MileValue is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

Note: Some of the offers mentioned below may have changed or are no longer be available. You can view current offers here.

The Starwood Preferred Guest personal and business credit cards from American Express now come with 35,000 bonus Starpoints for spending $3,000 and $5,000 respectively in the first three months of cardmembership.

Links:

- Starwood Preferred Guest® Credit Card from American Express (personal)

- Starwood Preferred Guest® Business Credit Card from American Express

The normal sign up bonus is 25,000 points, the twice yearly limited time offer is 30,000 points. This is the highest public sign up bonus ever on these cards. (And some people say the hobby is dying…)

American Express recently introduced a rule that you can only get the bonus once per lifetime on each of its cards. Eligibility is separate for each card. That means if you’ve only ever had the business card, you can still get the personal card or vice versa. But if you’ve had the personal card before, you can’t get this bonus on the personal card. If you’ve had the business card before, you can’t get this bonus on the business card.

If you get both cards, you’ll have to spend $8,000 total in the first three months of cardmembership. In return, you’ll get one Starpoint per dollar spent plus a 35,000 point bonus on each card for a total of 78,000 Starpoints. I get at least 2.5 cents of value per Starpoint in the following ways, meaning a total value of at least $1,950 to me.

Here are the main ways to get value from Starpoints:

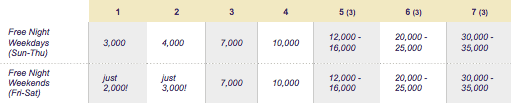

1. Free Night Awards

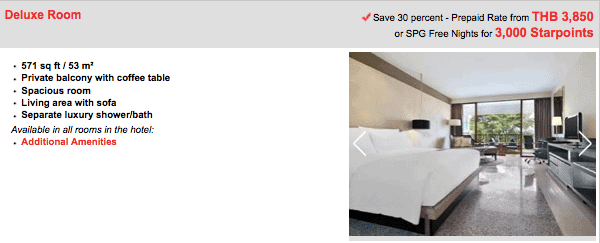

Starpoints can be used for free nights at any Sheraton, W, Westin, Le Meridien, Aloft, Four Points, St. Regis, Element, or Luxury Collection Hotel. Free nights start at 2,000 points per night. And the best part is: If a standard room is for sale, you can book it with Starpoints. Free night awards are not capacity controlled like award flights are.

Here is the Free Night Awards chart:

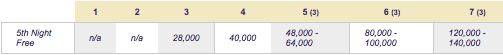

Book a four night award at Category 3-7 hotels and get a 5th night free. Here are the total prices for five nights:

There can be tremendous value in the free night awards. For instance:

These are old examples. The prices have surely changed. Just pay attention to the ideas embedded in them.

Le Méridien Chiang Rai Resort, Thailand is a stunning category 2 hotel that goes for only 3,000 points on the weekends. One weekend night in January goes for $123, so that redemption would be worth 4.1 cents per point.

And more importantly, 78,000 Starpoints would be enough for up to 39 weekend nights at some properties.

As another example of Free Night Awards, the cheapest SPG property in Hawaii is the Sheraton Kona Resort & Spa at Keauhou Bay, a category 4 property that costs 10k points per night or 40k for five nights, using the 5th Night Free pricing.

The property goes for $302 per night after taxes for a five-day stay in March: $1,510 total. Instead you could pay 40,000 Starpoints and get 3.76 cents per point in value. And more importantly, you’d be here:

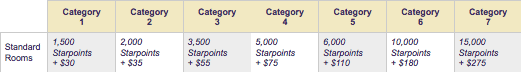

2. Cash & Points Awards

Cash & Points awards are a way to stretch your cash and your Starpoints. You’ll generally get even more value from your Starpoints through these awards though they are capacity controlled. Here is the Cash & Points chart:

As you’ll notice, a Cash & Points night requires half the Starpoints of a free night plus a cash co-pay.

Unless I were taking advantage of the 5th Night Free with Free Night Awards, a discounted weekend night, or I was cash poor at the moment, I would look to choose a Cash & Points award over a Free Night.

To see why, let’s look at the Sheraton Frankfurt Congress Hotel, a Category 3 property. For a Tuesday this month, the hotel wants 149 euros for the refundable rate. Or you could spend 7,000 Starpoints for a Free Night, or you could spend 3,500 Starpoints + $55.

Comparing them:

- 149 euros is $163

- 7,000 Starpoints for a free night is a respectable 2.32 cents per point

- 3,500 Starpoints + $55 is an incredible 3.09 cents per point

And I chose this hotel because I’ll be in Frankfurt next week, not because it has an abnormally valuable Cash & Points option. I’d frankly consider 3 cents per point about average for a Cash & Points redemption.

3. Transfer to Airlines with a Miles Bonus

For people who eschew chain hotels, Starpoints are incredibly valuable to transfer to airline miles because their are so many partner airlines, and in most cases, transferring 20k Starpoints nets you 25k miles in the account of your choice, a 25% bonus!

Starpoints transfer to 30 airlines in total, mostly at favorable rates.

The best three options are Aeroplan, Alaska Airlines, and Asiana. Starpoints transfer in a 20k points to 25k miles ratio (1:1.25) to all three airline airlines, and none is a transfer partner of Ultimate Rewards or ThankYou Points. Click here for the reasons to transfer to those three airlines.

Other partners where I would consider transferring Starpoints include:

- British Airways Avios for its distance-based chart’s sweet spots like 12,500 miles to Hawaii from the west coast

- Delta for Virgin Atlantic Upper Class without fuel surcharges

- Flying Blue (Air France) for one way awards on Delta metal

- Hawaiian for incredible award space to Hawaii, Asia, and Australia

- Singapore to book Singapore Suites Class

- Virgin Atlantic for incredibly cheap awards to London

- Miles & More (Lufthansa) to book Swiss First Class

(Note that many of the airlines on this bulleted list are Membership Rewards or Ultimate Rewards partners, and I would rather transfer those points to these airlines, since I value Starpoints more.)

The one glaring weakness in the airline transfer partners is that United is not a 1:1 transfer partner, 20k Starpoints transfers to only 12,500 United miles. Avoid that transfer, and earn Ultimate Rewards instead to transfer to United.

But apart from that, the transfer partner list is astoundingly excellent. You can get on most commercial flights worldwide through one of these transfer partners.

Other Important Things to Know about the Starwood Preferred Guest Program

Status

Both the Starwood personal and business cards confer 2 stay credits and 5 night credits toward elite status, and they are cumulative, so if you get approved for both cards, I’ll have 4 stays and 10 nights credited to your account, leaving you just 6 stays or 15 nights short of Gold Status.

Gold Status entitles you to free internet and a 4 PM checkout. You also get an extra Starpoint per dollar on Starwood purchases, so cardholders with Gold Status get 5 Starpoints per dollar.

Other than stays, you can also get Gold Status by having an American Express Platinum card or spending $30k per year on a Starwood credit card.

4x or 5x

Cardholders can earn 4 points per dollar on Starwood purchases, 5 points per dollar if they have Gold Status. This breaks down to 2 points per dollar for the spending normally plus another 2 points per dollar if the spending is on a Starwood card.

Combine Points

You can combine points between Starwood accounts if both parties have had the same address on file for 30 days.

This is hugely important, since certain blocks of Starpoints are critical. For instance, if you and your wife each have 10k Starpoints, you could each transfer them to your respective American Airlines accounts and have 10k miles in two accounts. Or you could combine the Starpoints and send the points to one person’s American Airlines accounts, leaving you with 25k American Airlines miles in one account after the transfer bonus.

Your Parents’ Card

Your parents like to travel, they’re jealous of your trips, and they want a rewards card. But they don’t want to keep track of category bonuses, ten programs, and tons of promotions. (OK, maybe I’m just describing my parents.)

Tell each of your parents to get the Starwood Preferred Guest® Credit Card from American Express. Of course you can do better than putting all of your spending on this card by taking advantage of other card’s bonuses, but you can do pretty well by putting all your spending year after year on this card and building a balance of valuable hotel points that can also transfer to 30 airlines. When people come to my Award Booking Service with a stash of Starpoints, I know the job will be easy.

Big Spenders

I’ve argued before that Big Spenders Should Be Using One of These Three Cards (And They Probably Aren’t). One of those cards is the Starwood card. Because of its transfer partners and transfer bonus, using the card is like earning 1.25 miles per dollar in almost any airline program.

Nights & Flights

I probably should give Nights & Flights more billing because it might be a better deal than Free Night Awards, Cash & Points awards, and airline transfers. With Nights & Flights, you get five hotel nights and 50,000 airline miles for only 60-70k Starpoints.

Unfortunately the award is limited to Category 3 and 4 hotels. But the price is unbeatable. Going back to the Sheraton in Kona discussed above, for 70k Starpoints, you could get five free nights at the property plus 50k American Airlines miles to get there (you only need 35k).

Moments

A lot of airlines and hotels, want you to blow your points on overpriced experiences and merchandise, but Starwood Moments have some good values. I spent 5,500 Starpoints for two tickets to a Captial Cities concert, plus the chance to meet the band beforehand, and free food and drinks at a reception.

All in One Place

Starwood has an awesome chart that compares many of the redemption options discussed here and some worse options not discussed here.

Referrals

If you have the personal or business card, you can refer friends to these offers and earn 5,000 bonus Starpoints for each friend who gets the card. Log in here to get your referral links. You can post or request referrals in the comments.

Recap

Currently, both the personal and business versions of the Starwood Preferred Guest credit card have a 35,000 Starpoint sign up bonus until March 30, 2016, their largest ever.

Getting both cards gives you 78,000 total Starpoints after meeting their minimum spending requirements. Through Free Nights, Cash & Points, airline transfers, and Nights & Flights, you can plan to get at least 2.5 cents of value per Starpoint.

These are the set-it-and-forget-it cards. For people who don’t have that attention span, these are go-to, everyday cards to keep in your wallet for a long time to build up balances towards incredible vacations.

Further Reading:

- Starwood Preferred Guest Primer and Three Great Uses for the Starpoints

- How to Get 10 Nights in Hawaii and First Class Flights for Free

- A Chance to “Buy” Starpoints for 1.1 Cents: Starwood Cash & Points Awards

- Limited Time: 50k AA Card Offer Plus Expiring SPG Cards’ Offer Means Round-the-World Business Class Award

Links:

Just getting started in the world of points and miles? The Chase Sapphire Preferred is the best card for you to start with.

With a bonus of 60,000 points after $4,000 spend in the first 3 months, 5x points on travel booked through the Chase Travel Portal and 3x points on restaurants, streaming services, and online groceries (excluding Target, Walmart, and wholesale clubs), this card truly cannot be beat for getting started!

Editorial Disclaimer: The editorial content is not provided or commissioned by the credit card issuers. Opinions expressed here are the author’s alone, not those of the credit card issuers, and have not been reviewed, approved or otherwise endorsed by the credit card issuers.

The comments section below is not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser’s responsibility to ensure all questions are answered.

For trying to get as many United flights as possible (because they don’t serve peanuts and my son has a severe allergy), would it be possible to transfer SPG points to US Air and then book United using US Air miles?

Yes. You can book any Star Alliance partner including United with US Airways miles.

Scott – What do you think of the argument that if one is staying at a Nights and Flights eligible property that one should always take the offer assuming they have enough points? An example to consider. I want to go to Disney for seven nights. It would cost me 60k for a room at the Swan for the week (40k for 4+1 free night, and 20k for last two nights). On a nights and flights booking it would be 90k for the same 7 nights but I would be getting 50k airline miles for 30k starwood points which is a great redemption. Would you do it even if you have no intention of using those miles to get to MCO? Would you credit to AA for a later international trip?

I would almost always take Nights & Flights if available. As you point out, I don’t think it matters whether you plan to use the 50k to get to MCO (in fact using the 50k AA to get to MCO would generally be a bad redemption. It just comes down to whether you’d trade 30k SPG for 50k AA. I would, but some people who routinely make incredible Cash & Points redemptions might not be interested in that trade.

YOU LIST 350 AIRLINES BOOKABLE THROUGH SPG FILGHTS I JUST EXPLORED THE WEBSITE AND CALLED SPG. THEY SAID SPG FLIGHTS ONLY BOOKABLE ONLINE AND

DROPDOWN CHOICES DO NOT INCLUDE SAS (SHE CONFIRMED THAT. THERE CERTAINLY ARE NOT 350 AIRLINES LISTED THERE.

spg points do not transfer to SAS either and SAS keeps its business class inventory (especially to and from SFO ) for its own Eurobonus members.

Know of any card available in US which would help me earn SAS eurobonus points?

“SPG Flights” was only mentioned in the bullet points for the card promulgated by American Express. I didn’t mention it in the main body of the article because SPG Flights is an awful deal and is not a point transfer mechanism at all. I do not know of any US card that can transfer to SAS.

Here’s more info on SPG flights –> https://www.spgflights.com/travel/arc.cfm?tab=a

@Jill,

Yes, you can can xfer SPG to any *Alliance member and book UA flights.

Thank you!

do star points ever expire? do you get to keep them without having to transfer them when you close a card? thanks.

Starpoints expire if you have no activity in your SPG account for 12 months. Using the credit card counts as activity though!

Just got my DBA yesterday (Soapy Notes=washable post-it notes I sell online) and the SPG business card today. Very exciting! Thank you all again for this awesome site!

I went to apply for the SPG Personal card, and noticed that in the left column of the application page, it says “If you are identified as a current American Express® Cardmember, you may not be eligible for this welcome bonus offer.” It also goes on to say “This offer is also not available to applicants who have had this product within the last 12 months.”

I have 2 Amex cards right now… I would hate to spend $5,000 only to find out that I would not get the 30,000 points.

Any opinions on this?

I think everyone is a bit confused by that language. My understanding from reading dozens of reports is that the 12 months rule refers to the Personal card. If you’ve never had the SPG Personal card, you can get the bonus even if you have other SPG cards.

But under no circumstances would you have to spend the $5k to find out your eligibility. You can confirm with the rep when you activate your card.

I applied for the personal card and was approved last week – activated the card last night. Today I applied for the business version, and got the following:

Thank you for applying for the Starwood Business Card. We value your membership and appreciate your interest in another American Express Card. According to our records, you submitted more than one application for a similar American Express Card so we’ve cancelled the duplicate request.

Anyone able to apply for both?

Have you called AMEX to ask them to reinstate the second app. I know many people have been approved for both at once. You might have also done better by applying for both at the same time.

[…] mentioned SPG’s Nights & Flights awards in passing in my Starwood Preferred Guest Primer, but I didn’t do the award justice. Here are the full details on Nights & […]

[…] example of a chart with low-point award levels would be the Starwood chart with free nights for as little as 2,000 […]

[…] Starwood Preferred Guest Primer (Everything You Need to Know about the Cards and SPG Program in One Place) […]

[…] Starwood Preferred Guest Primer to explain the program in depth […]

I am interested in applying, but when I click on your Starwood link, I don’t see anything about miles/pts other than the 5,000. Is the 20K offer after spending, x amount gone now?

The 25k offer is still around. I think it may be the cookies in your browser that are causing the inferior offer. Try to open it in another browser, and let me know if that works.

[…] But you don’t have to choose just one type of miles to stockpile, and if you’re a big spender you probably shouldn’t stockpile one type. That’s where the SPG card comes in. It earns 1 Starpoint per dollar on all purchases. But those can be transferred 20k points to 25k miles to Delta, American, US Airways, and many other programs, but not United. (See my full analysis of the card and the SPG program here.) […]

[…] But American Express has a lot of great personal cards with higher sign up bonuses. While $150 cash back is nice, it doesn’t compare to 25,000 Starpoints on the Starwood Preferred Guest® Credit Card from American Express. I value 25,000 bonus Starpoints at $625, and you could easily get $1,000 or more of value out of them by using the points for their highest value uses. […]

[…] Flying Blue is a 1:1 transfer partner of Membership Rewards and Starpoints. […]

[…] Flying Blue is a 1:1 transfer partner of Membership Rewards and Starpoints. […]

Even though I’ve never had the SPG Amex card, I can only get the 10k points offer because I have the Delta Amex card. (Dangit!)

I applied for ad received both cards. Hit my spending requirements within about 2 months – on both cards (unfortunately I had some exceedingly high veterinary bills). I cleared the spend hurdle on the personal card first and then on the business card.

I have received the bonus points on the business card but NOT on the personal card. I’ve contacted AMEX and SPG about it – I am unclear on who it is I need to reach. Does anyone happen to have a PDF or screen shot of the terms for this offer?

AMEX is who to contact. I don’t have a screenshot of the 30k offer from August, but they should know what offer you applied for.

Any suggestion on which phone number and what department I want? I’ve tried calling a couple of times and never seem to find anyone who is able (or willing) to assist me. Clearly I am now an existing account but it seems like the only people who might know something would be in the “new accounts” area.

I would just call the normal customer service. They should be able to see what the sign up bonus was on the card and whether you’ve met its terms.

[…] For instance, Starpoints in your Starwood Preferred Guest account are great for hotels, but they also transfer at a favorable rate to 30 major airlines. Read my Starpoints Primer here. […]

[…] Starwood Preferred Guest Primer (Everything You Need to Know about the Cards and SPG Program in One Place) […]

[…] For more info on Starpoints and more reasons why the Starwood cards are two of my favorite cards, see Starwood Preferred Guest Primer and Three Great Uses for the Starpoints. […]

[…] Flying Blue is a 1:1 transfer partner of Membership Rewards and Starpoints. […]

[…] Flying Blue is a 1:1 transfer partner of Membership Rewards and Starpoints. […]

[…] Starwood Preferred Guest® Credit Card from American Express […]

[…] Flying Blue is a 1:1 transfer partner of Membership Rewards and Starpoints. […]

[…] once-a-year 30k Starpoint bonus offer on the personal and business cards ends Tuesday. Getting both and hitting the minimum spending […]

[…] Flying Blue is a 1:1 transfer partner of Membership Rewards and Starpoints. […]

[…] Flying Blue is a 1:1 transfer partner of Membership Rewards and Starpoints. […]

[…] Flying Blue is a 1:1 transfer partner of Membership Rewards and Starpoints. […]

[…] is my Starwood primer, so you can understand how to use Starpoints for transfers to airline miles, hotels, and all the […]

[…] is my Starwood primer, so you can understand how to use Starpoints for transfers to airline miles, hotels, and all the […]

Scott-

Do you know whether there is a way to find out if you have previously had a particular AmEx card? I recall having had a SPG card some years ago, and I don’t want to apply and be approved for a card that will not earn the bonus.

Also, with the Marriott/Starwood M&A now approved by US and Canadian anti-trust authorities, do you have any thoughts on the loyalty programs? Earn or burn?

-g

Call and ask

[…] Right now the SPG personal and business cards are each offering their biggest bonus ever! […]

[…] For full details on the offers and uses of Starpoints, see My Primer on the 35,000 Point Offers. […]

[…] Seventy thousand Starpoints–the amount you’d have if you got both cards and met both spending requirements–transfer to 85,000 SkyMiles, which is enough for a roundtrip economy redemption to Africa, the Middle East, or Asia. For more information about the Starpoints program, see my primer. […]

[…] 1:1 to Alaska miles with a 5,000 mile bonus for every 20,000 points transferred. Right now the SPG cards have their biggest bonuses ever. The Alaska Airlines credit cards from Bank of America are […]

[…] should probably mention to your friends that in the last year we have seen 30,000 and 35,000 points offers, and you can only get the bonus on an Amex card once per […]

[…] Starpoints also transfer to Korean miles, and both SPG cards are in the middle of their biggest bonuses ever. […]

[…] Blue is a 1:1 transfer partner of ThankYou Points, Ultimate Rewards, Membership Rewards and Starpoints. You can get 100,000 bonus Ultimate Rewards after spending $4,000 on the Chase Sapphire Reserve […]

[…] Aside from transferring to airline loyalty program, you can also redeem SPG points on any Sheraton, W, Westin, Le Meridien, Aloft, Four Points, St. Regis, Element, o…. […]

[…] Blue is a 1:1 transfer partner of ThankYou Points, Ultimate Rewards, Membership Rewards and Starpoints. You can get 80,000 bonus Ultimate Rewards after spending $5,000 on the Ink Business […]