MileValue is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

Note: Some of the offers mentioned below may have changed or are no longer be available. You can view current offers here.

For five months, the Citi Executive AAdvantage World MasterCard has been offering 100,000 bonus American Airlines miles after spending $10,000 in the first three months. That’s why it is the #1 card for travel for June 2014.

Meet the card’s minimum spending requirement, and you’ll have 110,000 American Airlines miles, more than enough for a roundtrip award anywhere in the world or for a business class roundtrip award to Europe or South America.

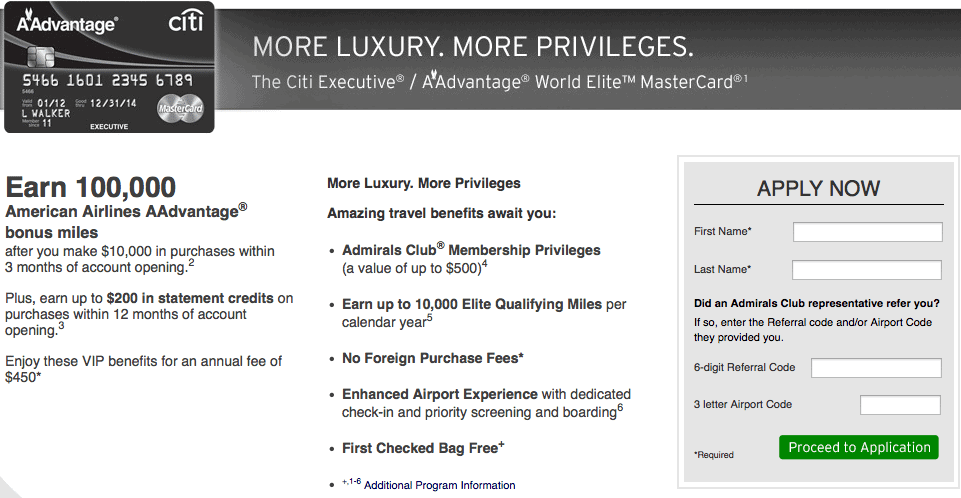

This week, the link to the card’s former landing page (pictured below) disappeared.

However a direct link to the card’s application where none of the bonus details are listed is still active. I have read reports online that this direct link is still offering 100,000 bonus miles. Folks have confirmed the sign up bonus with a rep while activating the card.

It appears to still be possible to quickly earn 110,000 American Airlines miles, but there are major drawbacks to the Citi Executive AAdvantage World MasterCard that you should consider before getting the card.

- What is the full offer on the Citi Executive AAdvantage World MasterCard?

- Can you get the card if you’ve had other Citi American Airlines cards?

- Can you get this sign up bonus more than once?

The Offer

Here were the bullet points available on the former landing page:

- Earn 100,000 American Airlines AAdvantage® bonus miles after you make $10,000 in purchases within 3 months of account opening.

- Plus, earn up to $200 in statement credits on purchases within 12 months of account opening.

- Enjoy these VIP benefits for an annual fee of $450

- Admirals Club Membership Privileges (a value of up to $500)

- Earn up to 10,000 Elite Qualifying Miles per calendar year after spending $40k

- No Foreign Purchase Fees

- Enhanced Airport Experience with dedicated check-in and priority screening and boarding

- First Checked Bag Free

I got the card this month because that sign up bonus is eye popping. The $450 annual fee was a concern, but you get $200 in statement credits after your first $200 spent on the card, so for the first year, the “effective” annual fee is $250.

I’m willing to pay $250 for 100,000 bonus American Airlines miles, which I value at over $1,700, especially when I can get free access to American Airlines Admirals Clubs for a year.

Who Can Get the Card?

This card is the Executive Card. It is different than the Platinum and Gold versions of American Airlines credit cards, which many more people have. If you only have those cards, you can get this card and its bonus as a new customer.

If you have gotten the Executive Card already, I have read dozens of successful reports of people getting two and even three Executive cards over a span of just a few months and getting the 100,000 mile bonus each time. Your mileage may vary.

The Drawbacks

The two things that will hold people back from getting this card are the minimum spending requirement and annual fee.

The minimum spending requirement is a huge $10,000 in three months. There are many great ways to meet minimum spending requirements, but make sure you only get this card if you can meet the minimum spending requirement without spending more than you ordinarily would and if meeting the minimum spending requirement will not cause you to go into debt.

The annual fee is $450 per year. The first year you get a $200 statement credit as you spend toward the minimum spending requirement, so the effective annual fee is only $250.

For that price, you get Admirals Club access. If you normally pay for Admirals Club access, this perk has real value. If you normally fly international business class awards–which come with lounge access–this perk has zero value. Figure out how much value lounge access has to you and mentally deduct that value from the annual fee.

Bottom Line

My take on this card is that for some people it will be one of the best offers of the year. For other folks, this will be an offer they should skip in favor of cards with spending requirements and annual fees that more closely align with their comfort levels.

You can apply for the Citi Executive card through this direct link that does not feature the bonus terms. Your mileage may vary.

Will you apply for the card?

Just getting started in the world of points and miles? The Chase Sapphire Preferred is the best card for you to start with.

With a bonus of 60,000 points after $4,000 spend in the first 3 months, 5x points on travel booked through the Chase Travel Portal and 3x points on restaurants, streaming services, and online groceries (excluding Target, Walmart, and wholesale clubs), this card truly cannot be beat for getting started!

Editorial Disclaimer: The editorial content is not provided or commissioned by the credit card issuers. Opinions expressed here are the author’s alone, not those of the credit card issuers, and have not been reviewed, approved or otherwise endorsed by the credit card issuers.

The comments section below is not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser’s responsibility to ensure all questions are answered.

It is an awesome card as long as you can handle the minimum spend. I got one card, then a second one less than two weeks later. This was in late March. I kind of over-extended myself since immediately after getting the cards CVS shut down VR purchases with credit cards, and it got a little stressful getting $20,000 done in 3 months. But I was traveling in Switzerland where you end up spending mucho cash regardless, and that zero foreign fee was very handy.

Yes, it is key not to overextend yourself. Also, keep in mind my prediction that AA devalues its chart in about 8-9 months, so if you can’t use up all the miles for travel in about 19 months, mentally devalue the bonus.

I just learned how to MS and and I opted to learn slowly. Now I’m pretty good at that, but $10,000 spend is still a little out of my comfort zone. Plus I need other cards for now. I just redeemed a ton of AA miles through cc sign up and miles purchase. I loved the ease although it was by no means FREE for me. #notasolotraveler

Could someone please confirm that the link still works? Thanks

Thanks for the update on this card. I applied for this card in January and got the 100k bonus. After reading your post, I applied again and was just approved for another 100k bonus!

Just approved and received confirmation of the 100,000 mile offer. Also, used two of your affiliate links for two other cards as a thank you for all the great content.

Link still works! Verified 100,000 miles and $200 statement credits today. Giddyap!

[…] instance, if you have a ton of AAdvantage miles from multiple Executive Card sign up bonuses, don’t send valuable Starpoints to your American Airlines account that you won’t be […]