MileValue is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

Note: Some of the offers mentioned below may have changed or are no longer be available. You can view current offers here.

The Delta Reserve is a niche credit card. Many won’t want to pay $450 for a card that earns solely Delta miles. But the Delta Reserve’s ability to earn Delta redeemable miles is not why people should open this card.

The Delta Reserve Card from American Express comes with 10,000 Medallion Qualification Miles (MQMs) for spending $3,000 on the card within three months of opening it. The 40,000 redeemable mile bonus that also comes along with meeting that minimum spending requirement is a nice perk, but still secondary to the MQMs, which can be hugely valuable (especially if you’re close to acheiving status).

That being said, if you do need a topping off of MQMs, now is the time to open the Delta Reserve Card because the sign up bonus is record high right now. The 10,000 MQMs are not a new, but the standard redeemable mile portion of the offer was a measly 10k miles. 40,000 miles is a huge increase.

Quick Facts

- Sign Up Bonus: 40,000 redeemable Delta miles and 10,000 MQMs after spending $3,000 on the card in the first three months

- Spending Threshold Bonuses: Spending $30,000 or more in a calendar year earns 15,000 bonus redeemable miles and 15,000 MQMs. Spending $60,000 or more earns an additional 15,000 bonus redeemable miles and an additional 15,000 MQMs

- Category Bonus: 2x Delta purchases

- Lounge Access: Delta SkyClub Access when flying Delta. Can bring along two guests for $29 each.

- First Checked Bag is Free

- Companion Certificate applicable for a free domestic first class, Comfort +, or an economy round trip ticket when another ticket is purchased (taxes still apply)

- Value of Redeemable Delta Miles: ~1.3 cents

- Global Acceptance: Chip technology and no foreign transaction fees

- Annual Fee: $450, not waived the first year

- Eligibility: Amex Once in a Lifetime Rule applies (you can’t get the bonus if you’ve ever gotten the bonus before, but note eligibility for the Platinum or Gold Delta cards is separate)

Earning Delta Status

Below is a refresher on how to qualify for Delta elite status in their Medallion program.

To be completely clear, none of the different types of “miles” I will discuss in this section are redeemable, unless I expressly say redeemable beforehand. They are instead separate metrics of spending/flying with Delta/partners one must reach in a calendar year in order to qualify for Medallion status the following year.

Status for the current year is earned by flight and spending activity from the previous calendar year. For example, your status in 2018 is what you’d be working on now–any Delta flight/spending activity from January 1, 2017 through December 31, 2017 counts towards your status for 2018.

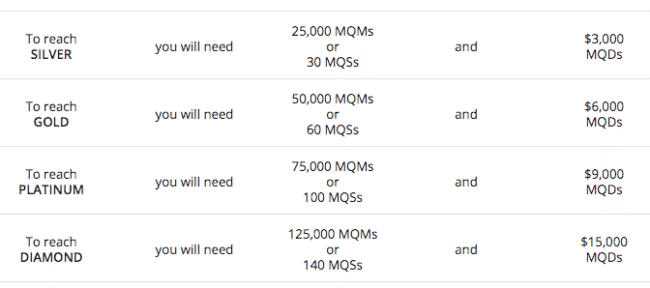

Requirements For Earning Delta Medallion Status

Key Terms

Key Terms

- MQM = Medallion Qualifying Mile

- MQS = Medallion Qualifying Segment

- MQD = Medallion Qualifying Dollar

You have to meet either the MQM or MQS threshold, whichever you hit first, as well as the MQD threshold for each respective tier to earn the benefits associated with that tier. You must meet these thresholds in the current calendar year (January 1 – December 31) to qualify for Medallion status in the following calendar year.

You earn Medallion Qualifying Miles by flying them. When you buy a cash ticket flying Delta and/or Skyteam partners, the amount of MQMs you’ll earn is based on the cabin and distance you fly.

You also earn Medallion Qualifying Segments by flying them. A segment is considered one takeoff and one landing.

Medallion Qualifying Dollars are “the sum total of the SkyMiles member’s spend on Delta-marketed flights (flight numbers that include the “DL” airline code), inclusive of the base fare and carrier-imposed surcharges, but exclusive of government-imposed taxes and fees” taken from Delta.com). If the flight is marketed and ticketed by a partner airline, you’ll earn MQDs based on a percentage of distance flown as determined by the fare class paid.

Bottom Line

There are two reasons the Delta Reserve Card should be on your radar:

- You are chasing Delta elite status and the MQM bonus(es) will help you get there faster

- You highly value Delta SkyClub lounge access

Due to the hefty $450 annual fee, personally I think the only reason you should get this card is if you’re reaching for Delta elite status. If you are, now is the time to open a Delta Reserve as it has the highest sign up bonus offer we’ve ever seen.

If you just want Delta miles for redemptions on awards, then consider the Delta Gold card that only has a $95 annual fee and. I’d wait to open a Gold card though as the sign up bonus, 30k for $1k spending in three months, isn’t historically high. Wait for at least a 50k bonus since you can only earn one public sign up bonus per Amex card.

Credit card links have been removed from posts and added to the menu bar at the top of every page of MileValue under the heading Top Travel Credit Cards.

Just getting started in the world of points and miles? The Chase Sapphire Preferred is the best card for you to start with.

With a bonus of 60,000 points after $4,000 spend in the first 3 months, 5x points on travel booked through the Chase Travel Portal and 3x points on restaurants, streaming services, and online groceries (excluding Target, Walmart, and wholesale clubs), this card truly cannot be beat for getting started!

Editorial Disclaimer: The editorial content is not provided or commissioned by the credit card issuers. Opinions expressed here are the author’s alone, not those of the credit card issuers, and have not been reviewed, approved or otherwise endorsed by the credit card issuers.

The comments section below is not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser’s responsibility to ensure all questions are answered.

Amen, SPM. My current plan has me 7500 MQM’s short of Diamond. A 10,000 MQM r/t from my local airport would run far more than $450. Now I can get all 10,000 by simply shopping and the 40,000 SkyMiles are handy too.

[…] Read about who the Delta Reserve Card is appropriate for in Attention Delta Status Chasers: Amex Reserve Card Has a New Bonus. […]

[…] Read about who the Delta Reserve Card is appropriate for in Attention Delta Status Chasers: Amex Reserve Card Has a New Bonus. […]