MileValue is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

Note: Some of the offers mentioned below may have changed or are no longer be available. You can view current offers here.

Update 10/26/17: This offer is ending next week, on Wednesday, November 1. Looking back historically, there is a decent chance this is the last elevated offer we will see for the SPG Business card if Chase takes over as the card issuer instead of American Express moving forward with the SPG/Marriott merger. If you were contemplating this card, give this post another read and make a decision by Halloween!

The Starwood Preferred Guest Business Credit Card from American Express is out with a new sign up bonus package.

- By spending $6,000 on the card within three months of opening it, you’ll earn 25,000 SPG Starpoints

- By spending an additional $4,000 on the card within six months of opening it, you’ll earn an additional 10,000 SPG Starpoints

So for spending $10,000 on your new card within six months, you’ll earn a total of 35,000 SPG points. We value SPG points higher than any other reward currency due to their extreme versatility–2.5 cents each. That makes this elevated bonus worth $875. Don’t forget you’d also earn at least 10,000 SPG points simply meeting the spending requirement for non-bonused spending. 45,000 Starpoints are worth roughly $1,000.

This is a big bonus–worth a lot of money–but it requires a lot of spending. Businesses tend to have large expenses so it’s not unrealistic, but I wouldn’t recommend opening it unless you can organically meet that spending requirement. Read Amex Adds Terms Allowing them to Temporarily Suspend Earning and Redeeming Membership Rewards from Doctor of Credit to learn why.

This offer ends November 1, 2017.

Quick Facts

- Sign Up Bonus: 25,000 bonus Starpoints after spending $6,000 on the card in the first three months, and an additional 10,000 bonus Starpoints after spending an additional $4,000 on the card within the first six months

- Category Bonuses: 2x on on SPG and Marriott stays

- Boingo Wifi: Complimentary, unlimited Boingo Wi-Fi on up to four devices at more than 1,000,000 Boingo hotspots worldwide

- Lounge Access: Sheraton Lounge Access

- Elite Credit: 5 nights and 2 stays each year toward SPG Elite status

- Value of Starpoints: We value Starpoints at 2.5 cents each

- Global Acceptance: Chip technology and no foreign transaction fees

- Annual Fee: $0 for the first 12 months, $95 per year afterwards

- Eligibility: You can’t get the personal bonus if you’ve ever gotten the personal bonus before (note eligibility for the business version of the SPG card is separate)

Credit card links have been removed from posts and added to the menu bar at the top of every page of MileValue under the heading Top Travel Credit Cards

How to Use Starpoints

These are the main ways to get value from Starpoints, which you can read about in detail here:

- Free Night Awards

- Cash & Points Awards

- Transfer to Airlines with a Miles Bonus

- SPG Nights & Flights

- SPG to Marriott for Hotel + Air

- 18,667 SPG to Marriott to 25,000 United Miles

They can be used for free hotel nights starting at 2,000 points per night or transferred to dozens of airline miles including American, Asiana, Alaska, ANA, Avianca, Delta, and Lufthansa at 1:1 rate with 5,000 bonus miles for every 20,000 points transferred. Many SPG airline partners are not partners with any other transferrable point and are hard otherwise to earn.

The SPG > Marriott > United Angle

For those that weren’t aware, SPG and Marriott recently merged.

A problem many of us face (a show of hands please? I know I’m not the only one!) is our inability to earn United miles due to the Chase 5/24 rule. Sure, I can collect Singapore miles via tons of cards, but I have to stick to redeeming them solely on United flights if I want to avoid fuel surcharges. United miles give you fuel surcharge free access to Star Alliance award availability, so it’s a bummer being locked out of them.

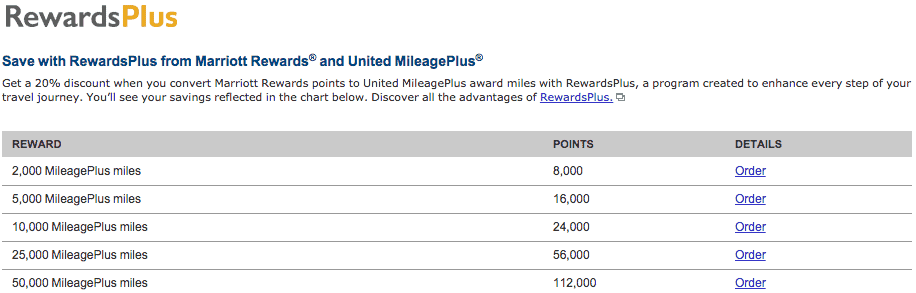

SPG and Marriott’s new relationship lends a helping hand in this aspect, since one can now transfer SPG points to Marriott Rewards, which in turn can be transferred to United at a much more favorable rate than directly transferring SPG points to United.That unlocks Star Alliance award space without having to worry about fuel surcharges. United, Copa, and Avianca are the only miles I’m aware of that can book fuel surcharge free awards across Star Alliance.

Twenty thousand Starpoints transferred to United is a measly 12,500 miles. Instead of transferring directly, do the following:

- Transfer 19,000 SPG points to 57,000 Marriott points

- Transfer 1,000 Marriott back to 333 Starpoints (necessary step because the starting amount of transfers from each program has to be an even thousand)

- Transfer 56,000 Marriott (18,667 Starpoints) to 25,000 United miles

Or you can turn 8,000 Starpoints into 10,000 United miles.

Another Angle Considering the SPG & Marriott Merger

We don’t know what the future of SPG and Marriott’s separate credit cards (issued by separate banks) will be. Until at least 2018, we will see the Marriott and SPG credit cards stick around:

If you’re a points omnivore like me, you’ll probably want to get both SPG cards (personal and business) as well as both Chase issued Marriott cards before 2018 when one or more might be killed off.

If you’re a points omnivore like me, you’ll probably want to get both SPG cards (personal and business) as well as both Chase issued Marriott cards before 2018 when one or more might be killed off.

Eligibility

In regards to eligibility (and everything else, for that matter), the Starwood Preferred Guest Credit Card and Starwood Preferred Guest Business Credit Card are different products entirely. You can have one/have had one and still be eligible for the bonus on the other.

You are limited to getting the bonus once per lifetime on American Express personal cards. If you’ve the bonus on the SPG Business Card before, you can’t get it again (publicly) with the bonus. If you are targeted for the offer, then you might be able to get it again. Due to this “once in a lifetime rule”, you should only snipe public Amex offers when they’re offering historically high sign up bonuses. While we’ve seen a lower spend requirement to trigger a 35k bonus for the business card in the past, it’s still as high as we’ve seen the offer for this card get. And like I said above, it’s possible one or more of the SPG Amex cards will get killed off in 2018 if they decide to go with a different issuer.

You are also limited to holding four to five American Express credit cards. Both personal and business count toward this limit. (AMEX Everyday, Delta, and SPG are credit cards.) Separately, you are limited to holding four to five American Express charge cards. Both personal and business count toward this limit. (AMEX Platinum is a charge card.)Both of these Hilton cards are credit cards.

If you’re on the verge and contemplating a fifth credit or charge card, read this post–you can apply basically risk-free.

You typically won’t be approved for more than one Amex credit card in a five day period. If you want to apply for another Amex card as well as this one soon, wait at least five days after you apply for the SPG Business Card.

Bottom Line

You can earn 35,000 bonus SPG points by opening a Starwood Preferred Guest Business Card before November 1, 2017, and spending $10,000 on it within the first six months of having it ($6,000 of which needs to be spent within the first three months).

Credit card links have been removed from posts and added to the menu bar at the top of every page of MileValue under the heading Top Travel Credit Cards

Hat tip Doctor of Credit

Just getting started in the world of points and miles? The Chase Sapphire Preferred is the best card for you to start with.

With a bonus of 60,000 points after $4,000 spend in the first 3 months, 5x points on travel booked through the Chase Travel Portal and 3x points on restaurants, streaming services, and online groceries (excluding Target, Walmart, and wholesale clubs), this card truly cannot be beat for getting started!

Editorial Disclaimer: The editorial content is not provided or commissioned by the credit card issuers. Opinions expressed here are the author’s alone, not those of the credit card issuers, and have not been reviewed, approved or otherwise endorsed by the credit card issuers.

The comments section below is not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser’s responsibility to ensure all questions are answered.

I just applied for and got approved for the Chase Ink Business Preferred last week. Is it ok to apply for this card so soon thereafter, or will that cause any issues with approval from AMEX?

No, that shouldn’t have an impact.

I realized my answer might have been a bit confusing. What I meant was your approval for the Ink Business Preferred shouldn’t affect your eligibility for the SPG Business Amex as they are from different issuers and Amex doesn’t enforce any rules over eligibility for their cards relating to other issuer’s cards.

[…] The rest of the card’s benefits look similar to those of the personal card. Read more about the elevated SPG Business Amex offer here. […]

Sorry if this is posted someplace else and I missed it. I noticed the statement at the top about the possibility/probability of the SPG brand cards moving to Chase. Is there more information on that? Or the likelihood? Since Amex was limited to one bonus per brand lifetime I had held off yet on doing an SPG business Amex, but if this is realistically the last time then that changes my decision paradigm. If there isn’t anything solid yet on this change I would appreciate your educated guess on probability.

[…] By traveling in American Airlines economy during the low season, you can bring the mileage price down to just 20,000 Etihad miles. All year round you can book American Airlines Business Class for 50,000 Etihad miles. Etihad Guest is a 1:1 transfer partner of Membership Rewards, ThankYou Points, and SPG Points. The SPG Business Amex’s 35k bonus ends tomorrow, FYI. […]