MileValue is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

Note: Some of the offers mentioned below may have changed or are no longer be available. You can view current offers here.

Update 6/30/2016: Alaska Airlines is changing the way you accrue redeemable Alaska miles when flying partner American Airlines for travel beginning August 1, 2016 to align with American Airlines’ changes to a revenue-based award earning structure. When I first published this post and crunched the numbers about which partner program was the most advantageous to credit miles to when flying American, Alaska Mileage Plan was among my top two choices. Due to the changes Alaska is making to their accrual rates, they are no longer a top contender.

In light of the news that American Airlines is changing to a revenue-based award earning structure, and the fact that all three major US carriers now abide by a revenue-based award earning structure, I am wrote a series of posts about when and where you should diversify the award miles you earn through paying for airfare. This post is Part 1, and discusses when and to where you should diversify your award earning when flying paid tickets on American Airlines flights.

“When & Where You Should Diversify Revenue Ticket Miles” Series Index

- Part 1 — Flying American Airlines (this post)

- Part 2 — Flying United Airlines

- Part 3 — Flying Delta Airlines

As of August 1, American Airlines will award miles for revenue tickets based on two things: the ticket price less any government imposed taxes or fees, and the elite status you have with the airline.

This is a big departure from the current system that awards miles based on the distance flown.

The new award earning structure will be worse for folks who fly far, cheap tickets and better for people who fly short, expensive tickets. That is, at least, if we’re talking about crediting miles to AAdvantage. But it is not obligatory to do that–you can enter your frequent flyer number with any American Airlines partner instead.

In your mind, this fact should pose two questions.

- When should I choose to credit my award miles to American Airlines?

- If not American Airlines, then who?

I’m going to dive into both questions here to help equip you with the knowledge to make these decisions in the future.

Note that this post is specifically referencing the award miles earned from flying American Airlines flights. The amount of American Airlines miles earned for flying a oneworld alliance or other partner airline will be based on a percentage of the distance flown and the fare class. These rates have yet to be published, but should be available by July 15.

When Should I Choose to Credit my Award Miles to American Airlines?

The simple answer to this question: Not when you’re buying a cheap economy ticket, but maybe if you’re buying an expensive premium cabin ticket. American Airlines’ new revenue-based award earning system rewards those who generate more revenue for American Airlines, point blank.

The more correct answer to this question is: when the math works out, and when you’re not chasing or trying to maintain status. Before I go any further, let me explain what I mean by the latter part of that sentence.

The value of status miles will factor into the decision too (in American’s case, they are called Elite Qualifying Miles, or EQM’s), if you’re trying to get or maintain American status. For example, even if an American Airlines Executive Platinum elite earns fewer redeemable American miles by crediting their butt in seat miles to American over Etihad, he might still prefer it to boost his Elite Qualifying Mile balance.

But if you’re not concerned with status, then all that should matter to you is the math.

The Math

To figure out how many American Airlines miles you’ll earn flying their planes, use the following equation:

Status multiplier x (ticket price – government-imposed taxes/fees) = award miles earned

The status multiplier depends on what tier elite status you might or might not have with the airline:

- 5x– AAdvantage member

- 7x – Gold

- 8x – Platinum

- 9x – Platinum Pro (will be introduced at some point in 2017)

- 11x– Executive Platinum

We know the ticket price is how much aa.com tells us the flight costs.

But how can we isolate the government-imposed taxes and fees from that price? ITA Matrix. If you’re not familiar with ITA Matrix, here’s how to use it— it will show you the breakdown of a ticket by base fare, fuel surcharges, and government-imposed taxes and fees.

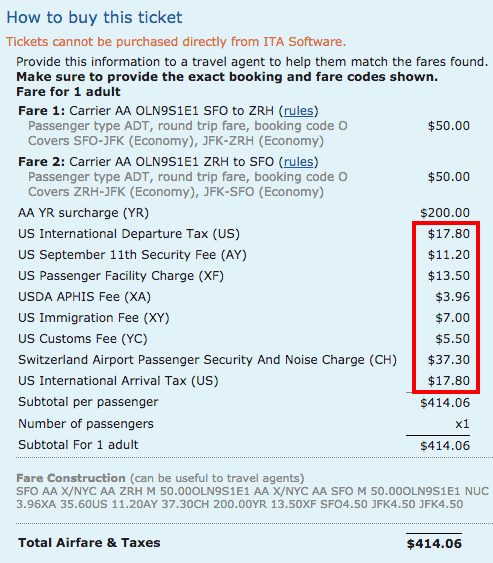

Look at this breakdown of a roundtrip American Airlines ticket between San Francisco and Zurich:

This is a great example of the kind of cheap revenue ticket readers of this blog would buy, because it’s an example where you’re probably better off paying for the flight in cash rather than using miles that could be put towards higher value redemptions (since it’s only $414 for a roundtrip between the United States and Europe!)

The dollar amounts outlined in the red rectangle are the government-imposed taxes and fees (sum = $114.06). Fuel surcharges are always labeled as either YR and YQ (in this case YR). Fare 1 and 2 are the base fares in each direction on the roundtrip.

Now we can plug in our equation.

5 x (414.06 – 114.06) = 1,500

So, assuming you are just normal AAdvantage member without status, you would earn 1,500 American Airlines miles for flying about 13,000 miles on an American Airlines plane.

Even if you are a Executive Platinum elite, you would only earn 3,300 American Airlines miles on this flight.

But let’s say you purchased a Business Class ticket on the same flight, which costs $7,059 (oh yea, now I remember why I collect miles!). Your equation would look like this:

5 x (7,059 – 114.06) = 34,725

Then you would certainly want to credit those miles to American Airlines, because you cannot beat that crediting to any other partner. It is easy to see how this system rewards those that spend more. But I assume the majority of us will find ourselves with something closer to the first equation’s answer most of the time.

Conclusion

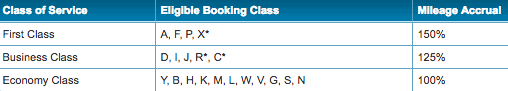

When it comes time for you to make this decision, plug your own numbers in. If you get a number greater than 125% of the distance flown (if flying Business Class) or a number greater than 150% of the distance flown (if flying First Class), then stick with collecting American Airlines miles. Those percentages represent the maximum amount of miles you could get crediting to any partner (assuming you don’t have status with any of them.)

Otherwise, read on to see your options for crediting to other partners.

If Not American Airlines, Then Who?

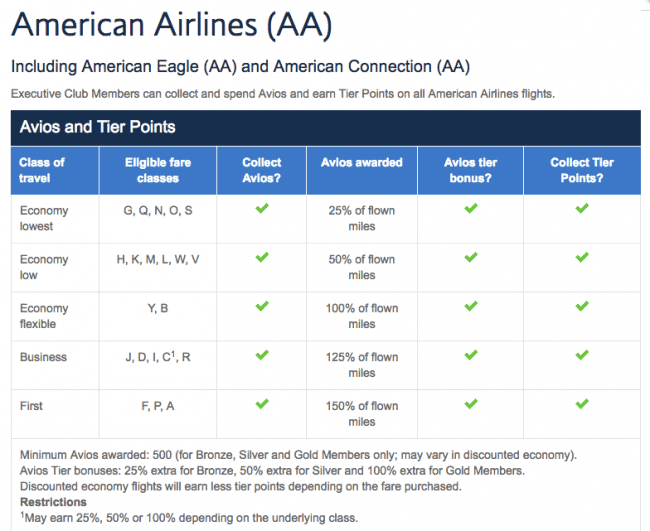

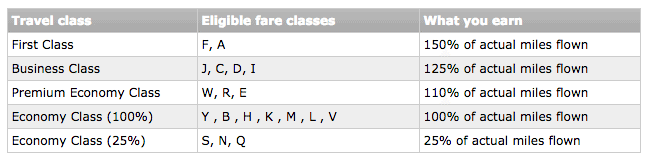

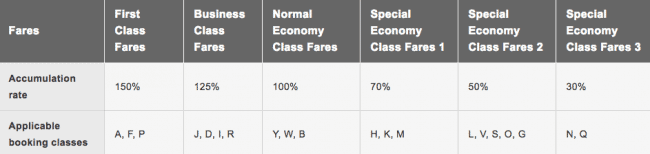

Listed below are the award earning structures for some of American Airlines’ partners. Loyalty programs that generally lack valuable award redemption opportunities have been left out. What you earn for crediting miles to these airlines is represented by the percentages in the tables below. To figure out the total, you multiply the percentage by the distance flown.

Members of oneworld Alliance

British Airways

Read further detailed info about crediting miles to British Airways Executive Club here.

Cathay Pacific (Asia Miles)

Read further detailed info about crediting miles to Asia Miles here.

Iberia

Iberia Avios doesn’t have a published earning structure online, but I would assume it’s somewhat like British Airways Avios. This FlyerTalk thread has a homemade earning chart, but beware it is from 2014 and appears to have some errors. Let us know in the comments if anyone is aware of a more accurate and recently published chart.

Japan Airlines (JAL)

Read further detailed info about crediting miles to Mileage Bank here.

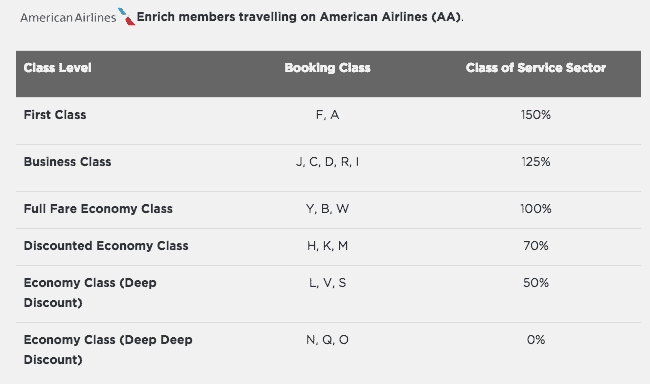

Malaysia Airlines

Read further detailed info about crediting miles to Enrich here.

American Airlines’ Other Partners

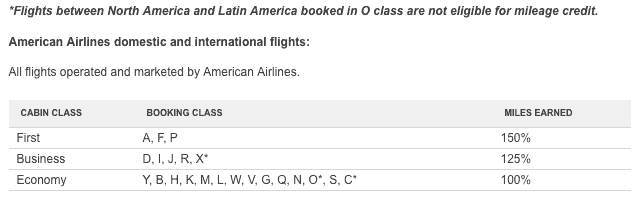

Alaskan Airlines

Read further detailed info about crediting miles to Alaska Mileage Plan here.

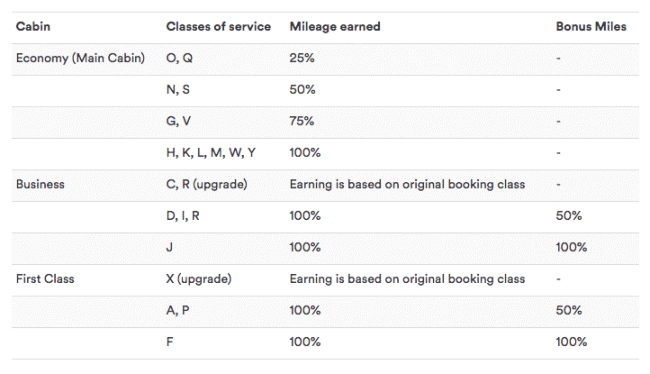

Etihad Airways

Read further detailed info about crediting miles to Etihad Guest here.

Hawaiian Airlines

Read further detailed info about crediting miles to HawaiianMiles here.

Conclusion

Again, the following conclusion is not considering the incentive of status. If you’re aiming for or trying to maintain status with American or one of its partner airlines, than perhaps the elite qualifying miles earned from crediting to them matter more to you than redeemable miles.

That being said, the best alternative airline to credit miles to when flying American Airlines is Etihad. It offers the highest percentages of distance flown, ranging from 100% for even the lowest economy fares (which are the most common types people like you and I buy) and 150% for First Class. I will choose to credit the miles I earn flying cheap American Airlines revenue tickets to Etihad Guest in the future.

The other options listed above offer similar ranges of percentages for distance flown, but with lower tiers for discount economy tickets that range from 0 to 50%. So if you’re flying a discounted ticket, like the one from the example in this post that is categorized as fare class “O”, then definitely choose Alaska or Etihad.

If your fare class is not one associated with a discounted economy ticket, then it doesn’t matter. Any full price fare will earn something in the 100% to 150% of distance flown range depending on whether it is full fare economy or First Class. If this is the case, then it’s a matter of choosing which miles are more valuable for you when redeeming awards. Click here to read about the top 11 most valuable miles to me.

Best Card to Buy Airfare With

Your top choice for buying American Airlines’ tickets with should be the Citi Prestige® Card, since it comes with a $250 Air Travel Credit every calendar year that applies to airfare. If you haven’t used the credit yet, buy the fare with your Prestige, and you will receive an offsetting credit on your next statement.

Even if you’ve already used your $250 credit for this year, the card offers 3x on all airfare purchases, which is a higher category bonus than what any of the American Airlines’ co-branded cards offer for buying their own plane tickets (2x).

See my review of the Citi Prestige Card which explains its many components like its annual $250 Air Travel Credit, 40,000 point sign up bonus, access to the American Airlines Admirals Clubs and Priority Pass lounges, 3x points per dollar on air travel and hotels, and a $450 annual fee.

Bottom Line

If you’re like me and only spend cash on the cheapest of airfares, then it is very likely you will not want to credit the miles you earn from flying American Airlines to AAdvantage anymore now that the airline has changed it’s award earning structure. If you haven’t started an account with Etihad’s frequent flyer program Etihad Guest, then do so today. Out of American Airlines’ partners, it is probably the most valuable program to funnel your miles into.

If you want to jumpstart that Alaska miles collection, sign up for the Alaska Airlines Visa Signature card. Earn 30,000 bonus miles after spending $1,000 within the first three months of opening the account.

Just getting started in the world of points and miles? The Chase Sapphire Preferred is the best card for you to start with.

With a bonus of 60,000 points after $4,000 spend in the first 3 months, 5x points on travel booked through the Chase Travel Portal and 3x points on restaurants, streaming services, and online groceries (excluding Target, Walmart, and wholesale clubs), this card truly cannot be beat for getting started!

Editorial Disclaimer: The editorial content is not provided or commissioned by the credit card issuers. Opinions expressed here are the author’s alone, not those of the credit card issuers, and have not been reviewed, approved or otherwise endorsed by the credit card issuers.

The comments section below is not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser’s responsibility to ensure all questions are answered.

Does the change take effect for tickets purchased after Aug. 1, or for flights taken after Aug. 1?

For flights taken August 1 and on.

Seems unfair. I bought a cash ticket to Hong Kong for November, and part of my calculation in doing that was the value of the miles I’d earn. That’s really changing the value of a ticket after it’s purchased. In any case, thanks for the article. As long as I can credit the miles to AS at full value, I’ll consider it an acceptable outcome.

I agree that using a travel by, instead of purchase by date is unfair. I am charitably assuming that they are doing it this way because it is (nearly) impossibly to program the computers the fairer way.

Went to my AA account looking for the link(s) to change crediting my AA miles from my AA flights to another carrier (Alaska) and couldn’t find the link. Where might they be?

For each flight, you type in your Alaska Airlines frequent flyer number at purchase (or later.)

Thank you for the quick reply. Can it be done semi-after the fact? Meaning, I’m completing an AA flight later in the month I’d like to credit to Alaska. Flew the first half months ago, and will take the final, return half late this month? Thank you

Thank you for your timely post. Just booked an AA flight, and changed my AA number to Alaska. Will be using your link for my next credit card!!

[…] Part 1 — Flying American Airlines […]

[…] Part 1 —Flying American Airlines […]

Hawaiian appears to have a very similar 100-150% mileage credit scheme to Etihad. (There are some fare class differences however) If that is true, how does crediting Hawaiian figure into your analysis?

[…] To look at options crediting redeemable miles to other oneworld programs, check out Where to Credit Butt in Seat Miles: Flying American Airlines. […]

[…] To look at options crediting redeemable miles to other Star Alliance programs, check out Where to Credit Butt in Seat Miles: Flying United Airlines. […]