AT&T with your AT&T Access More Card from Citi using the Phone Offer Link created individually for you.

There’s a report of one person ordering his phone the day after receiving his card and the phone arriving the next day.

You may redeem the Phone Offer using the link at any time after your Card account opening. Once you have made $2,000 in purchases within the first 3 months of your Card account opening, and purchased and activated your eligible phone, Citi will credit your account for the cost of the eligible phone you purchased up to $650 (exclusive of taxes, fees, shipping and wireless service) within 1 to 2 billing cycles. If you choose to purchase an eligible phone which costs more or less than $650, your credit will equal the cost of the phone or $650, whichever is less.

I haven’t seen reports of the credit being received yet, but the card is so new that no one has waited the required 1 to 2 billing cycles.

General Offer Terms

Offer is valid for a one time statement credit up to $650 for one eligible phone, is not transferrable and so long as your card account is open and current, does not expire. Offer is not combinable with other discounts on devices. If you close your account prior to redeeming your credit, the credit is forfeited. Terms subject to change.

Earning ThankYou Points

Category Bonuses

Getting a free iPhone is the headline grabber, but this card has sneaky big potential for every day spending. The card earns:

- 3x ThankYou Points on purchases made online at retail and travel websites

- 3x ThankYou Points on products and services purchased directly from AT&T

Retail websites are websites that sell goods directly to the consumer through an online website and include department store websites, specialty store websites, warehouse store websites and boutique websites. Travel websites are websites that allow you to book travel and include online travel agencies, hotel websites and airline websites. Purchases not eligible to receive the additional ThankYou Points include but are not limited to payment for or to medical services, insurance, taxes and government services, education, charities and utilities.

User x9bull reported getting 3x points for online purchases at “amazon, 6pm, guess, spear, drugstore, kohl’s” but not at “Stylenanda (billed as www.eximbay.com).”

My take is that almost all direct retail and travel websites, including the ones where you probably spend the most money like airline sites, Amazon, Walmart, and more, will earn 3x ThankYou Points.

Annual Spending Bonus

Any cardmember year that you spend $10,000 on the card, you get a bonus 10,000 ThankYou Points at the start of the the next cardmember year.

So if you get the card May 28, your cardmember year is May 28, 2015 – May 27, 2016, and you’ll get your bonus probably in early June 2016.

This is pretty generous, since most of your spending will probably already be earning 3x points from category bonuses.

Value of ThankYou Points

Citi’s ThankYou program is a bit confusing because the value of the points depends on the card on which you earn them. The AT&T Access More Card from Citi earns the least valuable ThankYou Points, worth just 1 cent each.

But Citi allows you to combine all your ThankYou Points into one account or gift your points to anyone, and these are easy ways to increase the value of your ThankYou Points.

Combine or Share with Prestige

If you have a Citi Prestige® Card (or share your points with someone who does), the points instantly become worth 1.33 cents each toward any airline. Or you’d be able to transfer these ThankYou Points to 12 airlines’ miles or Hilton points.

This is the ideal scenario.

Under this scenario, your online shopping now earns 4.8% back toward American Airlines flights or 3 Singapore/Air France/Virgin Atlantic miles per dollar. That’s unbeatable on Amazon and other online purchases!

Combine or Share with Premier

If instead you have a Citi ThankYou® Premier Card (or share your points with someone who does), the points instantly become worth 1.25 cents toward any airline’s flights. Or you’d be able to transfer these ThankYou Points to 11 airlines’ miles or Hilton points.

Under this scenario, your online shopping now earns 3.75% back toward any flights with no blackouts or 3 Singapore/Air France/Virgin Atlantic miles per dollar.

Getting a Second Citi Card

If you get the AT&T Access More Card from Citi, I highly recommend getting the Citi Prestige like I did to maximize the value of your ThankYou Points. You CANNOT be approved for two Citi cards on the same day. Wait 8+ days after the first application before the second application.

You CANNOT get three Citi cards in short order either. Make sure there is at least 65 days between your first and third Citi card applications if you want to get a free smartphone plus 96,000 ThankYou Points by getting the AT&T Access More Card from Citi, Citi Prestige, and Citi ThankYou Premier.

Fees

The card has a $95 annual fee. In year one, that is swamped by the $650 credit and 3x for online retail and travel purchases. In subsequent years, that is swamped by the 10,000 point annual spending bonus and 3x for online retail and travel purchases.

The card also has a 3% foreign transaction fee, so don’t use it abroad. The Citi Prestige, and Citi ThankYou Premier have no foreign transaction fees.

Bottom Line

The AT&T Access More Card from Citi offers up to $650 off a new phone after spending $2,000 in the first three months plus 3x for online retail and travel purchases.

The ThankYou Points earned on the card are only worth 1 cent each, but if you also have a Citi Prestige or Citi ThankYou Premier, the points become transferable to airline miles or at least more valuable when redeemed for flights on any airline with no blackouts.

Offer details:

- Exclusive New Phone Offer*

- 3 ThankYou Points for every $1 you spend on purchases made online at retail and travel websites*

- 3 ThankYou Points for every $1 you spend on products and services purchased directly from AT&T*

- 1 point earned for every $1 you spend on other purchases*

- 10,000 Anniversary bonus points after you spend $10,000 in prior cardmembership year*

Application Links:

- AT&T Access More Card from Citi

- Citi Prestige

- Citi ThankYou Premier

Just getting started in the world of points and miles? The Chase Sapphire Preferred is the best card for you to start with.

With a bonus of 60,000 points after $4,000 spend in the first 3 months, 5x points on travel booked through the Chase Travel Portal and 3x points on restaurants, streaming services, and online groceries (excluding Target, Walmart, and wholesale clubs), this card truly cannot be beat for getting started!

Editorial Disclaimer: The editorial content is not provided or commissioned by the credit card issuers. Opinions expressed here are the author’s alone, not those of the credit card issuers, and have not been reviewed, approved or otherwise endorsed by the credit card issuers.

The comments section below is not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser’s responsibility to ensure all questions are answered.

Thanks for the post! Any data points about using this card for MS? GCM, Amex, others?

Thanks for the post! Any data points about using this card for MS? GCM, Amex, others?

I already have an account with ATT. Can I use this card to get a phone which would be added to the existing account?

Other sites that mention this offer say “maintain phone service with AT&T” for 15 days, and no one mentions anything about a new ATT account, so I think we existing customers are good to go. This is a great deal, especially since ATT is no longer subsidizing phones with a renewed contract like it used to.

Anyone see any reason two folks on the same ATT contract couldn’t get two cards and two phones? I’d love to replace my not-fully-working iPhone.

I already have an account with ATT. Can I use this card to get a phone which would be added to the existing account?

Other sites that mention this offer say “maintain phone service with AT&T” for 15 days, and no one mentions anything about a new ATT account, so I think we existing customers are good to go. This is a great deal, especially since ATT is no longer subsidizing phones with a renewed contract like it used to.

Anyone see any reason two folks on the same ATT contract couldn’t get two cards and two phones? I’d love to replace my not-fully-working iPhone.

[…] can get a new iPhone (or another smartphone) by simply signing up for a new credit card. Whaaa? A Samsung Galaxy S6 for only $50 or so, […]

[…] can get a new iPhone (or another smartphone) by simply signing up for a new credit card. Whaaa? A Samsung Galaxy S6 for only $50 or so, […]

Does anyone know if the AT&T iPhone 6 would be unlocked? I would like to use the phone traveling internationally and insert my own country specific Sim card.

It is not unlocked, but you can pay $20-$30 to get someone to unlock it or AT&T will unlock it for free after sixty days of service.

Does anyone know if the AT&T iPhone 6 would be unlocked? I would like to use the phone traveling internationally and insert my own country specific Sim card.

It is not unlocked, but you can pay $20-$30 to get someone to unlock it or AT&T will unlock it for free after sixty days of service.

But….I’m a Verizon Wireless customer. And I’m not willing to switch to AT+T even for a phree Ifone. When will I be able to get a deal like this??

But….I’m a Verizon Wireless customer. And I’m not willing to switch to AT+T even for a phree Ifone. When will I be able to get a deal like this??

[…] Last week I wrote about the AT&T Access More Card from Citi comes with a $650 credit toward the purchase of a new smartphone after $2,000 in purchases in the first three months and 3x points on online purchases at retail and travel sites. […]

[…] Last week I wrote about the AT&T Access More Card from Citi comes with a $650 credit toward the purchase of a new smartphone after $2,000 in purchases in the first three months and 3x points on online purchases at retail and travel sites. […]