MileValue is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

Note: Some of the offers mentioned below may have changed or are no longer be available. You can view current offers here.

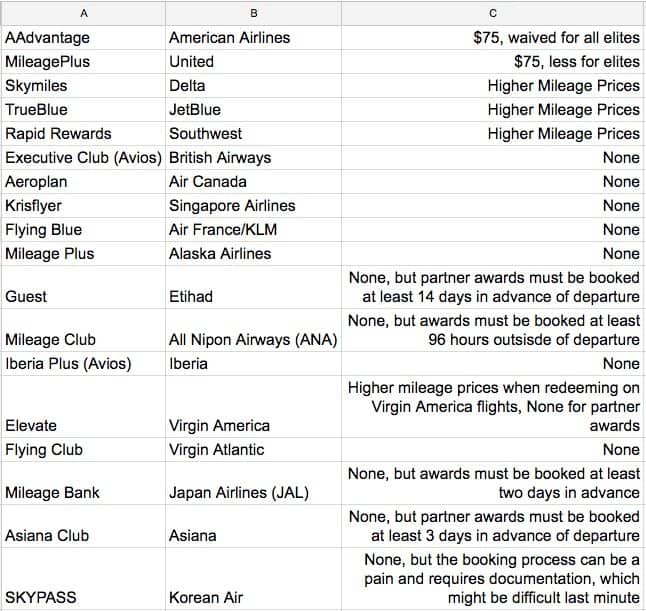

This comprehensive spreadsheet details commonly used loyalty programs and their policies towards booking an award close to the travel date.

To see how much you might have to pay for booking a last minute award, look up the loyalty program whose miles you will use on the chart (which might not necessarily be the airline you fly). You are subject to that programs’ rules and/or fees.

Below I expand a bit on a few of the loyalty programs’ policies that require further clarification.

American Airlines

The $75 close-in award booking fee applies when you book an award within 21 days of the travel date. This fee is waived for all elites.

United

The $75 close-in award booking fee applies when you book an award within 21 days of the travel date. Here’s a trick to avoid paying United’s close-in booking fee. I used it recently and it worked like a charm.

Fees for booking a last minute United award are waived for those with upper elite status (Premier Platinum, Premier 1K®, or United Global Services®) and also those that are United Club members. If you have a lower level elite status, the close-in booking fee will be less but not waived–read more details here.

Delta

Within 21 days of the departure date, Delta jacks up the price of their awards. So while there is no separately defined fee for booking close to the travel date, you will pay more miles.

That is not published online, nor are their award charts anymore, but you can see the pattern from a quick search on delta.com.

JetBlue

TrueBlue award prices are based on the cash price of the ticket, which naturally gets more expensive as you get closer to the travel date. So while there isn’t a separately defined “last minute award booking fee”, you will probably end up paying more since the award price will climb the closer in you get to your desired travel date.

Southwest

Rapid Reward prices are also based on the cash price of the ticket. Most Southwest flights have less Wanna Get Away fares left within one to three weeks of departure, and the other types of fares require more points per dollar. So again, you won’t pay a defined, separated last minute booking fee, but you’ll pay for it with more Rapid Rewards.

Virgin America

Elevate award prices are based on the cash price of the ticket when redeeming Elevate points on Virgin America flights, so you will run into the same issue of the award price going up as you get closer to the travel date. But when you redeem Elevate points on one of Virgin America’s partners, award prices are set and region-based, so you won’t have that issue– and there are no extra last minute award booking fees.

Korean Air

Here is a post that explains the booking process when you redeem Korean SKYPASS miles. It requires some extra steps that might be difficult to achieve if you’re trying to plan last second travel.

Bottom Line

Using miles from any of the three American legacy carriers to book an award within 21 days of departure is going to cost you. Avoid it by transferring points to a foreign program that doesn’t charge close-in booking fees– but remember that a few of them require award bookings to be at least a few days (and in Etihad’s case, up to 14 days!) in advance.

Just getting started in the world of points and miles? The Chase Sapphire Preferred is the best card for you to start with.

With a bonus of 60,000 points after $4,000 spend in the first 3 months, 5x points on travel booked through the Chase Travel Portal and 3x points on restaurants, streaming services, and online groceries (excluding Target, Walmart, and wholesale clubs), this card truly cannot be beat for getting started!

Editorial Disclaimer: The editorial content is not provided or commissioned by the credit card issuers. Opinions expressed here are the author’s alone, not those of the credit card issuers, and have not been reviewed, approved or otherwise endorsed by the credit card issuers.

The comments section below is not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser’s responsibility to ensure all questions are answered.

When I look on United’s webpage it shows a fee for changing any award travel so would the trick still work to book out more than 21 days in advance and then either online or call to change to a date within 21 days to avoid the $75 fee? I’d hate to book award travel for a date I don’t want and then when I go to change I incur a change fee and still have to pay the $75 fee on top of that. Thanks!

Just wanted to post an update…. I did this just today and booked a one way award flight for more than 21 days out and then after the confirmation I logged out, logged back in, went to my reservation, and changed it to the date that I actually wanted, that of course was within 21 days of flying. It worked like a charm! It gave me the option I wanted and was no additional miles or money! Thank you so much for saving me $75!!

great!

This is my favorite way to fly, so naturally I’ve already tabulated these, but it’s a great summary.