MileValue is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

Note: Some of the offers mentioned below may have changed or are no longer be available. You can view current offers here.

The Starwood Preferred Guest personal credit card has lowered its minimum spending requirement. Now to get the 25,000 bonus Starpoints, you need only spend $3,000 in the first three months after opening the account.

Previously the spending requirement was $5,000 in six months. American Express tested out this new, lower requirement last August on both the personal and business SPG cards, and was apparently satisfied with the results for the personal card. The business card remains with its traditional $5,000-in-six-months minimum spending requirement.

- Are you eligible for these offers if you’ve had Starwood cards before?

- Should you wait for a 30k offer on the Starwood cards?

- What are the best uses for Starpoints?

- Why get the offer?

- Why not get the offer?

What is Different about This Offer?

Other than the minimum spending requirement and time frame, this offer appears identical to the offer we’ve seen on the Starwood Preferred Guest card for months.

- Earn up to 25,000 bonus Starpoints

- 2 points per dollar on SPG stays, 1 point per dollar elsewhere

- $0 introductory annual fee for the first year, then $65.

Who Is Eligible?

Having the SPG business card is irrelevant to whether you can get the SPG personal card. You can get both SPG cards on the same day no problem if you’ve never had either card before.

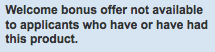

If you’ve ever had the personal SPG card before, you are ineligible to earn the sign up bonus on the card again. This is a new American Express policy as of May 1, 2014 for personal card sign up bonuses.

Should You Wait for a 30k Offer?

About once a year, American Express offers both SPG cards with a 30,000 point sign up bonus instead of the standard 25,000. The deal came up in August 2012, August 2013, and June 2014.

Based on that data, it seems like we may see a 30k offer in the next few months, but I have no inside information. I also wonder, if we get a 30k offer, what the minimum spending requirement will be. Will it be $3,000 or will it come with a higher spending requirement like $5,000?

Best Uses for Starpoints

Here is my Starwood primer, so you can understand how to use Starpoints for transfers to airline miles, hotels, and all the other great uses.

Here are some in-depth articles on top uses:

- How to Get 10 Nights in Hawaii and First Class Flights for Free (Nights & Flights Awards)

- A Chance to “Buy” Starpoints for 1.1 Cents: Starwood Cash & Points Awards (Cash & Points Awards)

- How to Transfer SPG Starpoints to Airline Miles

- Moments by SPG: Redeem Starpoints for Experiences

Why Get This Offer

Starpoints are the most valuable currency in the mileage world. I value them at 2.5 cents each since they transfer at a rate of 20,000 points to 25,000 miles to several important types of miles like American and Alaska or can be used for free hotel nights starting at 2,000 points.

If you spend a ton of money per year on credit cards that isn’t going to category or sign up bonuses, that spending should be on this card, so that you are accruing valuable, flexible points.

If you want SPG status, this card offers 2 stay credits and 5 night credits toward status.

Why Not Get This Offer

If you’re a small spender, it’s possible the new offer is worse for you. The total spending requirement has been lowered, but actually works out to more per month on average ($1,000) than the previous offer of $5,000 in six months ($834.) Maybe you could average $834 per month a new card, but not $1,000. (Although there are easy ways to bridge that gap and spend more on credit cards now without spending more money overall.)

If you think a 30k offer will come up on the SPG card this summer as it has the last three summers and don’t need your SPG points immediately, don’t get the card.

If you are irresponsible with credit cards (don’t pay them in full each month, incurring interest or spend more than you would if you just stuck to cash and debit cards), don’t get the SPG personal card or any other credit card.

Get a Referral

If you want to get the SPG personal card with its lowered $3,000-in-three-months minimum spending requirement, you can do it through a referral link that will earn me 5,000 Starpoints or through a bank link that won’t.

To get the referral link, leave a comment to this post asking for a referral. Fill in your real email address in that blank of the comment form. Your email address will NOT be displayed publicly, but I will use it to have the referral sent (and for no other purpose.) I promise to use my referral Starpoints for frivolous adventures!

If you don’t want to do that, here is a direct link to the new offer.

Just getting started in the world of points and miles? The Chase Sapphire Preferred is the best card for you to start with.

With a bonus of 60,000 points after $4,000 spend in the first 3 months, 5x points on travel booked through the Chase Travel Portal and 3x points on restaurants, streaming services, and online groceries (excluding Target, Walmart, and wholesale clubs), this card truly cannot be beat for getting started!

Editorial Disclaimer: The editorial content is not provided or commissioned by the credit card issuers. Opinions expressed here are the author’s alone, not those of the credit card issuers, and have not been reviewed, approved or otherwise endorsed by the credit card issuers.

The comments section below is not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser’s responsibility to ensure all questions are answered.

Is this new reduced spending offer also good for Starwood Business Card and do you also expect the Starwood Business Card to come out with a 30K offer later this Summer?

No, and I won’t hazard a guess but we’ve seen business card go to 30k the last three summers at the same time as the personal card.

Is this new reduced spending offer also good for Starwood Business Card and do you also expect the Starwood Business Card to come out with a 30K offer later this Summer?

No, and I won’t hazard a guess but we’ve seen business card go to 30k the last three summers at the same time as the personal card.

I know, if you’ve ever had the personal SPG card before, you are ineligible to earn the sign up bonus on the card again. How about if you’ve had the business SPG card? Can you get that again?

Yes, as long as the old one was closed for a year. According to conventional wisdom.

I know, if you’ve ever had the personal SPG card before, you are ineligible to earn the sign up bonus on the card again. How about if you’ve had the business SPG card? Can you get that again?

Yes, as long as the old one was closed for a year. According to conventional wisdom.

I currently hold a SPG personal AMEX, but have been considering getting a SPG Biz card and a Personal card for my wife. Since referrals are available to me I have a question. Can you refer yourself? (i.e. Can I send myself a referral link/email to apply for the business card?) I know I can get a referral for my wife but no sense in letting miles go to waste. If I can not, I will certainly sign up via your link. Thanks for all of the great information.

You can only refer for cards you have, making a self-referral impossible because you don’t have the SPG Business.

Thanks so much Scott. I had received the email from Amex for referrals with both the Personal and Business option, but I failed to see the smaller “I have this card” option. So I tried to hit the biz card after your response just for grins, and sure enough, Amex says I’m not eligible to send that referral.

I currently hold a SPG personal AMEX, but have been considering getting a SPG Biz card and a Personal card for my wife. Since referrals are available to me I have a question. Can you refer yourself? (i.e. Can I send myself a referral link/email to apply for the business card?) I know I can get a referral for my wife but no sense in letting miles go to waste. If I can not, I will certainly sign up via your link. Thanks for all of the great information.

You can only refer for cards you have, making a self-referral impossible because you don’t have the SPG Business.

Thanks so much Scott. I had received the email from Amex for referrals with both the Personal and Business option, but I failed to see the smaller “I have this card” option. So I tried to hit the biz card after your response just for grins, and sure enough, Amex says I’m not eligible to send that referral.

edit for above: “but have been considering getting a SPG Biz card and a Personal card for my wife.” I wanted to clarify that the Biz card is for me, and the Personal card is for my wife. Sorry for the confusion.

edit for above: “but have been considering getting a SPG Biz card and a Personal card for my wife.” I wanted to clarify that the Biz card is for me, and the Personal card is for my wife. Sorry for the confusion.

Could I please get a link for a referral? Thanks so much!

Could I please get a link for a referral? Thanks so much!

[…] Both cards offer 25,000 bonus Starpoints after spending $3,000 in the first three months. […]

[…] Both cards offer 25,000 bonus Starpoints after spending $3,000 in the first three months. […]

[…] The bonus on the SPG card is 25,000 Starpoints, and the minimum spending requirement just dropped to $3,000 in three months. […]

[…] The bonus on the SPG card is 25,000 Starpoints, and the minimum spending requirement just dropped to $3,000 in three months. […]