MileValue is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

Note: Some of the offers mentioned below may have changed or are no longer be available. You can view current offers here.

The Platinum Card® from American Express comes with an annual fee of $695 (Rates & Fees). But it also come with a litany of valuable benefits that make up for the annual fee, at least for the first year.

Unfortunately many of those benefits are not automatic. In order to get the most out of the card, you need to spend a little time signing up for each one.

All American Express Platinum cards–including the “regular” Platinum, Ameriprise Platinum, Morgan Stanley Platinum and Schwab Platinum–receive the following benefits in the first year that you have to activate yourself:

- Up to $200 in Uber credits annually (Enrollment Required)

- Up to $400 in airline fee statement credits (Enrollment Required)

- Up to $100 statement credit for Global Entry Free (Enrollment Required)

- Free lounge access (Enrollment Required)

- Hotel status (Enrollment Required)

- Up to Three $50 statement credit at Saks Fifth Avenue (Enrollment Required)

$200 in Uber Credits Annually

You’ll get up to $200 in Uber credits every year (Up to $15 a month and up to $35 in December). What’s nice is that you don’t actually have to pay for Uber with your Platinum card*. BUT you do need to add your Platinum Card as a payment method within your Uber account, and choose to use the credit for payment before completing the ride. The rest of the reimbursement process will happen automatically.

Credits won’t roll over–that is to say if you don’t use Uber at all in May, for example, you won’t start off the month of June with $30 credit, only $15. Credits are only applied to rides within the United States.

$Up to 400 in Airline Fee Statement Credits (Enrollment Required)

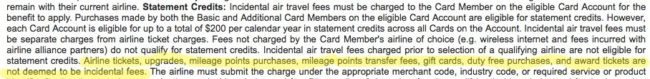

Platinum cards come with up to $200 airline fee credit each calendar year. That means in everyone’s first year of holding a Platinum card, you can get up to $400 worth of airline fees credited back to your card.

The airline fee credit is supposed to be for fees likes change fees, cancellation fees, and bag fees. The fee credit is not supposed to apply to ticket purchases, miles purchases, or gift card purchases.

But American Express’ computers decide whether a certain purchase qualifies for a fee credit, and in the experience of thousands of people, certain airline purchases will result in a statement credit (and sometimes even cheap flights that look like fees). That makes this benefit like getting up $400 in free flights, which almost completely offsets the annual fee in one swoop. There are FlyerTalk threads devoted to airlines that Amex will reimburse gift cards/cheap flights from.

In order to get the up to $200 airline fee credit, you have to choose a single airline on which you will receive credits for fees incurred. Designate that airline from the list of eligible airlines here.

It can take a few weeks for the offsetting statement credit to appear–though it usually takes just a few days. If yours doesn’t appear after a few weeks (for a legitimate incidental fee, not a gift card or cheap flight), you can call the number on the back of your card or initiate an online chat to get your statement credit.

$100 Global Entry Fee Credit (Enrollment Required)

Platinum card holders are entitled to a $100 statement credit when they pay the $100 Global Entry enrollment fee with their Platinum cards.

Having Global Entry allows you to skip the immigration and customs queues when arriving in the US. Instead of spending time in line and talking to an agent, you tap a few buttons at a kiosk and get to the curb in a few minutes. Global Entry membership is valid for 5 years. I love Global Entry.

There are just a few steps involved in obtaining Global entry: an application and an interview.

First, you need to create a US Customs and Border Protection Trusted Travelers Program account for Global Entry.

Once you are registered with the Trusted Travelers Program, log in to the system. Select the link that allows you to start the application for Global Entry. At this point you have two steps left;

In the application you will have to fill out a variety of personal information. And provide proof of your identity, US residency, and background information.

Fill out all the sections and submit your application. You will be prompted to pay the $100 application fee–make sure you use your Amex Platinum to pay this in order to have the fee credited back to you!

Once your application is approved, you can use the same account to schedule the interview, which will take place at any airport that participates in the Global Entry program.

To be clear, you could technically just apply for TSA Pre✓ and get an $85 statement credit for that application fee. But you might as well apply for Global Entry as you get up to a $100 statement credit (and all those with Global Entry also get TSA Pre✓ perks).

Free Lounge Access (Enrollment Required)

You can get free lounge access at Delta Sky Clubs by showing your American Express Platinum Card and boarding pass–no set up required! You also get free access to American Express Centurion Lounges, which are the nicest domestic lounges, as well as International American Express lounges and Airspace lounges.

You can get even better lounge coverage–especially internationally–by signing up for a free Priority Pass membership to complement the automatic free lounge access.

Priority Pass Select (Enrollment Required)

Priority Pass is the world’s largest independent airport lounge access program. Platinum Card holders plus two guests per visit gain access to over 1,200 lounges worldwide. Note that the two guest policy is only allowed when guests in general are allowed. Not all Priority Pass lounges allow guests.

Sign up for your free Priority Pass Select account here. I received my shiny black and gold Priority Pass card in the mail only 5 days after I called.

I downloaded the app on my phone, so I can search for participating lounges by airport while I travel.

There’s more information about this benefit here.

Hotel Status (Enrollment Required)

Marriott Bonvoy Gold Status (Enrollment Required)

Platinum Card holders are entitled to free Gold status in the Marriott Bonvoy program. These are the best parts of Gold Status, which you’ll get at all Marriott/SPG participating hotels:

Call the number on the back of your card to get free Marriott Gold Status. You will be transferred to an agent who can even create a new Bonvoy account for you and give it Gold Status.

According to a commenter on this post, if you already have status you can gift this benefit to someone so it doesn’t go to waste. If anyone has experience with this let us know in the comments.

Hilton Gold Status (Enrollment Required)

To get Hilton Gold Status, click this link.

If you have additional cardholders, they can get Hilton Gold Status too, just not online.

![]()

Hilton Gold Status entitles you to an 80% points bonus, fifth night free on award bookings, late checkout, 2nd guest stays free, and more. Click here for all the benefits of Hilton Gold.

Statement credits at Saks Fifth Avenue (Enrollment Required)

Amex will credit you $50 in Saks Fifth Avenue purchases January – June, and another $50 July – December. That’s a maximum of $150 in statement credits within the first year of holding the card. Example: You open the Amex Platinum this month (May), spend $50 in June, another $50 in November, and then another $50 in March of 2020. That’s $150 in statement credits.

Purchases can be online or in a store, but nothing shipped internationally will count. You must enroll here before using your card at Saks if you want the statement credits.

Recap

The American Express Platinum cards come with big annual fees, but even bigger benefits. The benefits require a little bit of work to set up, but none are hard to do.

-Call American Express at the number on the back of your AMEX card:

- Designate an airline to receive your $200 annual (calendar year) airline fee credit (or enroll online).

- Ask to be enrolled in Priority Pass Select (or enroll online).

- Ask to be given Gold status with Marriott (or enroll online).

-Add your Platinum Card as a payment method within your Uber account.

–Enroll for Hilton Gold Status online.

-Buy gift cards with your AMEX Platinum on the airline you designated that will be reimbursed by the airline fee credit. I recommend buying them with Delta, JetBlue, or Southwest. Then use those gift cards for free flights.

-Apply for Global Entry, paying the fee with your Amex Platinum. Then enjoy plane-to-curb times under ten minutes on international flights.

There are even more benefits of holding a Platinum Card, many more than would fit here and most of little use for the majority of people. For a complete list including benefits at car rental agencies, cruise agencies, and more, see here.

For me, a ten minute phone call was the easier way to enroll in these benefits. If you prefer not to speak to an agent, you can enroll for most benefits online here.

Just getting started in the world of points and miles? The Chase Sapphire Preferred is the best card for you to start with.

With a bonus of 60,000 points after $4,000 spend in the first 3 months, 5x points on travel booked through the Chase Travel Portal and 3x points on restaurants, streaming services, and online groceries (excluding Target, Walmart, and wholesale clubs), this card truly cannot be beat for getting started!

Editorial Disclaimer: The editorial content is not provided or commissioned by the credit card issuers. Opinions expressed here are the author’s alone, not those of the credit card issuers, and have not been reviewed, approved or otherwise endorsed by the credit card issuers.

The comments section below is not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser’s responsibility to ensure all questions are answered.

Nice post Scott, however, find that will all bloggers who write about AMX-P card for us miss (besides the 50K MR bonus) most important benefit for cruisers. If you book a cruise on 15 different cruiselines, pay with an AMX card (not a cobranded one like delta/costco) and are an AMX-P or Centurion card member you get cruise benefits for each cruise booked. For example, Cruise Privileges benefits aboard Silversea

$300 per stateroom shipboard credit

Complimentary bottle of premium champagne

Exclusive tour of vessel’s galley hosted by a chef

We book 2-3 cruises per year, have at least two (AMX-P cards each–rotate when annual fee is due) primarily for cruise benneis. Pls see this link:

https://travel.americanexpress.com/travel/cpp

Wes, do you also need to book the cruise through Amex travel? Or can you book through anywhere that has the lowest price and pay with Platinum in order to get the credit?

Flying Boat, No, u do not need to book via AMX Travel, tho sometimes their reps mistakingly tell clients they do. We have booked with our Travel AGent (TA) for nine years following this procedure to ensure we get our AMX-P cruise bennies. A few weeks prior to cruising, have your TA (or if you made a direct booking with the cruiseline hae the cruiseline rep contact AMX-P) contact their counterpart at AMX-P and get your AMX-P cruise benefit tracking number. A good back up once u board so if your $300 SBC and premium bottle of wine/Champagne (Dom) is not in your suite–you can have your TA (or the cruise reception desk) backtrack with this tracking # to ensure y0u get your cruise benefits. We have had to use this procedure just once in 12 cruises to get our benefits–11/12 times the SBC and Dom were waiting for us in our suite.

Wow,we cruise a lot.This is very helpful. My question is do you have to put the total amount of your booking on the Platinum? I split up mine to take care of multiple spending requirements for whatever cards I just signed up. Will this still work?

Another goldmine (well platinum mine) of information. Got the card a few months back with the 100,000 offer, signed up for all of the above, except the lounge pass. Thank you for your post and reminder.

One other really really good benefit is that Amex actually lets you BORROW Membership Rewards points before you earn them. As a Platinum card holder, you can borrow 60,000 points a year and you have a year to pay them back. This basically makes your signup bonus usable on Day 1 or any future spending you plan to do. I have already used this benefit twice this year, including when I completely rebooked my friend’s award flights to Cancun 2 days before the trip due to a canceled flight: Four Girls to Cancun Mishap: Completely Rebooking Tatyana at T minus 58 hours

Oh, and the SPG Gold status doesn’t even have to be to your account. You can gift it to someone else. This way the benefit doesn’t go to waste if you either 1. already have Gold like from spending $30,000 on your SPG Amex or 2. don’t use Starwood hotels.

There is another benefit that American Express Platinum doesn’t always let people know about regarding the $200 airline annual credit. Starting back in November 2012, they also credit back fees on partner airlines. Example, I chose Delta based on some European travel I have coming up in May. I will be flying Delta on the way over and back, but will utilizing Air France, Alitalia, and KLM for inter-European flights. AmEx Plat will now credit back the same fees on those flights as well. I was told that you probably would have to call and ask for partner credit. I took advantage of this with some booking fees for an award ticket on Alitalia. Called AmEx after about a month of not seeing a credit, and they immediately credited me back for the fees.

You learn something new everyday.

thanks for the great info. Do you think it would work to cancel my amex one with the $450 yr fee and ask for this one instead? and have the fee apply? or cancel ask for fee refund (partial) and then apply for this one. I have a good credit score but really don’t travel all that much. also what is your success with using this new card credits ect with delta as when I do fly I pretty much always go delta? I live in small town. vps…. thank you

Yes, I would call AMEX and see what they can do for you. The AMEX One doesn’t appear to have any valuable benefits from the quick look I took–certainly nothing in the league of the AMEX Platinum.

The AMEX Platinum points earned transfer 1:1 and instantly to Delta miles if that’s how you want to use them, so in that sense they work perfectly to fly Delta.

I got an email from GOES that said “my application status had changed.” So it didn’t tell me what the decision was, but it did tell me that there was a decision and I could log in to see it. Maybe you set your contact preferences differently?

LOVE your new look!

The new logo is a no go. If you want to build your brand, you need to be consistent.

I love the new look! I’d think your visor would be orange & blue, though?

I love your blog content, but I’m not a fan of the new logo. Sorry. I’ve pretty much taken advantage of the basic Plat benefits, and now I’m also looking into using the cruise benefits. Could come in very handy for it with the onboard credit.

Ironically got mine in the mail today… and fee free thanks to Ameriprise. (I know, min. spend is better, but I have my reasons.)

Can you elaborate on the $500 in statement credits (listed in red under the MBZ Plat Amex info)? I don’t see anything about this on the landing page or anywhere else – what do you need to do to get the $500 in statement credits? Am I missing something?

$400 in airline fee statement credits and $100 in Global Entry fee credit–the next two black bold headers in the post.

Thanks for clarifying – I thought that was a separate credit from the next two. Lots of great info -thanks!

[…] Malaysia Airlines lounge is the same lounge that Priority Pass users are granted access to, so anyone with an American Express Platinum can get in. It is called the Icare lounge and it has a pretty decent selection of food and snacks. […]

Are you sure that the Mercedes Benz card offers Global Entry benefits? I don’t see it mentioned anywhere on their website . . .

Nor is the $200 airline credit listed. But people get all the same benefits from both cards from everything I’ve read.

Just had a long talk with the Platinum Travel folks regarding the Business/First Class companion ticket. It’s a full-fare ticket.

For us that meant a Business-class ticket from LAX to NCE was $15,000.

We could buy the same ticket (same airline) ourselves for $7,300.

Or fly Virgin for $5944.

So, we’re better off buying our tickets outside of the Platinum program. It’s not all it seems.

[…] See here for the full rundown of benefits and how to activate them. […]

[…] The Mercedes Benz Platinum Card from American Express with 50,000 Membership Rewards after spending $3k in three months. This card has a $475 annual fee. You can recoup that value by following this step-by-step guide to activating the card’s benefits. […]

Don’t forget upgraded car rental status with Hertz, National and Avis. That alone is worth a couple bucks considering the Executive status with National requires 12 rental periods.

The Mercedes platinum card also comes with $100 gift certificate from MB for promotional merchandise- nice stuff, but not cheap if it were not free – insulated driving cup, umbrella, cooler bags, jacket.

Bev, concur… Besides the 50K MR bonus, Global Entry fee, $200 airline fee reimbursement, lounge access. Pls see links below (DW go two purses with her/my $100 MB certificate good for any MB accessory) but you have a potpourri of items to select from (e.g. cooler below (2nd link below)):

http://www.accessories.mbusa.com/MBUSA_2012/Lifestyle+Collection/Luggage+Handbags/?page_no=3

http://www.accessories.mbusa.com/MBUSA_2012/Lifestyle+Collection/Outdoor/

Two weeks ago DW ordered a couple of purses ($197) but paid for by MB $100 accessories cert u get from MBUSA about one month after your MB AMX card has been activated. Since we both got this card (netted over 100K MR points) in last 10 months (we had two $100 certs) to use. Tip, if u have a relationship with your local MB dealer, call the parts pro and then give he/she the accessory # of what you want (e.g., Large Maroon Satchel=Part Number: A9629990705) Let them know you are paying with your AMX MB cert and ask them to pls notify/call you when the part (purse) is in. If you exceed the cert’s value (e.g., for the item you select) you can expect to pay any State tax as well as the price difference.

[…] are a $200 annual airline fee credit, lounge access, and SPG Gold status. For more information, see Get the Most Out of Your American Express Platinum Card. The annual fee is […]

[…] credits plus worldwide airport lounge access plus Starwood elite status by holding the card. See Get the Most out of Your American Express Platinum Card for full details on how to activate all those benefits in a three minute phone […]

[…] One Complimentary Pass to the US Airways Club Annually: This is a solid, but not new, benefit. I haven’t used it because I get free access to the US Airways Club with my American Express Platinum Card. […]

[…] If you don’t win, you can always get lounge access worldwide with The Platinum Card® from American Express. (For more info on the lounge-access benefit, the $500 in statement credits in the first 12 months, and the card’s other benefits, see Get the Most out of Your American Express Platinum Card. […]

[…] are described in detail–including how to activate those that aren’t automatic–in Get the Most Out of Your American Express Platinum Card. Combined I think the benefits easily outweigh the $450 annual […]

[…] bonus Membership Rewards after spending $3k in three months. The card has a $475 annual fee that is totally worth paying. I also love the American Express® Premier Rewards Gold Card with its 25k bonus Membership Rewards […]

[…] If you don’t win, you can always get lounge access worldwide with The Platinum Card® from American Express. (For more info on the lounge-access benefit, the $500 in statement credits in the first 12 months, and the card’s other benefits, see Get the Most out of Your American Express Platinum Card.) […]

[…] I do embarrassingly often, I consulted a MileValue post to refresh my memory. Specifically I read Get the Most Out of Your American Express Platinum Card to remind myself of all of the card’s benefits and how to activate […]

[…] For more info on setting up and maximizing the benefits, see Get the Most Out of Your Platinum Card. […]

[…] The Business Platinum Card® from American Express OPEN with 25k bonus Membership Rewards after spending $5k in the first three months (plus all these benefits) […]

I have the Am Ex Business card (not platinum). It’s free. I also have Chase Platinum $95 yr.

Will fly from LA to Melbourne Jan 25 2015 and back to LA from Wellington Feb 25 2015. Does anyone know if either (or both) would help with an upgrade to Business on Quantas? Due to 4 leg vein surgeries this year, moving around and lying flat are important as well as for sleep. RT JFK to LA not a big deal. Thanks! Anne

[…] For more info on setting up and maximizing the benefits, see Get the Most Out of Your Platinum Card. […]

[…] If you don’t win, you can always get lounge access worldwide with The Platinum Card® from American Express. Terms & Conditions Apply. (For more info on the lounge-access benefit, the potential $500 in statement credits in the first 12 months, and the card’s other benefits, see Get the Most out of Your American Express Platinum Card.) […]

[…] Find out more about the benefits of the Business Platinum Card® from American Express OPEN in How to Get the Most out of Your Platinum Card. […]

[…] bonus Membership Rewards after spending $3k in three months. The card has a $475 annual fee that is totally worth paying. I also love the American Express® Premier Rewards Gold Card with its 25k bonus Membership Rewards […]

After many calls, the last with an Amex-P supervisor, I was told that I would not receive the 40K sign-up bonus points because I applied for the platinum card myself, (wasn’t marketed) after reading your blog, and was told the sign-up bonus was not in effect at the time of sign-up.

Not knowing of the bonus points not being valid, I easily spent over the 3-month financial threshold with the card.

Another lesson in why you can’t always believe what you read on the Web.

If it said 40k on the page where you applied on AMEX’s site, you should make that point to them. I’d be shocked if they didn’t honor the offer you saw when applying.

I made the “mistake” of applying over the phone – not online.

Because of this difference, the points were denied, and yes, I am “shocked”.

Applying online is better because you can record what the landing page offers looked like. Tough break!

Yes, but as the saying goes, “We learn from our experiences”.

That much said, (and learned!), at least now I know better.

Would you be able to take a companion with you into the lounge or get a discounted rate for the companion?

[…] The third card you’d want is the Platinum Card from American Express Exclusively for Mercedes-Benz. The Platinum Card from American Express Exclusively for Mercedes-Benz comes with 50,000 Membership Rewards after spending $3,000 in the first three months. The card has a $475 annual fee in the first year. But it comes with huge benefits like airline fee reimbursement, airport lounge access, and hotel status. For more info on setting up and maximizing the benefits, see Get the Most Out of Your Platinum Card. […]

[…] The Platinum Card from American Express Exclusively for Mercedes-Benz offers 50,000 bonus Membership Rewards after spending $3,000 in the first three months. Anyone can get this card even if you don’t have a Mercedes or plan to get one. This card has a $475 annual fee that I think is outweighed by $400 in free airline gift cards and Ce… […]

[…] is some differentiation though. The AMEX Platinum offers free SPG Gold elite status while you hold a Platinum card. The Citi Prestige® Card offers the 4th night free on hotel stays […]

[…] Get the Most out of Your American Express Platinum Card for a rundown of the […]

[…] updated Get the Most Out of Your American Express Platinum Card to include this benefit. If you have a Platinum card, you have to read that […]

Just wondering how much do you value each MR point? What is the best way to use MR point if you travel to hong kong mostly

2 cents each, probably transferring to Delta miles or Aeroplan miles. Depends on the exact award space picture on the day you want to fly.

[…] agent in the Gold elite line–a status I have because it is a free perk of the AMEX Platinum–informed me that I had been upgraded to a corner Sea View […]

[…] You can get free SPG Gold status if you hold any American Express Platinum card. […]

[…] sure to check out Rookie Alli’s post, Get the Most Out of Your American Express Platinum Card for the complete run down on Platinum card […]

[…] Find out more about the benefits of the Business Platinum Card® from American Express OPEN in How to Get the Most out of Your Platinum Card. […]

[…] Flying Blue miles are a 1:1 transfer partner of Membership Rewards, so she needs 13k Membership Rewards or a friend with 13,000 Membership Rewards. You can earn 40,000 Membership Rewards after spending $3,000 on The Platinum Card® from American Express. The card has a $450 annual fee that I think is more than made up for by having the best features of any card. […]

[…] bonus Membership Rewards after spending $3k in three months. The card has a $475 annual fee that is totally worth paying. I also love the American Express® Premier Rewards Gold Card with its 25k bonus Membership Rewards […]

[…] For more info on setting up and maximizing the benefits, see Get the Most Out of Your Platinum Card. […]

[…] For more info on setting up and maximizing the benefits, see Get the Most Out of Your Platinum Card. […]

[…] security, I headed for a lounge. I have an American Express Platinum card, which means I have free Priority Pass Select lounge access. I fired up the Priority Pass app and saw that the Virgin America Loft in Terminal 3 was open to […]

[…] Get the Most Out of Your American Express Platinum Card […]

[…] To maximize the benefits of your new AMEX Platinum, make sure you read Get the Most Out of Your American Express Platinum and Business Platinum Cards […]

[…] Get the Most Out of Your American … – The American Express Platinum personal and business cards come with annual fees of $450. But they also come with a litany of valuable benefits worth more than $450 … […]

[…] The card has a $475 annual fee in the first year, but it comes with huge benefits like airline fee reimbursements, airport lounge access, and hotel status. For more information about setting up and maximizing the benefits of this card, see Get the Most Out of Your Platinum Card. […]

[…] have Global Entry. For $100, the time it took to fill out a detailed form (an hour), and a twenty minute interview at a…, I can skip the immigration and customs lines every time I land in the United States for five […]

[…] For more info on setting up and maximizing the benefits, see Get the Most Out of Your Platinum Card. […]

[…] Get the Most out of Your American Express Platinum Card for a rundown of the […]

[…] For more info on setting up and maximizing the benefits, see Get the Most Out of Your Platinum Card. […]

[…] Here is how to set up and maximize those benefits. […]

Hi Scott: I recently received my Amex Platinum MB card and saw that my points could not be transferred to American Airlines. However, they can be transferred to the Starwoods Guest Program. In theory, I could then transfer them again, this time into American’s program. Have you had any experience making such a “double” transfer? Thanks, as always, for the great insights.

You technically could do that, yes, but I do not recommend it because every 1,000 Membership Rewards transferred to Starwood Preferred Guest becomes 333 SPG points (transfer rate of 1,000:333)…so you lose most of the value.

[…] One of the easiest way to earn a lot of Membership Rewards at once is by signing up for the Platinum Card from American Express Exclusively for Mercedes-Benz which offers 50,000 bonus Membership Rewards after spending $3,000 in the first three months. Read more about how to get the most of out the Amex Platinum for Mercedes-Benz card here. […]

[…] The Platinum Card® from American Express Read how to get the most out of your American Express Platinum cards. […]

[…] Being a cardholder gets you SPG Gold, Marriott Gold, Hilton Gold, and status and discounts with other companies. See this post for more information. […]

Scott: Last week I designated Delta as my airline on my AMEX MB card, but I no longer see the $200 travel credit being offered under the Card’s benefits section. Has that offer expired? Thanks for all the great information.

It is still a benefit.

Amex Plat is offering Hilton Gold status as well now. Got this card because of Scott last year, and absolutely love it.

Re the Cruise benefits –

There are exceptions. You generally cannot get the benefits on a ‘flash’ sale or some such nonsense, probably made up by agencies and TAs. I’m a total last minute value cruiser and often get in on these deals. I have been denied every time.

[…] Those with an American Express Platinum or Business Platinum card can access the Amex lounge in São Paulo sponsored by Bradesco. The Amex Platinum cards also come with lounge access to the Centurion and Airspace lounges, as well as Priority Pass lounges (but you have to sign up for the Priority Pass first–learn more about how to make the most out of your Amex Platinum). […]

[…] choose an airline for your $200 annual airline fee statement credit, you’ll also be able to redeem Membership Rewards for 2 cents per point toward paid flights […]

[…] Plus the card has all the standard Amex Platinum benefits like lounge access, hotel status, and much more. […]

[…] Get the Most Out of Your American Express Platinum Card […]

[…] strategy is obvious. Get the Business Platinum for its bonus, lounge access, airline fee credits, hotel status, and 50% rebate on…. But get another American Express card to actually use for […]

[…] Being a cardholder gets you SPG Gold, Marriott Gold, Hilton Gold, and status and discounts with other companies. See this post for more information. […]

[…] How to Get the Most out of Your American Express Platinum Card to go over the benefits the card already comes […]

So I’m pre-qualified for Amex Platinum ($550 year) but in 4 phone calls have not been able to get to the ‘person’ who will match that bonus to the Schwab platinum card of the same price.

GOES

Emailed me last Tuesday to set up a appointment . I could’ve @ ORD on Thursday was Wide open Every 15 mins picked another day .Lets C if I can get it before 9/20 then try for TSA pre check .

[…] Here is a link from an expert I frequently use that helped me get the maximum value out of this card. […]

[…] Learn more about getting the most out of your Amex Platinum benefits. […]

[…] The card has a $550 annual fee. But it comes with huge benefits like airline fee reimbursement (which you can also use to buy airline gift cards), airport lounge access, hotel status, $200 in Uber credit, and a 5x category bonus for purchases directly from airlines. For more info on setting up and maximizing the benefits, see Get the Most Out of Your Platinum Card. […]