MileValue is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

Note: Some of the offers mentioned below may have changed or are no longer be available. You can view current offers here.

My friend has a destination wedding in Roatan, Honduras over the July 4th weekend. He asked me to write a post explaining to his guests how they can get there with miles. This is the specific example I’ll use, but this post is broadly applicable when you need to plan airfare for any destination wedding. Follow the same three steps in this post.

Destination weddings don’t need to break the bank for attendees. Airfare can cost as little as the roundtrip aviation taxes to your destination ($29 to Honduras), and, worst case scenario, you can always get $500 off the cheapest fare to your destination.

There is a simple three-step process I would use to minimize the cost of airfare to a destination wedding.

For Roatan over July 4:

1. Search on united.com for award space from your home airport to Roatan.

2. If there is space you want, open the Chase Sapphire Preferred® Card. Meet its minimum spending requirement to unlock its bonus. Book the space you found on united.com.

For other destination weddings:

- Fill out a free credit card consultation form, and I will tell you what card(s) to open for the destination, time of year, and cabin of service you want.

- Meet the minimum spending requirements on those credit cards, and redeem your miles for the flights.

Let me go over these simple steps in detail at a beginners’ level, so anyone can follow along. No excuses for not showing up in Roatan!

Step 1. Search for Award Space on United.com

Ideally you could use 35,000 United miles and about $29 for a roundtrip from anywhere in the United States to Roatan.

I say “ideally” because United or its partners will need to release award space at the Saver level for your award to cost 35,000 miles. Saver award space is capacity controlled, and airlines only release it when they otherwise expect there to be empty seats on the plane.

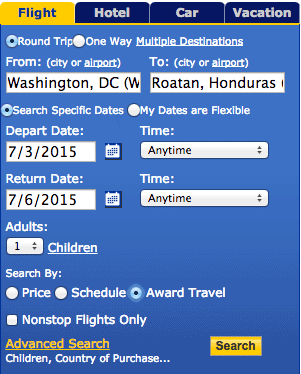

To search for Saver award space from your home airport to Roatan, go to united.com. Right on the home page is the search box.

Enter your home airport as the starting point and Roatan (RTB) as the destination. Select your preferred dates, the number of passengers, and select “Award Travel” under “Search By:”. Click “Search.”

Your results will look like this (click to enlarge):

You’re looking for the blue Select button in the Saver Award column under Economy. I’ve highlighted it in yellow above.

If a desirable itinerary appears with Saver award space in both directions, you are in good shape and will proceed to step 2a, getting a Sapphire Preferred. If no desirable itineraries appear with Saver space, proceed to step 2b, getting an Arrival Plus.

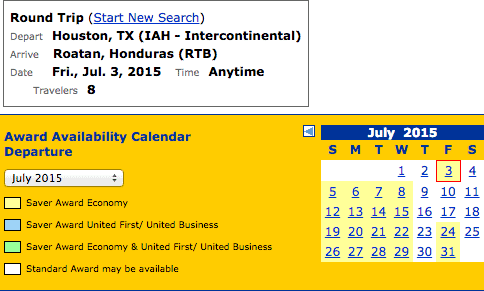

I think many people will find a desirable Saver itinerary. United has a daily flight from Houston to Roatan. The graphic below shows the days with Saver availability for eight travelers. As you can see, July 3, 2015 there are currently 8 Saver award seats in economy from Houston to Roatan.

That means if there is Saver award space from your home airport to Houston, you should have a good outbound Saver itinerary.

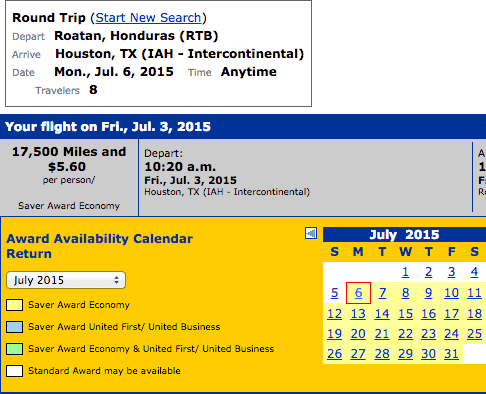

The return has 8 Saver award seats from Roatan to Houston on July 6 and 7.

Someone coming from Raleigh, for instance, would find this itineray for only 35,000 United miles + $28.70.

Step 2: Get the Right Credit Card

If there was good space on United.com, get the Chase Sapphire Preferred® Card.

If you found space in the previous section get the Chase Sapphire Preferred.

The card earns 2 points per dollar on travel and 1 point per dollar on everything else.

Ultimate Rewards transfer 1:1 instantly to miles with several airlines including United.

Once all your Ultimate Rewards post to your Chase Sapphire Preferred account, you’ll want to go back to united.com and make sure award space still exists on your dates, and if it does, transfer the appropriate number of points to United miles and book the trip on united.com.

Not Going to Roatan?

Combine Steps 1 and 2 into this: Fill out a free credit card consultation form, and I will tell you what card(s) to open for the destination, time of year, and cabin of service you want.

That consultation will also include basic instructions on how to redeem the miles I suggest getting. If those aren’t enough, you can hire my Award Booking Service to book your ticket for $125 per person.

Recap for Roatan

1. Search on united.com for award space from your home airport to Roatan.

2. If there is space you want, open the Chase Sapphire Preferred® Card. Meet its minimum spending requirement to unlock its bonus. Book the space you found on united.com.

Questions? Leave them in the comments.

Just getting started in the world of points and miles? The Chase Sapphire Preferred is the best card for you to start with.

With a bonus of 60,000 points after $4,000 spend in the first 3 months, 5x points on travel booked through the Chase Travel Portal and 3x points on restaurants, streaming services, and online groceries (excluding Target, Walmart, and wholesale clubs), this card truly cannot be beat for getting started!

Editorial Disclaimer: The editorial content is not provided or commissioned by the credit card issuers. Opinions expressed here are the author’s alone, not those of the credit card issuers, and have not been reviewed, approved or otherwise endorsed by the credit card issuers.

The comments section below is not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser’s responsibility to ensure all questions are answered.

Assuming there’s space on United, another option would be to use Singapore air miles obtained via Amex, thank you, or spg. Less miles and free stopover (even on one way)

Correct. I wanted to make this as simple as possible for presumed newbies, and I still couldn’t get it below 1900 words. But your tip is excellent.

Their is a simple…..

Thanks. It’s funny because I normally make ~0 errors on their/there/they’re, but on this post I remember correcting two on an edit, and I still missed one. Must have been tired. Buenos Aires!

AA also has a seasonal a couple times a week flight. So u can open an AA card or use avios. There is a $30 departure tax not included in ticket, pay in cash at exit. You can also fly to SAP/TGU and catch a prop plane there ATR. UA charges 10k each way (via taca/avianca). Yes more of a hassle and mor connections, but an option. Great diving and cheapest dolphin encounter in the Caribbean.

I tried to make this as simple as possible because I figure my friend’s guests probably know nothing about miles, and will glaze over at this 1900 word article. AA and Delta both fly to Roatan (as well as United partner TACA/Avianca), but the best space I found was on United via Houston with 8+ economy seats on 7/3 and 7/6 and 7/7.

Writing this article made me want to get to Roatan.

Thanks for the breakdown on how you go about working credit card and airline points. I’m definitely planning to use some of these principles on trips going forward.

As for the specific recommendations for how to execute this for the wedding, it all sounded great until the “Oh, just be sure to spend $4,000 on your Chase Sapphire within the first 3 months” bit… It looks like I need to spend a LOT of money to earn my “free” flight. #nofreelunch

Anyways, I think I’ve found some Saver flights that’ll work for me. I wouldn’t have thought to try that, so thanks for that tip!

Spending $1,333 per month on a credit card is easy for most people. If it’s hard for you, congrats on your frugality, but travel hacking probably isn’t for you.