MileValue is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

Note: Some of the offers mentioned below may have changed or are no longer be available. You can view current offers here.

I travel a lot internationally. My nomadic lifestyle means I’m outside the United States for the majority of the year, withdrawing cash from ATMs pretty regularly. If I didn’t use a debit card that reimburses all ATM fees (international and domestic), I would be losing a lot of money.

Thankfully I have one that does just that with the Schwab Bank High Yield Investor Checking Account. You can read all about how much money it saves me in this post about how I pay zero ATM fees worldwide. It charges no maintenance fees, no ATM withdrawal fees, and has no minimum balance.

Right now Charles Schwab is running a promotion. You can sign up for the same account I have and get a $100 for doing it.

How to Get a Charles Schwab Checking Account with No ATM Fees Worldwide and $100 Sign Up Bonus

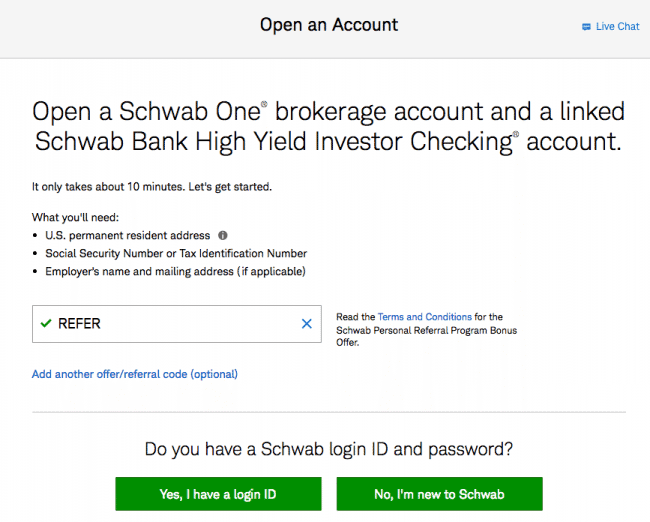

Step 1: Click this link, and then click Open an Account.

Step 2: You will be given the following options.  If you want the High Yield Investor Checking Account (what I have) with no maintenance fees, no withdrawal fees, and no minimum balance/minimum deposit requirement, then click Schwab Bank Checking Account.

If you want the High Yield Investor Checking Account (what I have) with no maintenance fees, no withdrawal fees, and no minimum balance/minimum deposit requirement, then click Schwab Bank Checking Account.

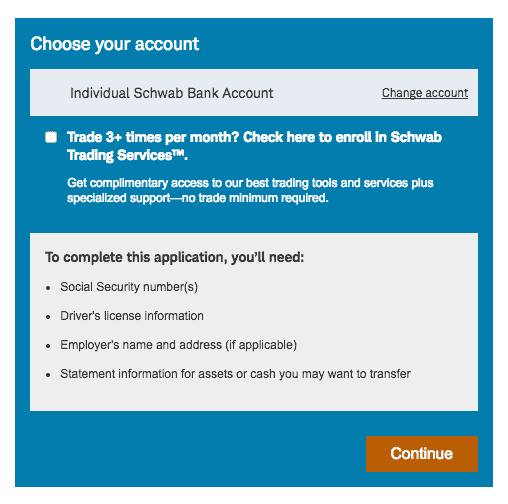

Step 3: Click continue.

Step 4: You will ultimately be taken to this screen.

You are required to open a brokerage account in conjunction with the High Yield Investor Checking Account, but don’t worry, the brokerage account also has no fees nor a minimum deposit/balance requirement.

Step 5: Either log in to Schwab if you already have an account or create a new one if you don’t, and follow the rest of the prompts for registration.

Terms and Conditions

Notice that the first line of the terms and conditions states: “A minimum deposit of $1000 is required to open most Schwab brokerage accounts…”, but don’t let that confuse you. If you open a High Yield Investor Checking Account in conjunction with a brokerage account via the steps outlined above, you will not be required to make a minimum deposit of $1,000 (nor keep any minimum balance in the brokerage account– I do not even use mine). However, if you choose Brokerage account in Step 2, then the $1,000 minimum deposit/balance requirement will probably apply.

I chatted with a Charles Schwab representative online that confirmed this.

Bottom Line

Applying for this debit card will trigger a hard credit inquiry, so I wouldn’t really consider signing up unless you travel often and will truly benefit from this account aside from the $100 bonus. The $100 bonus should just be icing on the cake to a card that will otherwise save you money with all the reimbursed ATM fees.

Application link (I don’t receive any compensation if you sign up, but you do have to apply via that link if you want the $100 bonus).

Just getting started in the world of points and miles? The Chase Sapphire Preferred is the best card for you to start with.

With a bonus of 60,000 points after $4,000 spend in the first 3 months, 5x points on travel booked through the Chase Travel Portal and 3x points on restaurants, streaming services, and online groceries (excluding Target, Walmart, and wholesale clubs), this card truly cannot be beat for getting started!

Editorial Disclaimer: The editorial content is not provided or commissioned by the credit card issuers. Opinions expressed here are the author’s alone, not those of the credit card issuers, and have not been reviewed, approved or otherwise endorsed by the credit card issuers.

The comments section below is not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser’s responsibility to ensure all questions are answered.

Charles Schwab is a garbage bank.. I signed up for this account since I always travel and never spend more than a week or 2 in the United States. They let me register everything and transfer $1000 to my account. I received my card and activated it but had not used it, maybe a month later I decided I would transfer more money to the account and start using it. Logged in and was blocked, called them and they said I needed to send them copy of my passport and multiple other things. I informed them I was now out of the country and asked about emailing it, they said the only possible way was to go in branch and show it all in person. I informed them I would not be in the United States for at least another 6 months and that this would not be possible. They said I could not have my funds back until I had done so. I called 3 or 4 times hoping for a different answer from anyone but there was no luck. If there was a problem with the account they should of flagged it before they allowed me to put funds in the account as I had completed all other steps and was told the account was active. 5 or 6 months months had passed since this happened and they would still not give my funds back, finally about a week ago I noticed they went back into the account I had transferred them from. I’d rather pay ATM fees than ever deal with Charles Schwab again.

That’s too bad, I’m sorry to hear it. I’ve had nothing but positive experiences with Schwab, but all data points are welcomed.

Beware the 1099 for the $100 account bonus! This is not a good thing to get a 1099 especially for certain people needing to hide assetts or stay under the IRS computer matching radar. Not a good deal. Also Schwab issues 1099’s for any interest on its brokerage account, so make sure you don’t open a brokerage account.