MileValue is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

Note: Some of the offers mentioned below may have changed or are no longer be available. You can view current offers here.

I recently booked two flights for only $102 total on Asian low-cost carriers. Asian low-cost carriers are so cheap that there are effects on United and American awards you might be considering booking.

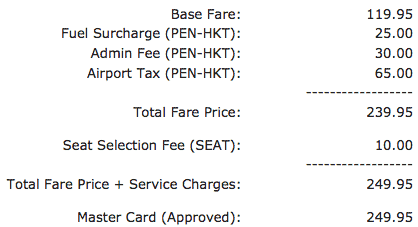

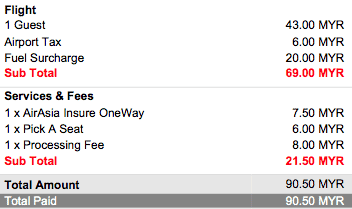

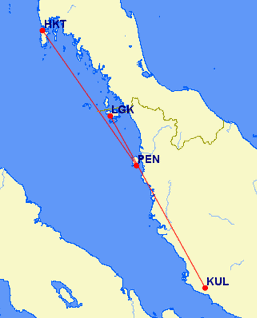

I booked Kuala Lumpur to Lankawi for $27 on Air Asia, and I spent another $75 on a Firefly flight from Penang to Phuket. (I ferried between Langkawi and Penang for $19.)

What important effects do Asian low-cost carriers have on award booking strategy?

Both low-cost carriers followed the same playbook: advertise an outrageously low base fare–as low as $14 on one flight–then tack on a fee for everything. Yet both all-in fares were still incredibly cheap.

So far I’ve flown the Air Asia flight, and it was adequate. I actually moved back one row from the seat I paid $2 to select and napped for half an hour in a totally empty row.

From what I was conscious for, there was nothing wrong with the flight that would make me want to pay any more to fly any other airline.

Since these flights are dirt cheap and adequate, they affect the best strategy for booking awards to Asia.

Effect on United Awards

United roundtrip awards allow one stopover and two open jaws. Free oneways on United awards require using that one stopover at your home airport.

That means you have a choice:

- You can use your stopover at your home airport and create a free oneway. The downside is that the award can see fewer cities in Asia.

- You can use your stopover in Asia and see more cities. The downside is that you have burned the stopover you need for a free oneway.

I’ve written about this choice before. See Choosing Between a Free Stopover and a Free Oneway on United Awards. On some trips, this might be a tough choice, but with dirt cheap Asian low-cost carriers, you should definitely preserve your stopover for a free oneway and hop around Asia with paid flights.

Let’s look at a hypothetical example to see why it’s so much better to pay for flights in Asia and save your stopover for a free oneway on more expensive American flights.

Consider the award I booked my friend the other day. Imagine he had wanted to fly from Los Angeles to Bangkok and Phuket instead of just Phuket. He could have booked the award like this:

- Los Angeles to Bangkok (uses his only stopover)

- Bangkok to Phuket (outbound destination)

- Phuket to Los Angeles (return destination)

That’s fine, but it means he wouldn’t get the free oneway from Los Angeles to Newark that I booked him.

To keep that, he could book this:

- Los Angeles to Bangkok (outbound destination)

- Phuket to Los Angeles (open jaw between Bangkok and Phuket to preserve his one stopover, which he uses in Los Angeles)

- Los Angeles to Newark (free oneway to return destination)

Then he could purchase Bangkok to Phuket on a low cost carrier.

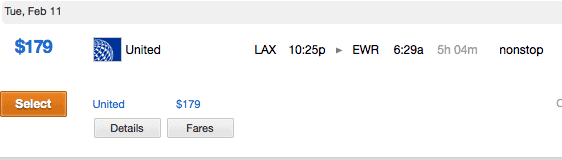

Which is better? It depends on whether Bangkok to Phuket or Los Angeles to Newark costs more. The answer is Los Angeles to Newark by almost $140.

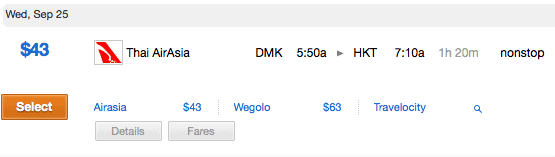

And the difference could be even larger because free oneways can go to almost anywhere in the domestic US and Canada, and there are plenty of Asian flights below $43.

The conclusion is clear. On United awards to Asia, you are very likely to be better off paying for the low-cost carrier flight intra-Asia to preserve a free oneway possibility in the US.

Effect on American Airlines Explorer Awards

American Airlines has the best round-the-world and multi-stop award possibility of any airline that it calls the Explorer Award.

Explorer Awards have several relevant rules impacted by Asian low-cost carriers:

- The miles price of an Explorer Award depends on the total distance flown.

- You are limited to 16 segments on an Explorer Award.

- You are limited to one open jaw on an Explorer Award.

If you want to save American Airlines miles or preserve your 16 segments for longer, more expensive flights, consider paying for low-cost carrier flights in Asia.

You can hop around super cheaply throughout Asia on paid flights, then restart your Explorer Award for long-haul flights.

Just keep in mind that you only get one open jaw on Explorer Awards. You may want to preserve it. In that case, fly the low-cost carriers in a loop, so that you can pick up your Explorer Award in the place where you left off.

Totally Free Flights in Asia

Paying $102 for my two flights or $43 between Phuket and Bangkok is still worse than paying zero. The ideal way to get free flights intra-Asia is to open theBarclaycard Arrival Plus™ World Elite MasterCard®.

The card comes with a 40,000 mile sign up bonus after spending $3k in the first 90 days. In addition, you get 2 miles per dollar on all purchases, and a 10% rebate in miles on all travel redemptions.

Arrival miles can be used for any flight, any airline, any time–with no hunting for award space–at a value of one cent per mile. That means that the 42,000 miles you have after meeting the minimum spending requirement is worth about $470 toward any flight.

To see how the card would work, consider my $27 flight from Kuala Lumpur to Langkawi. If I purchased that flight with the Arrival card, I could then redeem 2,700 Arrival miles (1 cent per mile) to remove the charge from my statement. That means the flight is free. Plus I would then get 270 miles (10% of my redemption) rebated back into my account.

The Arrival card is perfect for a lot of situations when ordinary airline miles provide poor value including super cheap cash flights intra-Asia. It’s also one of the three cards that I strongly recommend to big spenders. See my full analysis of the card.

Purchasing Low-Cost Carrier Flights

Low-cost carriers don’t always appear on search engines you might use like Kayak. The best way to purchase a flight from one is on its own site. You can find out which carrier(s) serve a route you want to fly by using my secret weapon: wikipedia.

Recap

Flights within Asia are so cheap that you should often buy them with cash to conserve miles or set up free oneways on your award tickets.

Buy the flights with aBarclaycard Arrival Plus™ World Elite MasterCard®, and they go from cheap to free.

- Earn 40,000 bonus miles after you spend $3,000 on purchases in the first 90 days — that’s enough to redeem for a $400 travel statement credit

- Earn 2X miles on all purchases

- Get 5% miles back to use toward your next redemption, every time you redeem

- Chip card technology, so paying for your purchases is more secure at chip-card terminals in the U.S. and abroad

- No foreign transaction fees on anything you buy while in another country

- 0% introductory APR for 12 months for each Balance Transfer made within 45 days of account opening. After that, a variable APR will apply, currently 16.24% or 20.24%, depending on your creditworthiness.

- Complimentary online FICO® Credit Score access for Barclaycard Arrival cardmembers

Application Link: Barclaycard Arrival Plus™ World Elite MasterCard®

Just getting started in the world of points and miles? The Chase Sapphire Preferred is the best card for you to start with.

With a bonus of 60,000 points after $4,000 spend in the first 3 months, 5x points on travel booked through the Chase Travel Portal and 3x points on restaurants, streaming services, and online groceries (excluding Target, Walmart, and wholesale clubs), this card truly cannot be beat for getting started!

Editorial Disclaimer: The editorial content is not provided or commissioned by the credit card issuers. Opinions expressed here are the author’s alone, not those of the credit card issuers, and have not been reviewed, approved or otherwise endorsed by the credit card issuers.

The comments section below is not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser’s responsibility to ensure all questions are answered.

Your point is taken, but there are indeed many routes within SE Asia which are not served by dirt cheap low-cost carriers, and in some cases in which they are served, the schedule sucks so bad that one does not want to do it and have to add on a night’s hotel, spending extra money on that and taxis, not to mention wasting precious vacation time, at least in the case of those of us who actually work for a living.

Amazing information, thanks.

I would argue that “Asia” in this context should exclusively refer to Southeast Asia; flights to/from Japan, for example, are incredibly expensive — especially last minute. A round-trip Tokyo-Seoul can cost >$500 and Tokyo-Beijing can be >$600.

Which is better? It depends on whether Bangkok to Phuket or Los Angeles to Newark costs more. The answer is Los Angeles to Phuket by almost $140.

I think this above text should say Los Angeles to Newark by almost $140. Thanks.

Corrected thanks.

A reasonable point, but the conclusions drawn are far too broad. Even within SE Asia there are routes/city pairs where the prices are not nearly that cheap. Especially when the strict carry-on allowances and bag fees come in to play.

This past January we had an award in to BKK and a revenue ticket out of RGN. We wanted to visit Luang Prabang and then make our way to Myanmar. No LCC service into LPQ meant we paid for BKK-LPQ. Sure, we could have extended the award into VTE with the same overnight in BKK but that “free” flight would have cost us at least half a day in getting up to LPQ. Well worth the cash in that case, skipping the cheaper/”free” option. Next up we did fly LPQ-VTE and then had options for VTE-RGN. Both are serve by Air Asia but it required a connection in KUL and Air Asia doesn’t issue through tickets on that routing. And the total cost, including a checked bag, was near $250/person. Spending the extra $50 for the Thai Airways flights, with through-checked bags and a protected connection which didn’t involve immigrating in KUL was a no-brainer.

LCCs can be great in certain circumstances, but they are not a panacea.

Good analysis in your case, and a good reason not to use LCCs

[…] You can see three cities in Southeast Asia on one award by having a stopover and an open jaw. For instance you can fly to Bangkok, stop, continue to the destination of Phuket, take an open jaw and return from Singapore. You would have to book Phuket to Singapore separately, but flights within Southeast Asia are dirt cheap! […]

[…] (in which the Malaysian company owns a 49% stake.) I spent $27 all in to fly AirAsia from Kuala Lumpur to Langkawi on a recent trip to Southeast Asia. The flight was unremarkable, just like I hope all my economy cabin flights […]

[…] flew from Kuala Lumpur to Langkawi in 2013 and really enjoyed both […]

[…] Search for award space on united.com and note it for the future call in. Try to keep segment numbers low because we want to keep this entire award to 10 segments, and we aren’t done yet. (If you want to go to a smaller airport in Asia, consider flying the award to a major airport and connecting with a super-cheap low-cost carrier.) […]