MileValue is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

Note: Some of the offers mentioned below may have changed or are no longer be available. You can view current offers here.

Southwest currently has a purely fixed-value rewards program. For every dollar of the base fare, you have to redeem 70 Rapid Rewards to get your ticket (plus you pay a $5.60 per direction government tax on each redemption.)

That’s about to get worse, much worse in my opinion.

Current Rapid Rewards Scheme

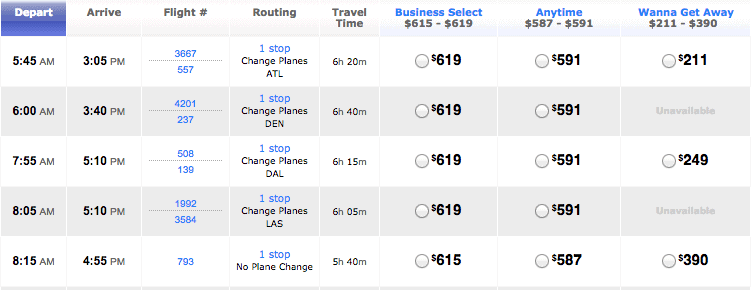

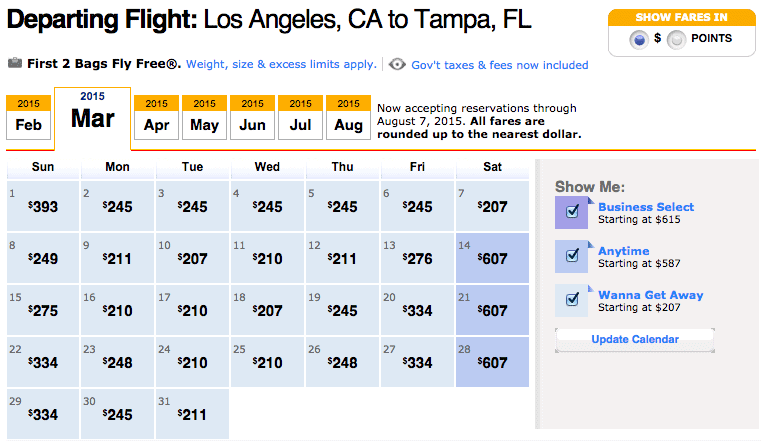

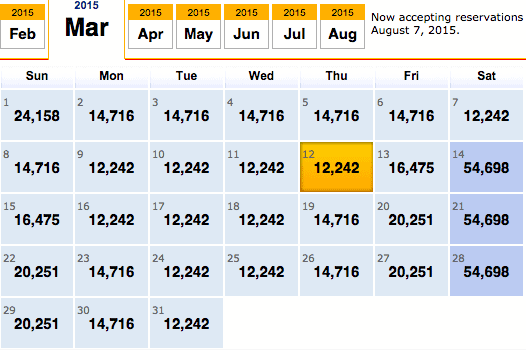

Let’s look at an example. Here are the pries for tickets from Los Angeles to Tampa this March. They vary greatly by day from $207 to $334 to $607.

If you select a day with $211 fares, not all fares that day are $211. Fares vary by flight.

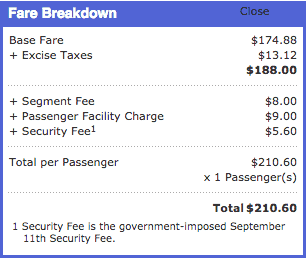

You can select the $211 fare and find it is $188 in base fare plus taxes.

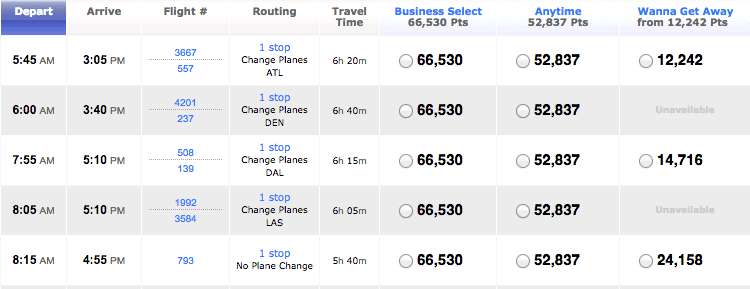

Now you can go back and look at the exact same calendar for Tampa to Los Angeles in points instead of cash. Now all those $207, $210, and $211 fare days show 12,242 points. The more expensive days require more points.

The exact same flight that costs $211 costs 12,242 points.

If you divide that 12,242 by 70, the supposed number of points needed per dollar, you get about $175, which is less than the listed base fare. Southwest often charges fewer points than the base fare times 70. Let’s not look into that too closely. 😉

If you divide that 12,242 by 70, the supposed number of points needed per dollar, you get about $175, which is less than the listed base fare. Southwest often charges fewer points than the base fare times 70. Let’s not look into that too closely. 😉

So that’s the current system. Every “Wanna Get Away” fare can be purchased with points at a fixed rate. No blackouts, no exceptions. The points are worth around 1.4 cents each. Most miles and points are worth more, but I still love the Rapid Rewards system for its simplicity and diversity.

Diversity is a key part of your miles strategy. If every program in which you collect miles is the same–it has a region-based award chart and capacity-controlled award space–you won’t get as much value as a mixture of region-based award charts (United, Delta, American), distance-based charts (British Airways), and fixed-value (Southwest, Arrival.) The diversity allows you to always have the right type of miles for the job, and fixed-value points specifically are usually the best option for domestic economy redemptions.

In return for “giving up” the ability to make tricky high-value routings and to redeem for aspirational awards with fixed-value points, I expect fixed-value points to be fixed value–worth the same for every flight with no blackouts.

That’s what’s changing with Southwest.

The New Rapid Rewards

Southwest released updates this week effective April 17:

Beginning April 17, 2015, the number of Rapid Rewards Points needed to redeem for certain flights will vary based on destination, time, day of travel, demand, fare class, and other factors. However, there are still many flights which will stay at the current redemption rate.

Whoa, whoa, whoa! That eviscerates the entire nature of Rapid Rewards. Rapid Rewards redemptions currently vary based on two factors: price of the ticket and which fare class you choose (until a few days before departure “Wanna Get Away” fares are available on 99% of flights, so this second factor is rarely important.)

Now an infinite list of factors has been added:

- destination

- time

- day

- demand

- other factors

First, this strikes me as very disingenuous. All these factors are captured in the price of the ticket which correlates perfectly with the price of current Rapid Rewards awards.

Second, this undermines the whole “contract” I talked about in the last section. We give up our tricks and aspirational awards for certainty under a fixed-value regime. Now we get no tricks, no aspirational awards, and no certainty.

Third, the size of this devaluation comes down to how it works in practice. We’ll just have to see how many award prices Southwest jacks up. And you’ll have to do the math on each award to find out since Southwest doesn’t have an award chart.

Fourth, in the sense of waiting, this devaluation is like Delta’s recent devaluation. When programs have no award chart and no fixed-way of pricing awards, we are completely at their mercy for award prices and further stealth devaluations. I don’t like that.

Bottom Line

We’ll see how much award prices actually change on Southwest beginning April 17. No matter what happens initially, I’m still calling this a massive devaluation.

It is a massive devaluation of the simplicity of Southwest’s program, which Southwest rightly touts at every turn. It is a massive devaluation of the fixed-value program “contract.” It is a massive devaluation of our ability to trust Southwest. It is also a devaluation of the value of one Rapid Reward, the exact size of which we won’t know until April 17 and will be subject to change daily.

Just getting started in the world of points and miles? The Chase Sapphire Preferred is the best card for you to start with.

With a bonus of 60,000 points after $4,000 spend in the first 3 months, 5x points on travel booked through the Chase Travel Portal and 3x points on restaurants, streaming services, and online groceries (excluding Target, Walmart, and wholesale clubs), this card truly cannot be beat for getting started!

Editorial Disclaimer: The editorial content is not provided or commissioned by the credit card issuers. Opinions expressed here are the author’s alone, not those of the credit card issuers, and have not been reviewed, approved or otherwise endorsed by the credit card issuers.

The comments section below is not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser’s responsibility to ensure all questions are answered.

Massive? Isn’t that a bit of hyperbole? Appears to be a “massive” way to get people to read the blog.

Did you read the post? I laid out my reasoning throughout and especially at the end. If you disagree, disagree substantively and explain why this is a small devaluation. Questioning my motives doesn’t improve anyone’s day.

I agree with Scott. Although they’re giving us notice about the devaluation, it’s massive (at this point) because they won’t tell us how it will change. Many people aren’t big fans of this type of award program (fixed point value), but predictability was it’s big asset. Now, they’re announcing that effective April 17, it won’t be predictable anymore, and they won’t even tell you how or when it won’t be predictable (but adds at the end that on occasion, it will still be predictable). I’m okay with Scott calling it a massive devaluation, and he wasn’t even trying to sell any credit cards application in the meantime. Scott did a great job communicating why it is massive, and I agree.

The new schedule (for fall travel) supposedly opens up on Feb 17, and I plan on booking many trips using my points on that day.

Also, I find it interesting that their doing this on the heels of Delta’s devaluation. Would Southwest have made this move if Delta didn’t? Maybe that’s why they’re not quite sure what the exact changes will be. We know United watches Delta carefully. Are they next? And then, that leaves AA that still hasn’t made a massive devaluation (aside from removing the RTW award last April). And we know (and seen posts predicting the time and amount) that will be a devaluation sometime in the next year. How massive will yet to be seen, but it’s not going to be pretty with Delta & Southwest already laying the groundwork, and my prediction of United following suit within the next month.

Massive? Isn’t that a bit of hyperbole? Appears to be a “massive” way to get people to read the blog.

Did you read the post? I laid out my reasoning throughout and especially at the end. If you disagree, disagree substantively and explain why this is a small devaluation. Questioning my motives doesn’t improve anyone’s day.

I agree with Scott. Although they’re giving us notice about the devaluation, it’s massive (at this point) because they won’t tell us how it will change. Many people aren’t big fans of this type of award program (fixed point value), but predictability was it’s big asset. Now, they’re announcing that effective April 17, it won’t be predictable anymore, and they won’t even tell you how or when it won’t be predictable (but adds at the end that on occasion, it will still be predictable). I’m okay with Scott calling it a massive devaluation, and he wasn’t even trying to sell any credit cards application in the meantime. Scott did a great job communicating why it is massive, and I agree.

The new schedule (for fall travel) supposedly opens up on Feb 17, and I plan on booking many trips using my points on that day.

Also, I find it interesting that their doing this on the heels of Delta’s devaluation. Would Southwest have made this move if Delta didn’t? Maybe that’s why they’re not quite sure what the exact changes will be. We know United watches Delta carefully. Are they next? And then, that leaves AA that still hasn’t made a massive devaluation (aside from removing the RTW award last April). And we know (and seen posts predicting the time and amount) that will be a devaluation sometime in the next year. How massive will yet to be seen, but it’s not going to be pretty with Delta & Southwest already laying the groundwork, and my prediction of United following suit within the next month.

I don’t consider this notice at all really. The coy “something’s going to change but we won’t tell you now” concept is most frustrating and untrustworthy.

“Beginning April 17, 2015, the number of Rapid Rewards Points needed to redeem for certain flights will vary based on destination, time, day of travel, demand, fare class, and other factors. However, there are still many flights which will stay at the current redemption rate.”

Funny, I thought the fares already took destination, time, day of travel, demand, fare class, and “other factors” into consideration. And since it’s more or less a direct conversion to points, I don’t see exactly what they are changing here. Totally get your point about being super vague.

Exactly. They’re double dipping.

“Beginning April 17, 2015, the number of Rapid Rewards Points needed to redeem for certain flights will vary based on destination, time, day of travel, demand, fare class, and other factors. However, there are still many flights which will stay at the current redemption rate.”

Funny, I thought the fares already took destination, time, day of travel, demand, fare class, and “other factors” into consideration. And since it’s more or less a direct conversion to points, I don’t see exactly what they are changing here. Totally get your point about being super vague.

Exactly. They’re double dipping.

This is a massive change of Southwest’s basic philosophy for Rapid Rewards–and that should not be taken lightly by us or by Southwest. What they do with this program will have repercussions for us personally, but also to Southwest corporately.

Southwest still maintains a positive image among most of their clients, but they are teetering on the edge of being just another big airline hosing their users because business is good. Tread carefully, Southwest! You don’t want to have to change the paint on the belly of your plane from a heart to a $ sign, do you?

As of today, I still LUV Southwest. Please keep it that way.

This is a massive change of Southwest’s basic philosophy for Rapid Rewards–and that should not be taken lightly by us or by Southwest. What they do with this program will have repercussions for us personally, but also to Southwest corporately.

Southwest still maintains a positive image among most of their clients, but they are teetering on the edge of being just another big airline hosing their users because business is good. Tread carefully, Southwest! You don’t want to have to change the paint on the belly of your plane from a heart to a $ sign, do you?

As of today, I still LUV Southwest. Please keep it that way.

That’s the deal here little by little they devalue how about in a year or sooner no second bag and you need that then still later all bags have fees. I use one card only or less per EU trip hard to fine one @ 60K (ink was 70k) and that’s what the slept trip may cost.

Use Them……

That’s the deal here little by little they devalue how about in a year or sooner no second bag and you need that then still later all bags have fees. I use one card only or less per EU trip hard to fine one @ 60K (ink was 70k) and that’s what the slept trip may cost.

Use Them……

Upon thinking about this, the future devaluation is a way to black-out certain dates without calling them black-outs. They know they can sell out the Baltimore – Montego Bay, or Chicago – Cancun flights (or most flights to Florida) around President’s weekend and the Christmas holiday season. There’s no way Southwest wants to fill the flight up with Point paying customers, when the can easily fill it up with dollar paying customers. So, my prediction is that these flights that are a gimme to sell out (or any flights that are already near sold-out), will give about a penny a point value if you want to book with points. This is sort of like Delta’s attitude of “we can charge whatever we feel like charging”. I suspect the companion pass has to be on their radar screen soon for a devaluation. Are there any hard statistics as to how many companion passes have been issued, or the average utilization of uses per companion pass year?

I think those numbers are not available but my Doc saved $6500 in 12 months then his wife got a comp pass so Big Bucks for some not me.

I’ve gotten it twice, and I think one time, I used it 2 or 3 times, and the other time, I used it about 4 or 5 times total. It conceivably makes money for Southwest too, since I booked my family of five on a flight with southwest, primarily because I had a companion pass. So, Buy 4 get 1 free isn’t a bad marketing strategy. (I’d be interested to see some study on point utilization – meaning, how many paid flights are booked in conjunction with someone getting a free flight (as most frequent flyer accounts don’t have hundreds of thousands of points (as I’m sure many of us readers have)). Probably hard to determine, since they have to be booked on separate reservations. I hope the Companion Pass is around when I retire in 15 years, so if I do fly around a lot with the spouse, we can really get good use out of it then (like your Doc).

I was shocked he went after it ( South Beach) but does what CHEAP people do book one Earlybird then save seats for 4 like I Do..

Great Doc

Upon thinking about this, the future devaluation is a way to black-out certain dates without calling them black-outs. They know they can sell out the Baltimore – Montego Bay, or Chicago – Cancun flights (or most flights to Florida) around President’s weekend and the Christmas holiday season. There’s no way Southwest wants to fill the flight up with Point paying customers, when the can easily fill it up with dollar paying customers. So, my prediction is that these flights that are a gimme to sell out (or any flights that are already near sold-out), will give about a penny a point value if you want to book with points. This is sort of like Delta’s attitude of “we can charge whatever we feel like charging”. I suspect the companion pass has to be on their radar screen soon for a devaluation. Are there any hard statistics as to how many companion passes have been issued, or the average utilization of uses per companion pass year?

I think those numbers are not available but my Doc saved $6500 in 12 months then his wife got a comp pass so Big Bucks for some not me.

I’ve gotten it twice, and I think one time, I used it 2 or 3 times, and the other time, I used it about 4 or 5 times total. It conceivably makes money for Southwest too, since I booked my family of five on a flight with southwest, primarily because I had a companion pass. So, Buy 4 get 1 free isn’t a bad marketing strategy. (I’d be interested to see some study on point utilization – meaning, how many paid flights are booked in conjunction with someone getting a free flight (as most frequent flyer accounts don’t have hundreds of thousands of points (as I’m sure many of us readers have)). Probably hard to determine, since they have to be booked on separate reservations. I hope the Companion Pass is around when I retire in 15 years, so if I do fly around a lot with the spouse, we can really get good use out of it then (like your Doc).

I was shocked he went after it ( South Beach) but does what CHEAP people do book one Earlybird then save seats for 4 like I Do..

Great Doc

First Delta and now Southwest are basically saying “TRUST US”! They must be kidding. Transparency is the only way customers have a chance at being treated fairly. If I was a marketer for a different airlines loyalty program I’d flood the market with the message “With us, you know what you get”. Let’s hope they read your posts and see how they can blow away the competition just by being honest. What a concept, honesty.

So glad I just got that companion pass and 110k miles.. to be worth less already.

[…] sale is also available with points. Most Southwest fares cost 70 points per dollar. The $49 fares are working out to 2,273 points + $5.60 one […]

[…] The free travel from the 110k Rapid Rewards and Companion Pass are worth around $3,142 even after Southwest’s recent devaluation. […]

[…] April 2015, Southwest went away from 70 points per dollar on all Wanna Get Away fares to 70 points per dollar only on the cheapest five fare classes of Wanna Get Away fares, and up to […]