MileValue is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

Note: Some of the offers mentioned below may have changed or are no longer be available. You can view current offers here.

United allows one free stopover on roundtrip awards. I’ve discovered and posted extensively on how this free stopover can be turned into a free oneway. See Free Oneways on United Awards.

A free oneway is a oneway trip to your home airport before your main award or from your home airport after your award. To unlock a free oneway, you need to conserve your United award’s free stopover.

Why? Because you need to take that free stopover at your home airport. Take a look at these two examples of a free oneway, and you’ll see that they rely on a free stopover at the home airport:

MIA-JFK (free oneway, stopover at JFK, home airport)

JFK-FRA (destination is Frankfurt)

FRA-JFK (return home)

and

JFK-FRA (destination is Frankfurt)

FRA-JFK (stopover at JFK, home airport)

JFK-SFO (free oneway)

The first itinerary has a free oneway from Miami to New York City before the main award. The second has a free oneway from New York City to San Francisco after the main award. Both rely on using the one and only free stopover on United roundtrip awards at JFK, the home airport in this example.

The fact that a free oneway relies on a stopover at your home airport means you can either get a free oneway OR a free stopover on your main journey–not both.

How do you choose between them? Simple math. Let’s use as an example a trip where Sam wants to see two cities in Europe–Copenhagen and Frankfurt–and would like a free oneway to Hawaii.

This award is impossible because it has two stopovers:

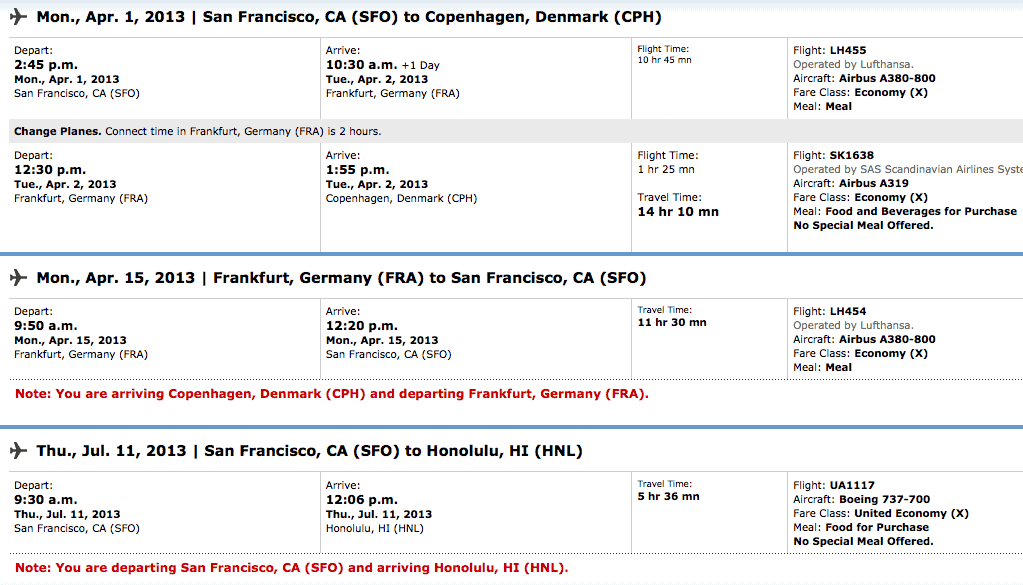

April 1 SFO-CPH

April 8 CPH-FRA

April 15 FRA-SFO

July 11 SFO-HNL

The stopovers are Copenhagen and San Francisco, with Frankfurt as the destination of the outbound and Honolulu the destination of the return. Remember that Sam can’t have two stopovers, so he has a choice. Keep the CPH-FRA leg or keep the SFO-HNL leg and cut the other.

Cutting either would work:

April 1 SFO-CPH

April 15 FRA-SFO

July 11 SFO-HNL

Cutting CPH-FRA leaves one stopover–just SFO–in addition to the outbound’s destination of Copenhagen and the return’s destination of Honolulu.

Or he could cut the free oneway at the end:

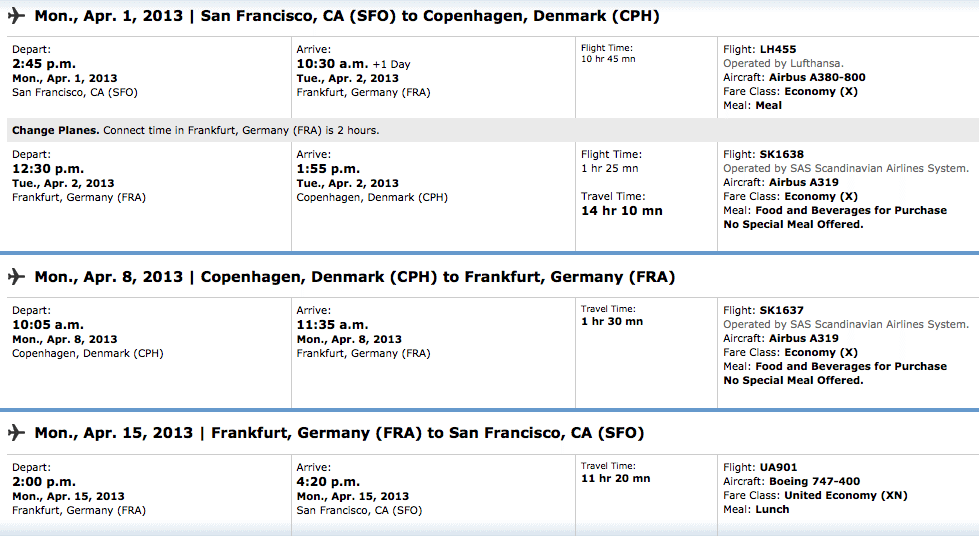

April 1 SFO-CPH

April 8 CPH-FRA

April 15 FRA-SFO

This is easy to see. It’s a roundtrip with a stopover in Copenhagen.

Which should Sam cut? That depends on a number of factors.

1. Is there a difference in the miles price?

I was being a bit breezy when I called the oneway at the end a “free oneway.” United treats Hawaii as a separate region from the continental US, so the oneway may or may not be free.

The oneway at the end of the award to Hawaii will cost the difference between flying back from your destination to the continental US and flying back to Hawaii. This depends on what region you choose and what class of service. For example:

When returning from Europe in economy, adding a oneway to Hawaii adds 2,500 miles.

When returning from Europe in business, adding a oneway to Hawaii adds 7,500 miles.

When returning from Europe in first, adding a oneway to Hawaii is free!

Check out your region and class of service on the interactive United award chart.

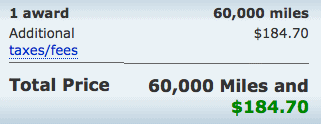

In Sam’s case, if he cuts SFO-HNL, his award is 60k miles. If he cuts CPH-FRA and keeps the Hawaii oneway, it will cost 62.5k miles.

2. What is the difference in taxes?

Keeping the intra-Europe segment results in taxes of $184. Keeping the oneway to Hawaii leaves total taxes at $159.

3. What is his value of the chosen and cut flights?

I said value not price. I would define value as the lower of price and your subjective value. This is an important consideration if you’re planning on taking two vacations no matter what, so that what you don’t add to the award, you’ll have to purchase.

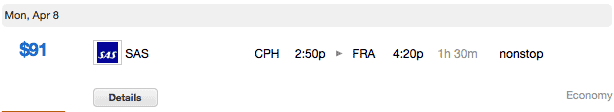

SAS is selling the direct CPH-FRA flight we might have to cut for $91 on Sam’s date.

And Hawaiian is selling SFO-HNL on July 11 for $314:

And Hawaiian is selling SFO-HNL on July 11 for $314:

If those are his values, for the flights, all other things equal Sam would prefer to keep the more expensive SFO-HNL flight.

If those are his values, for the flights, all other things equal Sam would prefer to keep the more expensive SFO-HNL flight.

When valuing a premium class itinerary remember that while domestic first class in the USA is just a big recliner, it’s actually much better than business class intra-Europe, which is just an economy seat with the middle seat empty.

Also, don’t forget to cap the value of the flights at the cost of getting an equivalent award. If you can replace an intra-Europe leg for 4,500 Avios that is selling for $400, don’t value it at $400–something like $70 would be more appropriate.

4. What are the miles earned for the taken or cut flights?

If Sam is going to buy the flight he cuts, he would earn 2,399 miles flying SFO-HNL and 423 from CPH-FRA.

You might notice that the four things to consider are roughly the same as the four entries into the Mile Value Calculator. That’s not a coincidence. And instead of doing any math after thinking about the four factors, we’ll instead plug the two possible awards into the Mile Value Calculator.

Plugging in both awards, we’ll get a cents per mile (CPM) valuation for each award. This CPM valuation will take into account all of the above factors and all of our subjective preferences. The award that gets a higher CPM is the better award. Ticket that award, and purchase the flight(s) you had to cut with cash or a separate award.

Let’s say that Sam values SFO-CPH and FRA-SFO at $1,000. He values the other possible segments at their costs–$314 for SFO-HNL and $91 for CPH-FRA. With that information, we can go to the calculator.

[wpcc id=”1″]

Plug 1314, 159, 62500, and 14219 into the calculator to get the value of the award that includes the oneway to Hawaii and cut the intra-Europe leg.

Plug 1091, 184, 60000, and 12244 into the calculator to get the value of the award that includes the intra-Europe segment but cuts the oneway to Hawaii.

For both of these, I got the Miles Foregone by looking at the distance of the award as constructed on gcmap.com.

The Mile Value calculator tells us that given the miles price, tax price, Sam’s subjective valuations, and the routings, Sam comes out ahead by cutting CPH-FRA from the award and buying it with cash and keeping SFO-HNL in the award.

The award with SFO-HNL gets 1.51 cents of value per mile. The award with CPH-FRA gets only 1.26 cents per mile.

This is hardly surprising since a trip to Hawaii usually costs more than a trip within Europe. In general, I advise people to buy intra-Europe or use Avios where appropriate to preserve their free oneway option.

Recap

You only get one stopover on a United roundtrip award–zero on a oneway. Since you need to preserve that stopover to construct a free oneway, you can either get a stopover on your main award or a free oneway.

I laid out the considerations to choose between the two options. The real trick though is to value each of your two possible awards in the Mile Value Calculator. Ticket the award that earns a higher CPM, and purchase the legs you had to cut with cash or a separate award.

Just getting started in the world of points and miles? The Chase Sapphire Preferred is the best card for you to start with.

With a bonus of 60,000 points after $4,000 spend in the first 3 months, 5x points on travel booked through the Chase Travel Portal and 3x points on restaurants, streaming services, and online groceries (excluding Target, Walmart, and wholesale clubs), this card truly cannot be beat for getting started!

Editorial Disclaimer: The editorial content is not provided or commissioned by the credit card issuers. Opinions expressed here are the author’s alone, not those of the credit card issuers, and have not been reviewed, approved or otherwise endorsed by the credit card issuers.

The comments section below is not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser’s responsibility to ensure all questions are answered.

Great post and your calculator comes in very handy 🙂

Why am I seeing easy rebates?

Is this a riddle? 🙂 I see the calculator where it is supposed to be.

On the calculator img

From this blog post, seems like its possible for two stops.

http://www.frugaltravelguy.com/2012/09/sunday-success-story-impractically-tall.html

I don’t love his terminology, but that isn’t two stops.

Los Angeles – Sydney (destination of outbound)

Auckland – Tokyo (stopover)

Tokyo – Newark (destination of return)

Also, going to Newark is not a free oneway as I define them because he didn’t stop at his home airport. He isn’t getting another half of a vacation later, he is just visiting many places on one vacations.

Just successfully book the “free one-way” on award (home)SFO-EDI/AMS-SFO(Stop)-MSY! It took 3 calls, and 2 unhelpful agents, and I was about to give up and then got a very helpful lady on the phone who said she will try to price it out. Keep trying guys! =D Thanks milevalue for all the tips and thanks to all the people who comment as well!

Congrats on the free oneway!

Great, thorough post. If you would be so kind as to talk me through this a bit:

I have 120,000 United miles, 120,000 BA and 55,000 Chase Ultimate. My wife and I will probably be using a companion ticket + one fare on Alaska to get from LAX to HI.

Then the big legs are HNL-BKK on approx Nov 10, 2013 and SYD-LAX on approx Feb 5, 2014.

On United, HNL-BKK almost always routes through Tokyo or Seoul, where we wouldn’t mind stopping. HNL-BKK is 25,000 miles, HNL-Tokyo/Seoul is also 25,000 miles.

I guess my question is: can I organize this so we get an extended layover in Tokyo or Seoul without a big mileage penalty or cost?

Thanks for any thoughts you have!

HNL-NRT

NRT-BKK

SYD-LAX

is a fine award

Thanks much for the reply. One thing I didn’t realize is that the free stopover appears to only be on UA flights, and not Partner flights.

So it looks like we may go:

HNL-ICN-KIX, business class (32.5k each), stay in Osaka and Kyoto for 10 days or so

KIX-ICN-BKK, economy (15k each)

This will total 95k miles.

Will figure out our return in late January later. Cheers!

[…] written about this choice before. See Choosing Between a Free Stopover and a Free Oneway on United Awards. On some trips, this might be a tough choice, but with dirt cheap Asian low-cost carriers, you […]

I understand your point about not wasting the stopover on what is typically an inexpensive (and not very special) intra-Europe trip, but what about doing the stopover in the US, en route to Europe? E.g.:

LAX- NYC

NYC- CDG

FRA- LAX

So that way you use your openjaw and your stopover, but the stopover is for a transatlantic flight (NY to Paris), so it’s still a good use of the free stopover as opposed to a short intra-Europe flight. Will that work without incurring any extra miles? Thanks!

I understand your point about not wasting the stopover on what is typically a cheap (and not very plush) intra-Europe fare, but what about using the stopover for the transatlantic flight, such as:

LAX-NYC

NYC- CDG

FRA- LAX

So that way you use the open jaw and the stopover, and the stopover is the flight from NYC to CDG, so you can hang out in NYC for a few days (could be any eastern city).

Was also thinking that you could do something similar and stop in the Caribbean on either the outbound or return as your stopover (I presume that’s allowed)? Let me know and thanks!

A stop in the Caribbean wouldn’t be allowed. This article really just presents a framework for determining which is the better deal given your preferences and flight costs. It’s very conceivable that a stopover in NYC is a good value.

I understand your point about not wasting the stopover on what is typically a cheap (and not very plush) intra-Europe fare, but what about using the stopover for the transatlantic flight, such as:

LAX- NYC

NYC- CDG

FRA- LAX

So that way you use the open jaw and the stopover, and the stopover is the flight from NYC to CDG, so you can hang out in NYC for a few days (could be any eastern city).

Was also thinking that you could do something similar and stop in the Caribbean on either the outbound or return as your stopover (I presume that’s allowed)? Let me know and thanks!

[…] Before the free oneway trick, you might have been tempted to fly Newark to London, London to Frankfurt, and Frankfurt to Newark on one award, using your stopover en route. That still might be the best deal–it depends on many factors, mainly whether you prefer London to Frankfurt or Newark to Phoenix in a premium class as a free flight because you can only get one of those on the award. For more info on this dilemma, see Choosing Between a Stopover and a Free Oneway on United Awards. […]

[…] For a full discussion, see Choosing Between a Free Stopover and a Free Oneway on United Awards. […]