MileValue is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

Note: Some of the offers mentioned below may have changed or are no longer be available. You can view current offers here.

Joanne writes:

“I have accumulated approximately 55,000 Southwest Rapid Rewards. I see that I have a Southwest flight credit that is expiring, and Southwest wants me to use 18,000 points to create a reward flight. I have my eye on a roundtrip award to Phoenix that costs 29,000 points. Is it worth it to do this? I am so confused. Any help is appreciated.”

I can sympathize with Joanne’s confusion. Southwest’s merger with Airtran has created several types of reward currencies between the two airlines including Rapid Rewards points, Rapid Rewards credits, Rapid Rewards awards, and A+ Credits. The good news is that the proliferation of currencies presents some pretty easy opportunities to get more value than normal from your Southwest and Airtran rewards.

Normally, Southwest Rapid Rewards are fixed value. You earn 6 per dollar spent on the cheapest fares, and you redeem 60 per dollar for any ticket in the cheapest fare class. I’ve discussed the standard redemption process before. See Anatomy of an Award: How to Book an Award on Southwest.

I’ve already detailed the main opportunity to stretch your Southwest point value too. If you transfer your Rapid Rewards points to A+ credits, then your new A+ credits to a Rapid Rewards award, you can get a roundtrip award (or two oneways) for 19,200 Rapid Rewards points. This process may sound complicated, but it takes about two minutes. See my post on this process titled How to Exploit the Southwest-Airtran Merger.

Let’s look at the the mechanics of the now allowable conversions between Rapid Rewards and A+ that I’ve been doing for the last seven months:

1,200 Rapid Rewards points converts to 1 A+ credit

1 Rapid Rewards credit to 1 A+ credit

1 Southwest Standard Award (two oneways) to 16 A+ credits

1 A+ credit converts to 1 Rapid Rewards credit

16 A+ credits can be used to fly two oneways on Airtran, and 16 Rapid Rewards credits can be used to fly two oneways on Southwest.

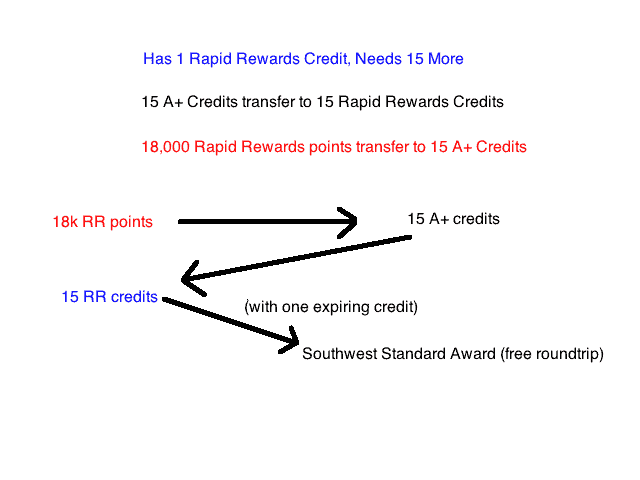

Joanne’s situation is that she has one Rapid Rewards credit and 55,000 Rapid Rewards points. Her credit is about to expire worthless. But since she has the credit for the moment, she only needs 15 more to get a Southwest Standard Award. That means she only needs 15 A+ credits, which means she only needs to convert 18,000 Rapid Rewards to get two free oneway or one free roundtrip. Or in visual form:

Is it a good deal for Joanne to transfer 18,000 Rapid Reward points in this manner? That answer depends on two things.

1) Would the roundtrip or two oneways she books with her newly minted Southwest Standard Award cost more than 18,000 Rapid Rewards?

2) Is there availability on the flights she wants with her Southwest Standard Award?

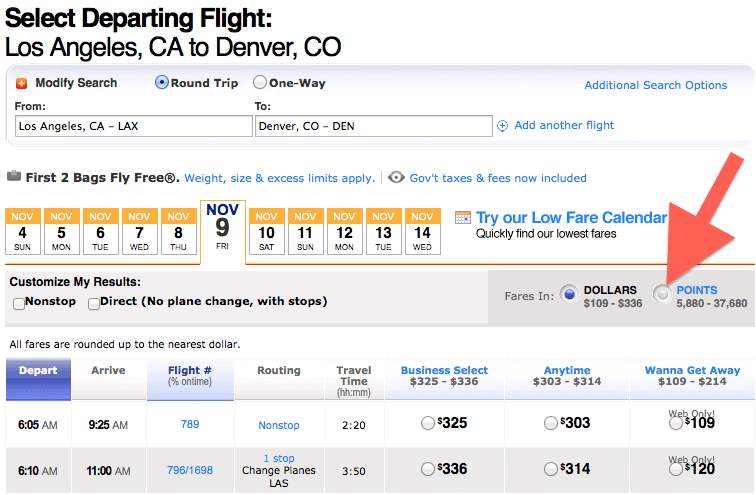

The first is easy to figure out. On any Southwest search results screen, you can toggle between seeing fares in dollars and seeing them in points.

Joanne found that the roundtrip she wanted to Phoenix cost 29,000 points, so 18,000 points would be a steal.

But would she be able to use her award for the flights she wanted? Southwest Standard Awards–unlike points awards–are capacity controlled, much the same way that United or American awards are capacity controlled.

To find out if the flights she wanted to Phoenix had award space, Joanne should call Southwest at 1-800-445-5764 to ask if those flights have standard award space. If they have the space, she can make the conversions and book over the phone without a phone-ticketing fee. Her 18,000 points will get her those 29,000-point flights.

In my experience, Southwest’s capacity-controlled awards have pretty phenomenal availability, so I don’t expect Joanne to have much of an issue getting the flights she wants.

How can you figure out if you should make points transfers like Joanne?

Because there are unlimited transfers between the programs, it means that we can use 19,200 (1,200 * 16) Rapid Rewards points for two free oneway trips on either airline.

19,200 Rapid Rewards points are worth about $324, so if you can find two oneways on either airline that cost more than that, you can profit from transferring.

In today’s airfare environment, finding a roundtrip or two oneways that cost more than that is pretty easy, especially since Airtran flies internationally to Mexico and the Caribbean.

Let’s go through some examples to show how to determine whether you can exploit the transfer options.

LAX-MDW-LAX for the dates I want costs $408, and I value it at that price because I need to get to Chicago, and there are no cheaper options. In Rapid Rewards points it costs 23,160 and $5. This is a prime example of a fare where exploiting the transfer options saves money!

Instead of paying cash or 23,160 points, I can transfer 19,200 Rapid Rewards points to A+ credits. The transfer is instantaneous. I can then immediately transfer 16 A+ credits to 16 Rapid Rewards credits. After that instantaneous transfer, I now have two free oneways on Southwest that I can use to fly LAX-MDW-LAX for just the same $5 in taxes.

So I got an itinerary for 19,200 Rapid Rewards points that should have cost me 23,160 Rapid Rewards points. Exploiting the transfers saved 3,960 Rapid Rewards points with a value of $63.54! Awesome!

Here’s an easy example of when not to transfer. I want to fly LAX-LAS-LAX, and the flights I want cost $114 or 5,520 Rapid Rewards points and $5. Transferring 19,200 Rapid Rewards points to 16 A+ Credits to 16 Rapid Rewards credits would be folly. Instead I would just book with 5,520 points and $5.

Now that you know when to transfer, here’s how to transfer. It’s incredibly easy.

- Log in to your Southwest account on the right side of southwest.com

- Click on the My Account link that appears where you typed your password.

- Click on the My Rapid Rewards tab.

- Choose the Transfer Between A+ Rewards and Rapid Rewards button on the left side of the page.

- Type in your Airtran account information, then follow the instructions to transfer Rapid Rewards points to A+ Credits (then A+ credits to Rapid Rewards credits if you are booking with Southwest)

Recap

This transfer option has made Southwest’s program much more lucrative for the last seven months. For short cheap flights, the normal points price will remain incredibly low, sometimes just a few thousand points for a roundtrip. For longer, more expensive flights, though, a roundtrip is effectively capped at 19,200 points, so we get the best of both worlds: points-cheap short trips and points-cheap long trips.

I hope everyone seriously looks into these transfers for their ability to use up orphaned Rapid Rewards credits, use up orphaned A+ credits, and save a bundle on expensive Airtran and Southwest flights.

Just getting started in the world of points and miles? The Chase Sapphire Preferred is the best card for you to start with.

With a bonus of 60,000 points after $4,000 spend in the first 3 months, 5x points on travel booked through the Chase Travel Portal and 3x points on restaurants, streaming services, and online groceries (excluding Target, Walmart, and wholesale clubs), this card truly cannot be beat for getting started!

Editorial Disclaimer: The editorial content is not provided or commissioned by the credit card issuers. Opinions expressed here are the author’s alone, not those of the credit card issuers, and have not been reviewed, approved or otherwise endorsed by the credit card issuers.

The comments section below is not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser’s responsibility to ensure all questions are answered.

For all the flights that I have wanted to do this with, there has been no standard award availability. This nullifies any value that transfer would have otherwise.

One trick I just confirmed is pretty amazing. I had an SWA award (two one-ways) that was due to expire in January 2013, and was having trouble finding a flight that worked for me before then. I converted that award into 16 A+ credits, which retained the original Jan 2013 expiration date. I then converted those 16 A+ credits into 16 SWA credits, which again retained the original Jan 2013 expiration date. However, when I converted those 16 SWA credits into an SWA award, it reset the expiration date to a year from today!

When these credits existed in A+, I could have been paying $29 per credit to extend them for a year. But instead, I was able to do essentially the same thing completely free!

[…] Bluebird Calculator ← Reader Question: Should I transfer Southwest Points to AirTran Credits? […]