MileValue is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

Note: Some of the offers mentioned below may have changed or are no longer be available. You can view current offers here.

If you were planning on paying your rent on a credit card for free for the rest of the year during Radpad’s Android Pay promotion, don’t. Radpad screwed up– admittedly so at least.

A couple weeks ago Scott wrote about the promotion Radpad was running that enabled you to pay rent on a credit card for free through Android Pay. It was supposed to last through the end of the year, but they greatly underestimated just how many of us would take advantage and don’t have the budget to cover the subsidies. Guess that marketing manager isn’t into miles.

Within the first two weeks, the number of Android Pay users charging their rent on Radpad soared from under 5% to 7%. They found themselves responsible for covering 2.99% (their standard credit card processing fee) of $5 million worth of rent.

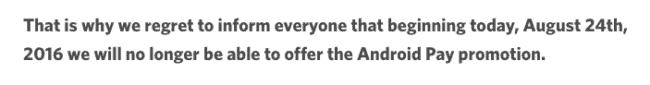

Yesterday, Radpad’s CEO released a statement retracting the promotion.

If you registered for the promotion prior to yesterday, August 24th, you can still submit one more payment through August 31 (but if you didn’t register, you can’t now). After the 31st, the normal 2.99% processing fee will apply, even for those who previously registered.

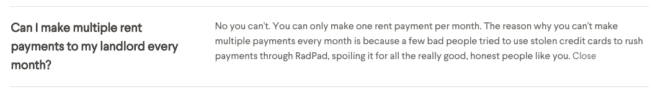

You’ll only be able to pay one month’s rent by August 31. Radpad double checks your rent details with your landlord before they send a check.

Plastiq Picking Up the Slack

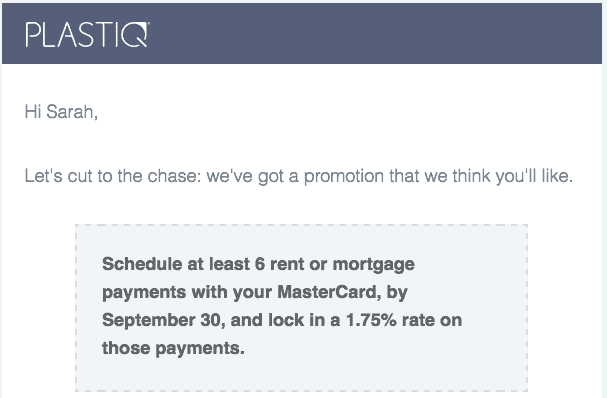

Sour because you planned on your rent making up a portion of minimum spending requirements? I’m sure you’re not the only one. Plastiq, an online bill payment processor, has stepped in turn Radpad’s lemons into their own lemonade.

I received the following email this morning.

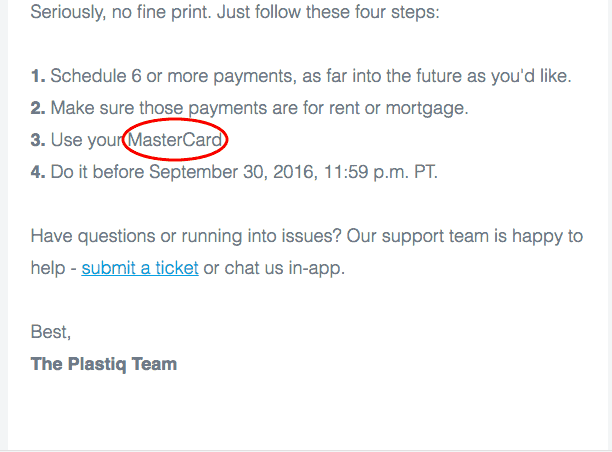

A 1.75% fee certainly isn’t free, but it’s slightly better than Radpad’s 2.99% and Plastiq’s standard 2.5% fee. Note that the discounted fee only applies to payments put on MasterCards. It’s pretty cool that you can pay up to six months worth of rent in advance though.

It’s not a targeted promotion, apart from the fact that I am registered on the site. I experimented by opening a new Plastiq account, and within ten minutes was sent the same promo email to the address I registered with the new Plastiq account. So if you aren’t already registered and want to use Plastiq to pay your rent or mortgage with a 1.75% fee, all you have to do is regiser now and wait for the email

Bottom Line

Radpad’s free credit card payments through 2016 on Android Pay promotion totally tanked. There’s no doubt about the fact that it sucks, but hopefully they learned their lesson. If you have any questions or wish to express how you feel, Radpad’s CEO Jonathan Eppers left his twitter handle, @jonathaneppers, in their statement.

If Radpad is leaving a serious gap in your spending plans, read this post about manufactured spending to learn about other ways to fill it. Or use Plastiq for the next six months instead and pay a 1.75% processing fee on your rent or mortgage.

Just getting started in the world of points and miles? The Chase Sapphire Preferred is the best card for you to start with.

With a bonus of 60,000 points after $4,000 spend in the first 3 months, 5x points on travel booked through the Chase Travel Portal and 3x points on restaurants, streaming services, and online groceries (excluding Target, Walmart, and wholesale clubs), this card truly cannot be beat for getting started!

Editorial Disclaimer: The editorial content is not provided or commissioned by the credit card issuers. Opinions expressed here are the author’s alone, not those of the credit card issuers, and have not been reviewed, approved or otherwise endorsed by the credit card issuers.

The comments section below is not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser’s responsibility to ensure all questions are answered.

For me using Plastiq to just pay regular bills means I am paying 1.75 cents/mile earned. However, if I am using them to meet the 3K payment for a new card, then I am getting those miles for a tiny fraction of cost per mile.

Exactly. Much higher return and can be worth it for big sign up bonuses.