MileValue is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

Note: Some of the offers mentioned below may have changed or are no longer be available. You can view current offers here.

The Citi Prestige® Card has the best benefits of any of the premium cards at the moment, which is why I consider it one of the top credit card offers on the market. Many of those benefits are annual benefits. It’s a new year, so here are the benefits you can maximize this year!

What are the benefits?

- $250 Air Travel Credit

- Priority Pass Select Membership (Lounge Access)

- Category bonuses: 3x points on Airlines and Hotels, 2x on Dining and Entertainment

- Fourth night free on paid hotel stays

- $100 credit for applying for Global Entry

- Travel insurance

- Valuable points that you can pool together from other cards that earn ThankYou points

- Global Acceptance: Chip technology and no foreign transaction fees

1. $250 Air Travel Credit

The Air Travel Credit is designed to offset air fares, baggage fees, award fees, lounge access, and some in-flight purchases (not including Gogo services). Most other premium cards that offer air travel credit don’t reimburse for actual airfare, only airline related expenses, but revenue tickets are included in the Citi Prestige® Card‘s definition of Air Travel. This is a huge perk that should be utilized to offset the $450 annual fee.

How to Maximize this Benefit

If you got your card last year, you now have the chance to come out on top in 2016 by redeeming another $250 in Air Travel expenses since this benefit resets every January. What do I mean by that?

Each time your statement closes, charges on that statement that coded as Air Travel are credited back to your account until $250 in credits are received for the calendar year. Hopefully you used your entire $250 credit last year. You should’ve gotten a new $250 Air Travel Credit in January, and if use it up before your second annual fee is due in 2016, then you will get $500 in free airfare and award fees for your first $450 annual fee.

Read more details about the $250 air travel credit.

2. Lounge Access: Priority Pass Select Membership

The Priority Pass Select Membership will get you into over 850 lounges worldwide. You can get in to any of the lounges you can search for here, except United Clubs and Copa Clubs.

How to Maximize this Benefit

You can bring in your spouse and all your children under 18 or any two non-related guests for free.

Read more details about the lounge access granted by the Citi Prestige Card.

3. Category bonuses: 3x points on Airlines and Hotels, 2x on Dining and Entertainment

- Earn 3x points on Air Travel and Hotels

- Earn 2x points on Dining at Restaurants and Entertainment

This card very clearly offers the biggest benefits to frequent travelers, since a number of its benefits like free hotel nights and lounge access will be most used by travelers. The category bonuses are no exception. If you buy a lot of airline tickets and hotel stays, and if you dine out while traveling, you will rack up a ton of extra points from these category bonuses.

Note that the 3x points on Air Travel and Hotels is worth at least 4.8% back toward travel on American Airlines, since points are worth 1.6 cents each toward those flights. That’s an incredible return.

How to Maximize this Benefit

ThankYou points are very valuable for booking international travel. Use all the extra points you earn from the category bonuses to book a great deal on an award.

I recently transferred ThankYou Points to Singapore Airlines miles to fly from Atlanta to Honolulu in a flat bed for 30,000 miles. I’ve also used Singapore miles to fly from Colombia to Argentina in Business Class for half the price it would have been with United miles. Singapore miles are also the only way to fly Singapore Suites, cheaper than United miles to book United flights to Europe, and offer two stopovers in addition to your destination on roundtrip awards. I also love Air France Flying Blue as a transfer partner because of its cheap awards to Europe, Israel, Hawaii and South America.

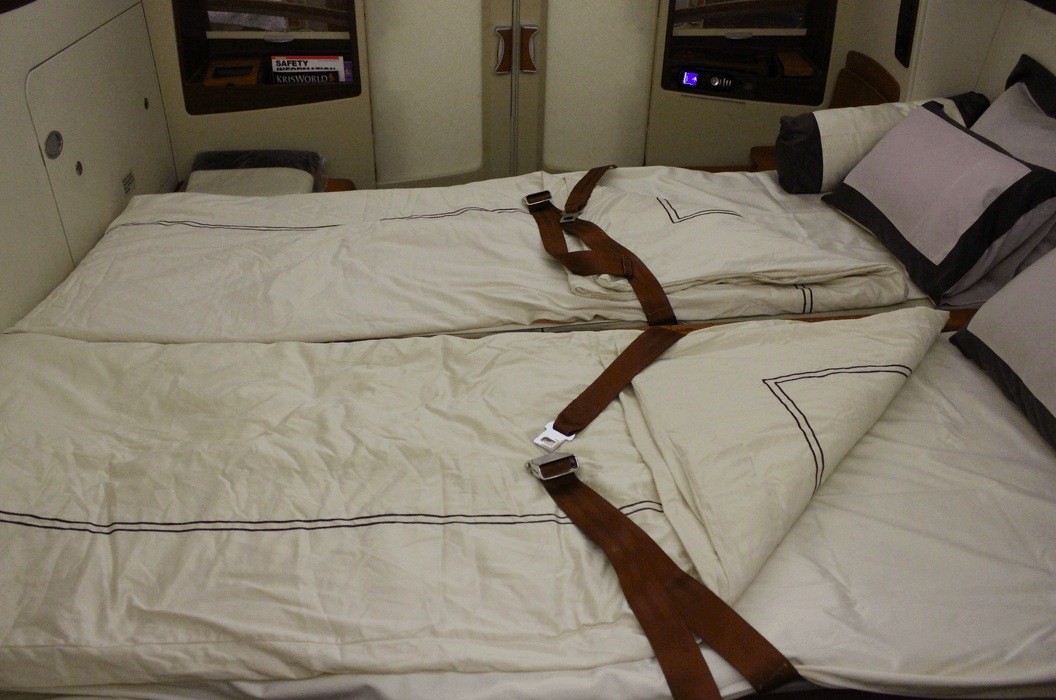

4. Fourth night free on paid hotel stays

Simply book your stay of 4+ nights through the Prestige’s concierge service, pay with your Prestige, and get the fourth night, including taxes, refunded to you after the stay.

How to Maximize this Benefit

It’s an amazing benefit that can get you way more than 25% off your hotel stay if you maximize it properly, like lining up the fourth night of your reservation to fall on a night with a higher rate. For example, a weekend night in Las Vegas or New Years Eve in New York City. Thankfully the benefit is not restrictive in this aspect no matter what the day of the week or what’s happening on a promotional level. If the hotel qualifies and the entire stay is paid on your Prestige, the fourth night is free.

Read more here about How to Save More than 25% Off Hotel Stays with Citi Prestige’s Fourth Night Free Benefit.

5. $100 credit for applying for Global Entry

Global Entry is amazing. Here’s a post in which I explain how to get it and why you want it. With Global Entry, you’ll breeze through Customs and Immigrations every time you return to the United States. Instead of spending time in line and talking to an agent, you tap a few buttons at a kiosk and get to the curb in a few minutes. It even lets you skip immigration queues in Australia and New Zealand. You’ll also breeze through security at every American airport because Global Entry gives you automatic TSA Precheck.

Applying for Global Entry costs $100, which is a small price to pay for the time savings in my opinion. Pay with your Citi Prestige® Card and get the $100 back via a statement credit.

How to Maximize this Benefit

Just sign up and do the interview. Global Entry membership is valid for 5 years.

6. Travel insurance

Worldwide car rental insurance, medical evacuation, trip cancellation/interruption, trip delay protection, baggage delay and lost baggage protection, and travel emergency assistance are all offered as a perk of the Prestige. The catch with many of these is that you have to have paid for the car rental/flight/trip on your Prestige to qualify for the coverage.

This benefit is similar to what is offered by most other premium cards, but it’s nice to keep in mind and could certainly prove useful.

How to Maximize this Benefit

Car rental insurance. All you have to do is pay for a rental car in full with your Prestige and decline the rental company’s collision loss/damage insurance. It can cost hundreds if you pay out of pocket to the car rental agency.

7. Points are combinable with other ThankYou Points earning Cards

Get the points you need for your dream award 2x, 3x, or 10x as fast by pooling points earned from several ThankYou Points earning cards and even by combining your points with other people’s.

How to Maximize this Benefit

Say your dream is to fly from Los Angeles to Tokyo-Narita in Singapore Suites Class for 74,375 Singapore miles + $113.30. You can get a Prestige and a Citi ThankYou® Premier Card and have both cards’ points go into a single account to get you to the miles you need twice as fast.

You can even get your friends and family in on the act. Have them open up ThankYou Points earning cards and transfer you the points for free (that you can then transfer to Singapore miles or use any other way.)

See How to Combine ThankYou Points into One Account and How to Share ThankYou Points with Anyone for more information.

8. Global Acceptance: Chip technology and No Foreign Transaction Fees

It should be obvious how to maximize this benefit– when you use your 40,000+ ThankYou points to travel, take your Prestige with you! And just think about all those points you’ll get from the category bonuses.

Bottom Line

In my opinion there are more than enough benefits from this card to merit keeping it despite the $450 annual fee. But if you do decide to cancel or downgrade, make sure you cash in on the benefits before doing so.

Just getting started in the world of points and miles? The Chase Sapphire Preferred is the best card for you to start with.

With a bonus of 60,000 points after $4,000 spend in the first 3 months, 5x points on travel booked through the Chase Travel Portal and 3x points on restaurants, streaming services, and online groceries (excluding Target, Walmart, and wholesale clubs), this card truly cannot be beat for getting started!

Editorial Disclaimer: The editorial content is not provided or commissioned by the credit card issuers. Opinions expressed here are the author’s alone, not those of the credit card issuers, and have not been reviewed, approved or otherwise endorsed by the credit card issuers.

The comments section below is not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser’s responsibility to ensure all questions are answered.

Can you please clarify how the 4th night free works? When you check out after a 4 night stay, do you (1) just pay for 3 of the 4 nights or (2) pay for all 4 nights, then get the 4th night refunded as a statement credit? Thanks

Fourth night is refunded as a statement credit.