MileValue is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

Note: Some of the offers mentioned below may have changed or are no longer be available. You can view current offers here.

The public (standard) sign up bonus offer for the American Express Gold Card, which you will see by clicking that link, is 35,000 bonus Membership Rewards for spending $2,000 on the new card within three months of account opening. That’s ok, but since you can only get the sign-up bonus on an Amex card once in a lifetime, you should know that the CardMatch Tool has been offering targeted customers 50,000 bonus Membership Rewards for the same minimum spending requirement of $2,000 in three months. I value 15,000 Membership Rewards at around $300, so that’s a much better offer.

Check to see if you’re targeted. Fill in the information requested on the landing page, and click GET MATCHES at the bottom of the form. And don’t worry, there will be no hard credit pull.

I have seen a 40k bonus for this card offered recently through referrals, but not 50k.

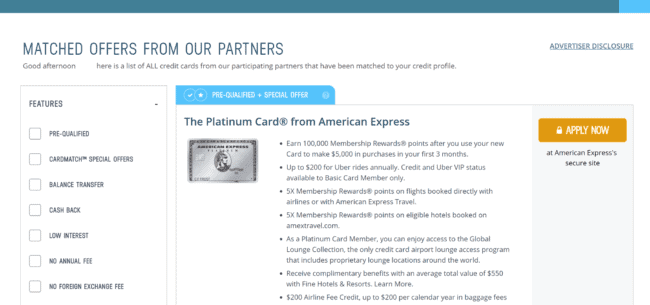

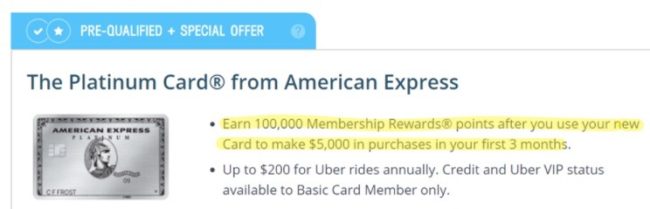

The offer you hear about more often from the CardMatch tool is the 100,000 bonus Membership Rewards for the Platinum Card from America Express. That’s significantly better than the 60k public bonus. It was popping up a bunch at the end of April/beginning of May, and apparently it’s still around. Check to see if you got lucky, for either the 50k Gold or 100k Platinum offers!

If you’re tentative about using or have any questions about CardMatch, please feel free to leave a comment.

About the Amex Gold Card’s Benefits

This card’s strengths are its lucrative category bonuses.

- 4 Membership Rewards earned per dollar spent at restaurants (not just in the US, but internationally)

- 4 Membership Rewards earned per dollar spent at supermarkets, capped after $25k in supermarket spend (within the US)

- 3 Membership Rewards earned per dollar spent on flights booked through Amex’s travel portal

You will also get a $100 incidental airline fee credit each year with your selected airline (not usable on tickets, but checked bag, upgrades, in-flight purchases yes), and another $120 in statement credits (doled at $10 at a time, monthly) at Grubhub, Seamless, The Cheesecake Factory, Ruth’s Chris Steak House, Boxed, and Shake Shack. So if you travel and dine out/order in often, those perks effectively reduce the annual fee from $250 to $30.

About the Amex Platinum’s Benefits

All American Express Platinum cards–including the “regular” Platinum, Ameriprise Platinum, Morgan Stanley Platinum, Goldman Sachs Platinum, and Schwab Platinum–receive the following benefits in the first year that you have to activate yourself (and that easily outweigh the $550 annual fee):

- $200 in Uber credits annually

- $400 in airline fee statement credits

- $100 statement credit for Global Entry Free

- Free lounge access

- Hotel status

- Three $50 statement credit at Saks Fifth Avenue

Read more about them and how to activate them in Get the Most Out of Your American Express Platinum Card.

They also each earn 5 Membership Rewards per dollar spent on flights booked directly with an airline or through Amex’s travel portal, as well as for prepaid hotels booked through Amex’s travel portal.

Just getting started in the world of points and miles? The Chase Sapphire Preferred is the best card for you to start with.

With a bonus of 60,000 points after $4,000 spend in the first 3 months, 5x points on travel booked through the Chase Travel Portal and 3x points on restaurants, streaming services, and online groceries (excluding Target, Walmart, and wholesale clubs), this card truly cannot be beat for getting started!

Editorial Disclaimer: The editorial content is not provided or commissioned by the credit card issuers. Opinions expressed here are the author’s alone, not those of the credit card issuers, and have not been reviewed, approved or otherwise endorsed by the credit card issuers.

The comments section below is not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser’s responsibility to ensure all questions are answered.