MileValue is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

Note: Some of the offers mentioned below may have changed or are no longer be available. You can view current offers here.

Update: Several–if not all–of these offers have expired. For the current best offers for free travel, see Best Credit Cards Offers.

When signing up for a credit card, I think there are four factors to consider:

- What is the value of the sign up bonus?

- What is value of putting my pattern of spending on the card? (category bonuses and the value of the base point earned)

- What are the benefits of holding the card? (lounge access, free checked bags, discounted awards, etc)

- When is the deal disappearing?

All things equal, you should apply for a card with a limited time sign up bonus over one that is stable. You can get the stable card next time.

With so much excitement around the disappearance tomorrow (9/3/13) at 5 PM ET of the SPG cards’ 30k offers, I thought it would be useful to compile a list of other cards offers that are soon to disappear.

What are the top nine credit card offers that are about to disappear? When are they disappearing? And how much worse will the upcoming offers be?

I don’t have inside information on when credit card offers will end, and I certainly don’t know for sure what the new offers will be. All the information on this list is compiled based on cards’ historical sign up bonuses and my best guesses. I’ve ordered the list by how much I would expect someone to lose by waiting until it’s too late to get the best current offer.

Nothing in this post should be construed as a suggestion to apply for a credit card now, or a guarantee that the offer will drop in the future. Don’t rush to get a card if you can’t meet its minimum spending requirement or use it responsibly. You are responsible for decisions that affect your credit.

1. Chase AirTran Airways A+ Rewards Credit Card with 32 A+ Credits after spending $2k in three months (two free roundtrips)

- The current offer is for 32 AirTran A+ Credits after spending $2k in three months

- This card will disappear during the Southwest/AirTran merger.

- Waiting could cost you 32 AirTran A+ Credits

Card Details:

2. US Airways Premier World MasterCard® with 30,000 US Airways miles after first purchase

- Card will disappear entirely when merger with American Airlines is complete

- Merger was expected to close in third quarter of 2013. Legal wranglings will probably push that back, but there is a trial date set for November 12, so I expect a merger this year.

- Citi will be the issuer of cards from the new American

- Waiting until the fourth quarter of 2013 (July 1 to September 30) could mean missing out on 30k US Airways miles that would be converted to American Airlines miles at the merger

- May be able to get a 35k offer as outlined in this post.

Full offer details:

- Earn up to 40,000 bonus miles on qualifying transactions

- EXCLUSIVE: Redeem flights for 5,000 fewer miles

- Zone 2 boarding on every flight

- Enjoy 2 miles per $1 spent on US Airways purchases

- Earn 1 mile per $1 spent everywhere else

- Annual companion certificate good for round-trip travel for up to 2 companions at $99 each, plus taxes and fees

- First Class check-in

- Please see terms and conditions for complete details

3. Barclaycard Arrival Plus™ World Elite MasterCard® with 40,000 miles after spending $3k in the first three months and no annual fee the first year

- No end date known for 40k offer

- Normal offer is 20k miles

- Missing out on the 40k offer and getting the 20k offer later would mean $222 less free travel

- My full analysis of the card

Full offer details:

- Earn 40,000 bonus miles after you spend $3,000 on purchases in the first 90 days — that’s enough to redeem for a $400 travel statement credit

- Earn 2X miles on all purchases

- Get 5% miles back to use toward your next redemption, every time you redeem

- Chip card technology, so paying for your purchases is more secure at chip-card terminals in the U.S. and abroad

- No foreign transaction fees on anything you buy while in another country

- 0% introductory APR for 12 months for each Balance Transfer made within 45 days of account opening. After that, a variable APR will apply, currently 16.24% or 20.24%, depending on your creditworthiness.

- Complimentary online FICO® Credit Score access for Barclaycard Arrival cardmembers

Application Link: Barclaycard Arrival Plus™ World Elite MasterCard®

4. Dead

5. Citi® / AAdvantage® Platinum Select® MasterCard® with 50,000 American Airlines miles after spending $3k in three months

Offer details:

- For a limited time, earn 50,000 American Airlines AAdvantage® bonus miles after making $3,000 in purchases within the first 3 months of account opening*

- First checked bag is free on domestic American Airlines itineraries for you and up to four companions traveling with you on the same reservation*

- Enjoy Group 1 Boarding on American Airlines flights*

- NEW – No Foreign Transaction Fees on purchases1

- Receive 25% savings on in-flight food and beverage purchases when you use your card on American Airlines flights*

- Double AAdvantage® miles on eligible American Airlines purchases*

- Earn 10% of your redeemed AAdvantage® miles back – up to 10,000 AAdvantage® miles each calendar year*

Landing Page: Citi® / AAdvantage® Platinum Select® MasterCard®

6a. Starwood Preferred Guest® Credit Card from American Express with 25,000 bonus Starpoints!

- As predicted the 30k offer ended 9/3/13. I still recommend this card.

6b. Starwood Preferred Guest® Business Credit Card from American Express with 30,000 bonus Starpoints

- As predicted the 30k offer ended 9/3/13. I still recommend this card.

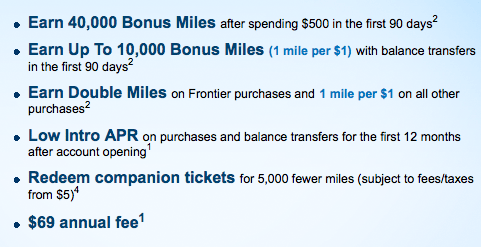

7. Frontier World MasterCard with 40k EarlyReturns miles after spending $500 in 90 days

- No information on when 40k offer ends

- Normal offer is 35k

- Waiting could cost 5k Frontier miles

- My full analysis of the card

Full offer details:

8. The Business Gold Rewards Card® from American Express OPEN with 50,000 Membership Rewards

- No information on when 50k offer ends

- The offer has bounced between nothing, 50k, and 75k this year a few times

- Waiting could mean the offer drops to zero, stays the same, increases 25k, or something else entirely

Offer details:

- Earn 50,000 Membership Rewards® points after you spend $5,000 in purchases on the Card in the first 3 months of Card membership.

- Earn points even faster to get more rewards for your business.

- 3X points on airfare purchased from airlines. 2X points at US gas stations.

- Up to $100,000 in each category per year, then 1 point.

- Terms and limitations apply.

- Reduce travel costs, show appreciation for employees and clients, and offset everyday expenses by using points to get something back and grow your business.

- $0 introductory annual fee for the first year, then $175

- Apply online to qualify for this offer. See offer terms for details.

9. Chase British Airways Visa with 50,000 bonus Avios after spending $2k in three months

- The normal offer on this card is 50k. The limited-time aspect is a waiver of the $95 annual fee for the first year

- The waiver will end 9/30/13

- Waiting until October will cost the $95 annual fee the first year.

Offer Details:

- 50k Avios after $2k spending in three months

- 1.25 Avios per dollar spent

- no annual fee the first year, then $95

Application Link: British Airways Visa

10. Alaska Airlines Visa with up to 40,000 Mileage Plan Miles

- There are three offers floating around that are better than the normal offer of 25k miles.

- Offer 1 is only for Alaska elites, but you may have success anyway. The offer is 25k miles after approval and 15k more miles for spending $10k in the first six months. There is a $75 annual fee that is not waived.

- Offer 2 is 30k miles upon approval. There is a $75 annual fee that is not waived.

- Offer 3 is 25k miles upon approval plus a $100 statement credit after spending $1k in three months. There is a $75 annual fee that is not waived.

- The normal offer is 25k miles upon approval and a $75 annual fee that is not waived.

- Waiting could cost $100 or 15k miles or 5k miles.

Just getting started in the world of points and miles? The Chase Sapphire Preferred is the best card for you to start with.

With a bonus of 60,000 points after $4,000 spend in the first 3 months, 5x points on travel booked through the Chase Travel Portal and 3x points on restaurants, streaming services, and online groceries (excluding Target, Walmart, and wholesale clubs), this card truly cannot be beat for getting started!

Editorial Disclaimer: The editorial content is not provided or commissioned by the credit card issuers. Opinions expressed here are the author’s alone, not those of the credit card issuers, and have not been reviewed, approved or otherwise endorsed by the credit card issuers.

The comments section below is not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser’s responsibility to ensure all questions are answered.

How does a person apply for both. I read few places where people got rejected for 2nd one

You just apply for both at once. You may have one of the applications put on hold for a few days. But I’ve read of multiple approvals.

Is the AirTran card fee waived for the first year? Also, why did you rank it as no. 1? I would think that the 50k AA citi card offer would have been tops.

The first year fee is NOT waived. As mentioned in the post, the rankings are what you stand to lose if you miss the offer. This offer will go from 32 credits to 0 during the merger. The AA card will go from 50k to 40k or 30k if you miss it.