MileValue is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

Note: Some of the offers mentioned below may have changed or are no longer be available. You can view current offers here.

If you’re just starting to collect miles and points, possibly the single best piece of advice is to sign up for five Chase cards before moving on to any other bank’s rewards cards. This post is going to talk about which five cards you should choose, depending on a few factors, and why.

The fact of the matter is that Chase will cut you off from eligibility for their travel rewards credit cards once you’ve opened five credit cards from any bank whatsoever in the last 24 months (not counting most business cards). It’s what people call the dreaded Chase 5/24 rule. Why does this matter? Because Chase issues some of the best rewards cards around with lucrative sign up offers as well as longterm value in the return you’ll get on spending.

Of course, not all consumers are the same. This is not a one five-card combination fits-all type of situation. I’ve broken down your options into four five-card combos, however, that I think will fit the majority of people’s needs. Today I’ll cover Combo #1. In the coming days I’ll write a few more posts about Combo #2 and #3, and the bonus Combo for true points omnivores.

Combo #1 (THIS POST)

- Chase Sapphire Reserve®

- Chase Freedom Flex℠

- Chase Ink Business Preferred® Credit Card

- One Chase Southwest consumer card (see options below)

- Southwest® Rapid Rewards® Premier Business Credit Card

If you’re not interested in Southwest Rapid Rewards nor the companion pass/don’t live in city served by Southwest, then apply for the:

- Chase Sapphire Reserve®

- Chase Freedom Flex℠

- Chase Ink Business Preferred® Credit Card

- Chase Ink Business Cash® Credit Card

- Chase Ink Business Unlimited® Credit Card

Not eligible for business credit cards? You sure? Ok, then here are the five consumer cards I’d go for.

- Chase Sapphire Reserve®

- Chase Freedom Flex℠

- Chase Freedom Unlimited®

- United℠ Explorer Card

- Marriott Bonvoy Boundless® Credit Card

Bonus Combo for Points Omnivores: read more in the linked post.

Today I’ll tell you a little about each card in Combo #1 and what you’d earn total from those cards.

Chase Sapphire Reserve®

The Chase Sapphire Reserve® comes with a bonus of 50,000 Ultimate Rewards after spending $4,000 on the card in the first three months. You should be able to earn $300 to $400 in statement credits each year of card membership that help defray the $550 annual fee:

- The first $300 in statement credits come from the automatic rebate of the first $300 you spend on the card in the travel category each cardmember year (not calendar year).

- The last $100 in statement credits you’ll earn by paying Global Entry’s $100 application fee with the card. If you already have Global Entry, you can pay someone else’s application fee.

The card also comes with airport lounge access at over 1,200 lounges worldwide via the Priority Pass for yourself and two guests.

You’ll earn 3 Ultimate Rewards points for every dollar you spend on dining. You’ll also receive the same point value on travel after earning your $300 travel credit. Ultimate Rewards are versatile–you can transfer them (1:1) to eight different airline loyalty programs. That includes four programs with region-based miles, three with distance-based miles, one with airline points. You can also redeem them for 1.5 cents each through the Chase travel portal on cash tickets, which is often the better option for domestic economy flyers.

No foreign transaction fees are collected.

Chase Freedom Flex℠

Freedom cards are marketed as a cash back cards, but if you also have a Chase card that earns Ultimate Rewards that can be transferred to airline/hotel partners (i.e. Sapphire Reserve, Chase Ink Business Preferred® Credit Card, Sapphire Preferred), then all you have to do is move the Ultimate Rewards earned by your Chase Freedom Flex℠ into that account and voilà. They turn into that kind of Ultimate Reward, that can be transferred to airline/hotel partners or be redeemed for 1.25 to 1.5 cents a piece through the Chase travel portal.

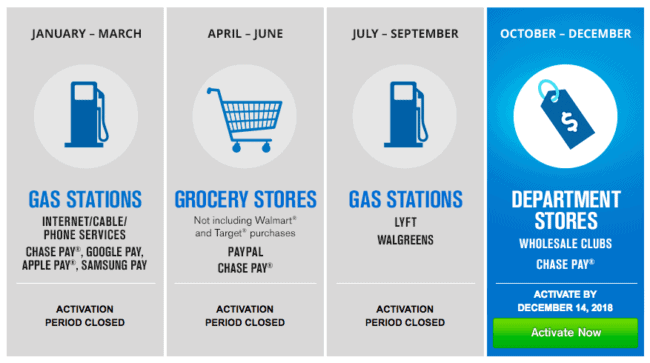

This card has no annual fee, and you’ll earn 5x points on the first $1,500 in spending per quarter in rotating categories.

Chase also issues another “cash back” card, the Chase Freedom Unlimited®, that earns a simple 1.5x points on all purchases. But you’d have to spend a lot more on it to make up for what you could earn with the Freedom Unlimited by maximizing category bonuses.

If you max out the spending for a year in bonus categories, you’d earn 30,000 Ultimate Rewards on your Chase Freedom Flex℠ for $6,000 in spending. The same spending on the Chase Freedom Unlimited® would earn 9,000 Ultimate Rewards. To make up the 21,000 Ultimate Rewards shortfall, you’d need to spend another $42,000 on each card in a year.

$48,000 on Freedom Unlimited = 72,000 Ultimate Rewards

$6,000 on Chase Freedom Flex℠ in 5x categories + $42,000 on Chase Freedom Flex℠ at 1x = 72,000 Ultimate Rewards

The Chase Freedom Flex℠ does charge foreign transaction fees.

Chase Ink Business Preferred® Credit Card

The Chase Ink Business Preferred® Credit Card has an annual fee of $95 and no foreign transaction fees.

You’ll earn 3x Ultimate Rewards on travel; shipping; internet, cable, and phone services; as well as search engine or social network advertising up to your first $150,000 combined in those categories during your cardmember year.

Read this if you’re not sure you qualify for a business card.

Southwest Cards

Southwest Rapid Rewards, if you live in a city served by Southwest and travel places served by Southwest, can often be the most valuable rewards currency for domestic travel. The major incentive behind the Southwest cards is that they’re a fast track to earning a Companion Pass–your travel companion flies free except for taxes. You need to earn 135,000 Southwest Rapid Rewards in a calendar year to qualify for that calendar year and the following one and Rapid Rewards earned by the bonuses on Southwest Cards count.

None charge foreign transaction fees.

You have five Southwest cards to choose from, but Chase only allows one consumer card per person. So if you want the 135k qualifying points for the Companion Pass, the business card + one consumer card is the fastest route.

The information for the Southwest Rapid Rewards Premier Credit Card has been collected independently by MileValue. The card details on this page have not been reviewed or provided by the card issuer.

What You’ll Get Total From Combo #1

Your potential for return on spending would span the following category bonuses:

- 5 Ultimate Rewards per dollar spent on rotating categories (common categories are gas stations, grocery stores, drug stores, PayPal and Apple Pay, restaurants, and Amazon)

- 3 Ultimate Rewards per dollar spent on travel and dining (via Sapphire Reserve)

- 3 Ultimate Rewards per dollar spent on travel; shipping; internet, cable, and phone services; as well as search engine or social network advertising

- 2 Southwest Raid Rewards per dollar spent on Southwest purchases

Timing of Applications

The general consensus is that Chase won’t, automatically at least, approve more than two applications in a 30 day period. It is possible to get approved for more than that, but you’ll almost certainly have to put in a reconsideration phone call and Chase representatives are known for being rather difficult in that aspect.

It’s wise to apply for two at the same time (on the same day), as the two hard credit inquiries should combine into one as long as both are personal cards or both are business cards. I’d recommend putting some time–at least three months if not four–between these double application days though, as Chase will shut down accounts for too many new accounts too quickly as it makes you look risky to lend more credit to.

Bottom Line

If you plan on pursuing miles and points as a hobby, it’s a no-brainer that your first five rewards cards should be issued by Chase. If you’re interested in earning a Companion Pass and/or Rapid Rewards for Southwest flights, then the first five should be the Sapphire Reserve, the Freedom, the Chase Ink Business Preferred® Credit Card, and two Southwest cards.

I’ll discuss Combo #2, #3, and the bonus combo in upcoming posts.

The above recommendations will apply to the majority of people, but not everyone. If you have a very specific destination in mind and you want to make sure you earn the right type of rewards for you trip, use our Credit Card Consultation Service. I’ll make sure you’re set up with the right cards.

Just getting started in the world of points and miles? The Chase Sapphire Preferred is the best card for you to start with.

With a bonus of 60,000 points after $4,000 spend in the first 3 months, 5x points on travel booked through the Chase Travel Portal and 3x points on restaurants, streaming services, and online groceries (excluding Target, Walmart, and wholesale clubs), this card truly cannot be beat for getting started!

Editorial Disclaimer: The editorial content is not provided or commissioned by the credit card issuers. Opinions expressed here are the author’s alone, not those of the credit card issuers, and have not been reviewed, approved or otherwise endorsed by the credit card issuers.

The comments section below is not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser’s responsibility to ensure all questions are answered.

[…] The Five Chase Cards You Should Apply For […]

I applied for the Reserve a few weeks back and got bounced by the 5/24 rule.

I didn’t bother to follow up.

Do you already have a Chase card or some other relationship with Chase? If so try going into a branch and following the steps outlined in this post. You may still have a shot.

question sarah, why wouldn’t you include sapphire preferred in combo #1 instead of the freedom? the bonus is much higher and after you get the bonus you can PC the preferred down to the freedom.

Put the Freedom in there because of the ability to to earn 5x on rotating categories for life w/no annual fee. But that is also a very good idea, thanks for pointing it out.

For anyone reading these comments, Drew’s idea is no longer possible. You cannot hold both a Sapphire Reserve and Sapphire Preferred at the same time.

Is the $300 travel credit an annual benefit every calendar year, or just the first year? If I renew my current CSR in Sept. ’17, I assume I’ll already have received one $300 credit between Jan. ’17 and Sept. ’17 (plus the $300 credit I got for Sept. ’16 to Dec. ’16) , so I won’t get another one for 2017. But, if I keep the card, would I be eligible for another $300 travel credit in 2018 and every year I renew? Or, was this just a one-time Chase offer to entice us to apply for the CSR? Also, doesn’t the Chase Ritz Carlton card have a similar benefit?

[…] The general rule of thumb concerning Chase cards is that you won’t be approved for them once you’ve opened five credit cards from ANY bank in the last 24 months. This is what people refer to as the 5/24 rule. If you haven’t hit 5/24 yet, stop reading this post and read the Best Order for Card Applications to Maximize Bonuses Over Your Lifetime and The Five Chase Cards You Should Apply For instead. […]

Here’s a 50k Signup referral link for the Southwest Premier Personal Card

https://applynow.chase.com/FlexAppWeb/renderApp.do?SPID=FHV5&CELL=63HB&MSC=1530198123

[…] 80,000 point bonus, and the good ole Sapphire Preferred with its 50,000 point bonus. These are the five Chase cards you should apply for if you’re not blocked out by the 5/24 […]

So I have the Southwest Chase card both personal and business and earned the Companion Pass last year. Yahoo! It will be good until the end of this year 2017. I just received the my January statement for the personal card which has a $99 annual fee. Is there any reason to keep the cards? I also have the Chase Reserve and the just got the Chase Business Preferred.

That’s going to depend on your personal preference. If you want to get the bonuses on them again, you have to close both and wait 24 months after you got the bonuses on each to re-apply, and stay under 5/24 of course. This might be something you want to consider if you want to eventually go for the companion pass again. If you don’t plan on doing that, then whether you keep them open depends on if it’s worth paying their annual fees to you–consider the benefits like an extra free checked bag and the anniversary Rapid Rewards bonus (6k for Premier cards, 3k for Plus) that help outweigh the annual fees.

[…] is significant because the United MileagePlus Explorer card is one of the first five travel credit cards we recommend applying for due to the Chase 5/24 rule–but only if its bonus is at 50k or […]

[…] one of the five Chase cards we recommend getting if you’re just starting out in this […]