MileValue is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

Note: Some of the offers mentioned below may have changed or are no longer be available. You can view current offers here.

At the end of May American Express introduced the Blue Business Plus Credit Card from American Express. This card’s appeal comes from its simple, impressive non-bonused spend earning power. For no annual fee whatsoever, on the first $50,000 in purchases per calendar year (January 1 – December 31), it earns 2 Membership Rewards on ALL purchases.

In a nutshell, if you can open a business credit card and…

- have a lot of expenses that don’t fall in more lucrative bonus spending categories

….then you should consider opening a Blue Business Plus Credit Card from American Express.

Quick Facts

- Earn 2X Membership Rewards on all purchases, up to $50,000 annually (January 1 – December 31), and 1 Membership Reward per dollar spent on all other purchases.

- Value of Membership Rewards earned: Points can be transferred to 17 airline miles and 3 hotel points or used like cash toward the purchase of any flight at a rate of 1 cent per point. We value Membership Rewards at 2 cents each, and I would not use them like cash toward the purchase of a flight.

- Global Acceptance: Chip technology

- Foreign transaction fees: 2.7%, so don’t use while traveling or to make purchases from foreign companies

- No Annual Fee

- Eligibility: American Express once in a lifetime bonus rule

And here’s a fun fact for existing Amex cardholders: If you already have a credit card issued by American Express, the bank might not hard pull your credit report upon subsequent applications. They only pull your credit report if you are conditionally approved from internal information Amex already has on record, to double check nothing major has changed since then. As long as nothing has drastically changed, chances are you will be approved. In practice this means you can apply for a second, third, etc. Amex card without worrying about wasting the hard credit inquiry in vain.

Let’s go over some lucrative bonus spending categories for other business cards to make sure you’re allocating your spending correctly.

Examples of Business Cards with High Bonus Spending Categories

Chase Ink Business Preferred® Credit Card

3 Ultimate Rewards earned per dollar spent on travel, shipping purchases, internet, cable and phone services, and on advertising purchases made with social media sites and search engines

American Express® Business Gold Card

You get to choose one of the following categories to earn 3 Membership Rewards per dollar spent:

- Airfare purchased directly from airlines

- U.S. purchases for advertising in select media

- U.S. purchases at gas stations

- U.S. purchases for shipping

- U.S. computer hardware, software, and cloud computing purchases made directly from select providers

Do I qualify for a business credit card?

Myth #1: A business must have employees.

Your business can be a sole proprietorship, meaning only you work on the business. That’s how MileValue started, just Scott, and he had multiple business cards before ever hiring any employees.

Myth #2: A business must be profitable.

Businesses are set up to earn profit, but they aren’t profitable all the time. One time when almost no business is profitable is when it is just starting. That’s a time when you have to put money into the business before you can start making money from it.

A new business–even if it’s not making money yet–is still a business, and you can still get a business card.

Myth #3: A business must have an EIN.

Having an EIN is not mandatory. In the field that asks for a Federal Tax ID on the application, you can put your social security number.

Examples of Businesses You May Not Think are Businesses

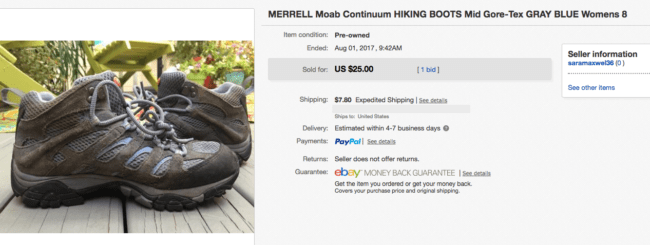

- Seller on eBay

- Seller on Amazon

- Seller on Etsy

- Seller at consignment shops

- Seller at yard sales

- Seller of baked goods

- Seller of souvenirs from your trips abroad

- Blogger

- Seller and collector of coins or stamps

Bottom Line

If you’re eligible for a business credit card and either have lots of spending power that wouldn’t otherwise earn a higher category bonus on another card or you can manufacture spend, then the Blue Business Plus Credit Card from American Express is a great option for you.

For the first $50,000 you put on the card every year, you can earn 2 Membership Rewards per dollar spent. That’s a 100k Membership Rewards a year.

Of course there are cards with sign up bonuses that high or almost that high that you could open and earn in three months for much less spending. But this is a brand new credit card, meaning you’re not held back from issuing bank rules that might prevent you from getting such bonuses (i.e. Chase’s 5/24, Amex’s Once in a Lifetime rule, and Citi’s 24 month rule).

Credit card links have been removed from posts and added to the menu bar at the top of every page of MileValue under the heading Top Travel Credit Cards.

Just getting started in the world of points and miles? The Chase Sapphire Preferred is the best card for you to start with.

With a bonus of 60,000 points after $4,000 spend in the first 3 months, 5x points on travel booked through the Chase Travel Portal and 3x points on restaurants, streaming services, and online groceries (excluding Target, Walmart, and wholesale clubs), this card truly cannot be beat for getting started!

Editorial Disclaimer: The editorial content is not provided or commissioned by the credit card issuers. Opinions expressed here are the author’s alone, not those of the credit card issuers, and have not been reviewed, approved or otherwise endorsed by the credit card issuers.

The comments section below is not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser’s responsibility to ensure all questions are answered.

SPM, we both got this card the moment it came out. 20K points and 2X everything with no fee? Yup. Quite frankly this card is busy cannibalizing my Everyday and PRG cards. It’s also eating into my Chase Freedom Unlimited(1.5X).

As Delta flyers this card is a must(we can argue about Delta/SkyMiles later:).

With just a bit of thought virtually every purchase anywhere should be at the very least 1.5X(Chase) and 2X(up to 5X..air/hotels? with Platty) with AMEX.

Yea it’s a stellar card. Shame that 20k bonus is gone, hoping it will come back as I feel that many are turned off by the lack of a sign up bonus.

I heard that some people are being targeted for the 20k offer still. If true, rookie question: are there DPs showing how to get targeted for this offer?

I had 2 SPG Amex 2 years ago .No one wanted the card I paid IRS with it then shelved it .

INKer 4 ever..

No one wanted the card? Do you live in the US? We almost never encounter someone who doesn’t take AmEx anymore. Even so, why you an Ink when you can add a no-fee Freedom Unlimited and get 1.5x on all unbonused spend?

[…] purchase with whatever card gives you the best return everyday purchases. That could likely be the Blue Business Plus Card from American Express that earns 2 Membership Rewards on ALL purchases (capped at $50k per year), the Freedom Unlimited […]

[…] the Starwood Preferred Guest Credit Card, whose points I value at 2.5 cents each, or the Blue Business Plus Credit Card from Amex which earns 2 Membership Rewards per dollar spent on ALL purchases (that’s like […]

[…] Blue Business Plus Credit Card from American Express: no sign up bonus but 2 Membership Rewards per dollar spent on ALL purchases […]

[…] that’s the Starwood Preferred Guest Credit Card, whose points I value at 2.5 cents each, or the Blue Business Plus Credit Card from Amex which earns 2 Membership Rewards per dollar spent on ALL purchases (that’s like […]

I got the old blue card about a month ago and initially felt lucky, but that good feeling lapsed as I would need to focus too much spend at 1% before getting to the cherry. I then found that Amex will not allow a car payment on Plastiq and then the cherry seemed much further out. I cancelled it, along with a couple of the Hilton cards that moved over from Citi, then applied for the Blue Business Plus and it went pending.

As I have a legitimate LLC, it would fit nicely between Platinum and the hotel Business cards. Plat works great for travel, SPG and Hilton Bus. cards are great at those hotels, and then the 2x points on the BBP would be the everyday spend for most things but meals which waffles between the Uber card and Reserve card.

I called in, but got nothing favorable. Scratching my head as I rarely get the “pending or further review” message.

Also, Amex would not do a product change from non-business to business.

How many charge cards do you have open that are issued by Amex? And how many credit cards? You are limited to holding four to five (depending on the individual) American Express charge cards. Separately, you are limited to holding four to five (again, depending on the individual) American Express credit cards. Both personal and business count toward both limits. Perhaps it’s this rule that’s tripping you up?

Follow the math here: I had 6 at the time of Hilton move to Amex, 2 were Hilton, 4 were Amex. I applied for Amex Hilton Bus. and approved. Now count was 7. I applied for old blue card and approved, now count was 8. I cancelled the Hilton Ascend since Hilton. business is the same. Now count was 7. Cancelled the old blue, count was now 6. Applied for Blue Business Plus, went pending, then email saying approved. Count is now 7, with 6 Amex and 1 old Hilton.

I will use BBP card for everyday spend at 2x, use the Uber and Reserve for meals at 4x and 3x. I also have the ATTMore that does 3x that I use on Amazon.

I have a spreadsheet where I project my larger payments (mortgage, cars, donations, taxes, etc.) and where those hit one time or each month. I then plan my minimum spend against that using either Plastiq or direct spend. I have 4 cards in the minimum spend plan now, and have had as many as 6. Without a plan like this I could never keep in my head how to meet those minimums and whether or not to apply for something. I have a BA card that gives 100K Avios at 20K spend. Without the spreadsheet I would never know where I was on hitting that amount.