MileValue is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

Note: Some of the offers mentioned below may have changed or are no longer be available. You can view current offers here.

This golf benefit expires July 23, 2017.

The Citi Prestige® Card offers cardholders three free rounds of golf per calendar year at over 2,400 public and private courses. That’s six free rounds before your second annual fee is due–three in 2015 and three more in early 2016.

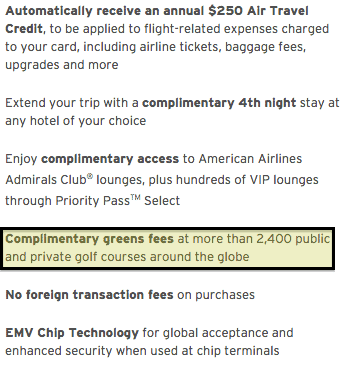

That’s in addition to the more famous benefits of the Citi Prestige® Card like:

- 40,000 bonus ThankYou Points after spending $4,000 in the first three months

- $250 in airfare or airline fee credits per calendar year

- free access to the American Airlines Admirals Clubs and Priority Pass lounges for you plus two guests

- the fourth night free on paid hotel stays

- 12 airline transfer partners for ThankYou Points

- 3x points per dollar on air travel and hotels.

I love golfing, so I wanted to investigate this benefit. Here’s what I found:

- Golf Switch, a tee time portal, handles the benefit for Citi

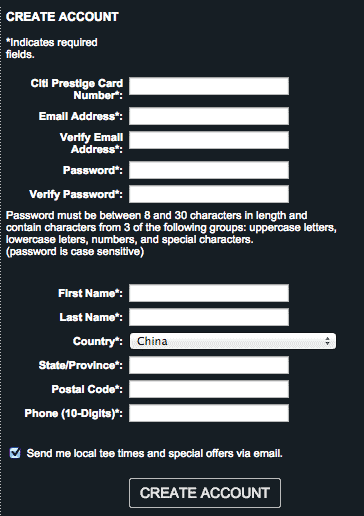

- You sign up for a free account through citiprestige.golfhub.com and book tee times online

- You can only have one pending reservation at a time

- You can only book free tee times for yourself

- Some of the top courses in the world are free through the benefit including TPC and PGA courses

What Courses Are Available?

At citiprestige.golfhub.com, you should be able to see all participating courses by selecting “Golf Courses” or “Golf Destination” at the top.

Unfortunately that kept redirecting me to log in or create an account, and I don’t have my Citi Prestige® Card at the moment. (I lost it in Madrid, and they are sending a new one to me in Tallinn.)

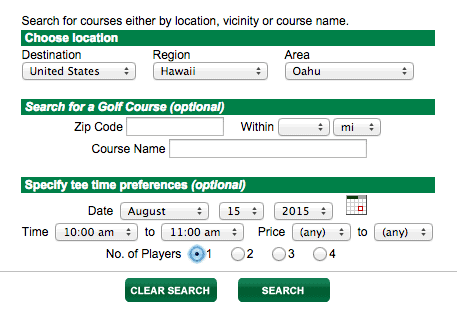

If you don’t want to sign in or don’t have a Citi Prestige® Card yet, you can search Golf Switch courses through this link.

I believe all the courses on that search engine are included in the 2,400 courses that you can play for free with the Citi Prestige® Card golf benefit.

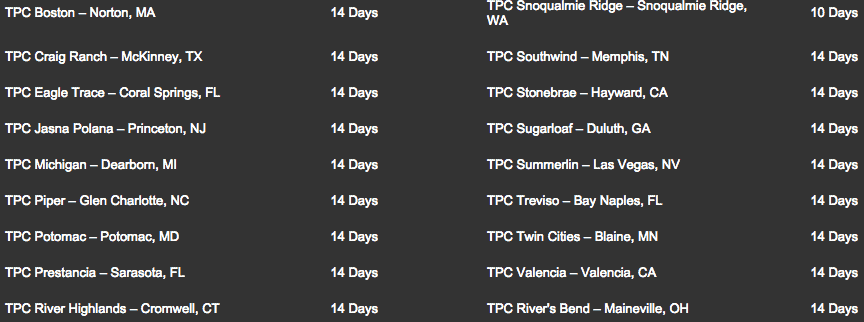

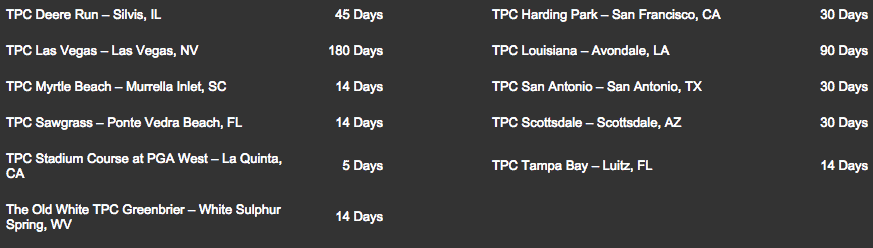

TPC Properties

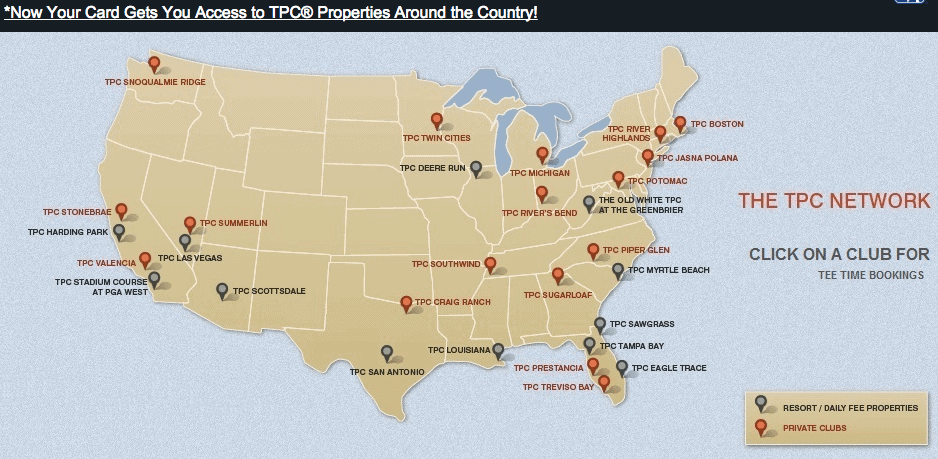

Tournament Players Club (TPC) courses are courses owned and operated by the PGA tour. They’re professional caliber courses that often host professional tournaments. These 29 TPC courses are available through the Citi Prestige® Card golf benefit.

Most of the private courses must be booked between 14 and 3 days before teeing off.

Many of the resort courses can be booked farther in advance.

It would be a dream for me to play the TPC Sawgrass, the perennial host of The Players Championship and flagship TPC course. This course is bookable for free with the Citi Prestige golf benefit. The course goes for over $450 during the Spring.

Hawaii

More likely, I’ll play my free rounds in Hawaii. On Oahu, Ko Olina is a free course that normally goes for over $200 per round.

Good Courses

Cross check convenient courses against the Golf Digest course rankings to see if the course you’re looking at is worth playing.

There is also a good list of top courses included in the benefit in this FlyerTalk post.

Booking Rules

- The big booking rule is that you can only book your free tee times in your name.

- You must book your free round at least three days in advance. Different courses open reservations at different times, so the maximum advanced booking varies by course.

- You can only have one active reservation at a time. You must cancel or play your active reservation to be able to make the next reservation.

These are the official rules, though they may not all be enforced in practice. One FlyerTalker claims to have gotten his parents a free round each by making two reservations in his name. Whether someone else can play a reservation in your name will probably be up to the pro shop’s discretion on the day of the round.

You get three free rounds per calendar year. If you opened the Citi Prestige® Card today, that means you could play three rounds in the rest of 2015 and three more by June 2016 to get six free rounds before your second annual fee is due.

I’ll Keep Prestige

The Citi Prestige® Card has a $450 annual fee, but I believe I’ll keep mine indefinitely. The first annual fee is a no-brainer because the sign up bonus on the card and first year’s benefits like $500 in free flights are worth $1,700+ to me.

But I wasn’t sure about holding the Citi Prestige® Card for a second year and paying another $450. After having the card and investigating its benefits, I think $450 is a small price to pay. For the $450, I’ll get:

- $250 more in free airfare or award taxes in 2017

- three more free rounds of golf in 2017

- lounge access for another year

I value that at $600 to $700.

Bottom Line

The Citi Prestige® Card offers three free rounds of golf per calendar year. That’s six before your second annual fee is due.

There are over 2,400 courses you can book online for your free rounds including top TPC courses and courses all over the world including places you’ll vacation like Hawaii.

This benefit can be worth over $1,000 per calendar year at retail prices for the tee times. I value it at around $250 per calendar year, so along with the other benefits of the Citi Prestige® Card, it has tipped the balance and made me plan to hold the Citi Prestige® Card indefinitely.

Just getting started in the world of points and miles? The Chase Sapphire Preferred is the best card for you to start with.

With a bonus of 60,000 points after $4,000 spend in the first 3 months, 5x points on travel booked through the Chase Travel Portal and 3x points on restaurants, streaming services, and online groceries (excluding Target, Walmart, and wholesale clubs), this card truly cannot be beat for getting started!

Editorial Disclaimer: The editorial content is not provided or commissioned by the credit card issuers. Opinions expressed here are the author’s alone, not those of the credit card issuers, and have not been reviewed, approved or otherwise endorsed by the credit card issuers.

The comments section below is not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser’s responsibility to ensure all questions are answered.

TPC Louisiana does not come up when I search. Much like the “$800 of value” that I won’t get, because AA flights are way overpriced on the ThankYou travel search engine, I anticipate not actually getting any value from this.

Flights and dates when TY search and aa.com search don’t match? I’m not saying definitively they always match, but I haven’t seen a mismatch.

As for TPC Louisiana, it should be bookable between 90 and 3 days out. If you don’t see any tee times, call Prestige at number on back of card. If you still can’t get a tee time, that would be disappointing, but there are other courses, so I hardly see the benefit dropping to $0 value.

[…] The Prestige really differs from the other ThankYou cards with its benefits and commensurate annual fee. The card offers lounge access for you plus two guests into the American Airlines lounge every time you fly American Airlines or US Airways and into Priority Pass lounges worldwide no matter what airline you fly. It also offers a $250 per calendar year Air Travel credit that wipes out your first $250 spending on tickets, fees, or award taxes. The card even offers a $100 statement credit to offset the Global Entry application fee and three free rounds of golf per year. […]

[…] lounges, 3x points per dollar on air travel and hotels, the fourth night free on paid hotel stays, three free rounds of golf per year, and a $450 annual […]

[…] annual fee the first year. I think the fee is worth it year after year because of benefits like free golf, free hotel nights, free lounge access, and a $250 Air Travel Credit per calendar year. Speaking […]

[…] What courses are available and how do you make tee times? […]

[…] Prestige® Card offers the 4th night free on hotel stays booked through its travel provider and three free rounds of golf per calendar […]

[…] The Citi Prestige® Card offers cardholders three free rounds of golf per calendar year at over 2,400 public and private courses– search to see which ones here. You can read more details about this benefit in the Complete Guide to Citi Prestige Free Golf Benefit. […]

[…] That’s a $50 profit in my first year of cardmembership even before factoring in the 50,000 bonus points, lounge access, fourth night free on paid hotel stays, and three free rounds of golf per calendar year. […]