MileValue is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

Note: Some of the offers mentioned below may have changed or are no longer be available. You can view current offers here.

In July of last year I published a post welcoming readers to share their American Express card referral links in the comments. Since many of the offers in the comments have expired, I decided to start fresh with a new thread in January. And in light of the fact that there’s a new 35k (historical high) bonus on the SPG Business card, I’m bumping this post to the top of the site so you can feel free to leave your SPG Business referrals in the comments.

Do you have an American Express credit card? If you do, are you aware that you may have the ability to share referral links with others that will earn you tons of bonus points?

Checking For Referrals

Signing in here will take you to a landing page that should show any/all offers available for you to refer. You will be given the option to send your link via email by entering your friend or family’s email address, share your link on Facebook or Twitter, or you can simply copy and paste your personalized links to share how you wish.

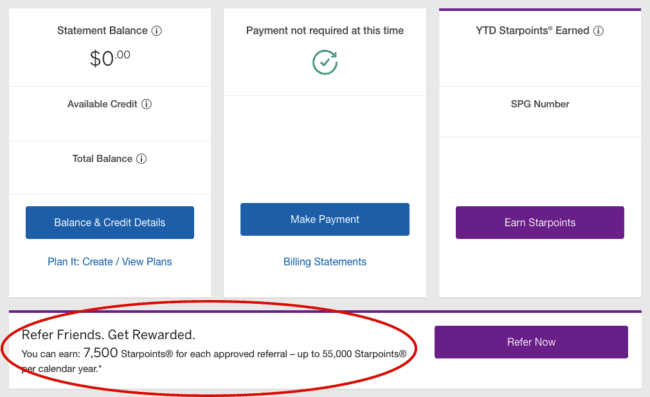

You can also get your personalized referral links by signing into your Amex account and scrolling down below the statement balance, payment, and rewards boxes. In between those boxes and the section about recent transactions is the area where referral information pops up.

My Referrals

At the moment I hold two American Express credit cards, and I have a referral available for the SPG Business card:

- The Starwood Preferred Guest Business Card – 35,000 Starpoints for spending $7,000 on the card within three months of account opening. Expires 3/28/2018.

If you would like to help me out by signing up through my referral links, email me at sarahpage@milevalue.com and we can connect.

Leave Your Referral Info in Comments

If you’d like to share your referral link(s), feel free to in the comments. Please include:

- the specific Amex card and offer

- your email address so someone who is interested can contact you

- the expiration date of your offer (all referral links eventually expire–check when yours does by clicking the Refer Now box within your online account and then clicking the *Terms Apply hyperlink)

Everyone is capped at 55k bonus miles you can earn per year per card through referrals, so be kind enough to comment on your comment if you reach the limit so the points love can be spread elsewhere.

Everyone is capped at 55k bonus miles you can earn per year per card through referrals, so be kind enough to comment on your comment if you reach the limit so the points love can be spread elsewhere.

Don’t worry if your comment doesn’t publish immediately–you don’t need to comment again. If it’s your first time commenting on a MileValue post, I will have to approve the comment before it’s published for everyone to see.

If you’re sending a referral link through email….

Make sure the recipient has opted in to receiving marketing emails from American Express, or else they might not get your email. The following is from Amex terms regarding referrals:

“The friends you refer may not receive the referral email if they previously opted out of receiving email marketing communications from American Express, by pressing ‘SEND EMAIL’, you are directing American Express to send a referral email to your friend at the email you have provided and hereby authorize us to share your first name, last name, and status as an American Express Card Member within that email.”

Reminders About Amex Eligibility

- You can only get the bonus on an American Express card once per lifetime. However if you were targeted for an American Express offer, it is possible to still be approved (YMMV) even if you have had the card before.

- You are limited to holding four to five American Express credit cards. Both personal and business count toward this limit. (AMEX Everyday, Delta, and SPG are credit cards.)

- Separately, you are limited to holding four to five American Express charge cards. Both personal and business count toward this limit. (AMEX Platinum is a charge card.)

- If you’re on the verge and contemplating a fifth credit or charge card, read this post–you can apply basically risk-free.

BONUS: Interested in a 70k Delta mile bonus offer?

Mommy Points recently posted about a referral link she has for a Platinum Delta SkyMiles Card, issued by Amex, with a 70k redeemable mile/10k MQM mile bonus offer. The standard public offer right now is a measly 35k redeemable miles + 5k MQM miles, so go for the referral if you were thinking of opening the premium Delta card. You can help Mommy Points out by applying here.

If you opened a Delta Platinum Amex last year when the bonus was elevated to 70k, check to see if you have the same referral link available. Feel free to share it in the comments!

Bottom Line

You can check for available referral bonuses by logging into your Amex online account. Share any and as many links you might have (or your email) below. Referrals are a great way to earn a significant amount of extra points each year.

Just getting started in the world of points and miles? The Chase Sapphire Preferred is the best card for you to start with.

With a bonus of 60,000 points after $4,000 spend in the first 3 months, 5x points on travel booked through the Chase Travel Portal and 3x points on restaurants, streaming services, and online groceries (excluding Target, Walmart, and wholesale clubs), this card truly cannot be beat for getting started!

Editorial Disclaimer: The editorial content is not provided or commissioned by the credit card issuers. Opinions expressed here are the author’s alone, not those of the credit card issuers, and have not been reviewed, approved or otherwise endorsed by the credit card issuers.

The comments section below is not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser’s responsibility to ensure all questions are answered.

Hi i have the spg business card referral for 7500 for me and 25k for sign up. My email is lintinoelloco@yahoo.com. my offer expires october 31, 2018. Link is http://refer.amex.us/JOHNNPn0M?xl=cp27

Amex Everyday Card

Here is a link for 15K MR Points after 1K spend in the first 3 months. Also 0% APR on balance transfers and purchases for first 15 months with no balance transfer fee.

http://refer.amex.us/FRANKCpLOr?xl=cp27

AMEX PLATINUM – **60K BONUS POINTS**

Apply for an American Express Card with this link. We can both get rewarded if you’re approved! http://refer.amex.us/RYANStquU?XLINK=MYCP

AmEx SimplyCash Preferred referral link: http://amex.ca/share/joeldwfat?CPID=100200329

This is for the UK Amex credit cards:

Use the below link to sign up for the American Express Preferred Rewards Gold Credit Card

and you will receive:

22,000 Membership Rewards points/Avios Points when you spend £2,000 in the first 3 months.

Link: https://amex.co.uk/refer/robergnhjc

This is an EXTRA 2,000 on top of what you would receive if you signed up without the link!

You will also get 1 membership reward point/Avios (they can be converted 1 to 1) for every £1 spent. Plus 10,000 bonus points if you spend £15,000 in the first year.

The card is free for the the first year and then you can cancel it before having to pay anything.

http://refer.amex.us/FRANKCTQkU?XLINK=MSIA

The above is for the Gold card but you will also receive links to all other cards. Currently there is an increased offer on the BCP and Green. Check it out.

http://refer.amex.us/GAVINYK0L5?XLINK=MYCP

Amex Hilton Honor/ Ascend/ Aspire/ Business cards

Amex Hilton $0 annual fee 100,000 for $1,000

Amex Hilton Ascend $95 annual fee, 150,000 for $3,000

Amex Hilton Aspire $450 annual fee, 150,000 for $4,000 + Free Weekend Night on Signup + Free Weekend Night each year on renewal

Amex Hilton Business $95 annual fee, 125,000 for $3,000

SPG – http://refer.amex.us/EUGENFK3k4?XLINK=MYCP

my email address so someone who is interested can contact me – sofulchik@yahoo.com

the expiration date 10/31/2018 of offer

Thank you for using my link

American Express EveryDay Card — 15,000 Membership rewards after spending $1,000 in first 3 months.

http://refer.amex.us/JORDABpCCF?XLINK=MYCP

Expires 7/24/2019

Contact: sk8uno@gmail.com

Hi everyone, hope one of these is valuable to someone and I can refer you:

1. Amex Business Platinum: earn 50,000 Membership Rewards® points after you spend $10,000 and an extra 25,000 points after you spend an additional $10,000 on qualifying purchases on your new Card within first 3 months of Card Membership. Offer expires 1/17/2018.

2. Amex Everyday Preferred: earn 20,000 Membership Rewards® points after you use their new Card to make $1,000 in purchases within the first 3 months of Card Membership. Offer expires 7/24/2019.

3. Amex Delta Platinum: earn 70,000 bonus miles and 10,000 Medallion® Qualification Miles after you use your new Card to make $3,000 in purchases within the first 3 months and a $100 statement credit after you make a Delta purchase with the new Card within the first 3 months of Card Membership. Special Offer ends 01/31/2018.

4. Amex SPG Business: earn 25,000 Starpoints® after you use their new Card to make $5,000 in purchases within the first 3 months of Card Membership. Offer expires 1/31/2018.

You can contact me at akobilarov [at] gmail.com

American Express Gold Delta Skymiles — Up to 60,000 Delta Miles. 50k after spending $2,000 in first 3 months, and an additional 10,000 after spending an additional $1,000 in first 6 months. Also get $50 statement credit after making a Delta purchase within 3 months.

http://refer.amex.us/JORDABEilY?XLINK=MYCP

Expires 1/31/2018

Contact: sk8uno@gmail.com

American Express Starwood Preferred Guest — Earn 25,000 Starpoints after spending $3,000 in first 3 months.

http://refer.amex.us/JORDABnICm?XLINK=MYCP

Expires 10/31/2018

Contact: sk8uno@gmail.com

You will get 85,000 Hilton Honors™ Bonus Points after you use the new Card to make $3,000 in purchases within the first 3 months of Card Membership. If any questions, please email ihsin2@yahoo.com

http://refer.amex.us/DAVIDCK22t?XLINK=MYCP

The link expires on 1/17/2018. (disclosure: I would get 20000 Hilton points if you are approved. I thank you for using this link. It helps me a lot.)

American Express Hilton Honors Card — Earn 75,000 Hilton points after spending $1,000 in first 3 months.

http://refer.amex.us/JORDABwifJ?XLINK=MYCP

Expires 1/17/2018

Contact: sk8uno@gmail.com

Thank you for the opportunity to share!

I have 7 referrals available, email is alipss@gmail.com if you want to get in touch.

http://refer.amex.us/ALBERIICbu?XLINK=MYCP

Link expires 10/31/2018

Each friend can earn: 25,000 Starpoints® after they use their new Card to make $3,000 in purchases within the first 3 months of Card Membership.

Personal Platinum (exp. 9/28/18):

60,000 Membership Rewards® points after they use their new Card to make $5,000 in purchases within the first 3 months of Card Membership.

http://refer.amex.us/STEPHH9In2?XLINK=MYCP

Hilton Surpass (Exp. 1/17/18):

85,000 Hilton Honors™ Bonus Points after they use their new Card to make $3,000 in purchases within the first 3 months of Card Membership. Offer expires 1/17/2018.

http://refer.amex.us/STEPHHA8yV?XLINK=MYCP

SPG Personal (exp. 10/31/18):

25,000 Starpoints® after they use their new Card to make $3,000 in purchases within the first 3 months of Card Membership.

http://refer.amex.us/STEPHHlHBs?XLINK=MYCP

Business Platinum (exp. 1/17/18):

50,000 Membership Rewards® points after they spend $10,000 and an extra 25,000 points after they spend an additional $10,000 on qualifying purchases on their new Card within their first 3 months of Card Membership.

http://refer.amex.us/STEPHHIKaG?XLINK=MYCP

SPG Business (exp. 10/31/18)

25,000 Starpoints® after they use their new Card to make $5,000 in purchases within the first 3 months of Card Membership.

http://refer.amex.us/STEPHH7ukn?XLINK=MYCP

Business Gold (exp. 1/17/18)

50,000 Membership Rewards® points after they use their new Card to make $5,000 in purchases within the first 3 months of Card Membership.

http://refer.amex.us/STEPHHJ1Fw?XLINK=MYCP

Thank you for the opportunity to share!

Starwood SPG Personal card

I have 7 referrals available, email is alipss /at/ gmail if you want to get in touch.

http://refer.amex.us/ALBERIICbu?XLINK=MYCP

Link expires 10/31/2018

Each friend can earn: 25,000 Starpoints® after they use their new Card to make $3,000 in purchases within the first 3 months of Card Membership.

(moderator – please delete previous post as I forgot to note the card)

SPG Business: 25k expires 10/31/18

Hilton Surpass (soon to be Aspire): 85k expires 1/17

thegcduke@gmail.com

Also have Business Plat and Platinum, but they are 60k or less bonuses.

Thanks for setting this up!

We’re planning an insane 50th Birthday trip around the world in 2018. All points will be used (& abused) wisely! Thank you for using our referrals!

SPG: http://refer.amex.us/SEANH9eWa?XLINK=MYCP

SPG BUSINESS: http://refer.amex.us/SEANHAzYp?XLINK=MYCP

AMEX PLATINUM PERSONAL: http://refer.amex.us/SEANHnWMD?xl=cp20

AMEX EVERDAY PREFERRED: http://refer.amex.us/MARIOBjjqM?XLINK=MYCP

AMEX EVERYDAY: http://refer.amex.us/SEANHUiIM?XLINK=MYCP

AMEX HILTON HONORS SURPASS: http://refer.amex.us/SEANHBNRM?XLINK=MYCP

AMEX BUSINESS GOLD REWARDS: http://refer.amex.us/SEANH1Evj?XLINK=MYCP

CHASE SAPPHIRE PREFERRED: https://www.referyourchasecard.com/6/CMGJSU0680

CHASE HYATT: https://www.referyourchasecard.com/205/UH3LGTRGYL

Hi everyone, hope one of these is valuable to someone and I can refer you:

1. Amex Business Platinum: earn 50,000 Membership Rewards® points after you spend $10,000 and an extra 25,000 points after you spend an additional $10,000 on qualifying purchases on your new Card within first 3 months of Card Membership. Offer expires 1/17/2018.

2. Amex SPG Business: earn 25,000 Starpoints® after you use their new Card to make $5,000 in purchases within the first 3 months of Card Membership. Offer expires 1/31/2018.

2. Amex SPG Personal: earn 25,000 Starpoints® after you use their new Card to make $5,000 in purchases within the first 3 months of Card Membership. Offer expires 1/31/2018.

You can contact me at troyhouse [at] gmail.com

SPG 25000 points sign up bonus:

You will earn 25,000 Starpoints® after they use the new Card to make $3,000 in purchases within the first 3 months of Card Membership. Please contact me at hemang88888@yahoo.com if you have any questions.

http://refer.amex.us/HEMANNOvQV?XLINK=MYCP

The offer expires on 10/31/2018.

Disclosure: I will get 7500 points if you are approved. Thanks for using my link, as it helps me and my family.

SPG Personal

Earn 25,000 Starpoints® after they use their new Card to make $3,000 in purchases within the first 3 months of Card Membership.

Blue Cash Everyday® Card

Earn: $200 back after they spend $1,000 in purchases on their new Card in their first 3 months of Card Membership.

sanj.sharma [at] gmail.com

Thanks for setting this up!

The Business Platinum Card

Earn 50,000 Membership Rewards® points after you spend $10,000 and an extra 25,000 points after you spend an additional $10,000 all on qualifying purchases on the Business Platinum Card within your first 3 months of Card Membership.†

Apply for The Business Platinum Card® with this link. We can both get rewarded if you’re approved! http://refer.amex.us/DAVIDBcufq?xl=cp27

Expires 1/17/2018

AMEX Business Platinum. (LOVE this card!)

If I can refer you….much thanks!

We haven’t gotten any points from referrals (ever).

Maybe now!

dianelp@bellsouth.net

The information is the same offer as listed above.

50,000 points with $10,000 spend in 3 months

and extra 25,000 points with an additional $10,000 spend.

http://refer.amex.us/TIMOTSkk2K?XLINK=MYCP

There we go! There’s a reason we don’t get referral sign on bonues!

Slowly figuring this out!

TIA!

Hello everyone, here are a few of my links. Hope they are helpful:

50,000 bonus on Platinum Business: http://refer.amex.us/ISMAESZGC3?XLINK=MYCP

25,000 bonus on SPG Business: http://refer.amex.us/ISMAESzqyd?XLINK=MYCP

15,000 bonus on Everyday: http://refer.amex.us/ISMAESTKF5?XLINK=MYCP

Platinum-60k points for $5k in spend.

Bus platinum- 50k for $10k + another 25k for $10k in 3 months.

Gold PRG – 25k for $2k

Delta platinum- 70k miles & 10k mqm & $100 credit for $3k

Bus SPG- 25k for $5k

Hilton Honors- 75k for $1k

Hope this helps!

rainmanpi@yahoo.com

Each friend can earn: 60,000 Membership Rewards® points after they use their new Card to make $5,000 in purchases within the first 3 months of Card Membership.

http://refer.amex.us/MARKLrNoK?XLINK=MYCP

Each friend can earn: 15,000 Membership Rewards® points after they use their new Card to make $1,000 in purchases within the first 3 months of Card Membership.

http://refer.amex.us/MARKL4Tsd?XLINK=MYCP

Each friend can earn: 75,000 Hilton Honors™ Bonus Points after they use their new Card to make $1,000 in purchases within the first 3 months of Card Membership.

http://refer.amex.us/SARAHLFpYX?XLINK=MYCP

Amex Platinum – earn 60,000 Membership Rewarsa points after you use this card to spend $5,000 in the first theee months. Offer expires on 9/29/2018.

Amex Business Rewards Gold – earn 50,000 Memberhsip Rewards Points after using this card to spend $5,000 in the first three months. Offer expires 01/17/2018.

Amex Starwood Business – earn 25,000 Starpoints after using this card to spend $5,000 in the first three months. Offer expires 10/31/2018.

Amex Premium Rewards Gold – earn 25,000 membership rewards points after using this card to spend $2,000 in the first three months. Offer expires 07/24/2019.

Amex Everyday preferred – earn 20,000 membership rewards points after using this card to spend $1,000 in the first three months. Offer expires 7/24/19.

Hilton Surpass – earn 85,000 Hilton honors points after using this card to spend $3,000 in the first three months. Offer expires 01/17/2018

Hilton Honors – earn 75,000 Hilton honors points after using this card to spend $1,000 in the first three months. Offer expires 01/17/2018

My email address is sadiesloane2017@gmail.com

Thanks for the consideration!!!

Hi all,

This is a referral link for the Platinum Delta SkyMiles Card with a 70k redeemable mile/10k MQM mile bonus offer. Expires 1/31.

http://refer.amex.us/HUIHUCQi6q?xl=cp69

Thank you!

First, I would like to thank Sarah for the opportunity everybody can share the referral link here.

I will have a nice little surprise gift for person I can refer.

#1 AMEX business platinum card:

Each friend can earn: 50,000 Membership Rewards® points after they spend $10,000 and an extra 25,000 points after they spend an additional $10,000 on qualifying purchases on their new Card within their first 3 months of Card Membership.

#2 Delta Skymiles Business card:

Each friend can earn: 50,000 bonus miles after they use their new Card to make $2,000 in purchases within the first 3 months and a $50 statement credit after they make a Delta purchase with their new card within the first 3 months of Card Membership. Plus, they can earn an additional 10,000 bonus miles after they make an additional $1,000 in purchases within their first 6 months. Offer expires on 1/31/2018

Thanks for reading my post. Please send me email to fangjk@yahoo.com if you are interested.

Hi all. I would greatly appreciate anyone who uses my referrals! Would be my first time receiving a referral bonus. I have two to offer:

1) Business Rewards Gold: 50,000 MR rewards points for $5,000 spend within the first three months. Offer ends 1/17/18

http://refer.amex.us/ZACHABtxeM?xl=tw19

2) SPG Business: Earn 25k Starpoints after $5000 spend in the first three months. Offer ends 1/31/18

http://refer.amex.us/ZACHABOJth?xl=tw19

If you have any questions you can reach me at: Alexmilkk@gmail.com Thank you!

SPG Personal: http://refer.amex.us/SUHANVEdzy?XLINK=MYCP

25,000 Starpoints after $3,000 in purchases within the first 3 months. Offer expires 10/31/18

Hi, I have a few links to share:

1. Premier Rewards Gold card – earn 25,000 MRs after spending $2000 in the first 3 months. Offer expires 07/24/2019 – http://refer.amex.us/LEAB9xqI?xl=cp09

2. Starwood Preferred Guest® Credit Card – earn 25,000 Starpoints after spending $3000 in the first 3 months – Offer expires 10/31/2018 – http://refer.amex.us/LEABls5k?xl=cp09

3. Gold Delta SkyMiles® Credit Card – earn 50,000 miles after spending $2000 in purchases within the first 3 months and a $50 statement credit afer making a Delta purchase with the card in the first 3 months. Earn an additional 10,000 bonus miles after making an additional $1000 in purchases within the first 6 months. – Offer expires 01/31/2018 – http://refer.amex.us/LELIAB2M1k?xl=cp09

4. Hilton Honors™ Surpass Card – earn 85,000 bonus points after spending $3000 within the first 3 months – offer expires 01/17/2018 – http://refer.amex.us/LELIABPnFd?xl=cp09

Feel free to contact me at 2btraveling@gmail.com

Hello. I greatly appreciate anyone who uses my referrals!

1. **STARWOOD** Earn 25K after $3K spend in 3 months. Expires 10/31/2018.

http://refer.amex.us/LANCESRgFJ?XLINK=MYCP

2. **AMEX EVERYDAY** Earn 15K after $1K spend in 3 months. Expires 7/24/2019. http://refer.amex.us/LANCESI6cL?XLINK=MYCP

3. **GOLD DELTA SKYMILES** Earn 60K + $50. Earn 50K after $2K in 3 months. Earn additional 10K after $1K in 6 months. Earn $50 after any Delta purchase in 3 months. Expires 1/31/2018.

http://refer.amex.us/LANCESZqgU?XLINK=MYCP

Contact: lssubl01@att.net

Apply for the Platinum Delta Card

http://refer.amex.us/HARVENSL4w?xl=tw55

Earn 70,000 bonus miles and 10,000 Medallion® Qualification Miles after $3,000 in purchases within the first 3 months and a $100 statement credit after a Delta purchase within the first 3 months of Card Membership.

Offer ends 01/31/2018.

SPG Personal

Apply for the Starwood Credit Card with this link. We can both get rewarded if you’re approved! http://refer.amex.us/FERNABD9n2

I have the Hilton Honors Surpass Card from AMEX referral for 20k Hilton Honors points for me and 85k Hilton Honors points for you. Big thank you for using my referral and to MileValue for doing this. You need to spend $3k within first 3 months of the card to qualify for the bonus.

Contact: demapan@gmail.com

My offer expires January 17, 2018.

Apply for the Hilton Honors™ Surpass Card from American Express with this link. We can both get rewarded if you’re approved! http://refer.amex.us/MICHADRRn7?xl=cp27

Hello! It’d be awesome if you would use my referrals!!

SPG Business – earn 25,000 Starpoints!! after using this card to spend $5,000 in the first three months. Offer expires 10/31/2018.

http://refer.amex.us/HEATHB0omr?XLINK=MYCP

my email is caycebiggerstaff1@gmail.com

THank you!

satobt@hotmail.com

Apply for the Platinum Card® with this link. 15K for me 60K for you!

Expires 09/29/2018

http://refer.amex.us/BRETTSRQ5z

!!ABOVE AVERAGE HILTON HONORS BONUS!! !!GREAT FOR LOW BUDGETS!!

Amex Rewards Gold: 25,000 Membership Rewards® points after $2,000 in purchases within the first 3 months of Card Membership

CODE: http://refer.amex.us/TYLERMnaad?XLINK=MYCP

Hilton Honors: 75,000 Hilton Honors™ Bonus Points after $1,000 in purchases within the first 3 months of Card Membership.

CODE: http://refer.amex.us/TYLERMsWtg?xl=cp33

Hopefully you will find use from some of these. Looking to use points to take my Fiance and I on an unforgettable Honeymoon! Best of luck to you and thank you! Cheers.

1. Platinum: 60K points after $5k spend in 3 months. One of my favorite cards because of all of the outstanding benefits. http://refer.amex.us/BRENNMRgBd?xl=cp27

2. SPG Personal: 25K points after $3k spend in 3 months. Super versatile and great for cheap hotel bookings at 3K points/night and SPG gold status. http://refer.amex.us/BRENNMxtVG?xl=cp27

3. Amex EveryDay: 15K points after $1k spend in 3 months. Awesome NO annual fee card that earns MR. 2x at grocery stores. http://refer.amex.us/BRENNMZN8U?xl=cp27

4. Hilton Honors: 75K points after $1k spend in 3 months. Another no fee card great for adding Hilton points and with a 5x bonus at grocery, restaurant and gas stations. http://refer.amex.us/BRENNMRIGs?xl=cp27

Thank you for the opportunity to leave referrals here! For anyone who fancies a link I’ve got the following:

Amex EVERYDAY: 15,000 Membership Rewards® points after $1,000 in purchases within the first 3 months:

http://refer.amex.us/NINAF4hV3?XLINK=MYCP

Amex SPG: 25,000 Starpoints® after $3,000 in purchases within the first 3 months:

http://refer.amex.us/NINAFZoxQ?XLINK=MYCP

Amex Hilton: 85,000 Hilton Honors™ Bonus Points after $3,000 within the first 3 months. THIS OFFER EXPIRES 1/17/2018:

http://refer.amex.us/NINAFJodh?XLINK=MYCP

Hi All,

AMEX Everyday card- 15000 membership rewards after $1000 in spending in the first three months.

Apply for the Amex EveryDay® Credit Card with this link. We can both get rewarded if you’re approved! http://refer.amex.us/EDWARO9PsF?xl=cp27

Expires 7/24/2019

Contact: edik1@aol.com

Many Thanks!

Here are the current Amex offers I have for you. Thank you for using this! I reply quickly so I will watch for your email and will enter the referral into Amex right away. Have a great day!–Josh

***Platinum Delta SkyMiles***–earn: 70,000 bonus miles and 10,000 Medallion® Qualification Miles after they use their new Card to make $3,000 in purchases within the first 3 months and a $100 statement credit after they make a Delta purchase with their new Card within the first 3 months of Card Membership. (Special Offer ends 01/31/2018.)

***Platinum Delta SkyMiles-Business Card***–70,000 bonus miles and 10,000 Medallion® Qualification Miles after they use their new Card to make $4,000 in purchases within the first 3 months and a $100 statement credit after they make a Delta purchase with their new Card within the first 3 months of Card Membership. (Special Offer ends 01/31/2018.)

******SPG Personal Amex***– earn: 25,000 Starpoints® after they use their new Card to make $3,000 in purchases within the first 3 months of Card Membership. (Expires Oct 31, 3018)

What a true man of the people! Looks like I also have a link to the nonpublic 70k Delta offer.

Delta Platinum Personal: 70,000 SkyMiles for $3,000 spend in 3 months.

http://refer.amex.us/KIRSTLpLAs?XLINK=MYCP

Starwood Personal: 25,000 Starpoints for $3,000 spend in 3 months.

http://refer.amex.us/KIRSTL8PY2?XLINK=MYCP

I have only one AMX card and would greatly appreciate anyone who uses my referral. My wife and I would love to earn enough skymiles to take a trip to Italy for our 40 Anniversary!

American Express Gold Delta Skymiles — Up to 60,000 Delta Miles. 50k after spending $2,000 in first 3 months, and an additional 10,000 after spending an additional $1,000 in first 6 months. Also get $50 statement credit after making a Delta purchase within 3 months.

Apply for the Gold Delta SkyMiles® Credit Card with this link. We can both get rewarded if you’re approved!

http://refer.amex.us/DAVIDSlK5p?xl=cp55

Expires 1/31/2018

Contact: d403sz@gmail.com

Amex personal platinum : earn 60,000 Membership Rewards® points after using new Card to make $5,000 in purchases within the first 3 months of Card Membership (expires 9/29/18). Thanks !

http://refer.amex.us/DOUGLJ2wc7?XLINK=MYCP

PLATINUM CARD

Each friend can earn: 60,000 Membership Rewards® points after they use their new Card to make $5,000 in purchases within the first 3 months of Card Membership.

seems like a great return on a $5000 investment of spend, as well as the many benefits PLATINUM provides.

http://refer.amex.us/ADRIAMdQGM?XLINK=MYCP

Thanks for this opportunity!

Hilton Surpass – $3,000 in 3 months for 85,000 Hilton points.

Apply for the Hilton Honors™ Surpass Card from American Express with this link. We can both get rewarded if you’re approved! http://refer.amex.us/SUSANA0urw?xl=cp35

Thank you!

Hi! I am happy to share the following links that benefit both of us:

1. SPG Business — 25K bonus miles, $5K spend in 3 mo, expires 10/31/18

http://refer.amex.us/ROBERFavlX?xl=cp01

2. Blue Cash Preferred — $250 bonus cash,$1K spend in 3 mo, expires 3/27/19

http://refer.amex.us/ROBERF4H5y?xl=cp33

3. Everyday — 15,000 bonus MR points, $1K spend in 3 mo, expires 7/24/19

http://refer.amex.us/ROBERFVWkb?XLINK=MYCP

4. SPG Business — 25K bonus miles, $5K spend in 3 mo, expires 10/31/18

http://refer.amex.us/PATRIFRLK2?XLINK=MYCP

5. SPG Personal –25K bonus miles, $3K spend in 3 mo, expires 10/31/18

http://refer.amex.us/PATRIFY9JL?XLINK=MYCP

6. Delta Gold — 50K bonus miles + $50 stmt credit + bonus miles, $2K spend in 3 mo, expires 1/31/18

http://refer.amex.us/PATRIFcCuj?XLINK=MYCP

Thanks for considering these offers!!

Contact me at: hoglard1@comcast.net

Delta Platinum Amex (70,000 bonus):

http://refer.amex.us/JAREDS54p3

Delta Gold Amex (60,000 bonus)

http://refer.amex.us/JAREDS734r

Thank you for your consideration in using my links.

American Express Business Platinum: http://refer.amex.us/SAMUESlqNP?xl=cp09

You get 50,000MR after $10k spend, additional 25,000MR with additional $10k spend. I get 20,000MR.

American Express Platinum (my first choice): http://refer.amex.us/SAMUESydwH?xl=cp09

You get 60,000MR after $5k spend. I get 15,000MR.

American Express SPG Business: http://refer.amex.us/SAMUESKhdc?xl=cp09

You get 25,000SPG after $5k spend. I get 7,500SPG.

American Express Delta Platinum Skymiles: http://refer.amex.us/SAMUESvZuz?xl=cp09

You get 70,000SM, $100 statement credit and 10,000MQM after $3k spend. I get 10,000SM.

American Express Hilton Honors http://refer.amex.us/SAMUES4H6b?xl=cp09

You get 75,000HH after $1k spend. I get 15,000.

Good luck! I’m about to leave on my SECOND annual full circumnavigation of the globe in business class on points! Going counterclockwise this time 🙂

Sam

Great !! Post how u did when u come back people who have done are the best reporters.

CHEERS

Greetings, Thank you for the opportunity to help others and oneself

***1. Platinum Delta SkyMiles Credit Card 70,000 miles http://refer.amex.us/MUHAMZ2nOx?xl=cp33

70,000 miles & 10,000 Medallion® Qualification Miles after spending $3k and a $100 statement credit after a Delta purchase within the first 3 months. (Special Offer ends 01/31/2018.) I will earn 10K points

——————————-

**2. American Express Business Platinum: Up to 75,000 points http://refer.amex.us/MUHAMZlqgt?xl=cp15

75,000 points -> 50,000 points after spending $10,000 and 25,000 points after $10K in first 3 months (Annual Fee: $450) I will earn 20K points

——————————-

*3. Premier Rewards Gold Card :25,000 points after spending $2,000 in purchases within the first 3 months of Card Membership. I will earn 10K points

http://refer.amex.us/MUHAMZGUvo?xl=cp15

——————————-

4. Blue Cash Everyday® Card: http://refer.amex.us/MUHAMZDwQV?xl=cp15

$200 back after spending $1,000 in purchases & I earn 75 points

——————————-

THANK-YOU, for considering, hope you find the best offer from these links or someone else’s. Have a joyous New Year!!! (feel free to contact mzahid@buffalo.edu)

This link is for The Starwood Preferred Guest® Credit Card from American Express http://refer.amex.us/PHILIFYz5P?xl=cp27.

The offer is 25,000 Starpoints after you make $3,000 in purchases within the first 3 months of Card Membership. Thanks for using my link!

Starwood Preferred Guest Biz Card – 25,000 points after $5,000 spend in 3 months -http://refer.amex.us/SCOTTBSZKc?xl=cp27

Hilton Amex Surpass – 80,000 points after $3000 spend in 3 months – http://refer.amex.us/SUSANBDAfs?XLINK=MYCP

Did not realize I can’t edit my posts, so here’s more.

Amex EveryDay® Credit Card: http://refer.amex.us/PHILIFW2yK?xl=cp27

15,000 Membership Rewards® points after making $1,000 in purchases within the first 3 months.

Hi everyone! This one is super simple. AMEX Blue Cash Everyday Card. “Each friend can earn:

$200 back after they spend $1,000 in purchases on their new Card in their first 3 months of Card Membership.” My link: http://refer.amex.us/BARBACjGj0?xl=cp27

Thanks for putting this together for us. Very thoughtful and a great way to share. Happy New Year everyone!

SPG Personal – http://refer.amex.us/HOKWhuG7?XLINK=MYCP

25,000 Starpoints® after $3,000 in purchases within the first 3 months of Card Membership

Blue Cash Everyday – http://refer.amex.us/HOKWX7Uj?XLINK=MYCP

$200 back after $1,000 in purchases in first 3 months of Card Membership. Will receive $200 back in the form of a statement credit.

Thank you.

SPG Personal: http://amex.co/2EkV3KU

25,000 Starpoints after $3,000 in purchases within the first 3 months of Card Membership

$0 annual fee for the first year, then $95

Gold Delta SkyMiles Personal: http://amex.co/2CU7ocB

Earn up to 60,000 Bonus SkyMiles after $3,000 in purchases within the first 6 months of Card Membership, plus a $50 statement credit!

$0 annual fee for the first year, then $95

Several cards to refer here!! Follow the URL for all application links! https://redd.it/6hhn77

Chase Freedom LINK 01.02.2018

Chase Hyatt LINK 01.02.2018

Chase Sapphire Preferred LINK 01.02.2018

Chase Sapphire Reserve LINK 01.02.2018

Chase Sapphire Reserve #2 LINK 01.11.2018

Chase Ink Preferred LINK 01.11.2018

AmEx Delta Platinum Personal LINK 01.02.2018

AmEx Delta Gold Personal LINK 01.02.2018

AmEx Platinum Personal LINK 01.02.2018

AmEx SPG Personal LINK 01.02.2018

AmEx SPG Business LINK 01.02.2018

Hello All! Thank you for the opportunity to leave referrals here! For anyone who would like a link I’ve got the following:

Amex Premier Rewards Gold Card: 25,000 Membership Rewards® points after $2,000 in purchases within the first 3 months (expires 7/24/19):

http://refer.amex.us/STEVECBT48?xl=cp27

Amex Starwood Preferred Guest®: 25,000 Starpoints® after $3,000 in purchases within the first 3 months THIS OFFER EXPIRES 10/31/2018

http://refer.amex.us/STEVEC4Zrj?xl=cp27

Amex Hilton Honors™ Card: 75,000 Hilton Honors™ Bonus Points after $1,000 in purchases within the first 3 months. THIS OFFER EXPIRES 1/17/2018:

http://refer.amex.us/STEVECWqP5?xl=cp27

Chase Sapphire Reserve: 50,000 bonus points after $4,000 in purchases within the first 3 months.

https://www.referyourchasecard.com/19/KH8QA4ZYBU

Chase Freedom Unlimited: $150 bonus after $500 in purchases within the first 3 months.

https://www.referyourchasecard.com/18/6FH4WG994P

Chase Freedom: $150 bonus after $500 in purchases within the first 3 months.

https://www.referyourchasecard.com/2/BX59SFDVCM

I can be reached at sschea@gmail.com.

If anyone needs a Delta Platinum or Gold Amex Referral, please email me at:

emma98115 at gmail dot com.

Platinum Bonus: 70k

Gold Bonus: 60k

https://rankt.com/wallet/whtommy123

spg 25k

hyatt 40k

chase freedom $150

amex hilton 65k

amex everyday 15k

thanks!!!!

感谢!!

Apply for the Hilton Honors Ascend Card with this link. We can both get rewarded if you’re approved! http://refer.amex.us/ALEXResYd

Thanks a million if you use my link!!

Hey Alex, Okay, so I’d get the 100,000 points without the referral, but I’d be interested in a 50/50 trade for the referral as transferring points is free. So, essentially, you’d send 10,000 to me and you’d get 10,000 points for using the referral.

Thanks for using my referral code:

Apply for The Platinum Card® from American Express with this link. We can both get rewarded if you’re approved! http://refer.amex.us/LOUISCpQmR?xl=cp27

Offer: 60,000 points

Expires: 9/29/18

You can reach me at kadechisholm@gmail.com

Hi ???? Thanks in Advance!

SPG Offer 25K, Exp. 4/15/18

Link: http://refer.amex.us/BRIANSMeNR?xl=cp27

Contact Brian: briane350@yahoo.com

Get a bonus 25,000 SPG points!

http://refer.amex.us/LAUREG5VTj?xl=cp27

I would appreciate if you use my links as I am saving points for my honeymoon!

Amex Platinum: 60k points

http://refer.amex.us/FRANZOOl9tX?XLINK=MYCP

Amex Business Platinum: 60k points

http://refer.amex.us/FRANZO2b0d?XLINK=MYCP

Amex Personal Gold: 25k points

http://refer.amex.us/FRANZOOl7h4?XLINK=MYCP

Amex Hilton Ascend 75k Hilton Honors points:

http://refer.amex.us/FRANZOPJzw?XLINK=MYCP

Amex SPG Personal 5k

https://www262.americanexpress.com/business-card-application/flexapp/starwood-preferred-guest-business-credit-card/apply/47044-9-0-67517124D744D4A4A7C6DAD27152692DF630B68437904BAA-201314-YtVXanu0OUC0WK6HoMl8ToQOl6w=?cellid=LK111683&cellid=&om_rid=CiCI5R&om_mid=_BZPqaAB9S1gJbm&om_lid=axp11

Amex SPG Business 35k

http://refer.amex.us/FRANZOF0Htl?XLINK=MYCP

Amex Delta Gold Business 50k miles

http://refer.amex.us/FRANZOsPCs?XLINK=MYCP

Hey Frank, I’d get the 100,000 points without the referral, but I’d be interested in a 50/50 trade for the referral as transferring points is free. So, essentially, you’d send 10,000 to me and you’d get 10,000 points for using the referral.

SPG BUSINESS CARD – 35,000 Starpoints for spending $7,000 on the card within three months of account opening. Expires 3/28/2018. 35K BONUS +7K MINIMUM SPEND = 42k SPG (126.000 MARRIOT REWARD POINTS). Possibly qualify as sole proprietor. Thanks link: http://refer.amex.us/RENEAXWYn?XLINK=MYCP

I have a few. Thank you for the opportunity:

Amex Platinum: http://refer.amex.us/RICHARP5eO?XLINK=MYCP

Amex Everyday Preferred: http://refer.amex.us/RICHARon9Z?XLINK=MYCP

Amex Hilton Ascend: http://refer.amex.us/RICHAR6PZm?XLINK=MYCP

Amex SPG Biz: http://refer.amex.us/RICHARRoRD?XLINK=MYCP

Hey Richard, I’d get the 100,000 points without the referral, but I’d be interested in a 50/50 trade for the referral as transferring points is free. So, essentially, you’d send 10,000 to me and you’d get 10,000 points for using the referral.

AMEX SPG BUSINESS 35,000: http://refer.amex.us/INGETwND1?xl=cp27

35,000 Starpoints after $7,000 in purchases in the first 3 months of Card Membership

Offer ends 03/28/2018

http://refer.amex.us/ALEXALgavB?XLINK=MYCP

SPG Amex: 25,000 Starpoints® after $3,000 in purchases within the first 3 months of Card Membership.

http://refer.amex.us/CHRISUT2lE?xl=cp15

All my points and any referral points help my daughter who is in grad school studying to be a virologist (curing worldwide viruses) in her scientific international studies (for flights). Thank you for your consideration!!

Hilton Honors Aspire Amex: http://refer.amex.us/GREGOR1gpB?xl=cp27

100k bonus after $4k spend in 3 months

$450 annual fee is worth it (for 1 year at least) thanks to benefits:

Hilton Diamond status (automatic)

$250 airline credit per calendar year (AA or SWA gift card)

$250 Hilton resort credit per card year

1 free weekend night up front plus another every year after renewal (plus 1 for $60k annual spend)

Priority Pass Select: you + 2 guests free (unlimited lounge visits)

$100/visit Hilton property credit (2-night min.; be sure to compare room rate against other discounts/offers)

14X Hilton Honors bonus points per dollar spent at Hilton

Travel Accident Insurance, Baggage Insurance, Car Rental Insurance, Return Protection, Purchase Protection, Extended Warranty, no FTFs

Strategy: sign up now, then refer your spouse/partner in early Dec. to have 2 free nights for Feb./Mar. 2019

Let me know if you used my link so I can send you a thank-you note!

I can refer to the following:

Hilton ASPIRE card: earn 100,000 Hilton points after $4,000 spend in 3 months; apply by 08/14/2019. http://refer.amex.us/THOMASYplg?xl=cp33

Hilton ASCEND card: 100,000 Hilton points total; 75,000 Hilton Honors Bonus Points after $2,000 within their first 3 months of Card Membership and an additional 25,000 Hilton Bonus Points after an additional $1,000 in purchases within the first 6 months. http://refer.amex.us/THOMASyHFQ?XLINK=MYCP

AmEx Everyday card: earn 15,000 Membership Rewards points after $1,000 in purchases within the first 3 months of Card Membership. http://refer.amex.us/THOMAStK43?XLINK=MYCP

Blue Cash card: $200 back after $1,000 in purchases on the new Card in the first 3 months of Card Membership. http://refer.amex.us/THOMASkeFO?XLINK=MYCP

Thanks!!

Hey Thomas, So I’d get the 100,000 points without the referral, but I’d be interested in a 50/50 trade for the referral as transferring points is free. So, essentially, you’d send 10,000 to me and you’d get 10,000 points for using the referral.

Did that work?

Hi – I have 2 Amex cards with available referrals. I’d love for anyone to use them. My email is LinMyoung@aol.com

1) The Platinum Card from American Express. You’d get 60,000 Membership Rewards points after using your new card to make $5,000 in purchases in the first 3 months. Expires 9/29/2018. My referral link: http://refer.amex.us/LINDAYRs2D?xl=cp27

2) SPG Business Card. You’d get 35,000 bonus Starpoints after using your new card to make $7,000 in purchases in the first 3 months. Expires 3/28/2018. My referral link:

http://refer.amex.us/LINDAYbY1V?xl=cp27

Thank you!!

Thank you so much for letting me post this.

AMEX Plat – 55,000 MR Points

http://refer.amex.us/MARKLrNoK?XLINK=MYCP

AMEX Hilton Honors Aspire – 100,000 Hhonors Points

http://refer.amex.us/MARKLI8vs?XLINK=MYCP

Hi Sarah, do you have Aspire referral bonuses left? I need one to use, but want the person to get a bonus.

Need any of mine? (Blue Business Plus, Delta Platinum Personal or Business?)

Apply for the Platinum Delta SkyMiles® Credit Card with this link. We can both get rewarded if you’re approved! http://refer.amex.us/MATTHBJ5Lr?xl=cp27

Earn 70,000 miles and 10,000 MQM after $3,000 in three months, $100 statement credit with Delta Purchase in first 3 months. My email is matthewblanton123@gmail.com

Thank you!

35,000 Starpoints after $7,000 in purchases

http://refer.amex.us/ZHANGJG4ga?xl=em19

thanks

Personal Platinum

http://refer.amex.us/VASHDHBELF?XLINK=MYCP

60,000 Membership Rewards® points after you use your new Card to make $5,000 in purchases within the first 3 months of Card Membership.

Hi I have the SPG Am Ex Card referral for 7500 for me and 25k for you if you sign up. My email is asadeghi@hotmail.com. my offer expires April 15, 2018. Apply for The Starwood Preferred Guest® Credit Card from American Express with this link. We can both get rewarded if you’re approved! My link is:

http://refer.amex.us/ALANSbU2B?xl=cp27

Hi I have the Hilton Honors Ascend Card referral for 20,000 points for me and 75k for you if you sign up. My email is asadeghi@hotmail.com. My offer expires July 17, 2019. Apply for the Hilton Honors Ascend Card with this link. We can both get rewarded if you’re approved! http://refer.amex.us/ALANSZi55?xl=cp27

Hey Sadeghi, Okay, I’d get the 100,000 points without the referral, but I’d be interested in a 50/50 trade for the referral as transferring points is free. So, essentially, you’d send 10,000 to me and you’d get 10,000 points for using the referral.

Hi I have the Delta Reserve® Credit Card from American Express Card referral for 10,000 points for me and 10,000 Medallion® Qualification Miles (MQMs) and 40,000 bonus miles after you use your new card to make $3,000 in purchases within the first 3 months of Card Membership. My email is asadeghi@hotmail.com. My offer expires May 18, 2018. Apply for the Delta Reserve® Credit Card from American Express with this link. We can both get rewarded if you’re approved!

http://refer.amex.us/ALANSqi43?xl=cp01

Hi I have the Gold Delta SkyMiles® Credit Card from American Express Card referral for 10,000 points for me and 50,000 bonus miles after you use your new card to make $2,000 in purchases within the first 3 months of Card Membership. You can earn an additional 10,000 bonus miles after you make an additional $1,000 in purchases within your first 6 months. My email is asadeghi@hotmail.com. My offer expires 5/16/2018. Apply for the Gold Delta SkyMiles® Credit Card with this link. We can both get rewarded if you’re approved!

http://refer.amex.us/ALANSw4mn?xl=cp01

Thank you! Here’s mine: http://refer.amex.us/YOU-WCgH8j?xl=cp15

25,000 Starpoints® after they use their new Card to make $3,000 in purchases within the first 3 months of Card Membership.

Here is the link for the Blue Business Plus. It gives you 2x MR points for every dollar spent up to $50,000. Plus, these business cards are treated differently for credit scores, Chase, etc. which makes them a great card to have.

http://refer.amex.us/JOHNHBWqc?XLINK=MYCP

Thanks

Thank you for letting us share our links. Would be honored if anyone decides to use mine:

AMEX BIZ GOLD: Each friend can earn: 50,000 Membership Rewards® points after they use their new Card to make $5,000 in purchases within the first 3 months of Card Membership.

http://refer.amex.us/NINAFk5E1?XLINK=MYCP

HILTON HONORS: Each friend can earn:75,000 Hilton Honors Bonus Points after they spend $2,000 or more in purchases with their new Card within their first 3 months of Card Membership and an additional 25,000 Hilton Bonus Points after they make an additional $1,000 in purchases with their new Card within their first 6 months

Apply for the Hilton Honors Ascend Card with this link. We can both get rewarded if you’re approved! http://refer.amex.us/NINAFc9RI?xl=cp33

SPG: Each friend can earn:25,000 Starpoints® after they use their new Card to make $3,000 in purchases within the first 3 months of Card Membership.

http://refer.amex.us/NINAFcFN6?xl=cp15

AMEX EVERYDAY: Each friend can earn:15,000 Membership Rewards® points after they use their new Card to make $1,000 in purchases within the first 3 months of Card Membership.

http://refer.amex.us/NINAFa18s?xl=cp15

Hey Nina, I’d get the 100,000 points without the referral, but I’d be interested in a 50/50 trade for the referral as transferring points is free. So, essentially, you’d send 10,000 to me and you’d get 10,000 points for using the referral.

SPG 25k for 3k spend.

http://refer.amex.us/STEPHHvYD4?xl=cp27

delta 70k for 3k spend.

http://refer.amex.us/STEPHH8IkQ?xl=cp27

hilton honors ascent 100k for 3k spend

Here are a few referral links if anyone is interested. Hope everyone is having a good week!

[AMEX Gold Personal]

25k after $2k

Link: http://refer.amex.us/PARKESGkWf?XLINK=MYCP

[AMEX Gold Business]

50k after $5k

Link: http://refer.amex.us/PARKESSOP5?XLINK=MYCP

[AMEX Platinum Personal]

60k after $5k

Link: http://refer.amex.us/PARKESYA50?XLINK=MYCP

[AMEX Platinum Business]

50k after $10k, additional 25k after an additional $10k

Link: http://refer.amex.us/PARKESXuAO?XLINK=MYCP

[SPG Personal]

25k after $3k

Link: http://refer.amex.us/PARKESDRkK?XLINK=MYCP

[SPG Business]

25k after $5k

Link: http://refer.amex.us/PARKESSWQO?XLINK=MYCP

[Delta Gold Personal]

50k after $2k, 10k additional after $1k + $50 credit

Link: http://refer.amex.us/PARKESp2rq?XLINK=MYCP

[Hilton Honors Card]

75k after $1k

Link: http://refer.amex.us/PARKES97vX?XLINK=MYCP

[Blue Cash Everyday]

$200 CB after $1k

Link: http://refer.amex.us/PARKES5Iaz?XLINK=MYCP

[Delta Platinum Business]

70k after $4k + $100 credit

Link: http://refer.amex.us/PARKESrIR5?XLINK=MYCP

The Starwood Preferred Guest® Credit Card from American Express

25,000 Starpoints® after they use their new Card to make $3,000 in purchases within the first 3 months of Card Membership.

http://refer.amex.us/CHRISSbokg?xl=cp27

—————————————————————————-

Gold Delta SkyMiles® Credit Card

50,000 Bonus Miles after they spend $2,000 or more in purchases with their new Card within their first 3 months of Card Membership and a $50 statement credit after they make a Delta purchase with their new Card within their first 3 months. They can earn an additional 10,000 bonus miles after they make an additional $1,000 in purchases within their first 6 months.

Limited Time Offer ends 05/16/2018

http://refer.amex.us/CHRISS2ETu?xl=cp27

—————————————————————————-

Blue Cash Preferred® Card from American Express

$250 back after they spend $1,000 in purchases on their new Card in their first 3 months of Card Membership. They will receive $250 back in the form of a statement credit.

http://refer.amex.us/CHRISSskya?xl=cp27

—————————————————————————-

Hilton Honors Ascend Card

75,000 Hilton Honors Bonus Points after they spend $2,000 or more in purchases with their new Card within their first 3 months of Card Membership and an additional 25,000 Hilton Bonus Points after they make an additional $1,000 in purchases with their new Card within their first 6 months.

http://refer.amex.us/CHRISSgQtM?xl=cp27

35k SPG business highest bonus ever offered – referral link:

http://refer.amex.us/ROBERHWNgi?xl=cp27

Amex Everyday referral link (no annual fee):

http://refer.amex.us/ROBERHqmgV?XLINK=MYCP

Delta Gold referral link:

http://refer.amex.us/ROBERHuZy5?XLINK=MYCP

New Hilton Honors Ascend referral link:

http://refer.amex.us/ROBERH1QpI?XLINK=MYCP

This refers you to the 35k point SPG Business Am Ex link, NOT the 25k. Thank you!

http://refer.amex.us/GEOFFC2Ex8?XLINK=MYCP

Hilton ASPIRE

Earn: 100,000 Hilton Honors Bonus Points after spending $4,000 in purchases on the Card within the first 3 months of card membership. http://refer.amex.us/ERIKAR2nSR?XLINK=MYCP

Thanks!

Email me shehlovee@gmail.com for the following referrals and let me know which card you’d like: THANK YOU IN ADVANCE!

Delta Amex Platinum-

70,000 bonus miles and 10,000 Medallion® Qualification Miles after they use their new Card to make $3,000 in purchases within the first 3 months and a $100 statement credit after they make a Delta purchase with their new Card within the first 3 months of Card Membership.

Starwood Amex-

STARWOOD PREFERRED GUEST

Here are some referral links. The first one expires today!

Starwood Preferred Guest Business Credit Card

apply by 03/28/2018

35,000 bonus Starpoints after spending $7,000 within 3 months

http://refer.amex.us/DEBORLCHzk?xl=cp82

American Express Business Platinum Card

apply by 07/25/2018

50,000 membership rewards points after spending $10,000 and an extra 25,000 points after spending an additional $10,000 within 3 months

http://refer.amex.us/DEBORLIsRy?xl=cp33

American Express Blue Business Plus Credit Card

apply by 07/25/2018

10,000 membership rewards points after spending $3,000 within 3 months

http://refer.amex.us/DEBORL3qJk?xl=cp01

For the 35k SPG Business Card. Not the 25k one.

http://refer.amex.us/STEPHHXpk3?XLINK=MYCP

Thanks Jill, I used your link for my signup.

Amex Blue Cash Everyday referral.

You get $200 credit after spending $1000 in 3 months. (Only $150 from Amex website)

refer.amex.us/LIHAOL1slz?xl=cp20

Hilton Aspire: http://refer.amex.us/WEIYUbQo?XLINK=MYCP

Hilton Ascend: http://refer.amex.us/WEIYV2ax?XLINK=MYCP

Hilton: http://refer.amex.us/WEIYbEyX?XLINK=MYCP

Delta Personal Gold, up to 60K: Apply for the Gold Delta SkyMiles® Credit Card with this link. We can both get rewarded if you’re approved! http://refer.amex.us/GARYPrnnl?xl=cp01

Appreciate anyone that applies via my link.

Apply for the Platinum Delta SkyMiles® Credit Card with this link. We can both get rewarded if you’re approved! http://refer.amex.us/XIAOXYTj6C?xl=cp01

Each friend can earn:

70,000

bonus miles and 10,000 Medallion® Qualification Miles after they use their new Card to make $3,000 in purchases within the first 3 months and a $100 statement credit after they make a Delta purchase with their new Card within the first 3 months of Card Membership.

Limited Time Offer ends 05/16/2018.

Amex Blue Cash Everyday

Each friend can earn: $200 back after they spend $1,000 in purchases on their new Card in their first 3 months of Card Membership. They will receive $200 back in the form of a statement credit.

http://refer.amex.us/XIAOXYymrE?XLINK=MYCP

Platinum Card referral link

http://refer.amex.us/JONSooaM

Get 60,000 bonus points upon approval and minimum spending limit.

Platinum is the way to go!

Again link for 60,000 bonus Amex points and a new Platinum card is

http://refer.amex.us/JONSooaM

http://refer.amex.us/SHERRGUNn9?XLINK=MYCP

Each friend can earn: 65,000 Hilton Honors Bonus Points after they spend $1,000 in purchases on the Card within their first 3 months of Card membership.

Thanks!

http://amex.co.uk/refer/paulbDYRe?XLINK=MYCP

American Express Preferred Rewards Gold Credit Card:

Your friend will receive 22,000 Membership Rewards points if they apply for the American Express Preferred Rewards Gold Credit Card, are approved and spend £2,000 in their first 3 months of Cardmembership.

Free 65000 Hilton Honors points at http://www.hilton65000bonus.com, which redirects to the American Express website.

If one signs up for the free no-annual-fee American Express Hilton Honors card without a referral, one would get only 50000 points. But if one signs via a referral, one gets 15000 more points (65000), and the person who refers (such as I) gets 15000 points too.

Hilton Honors is the loyalty program of Hilton Hotels & its associates. Hilton’s portfolio can be viewed at http://hiltonhonors3.hilton.com/en/explore/brands/index.html.

It’s even more ideal for couples, as one person can sign up using a referral from someone (such as mine at http://www.hilton65000bonus.com), and can then refer his/her partner, for a total of 145000 points, without spending a dime! Not that I encourage polyamory, but points from up to 10 accounts (including one’s friends’ & of course, one’s family) can be pooled.

Redemption rates (number of points required for free stays) can vary a lot depending upon the dates. One of the DoubleTrees in Pittsburgh usually requires 22000 points for a night’s stay, so you can gauge the value of these points. Explore more at http://hiltonhonors3.hilton.com/en/earn-use-points/hotel/using/index.html.

For Australia

Amex Qantas ultimate

You get 65,000 qantas points

I get 30,000

1.5 points per dollar.

2 qantas lounge passes

2 amex lounge passes

$3,000 spend in first 3 months

$450 annual fee – Offset by $450 annual travel credit ( Use it at the end and very start of new year)

http://amex.com.au/refer/michateNgS

Each friend can earn:

50,000

spend $2,000 or more in purchases within first 3 months of Card Membership and a $50 statement credit after making a Delta purchase with new Card within their first 3 months. earn an additional 10,000 bonus miles after making an additional $1,000 in purchases within first 6 months.Offer ends 05/16/2018

http://refer.amex.us/HARINK2trf?xl=cp55

AMEX GOLD REFERRAL LINK UK

http://amex.co.uk/refer/elliogCq6X?XLINK=MYCP

AMEX EVERYDAY (USA Only) – 15,000 points sign up bonus, No Annual Fee, 2X points on groceries! Earns MR!

http://refer.amex.us/AMANDSQMmA?xl=cp33

AMEX EVERYDAY (USA Only) – Earn increased 15,000 points when you spend $1000 in 3 Mo, $0 Annual Fee, 2X points on groceries. Card earns MR points.

http://refer.amex.us/AMANDSQMmA?xl=cp33

US OFFERS

Delta Platinum (with free companion ticket each year!) 50k signup miles! http://refer.amex.us/ANDER3Tw0?XLINK=MYCP

Delta Platinum Business (also free companion ticket each year) 35k signup miles http://refer.amex.us/ANDERxXcP?XLINK=MYCP

Hilton Ascend 100k bonus points http://refer.amex.us/CYNTHAYNUS?XLINK=MYCP

AmEx Blue Business Plus 10,000 MR points 2x MR points per $ on all spend up to $50k per year

http://refer.amex.us/GLENMjecc?XLINK=MYCP

Thanks!

I’m using another poster’s referral bonus for a Hilton Aspire… Hoping for some good karma and someone uses one of mine!

For Australians: Qantas American Express Ultimate Card

You’ll earn 65,000 Qantas points, if you spend $3,000 in the first 3 months, and I’ll receive 30,000 points for referring you. (Thanks in advance!)

You’ll also get:

• 1.5 points per dollar spent

• 2 Qantas lounge passes per year

• 2 Amex lounge passes per year

• $450 annual travel credit, which offsets the $450 annual fee

http://amex.com.au/refer/kathekh0hy

I am trying to get enough points for ANA to Japan and Singapore (life long dream)

Any Help by using these links would be very appreciated (Thank you in advance)

American Express Business GOLD Card

50+K points

The part I love is the 2X bonus categories, and I selected 3X as my super bonus category.

http://refer.amex.us/NANCYCCtN8?XLINK=MYCP

American Express Blue Business Plus Credit Card

NO ANNUAL FEE that earns MR points

10,000 membership rewards points after spending $3,000 within 3 months

This Card gets 2X on EVERYTHING – Its my favorite card.

http://refer.amex.us/NANCYCbL4d?XLINK=MYCP

Hilton Honors Card (No Annual Fee)

Earn 75,000 Hilton Honors Bonus Points after you spend $1,000 in purchases on the Card within your first 3 months of Card Membership.

http://refer.amex.us/BRIANCR4kb?xl=cp15

Hi this is for Uk based applicants only thanks

Hello everyone this is my referral link for American Express® Preferred Rewards Gold Credit Card, you will receive 22,000 MR points when you hit the minimum spend target and the card is free for the 1st year, its the best card out there in my opinion, thanks Stevie.

At the time of posting I have 5 referalls remaining

http://amex.co.uk/refer/stephtR6wc?XLINK=MYCP

Hilton Honors Card (No Annual Fee)

Earn 65,000 Hilton Honors Bonus Points after you spend $1,000 in purchases on the Card within your first 3 months of Card Membership.

http://refer.amex.us/BRIANCLR7p?xl=cp27

Hi-

I have a referral for a Delta Amex Gold with 60,000 mile bonus. If interested, please email me at tburgs808 at gmail dot com or see this link:

http://refer.amex.us/TERILSHiXl?XLINK=MYCP

Thanks,

T

Hi all,

I have a referral for Amex Starwood Preferred Guest Business Credit Card.

You will earn:

100,000 bonus points after use the new Card to make $5,000 in purchases within the first 3 months of Card Membership. $0 annual fee for the first year, then $95. Anniversary free night up to 35,000 points.

Referral link is:

http://refer.amex.us/JIALECZZsa?xl=cp15

Thanks,

J

Referral for Amex Platinum Card

You earn 60,000 Membership Rewards® points after you use you new Card to make $5,000 in purchases within the first 3 months of Card Membership.

Link:

http://refer.amex.us/BRYANWslQH?XLINK=MYCP

Hey everyone! Here’s my referral,

Amex Platinum Card: 60K MRP after 5K minimum spend within 3 months.

Link: http://refer.amex.us/SOPHASeEnH?XLINK=MYCP

Amex Everyday Card: 15K MRP after 1K minimum spend within 3 months.

Link:

http://refer.amex.us/SOPHAS6hPb?XLINK=MYCP

Premier Rewards Gold Card: 25K MRP after 2K minimum spend within 3 months.

Link:

http://refer.amex.us/SOPHAS7A7f?XLINK=MYCP

Platinum Delta Skymiles: 70,000 bonus miles and 10,000 Medallion® Qualification Miles after they use their new Card to make $3,000 in purchases within the first 3 months. Offer ends 11/07/2018.

Link:

http://refer.amex.us/SOPHASDx8S?XLINK=MYCP

Hi all,

****THIS IS FOR THE UK AMEX, NOT USA*****

I know there are a few referral links for the BA Premium AMEX but incase anyone needs a referral for an extra 2,000 avios to reach the required avios amount for their companion ticket feel free to use the link below.

You will get;

– 26,000 avios instead of 24,000

– a brand spanking new AMEX card

– 1.5 avios per £1 spent, 3 avios per £1 is spent directly on BA

– BA Companion ticket once spending has reached £10,000 in the year

– an extra 3,000 avios if a supplementary card is taken out

– my eternal gratitude

http://amex.co.uk/refer/darreetxeo?XLINK=MYCP

I also have the AMEX Gold Credit Card..

You will get;

– 22,000 amex points instead of 20,000 points which can be transferred to loads of different point schemes

– a brand new shiny gold AMEX card

– 2 Lounge passes for airport use (one for you and one for the Mrs/Mr)

– Discounted restaurants in the UK via Amex Taste Invites, 20% off

– 1 point earned per £1 spent, 1.5 points for every £1 spent abroad

– an extra bonus 10,000 points if spent £15,000 within one year

– an extra 3,000 amex points if a supplementary card is taken out

– my eternal gratitude

http://amex.co.uk/refer/darreenhde?XLINK=MYCP

Hey guys I have the referral for the Starwood Preferred Guest® Credit Card from American Express. Earn 75,000

bonus points after you use your new Card to make $3,000 in purchases within the first 3 months of Card Membership. Offer expires 07/31/2019.

Link: http://refer.amex.us/SOPHASj6mu?xl=cp20

This is for the USA Amex Blue Business Plus Card. Earn 10,000 Membership Rewards® points after you use their new Card to make $3,000 in purchases within the first 3 months of Card Membership. No Annual Fee. The card earns 2X points on all purchases up to $50,000 a year. Pair it with a Membership Rewards earning card such as Amex Everyday Card to earn MR points that are transferrable to airline and hotel partner. Link below:

http://refer.amex.us/AMANDSWPRM?XLINK=MYCP

USA AMEX SPG BUSINESS CREDIT CARD 100,000 WELCOME BONUS ($5K SPEND IN 3 MO)

– annual fee waived first year, $95 after

– 6X points on Marriott/SPG purchases, 4X U.S. restaurants, gas stations, wireless phone services, purchases for shipping, 2X on all other purchases

– FREE award night every year at card membership renewal

—- INCREASED OFFER ENDS 10/31/2018 —-

https://www.americanexpress.com/us/credit-cards/card-application/apply/starwood-preferred-guest-business-credit-card/54620-9-0-4D988FA664EDFB8BCEE5C6E5847B6757-205272-43B1B04F1CDF826F3E557205DE9D1B7B-EqYbRuQK5Atizmi0AwfO31KcL3w=?mgmtrackingParam=US-mgm-spa_web_myca-copypaste-474-205272-GBAB:0001-474-GBAB:0001&intlink=US-mgm-spa_web_myca-copypaste-474-205272-GBAB:0001-474-GBAB:0001#/

amex gold 50,000 with 2000 spend pretty good deal. new metal card.

NEW Amex Gold 50K after $2K spend in 3 months. 4x Restaurants 4x Grocery stores, 3x flights w/airline or on amex.com $120 dining credit $100 airline credit. Offer expires 01/09/19

http://refer.amex.us/DIANANJX1D?xl=cp27

Thanks!

Referral lnk for amex gold card

http://amex.co.uk/refer/davidryjyi?XLINK=MYCP

Hope that is useful if you are looking for extra rewards points 🙂

— New American Express Gold Card —

50K after $2,000 spending in 3 months.

4x Restaurants/4x Grocery Stores/3x Flights Directly with Airlines

$120 Dining Credit + $100 Airline Credit

BONUS 20% back as Statement Credit from U.S. Restaurants up to $100

Offer expires 01/09/19!

https://mgmee.americanexpress.com/refer/us/en/card-details/personal/gold-card/D233CA6ADA459E7E9052D70D6D6B1042E2A181B4F4907C6A3AD8900CBF5BDBCD42F5FB1476008E144691E769D0F60E9053F4B6992AA1DCC1E8561CF37A73EF7422F7749EE1EBF29279EDD48551A86861BEA42553B29591751B20BD4F76026AF84DC2CB58DE689974A12D0AF8CD21D932

I just got the new Amex Gold Card in Rose Gold.

I only got the 25k MR points and by me referring the link, you get the 50K MR points and I think I get 10k points up to 55k a year. Hope this helps.

http://refer.amex.us/CHRISGxdxO?XLINK=MYCP

UK Amex referrals

For anyone applying for a UK Amex, I would be grateful if you consider using my referral. Please see referral links for the following U.K. Amex cards to increase your sign up bonus.

British Airways Premium Plus card

26,000 bonus Avios welcome offer, if you spend £3,000 in your first three months of Cardmembership

£195 annual fee, which is refunded pro rata when card is cancelled

Get 2-for-1 travel with a Companion Voucher when you spend £10,000 each year

Collect 1.5 Avios for virtually every £1 spent, and 3 Avios for every £1 spent with British Airways or BA Holidays

Travel accident and Travel inconvenience insurance

http://amex.co.uk/refer/damiebgnly?CPID=100200082

UK SPG Amex referral link

If anyone is looking for a Starwood Preferred Guest referral I would appreciate if you consider using the one below.

Through this link you will get 33,000 SPG points instead of the usual 30,000 points when you spend £1,000 within the first 3 months of card membership.

http://amex.co.uk/refer/damiebppfx?XLINK=MYEM

I hope this is useful for someone.

Each friend can earn: 150,000 Hilton Honors Bonus Points after they spend $3,000 in purchases on their new Hilton Honors American Express Ascend Card within their first 3 months of Card membership

http://refer.amex.us/DONALN2HXV?XLINK=MYCP

Each friend can earn: 100,000 Hilton Honors Bonus Points after they spend $1,000 in purchases on their new Hilton Honors American Express Card within their first 3 months of Card membership.

http://refer.amex.us/AJITCkBtM?XLINK=MYCP

UK. Referalls only

http://amex.co.uk/refer/stepht8vob?XLINK=MYCP

This referal is for the new American Express® Preferred Rewards Gold Credit Card.

Use my referral code above and you will receive.

An extra 2000 MR points on top of the 20,000 you will have after you spend £2000 on the card in 3 months, so in effect your new card will have generated you 24,000

(2000 points with your own spending plus the bonus 22,000 points very nice)

You can also use my referral link to choose any of the other cards on offer.

I will receive 9000 MR points for referring you.

Hi everyone, 4th November 2018 update:

http://amex.co.uk/refer/luisvkmqq?CPID=100200082

Same as above.. anyone wants to use mine for the AMEX Gold go for it ;);)

http://amex.co.uk/refer/luisvkmqq?CPID=100200082

Referral link for extra 2.000 points on top of the 20.000 🙂

Still have 9 referrals to go..

The referral code is below to receive your 50,000 points bonus on newly released Amex Gold thru the referral link. 50,000 points are worth $1000 if redeemed wisely!

http://refer.amex.us/STANIRENid?xl=cp01

USA American Express Platinum charge card.

Earn 60,000 rewards points after spending $5000 in three months

http://refer.amex.us/DANIESrE9B?XLINK=TWIT

USA American Express Platinum Delta SkyMiles.

Earn 60,000 miles after spending $2000 in three months

http://refer.amex.us/DANIESSA3k?XLINK=TWIT

Netherlands / Dutch flying blue American express gold card.

Earn 30XP

Earn 22.000 FB miles after spending 500 euro in first 3 months.

First year free.

http://www.americanexpress.nl/introduceren/markri7wh?XLINK=MYCP

Thanks for putting this together. Here are my referral links for bonus

US AMEX

(1) Referral link for any Amex Personal cards come with bonus (good till 04/16/2020)

http://bit.ly/2EMQZav

(2) Referral link for any Amex Business cards come with bonus (good till 04/24/2020)

http://bit.ly/2Lyw3Ex

Thanks 🙂

Amex Delta gold card referral link

50k miles after $1000 spend in 3 months.

AF waived the 1st year.

http://refer.amex.us/TIMOtCWQ76?XLINK=MYCP

Delta Amex Platinum (60,000 mile bonus)

http://refer.amex.us/JAREDSPgRs?XLINK=MYCP

Delta Amex Gold (50,000 mile bonus)

http://refer.amex.us/JAREDS9ouf?XLINK=MYCP

Jan 20th 2019 – Thank You. Appreciate if anyone use my referral links. All these are having best sign up bonus offers.

Amex All Personal & Business Cards – Choose the card that you want to apply by Clicking on the below link. Please contact me san.kilogram111@gmail.com for any information.

https://mgmee.americanexpress.com/refer/us/en/card-list/personal/2BC6383FF7252EC6B68B48014A167EF9BD9BEC2F0E5D86EA3AD8900CBF5BDBCD42F5FB1476008E14A8A4BD8654DD8106FA94121A30182B3F0801417C66698CBB5A55C48B3275B29F294556D615C9235391454460C2851272A1E8600E103CEB1959F91E0D25304F73830276330A6861DA?CPID=201279&extlink=US-mgm-hubcontentbox-copypaste-137-201279-CF7H:0001&GENCODE=349992421122050&CORID=V:E:N:K:A:K:Q:E:b:a-1548023680258-816387720

Hello! If anyone needs a referral for the US Amex Delta Reserve, I have the 70,000 mile offer available to share until 1/30. I also have the other Delta offers available. Please reach out at jmaxo@outlook.com and I’ll send you a direct referral link (or see below for general one). There is also the Delta Platinum offer available for a 60,000 mile bonus, and then the Delta Gold at 50,000 mile bonus. Regards, Jim

http://refer.amex.us/JAMESSOllf?XLINK=MYCP

US – Delta Amex Reserve (70,000 mile bonus)

http://refer.amex.us/JAMESSOllf?XLINK=MYCP

*Link includes access to other Delta cards as well!

Greetings.

Apply for an American Express Platinum Card with this link. We can both get rewarded if you’re approved! http://refer.amex.us/VENKAKQEba?xl=cp20

You can also apply any other Personal or Business credit card with the above link. Once the page is opened, scroll down and click on All Personal Cards.

Thank You

I have the amex gold card and signing up with the link below can earn increased sign up bonuses for most amex personal cards, Take a look!

http://refer.amex.us/GRANTMzlz5

Hello! I have the amex gold card and signing up with the link below offers increased sign up bonuses for most amex personal cards, Take a look!

http://refer.amex.us/GRANTMzlz5

20,000 Membership Rewards® points after they use their new Amex EveryDay℠ Preferred Credit Card to make $1,000 in purchases within the first 3 months of Card Membership. You will be able to choose from all available American Express Personal and Business Card offers.

http://refer.amex.us/ZDENEHL3xP?XLINK=MYCP

Here is my referral code for AMEX. Each Friend Can Earn: 40,000 Membership Rewards® Points after they use their new Card to make $2,000 in purchases within the first 3 months of Card Membership. Your friend can explore Cards. Your friend will be able to choose from all available American Express Personal and Business Card offers.

Hilton Honors Card – 100,000 Hilton Honors Bonus Points after you spend $1,000 in purchases on the Card within your first 3 months of Card Membership.

http://refer.amex.us/WEERAA9yIr?XLINK=MYCP

Hilton Aspire Card – Earn 150,000 Hilton Honors Bonus Points after you spend $4,000 in purchases on the Card within your first 3 months of Card Membership.

http://refer.amex.us/WEERAAEmXP?XLINK=MYCP

Referral link for all Amex Personal cards come with bonus. Choose the card that you would like to apply.

https://amex.co/2THkjpM

Referral link for all Amex Business cards come with bonus. Choose the card that you would like to apply.

https://amex.co/2Twm3mw

Thank You

Sign up now with this link and you’ll receive 22,000 Membership Rewards points when you apply for the AMEX Preferred Rewards Gold Credit card and spend £2000 in your first 3 months.

http://www.amex.co.uk/refer/sARAFfJWs?CPID=100200078

Then get 9,000 points for every person you refer!

Apply for an American Express Card with this link. We can both get rewarded if you’re approved! http://refer.amex.us/ANDREDKAwY?xl=cp20

Thanks y’all

http://refer.amex.us/ROBErLpAaU?XLINK=MYCP

BEST OFFER!

Each Friend Can Earn: 40,000 Membership Rewards® Points after they use their new Card to make $2,000 in purchases within the first 3 months of Card Membership. Your friend can explore Cards. Your friend will be able to choose from all available American Express Personal and Business Card offers. You can receive your referral bonus no matter what Card your friend is approved for.

This link works for all cards: goo.gl/UM5Coj

Whichever card you are planning to open, you can choose from the list and you will get the enhanced referral sign-up bonus. Thank you!

8 more referrals left for the American Express Preferred Gold Card. Infact the link works on all american express credit cards. I would personally advise going for the Gold card as the annual fee is waived off for the first year and you get 10% additional sign on bonus

http://amex.co.uk/refer/sohelmav2c?XLINK=MYCP

If anyone is still looking for a referral for Amex. Feel free to use this referral link

http://amex.com.au/refer/aNDRELesyP?CPID=999999537

Extra 10k points for anyone applying for AMEX Australia cards:

Explorer – http://amex.com.au/refer/rosshcMWE?XLINK=MYCP

Platinum Edge – http://amex.com.au/refer/rosshxtlx?XLINK=MYCP

Others (Qantas, Virgin Australia Velocity, David Jones, Platinum Charge card) also available via the above links!

Thanks!

American Express Gold Card – Earn 40,000 points after $2,000 spend.

This link also allows you to view offers for other American Express cards. Thank you!

http://refer.amex.us/MITCHLtG3t?xl=cp20

Anyone looking for an Amex Gold Delta Business card?

70K miles / $4k spend/ 3 months, +$50 stmt credit!

4 referrals left. Expires 5/1/19: http://refer.amex.us/SIERRKy0Ta?xl=cp54

http://refer.amex.us/CYNTHAfyYv?XLINK=MYCP You get 10,000 MR with $3k spend on the Blue Business Plus, but the value in this card is the 2x MR on first $50k spend per calendar year!

http://refer.amex.us/CYNTHATIC0?XLINK=MYCP You get 150,000 Hilton Honors points on $4k spend on the Hilton Aspire.

http://refer.amex.us/ANDERkAOx?XLINK=MYCP You get 75,000 Delta points AND $100 statement credit on $3k. Wow!

http://refer.amex.us/MAKOTYyE8S?XLINK=MYCP

Amex Hilton 100K bonus points.

After you spend $1,000 in purchases on the Card within your first 3 months of Card Membership. No Annual Fee.

amex gold 40k offer

Apply for an American Express Card with this link. We can both get rewarded if you’re approved! http://refer.amex.us/GLENK9eAb?xl=cp15

Working referral link Delta Gold SkyMiles 40,000 miles 2019!!

http://refer.amex.us/LIlIAQFPPu?XLINK=TWIR

Australian AMEX ultimate card- 75000 bonus! (signing up without this link will only get you 55000). $450 fee but also $450 qantas travel credit so if you are going to fly anyway it is effectively free. Also 2x Qantas lounge passes included. Apply by June 5 2019!

https://www.americanexpress.com/australia/refer/jACKCFUMvy/?CPID=100341074

I have referrals to give out (US Card). Email me jeremybrockert @ gmail.com (no spaces). Put Credit Card Referral in the subject line. Thanks, Jeremy!

Amex Platinum w/ 60k bonus – http://refer.amex.us/MOHAmDMZ2n?xl=cpu4

Amex Gold/Pink w/ 40k bonus – http://refer.amex.us/MOHAmD3C8E?xl=cpu4

Amex Business w/ 10k bonus – http://refer.amex.us/MOHAmDpm5W?xl=cpu4

[…] have seen a 40k bonus for this card offered recently through referrals, but not […]

http://refer.amex.us/JAYPcdds?XLINK=MYCP

REFERRAL LINK SIGN UP AND RECEIVE 40,000 bonus POINTS rose gold offer

American Express® Preferred Rewards Gold Credit Card (UK) or scroll down to choose a card suitable for yourself.

You will get 12000 points when spending £3000 in 3 months.

http://amex.co.uk/refer/aSHWaJEVTC?XLINK=MYCP

Here is a referral link to the American Express Gold Card with 40k Membership Reward points expiring on 7/17/2019. I may receive 10k points if you are approved. Thanks!

https://mgmee.americanexpress.com/refer/us/en/card-details/personal/gold-card/F7E3FB9129040C4B6B87229FBD04F724378A3C7EFCFF16653AD8900CBF5BDBCD42F5FB1476008E144691E769D0F60E9073F501BE36D972817C07C61EED1DE0C822F7749EE1EBF292B41AABA56AFD146ABEA42553B29591751B20BD4F76026AF85A257A214AC53C04

Referral link for all Amex Personal cards come with bonus. Choose the card that you would like to apply.

https://amex.co/2J3rEIZ

Referral link for all Amex Business cards come with bonus. Choose the card that you would like to apply.

https://amex.co/2KFfSYy

Thanks. Have a great day