MileValue is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

Note: Some of the offers mentioned below may have changed or are no longer be available. You can view current offers here.

On July 5, 2017, the temporarily increased sign up bonus offers for the Delta Gold and Platinum cards issued by American Express will end.

Why SkyMiles?

People like to call Delta miles SkyPesos, me included sometimes, especially when another unannounced devaluation occurs and I’m feeling resentful. That doesn’t mean they’re worthless though…every mile has its niche, including SkyPesos. And I’ve put my money where my mouth is. I’ve held a personal Gold card in the past and currently hold the business gold card.

Delta miles are good for specific reasons. One reason is to use on market standard/cheap economy awards. Another is for flash sales they run roughly once a month, because you can book heavily discounted awards. Another is if you live in a hub city, then Delta miles will give you access to more award space. And finally–my personal reasoning for earning Delta miles–is diversity for being able to book last minute. I tend to plan things down to the wire, sometimes on purpose and sometimes spontaneously, and having more miles to choose from increases my likelihood of booking something.

Why now?

Both offers are the highest on record. It’s always important to apply for Amex cards when they have a historically high sign up bonus since you can only get the public sign up bonus on a card once in your lifetime.

The Offers

- Sign Up Bonus: Platinum: 70k miles, 10k MQMs, and $100 statement credit after spending $4,000 in the first three months. Gold: 60k miles and $50 statement credit after spending $3,000 in the first three months

- Category Bonuses: 2 miles per dollar on Delta purchases

- Value of Delta Miles: Worth 1.3 cents each to me

- Free Checked Bag for you plus up to three others on same Delta reservation

- Priority Boarding

- No Foreign Transaction Fee

- Annual Fee:

Platinum: $195, not waived (so a net of -$95 after statement credit)

Gold: $95, waived for first year (so a net of +$50 after statement credit) - Eligibility: You can only get the bonus once per lifetime on public Amex offers. For example, if you’ve opened just a Gold card in the past, you are ineligible to get the bonus on the Gold again, but you can get the bonus on the Platinum.

Credit card links have been removed from posts and added to the menu bar at the top of every page of MileValue under the heading Top Travel Credit Cards.

Delta Flash Sales

Delta often runs “flash sales” on awards to specific regions for specific travel dates, sometimes in a specific cabin class. These sales usually only last a couple days–hence the name “flash”–so when you see one that appeals to you, book fast. If there’s a particularly good one going I’ll be sure to write about it here on MileValue.

Examples of past flash sales:

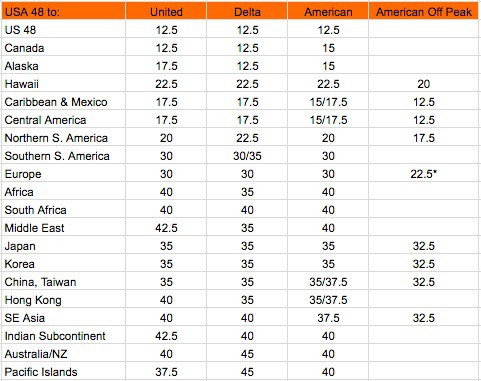

United, Delta, and American Economy Award Chart

Below is a comparison of the three legacy carriers economy award prices to all regions from the continental United States. You can see charts for Business and First Class in Comparison of United, Delta, & American Airlines Latest 2017 Award Charts

Between the three, Delta has the cheapest economy prices to Alaska, Africa, and the Middle East. It has market standard economy prices to most other regions, with the exception of flying to South America, Australia, New Zealand, or the Pacific Islands.

Delta Hubs

This one seems obvious but I think is worth pointing out anyways. It’s easy to get caught up in the math and forget about logistics.

If you live in Atlanta, Cincinnati, Boston, Detroit, Los Angeles, Minneapolis, New York, Salt Lake City, or Seattle, Delta miles are going to give you access to more award space, as those are Delta hubs. In particular, if you live in Atlanta, Cincinnati, Boston, Detroit, Minneapolis, Salt Lake City, or Seattle, Delta miles are even more important, as those cities are specifically, solely Delta hubs (United and American Airlines also have hubs in Los Angeles and New York).

Don’t Hold, Spend

All of this being said, it’s not wise to hoard Delta miles. Earn them and burn them as quickly as you can. All rewards depreciate over time, but I think it’s safe to say that SkyMiles do so more rapidly than other reward currencies.

Bottom Line

For the moment both Delta co-branded Amex cards are offering enhanced sign up bonuses: 60k for the Gold and 70k for the Platinum. Both are record high, and expire July 5, 2017.

If you’re wavering between the two cards, read more about the specifics of each offer here. Essentially, if you don’t value Delta status, they are similar offers. If you value Delta status, get the Delta Platinum card.

Value is subjective (to an extent). I collect SkyMiles for the purpose of having a diverse rewards stash. If you collect SkyMiles, what’s your reasoning?

Just getting started in the world of points and miles? The Chase Sapphire Preferred is the best card for you to start with.

With a bonus of 60,000 points after $4,000 spend in the first 3 months, 5x points on travel booked through the Chase Travel Portal and 3x points on restaurants, streaming services, and online groceries (excluding Target, Walmart, and wholesale clubs), this card truly cannot be beat for getting started!

Editorial Disclaimer: The editorial content is not provided or commissioned by the credit card issuers. Opinions expressed here are the author’s alone, not those of the credit card issuers, and have not been reviewed, approved or otherwise endorsed by the credit card issuers.

The comments section below is not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser’s responsibility to ensure all questions are answered.

Delta is the only airline I think that flys from NCE to JFK with NO connecting Flts in the EU which is a Good thing @ this time !!!! I checked Sept. Flts 60K points RT + but u have to Deal with Delta Airlines .I would really chose paying cash or walking or joining the navy first .

haha

Alaska also has a hub in Seattle. Currently my favorite program.

Indeed. Especially if you live in the western half of the country, Alaska is great for flying domestically. I’m also a huge fan of their loyalty program.

I just got a letter yesterday saying I had till late August to apply and get the 60k bonus (the mailer was only for the gold card).

[…] In light of the fact that the Delta co-branded American Express cards (both Gold and Platinum) have enhanced sign up offers ending soon (on July 5), a little over a week ago you saw me dive into the reasons why I think SkyMiles are worth collecting. […]