MileValue is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

Note: Some of the offers mentioned below may have changed or are no longer be available. You can view current offers here.

Today Alaska Airlines announced it will buy Virgin America, after weeks of speculation. Alaska beat out JetBlue in the bidding.

Alaska is predicting that it will take nine months to close the deal and another year beyond that for the carriers to combine onto a single operating certificate.

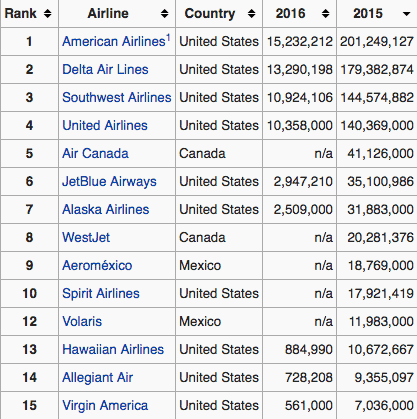

To give you an idea of the relative sizes of these airlines, look at the 2015 passenger numbers for North American airlines, according to Wikipedia.

Virgin America is a minnow. Combining with Alaska will only move Alaska up one spot into the fifth largest American airline, passing JetBlue, but even the combined airline will be less than a fifth the size of American Airlines. (Even if a future tie up with JetBlue happens as some have speculated, the combined JetBlue-Alaska-Virgin America would be only about half the size of United or Southwest and 40% as big as American.)

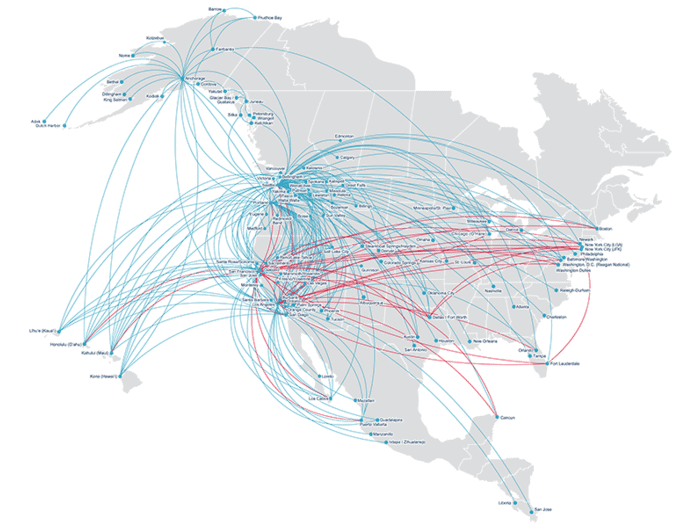

Alaska and Virgin America are both primarily West Coast airlines. The combined route map shows that.

Both airlines have a hub in Los Angeles right now. Additionally Alaska has hubs in Portland, Seattle, and Anchorage, with a focus city in San Jose. Virgin has a hub in San Francisco and a focus city in Dallas.

Both airlines have a hub in Los Angeles right now. Additionally Alaska has hubs in Portland, Seattle, and Anchorage, with a focus city in San Jose. Virgin has a hub in San Francisco and a focus city in Dallas.

What Will Happen to Alaska Miles & Virgin America Points

I mainly care about this merger as it affects my points.

Basics of Each Program

Alaska Airlines runs a traditional mileage program in which miles are earned by distance flown and redeemed according to region-based award charts.

I have Alaska miles as the fourth most valuable miles, worth 1.75 cents each. Alaska miles are fantastic to fly Cathay Pacific First or Business Class, Iceland Air, Hainan Air Business Class, American Airlines at pre-devaluation prices, Fiji Airlines, and several other interesting partners. Unfortunately they are no longer useful to book Emirates First or Business Class.

Virgin America runs a new-school points program with earning and redemption revenue based on Virgin America flights, though points are redeemed according to award charts for Virgin America partner flights.

Virgin America points are actually the most valuable points on my list, worth 2.3 cents each. Virgin America points can be redeemed on Virgin America flights with no blackouts, at a rate of 2-2.3 cents per point. Partner awards include 80,000 points roundtrip to Australia in a flat bed with no fuel surcharges.

Both programs are great, and they are very different from one another. I hate to see them merge because diversity in mileage programs is per se a good thing for us. It lets us use each program for its unique strengths, raising the value of all of our miles and points.

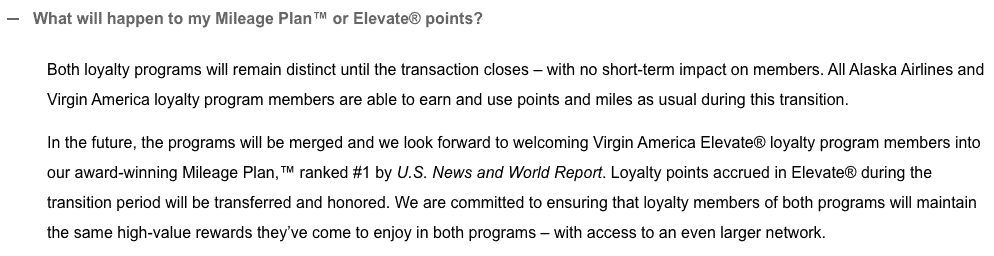

Unfortunately the two programs will merge, although not until after the transaction closes, which is predicted for January 1, 2017.

Alaska miles should be the surviving miles. I expect Virgin America points to become Alaska miles at a 1:1 rate, which is a slight devaluation of Virgin America points.

Alaska miles should be the surviving miles. I expect Virgin America points to become Alaska miles at a 1:1 rate, which is a slight devaluation of Virgin America points.

Hopefully there is a period before the forced conversion of Virgin America points during which you can transfer points freely back and forth between your Alaska and Virgin America accounts. We saw that option during the United/Continental merger, though there was no such option during the American/US Airways merger.

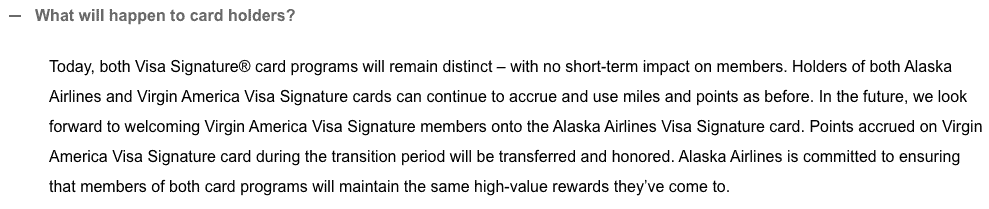

Credit Cards

Similarly, it looks like the Alaska credit card will survive and the Virgin America credit card will disappear.

This is a little different than the American/US Airways merger which left Citi as the only issuer of new American Airlines credit cards, but let Barclaycard convert US Airways cards to American Airlines cards and continue to service its old accounts.

Transfer Partners

Virgin America is a transfer partner of Citi ThankYou Points and American Express Membership Rewards. Both have a transfer ratio of two credit card points to one Virgin America Elevate point, although both have offered 25% transfer bonuses (8:5 ratio during bonus).

Alaska is a transfer partner of SPG Starpoints. Twenty thousand Starpoints equals 25,000 Alaska miles.

It would be amazing if the new Alaska retained all three transfer partners! Imagine being able to transfer ThankYou Points 1:1 to Alaska miles and booking Cathay Pacific for 70,000 miles one way to Asia or Africa!

Bottom Line

Alaska Airlines is buying Virgin America and expects the deal to close at the start of 2017. Alaska will fold Virgin America’s brand and frequent flyer program into its own.

I will keep a close eye on the combination of Alaska Mileage Plan and Virgin America Elevate, so we can maximize the value of the programs before, during, and after the merger.

Just getting started in the world of points and miles? The Chase Sapphire Preferred is the best card for you to start with.

With a bonus of 60,000 points after $4,000 spend in the first 3 months, 5x points on travel booked through the Chase Travel Portal and 3x points on restaurants, streaming services, and online groceries (excluding Target, Walmart, and wholesale clubs), this card truly cannot be beat for getting started!

Editorial Disclaimer: The editorial content is not provided or commissioned by the credit card issuers. Opinions expressed here are the author’s alone, not those of the credit card issuers, and have not been reviewed, approved or otherwise endorsed by the credit card issuers.

The comments section below is not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser’s responsibility to ensure all questions are answered.

The most positive impact of this for east coast-based Mileage Plan members is the increased ability to reach the west coast on Alaska-branded flights en route to Asia / Aus / NZ / S Pacific, thereby satisfying the maximum of one partner airline per Mileage Plan award. Right now there is virtually no ability to do this, requiring a separate positioning flight to get to LA / SF / Seattle. For those aiming to use Mileage Plan to travel across the Pacific, it significantly increases the value of Alaska’s miles in the intermediate term.

I didn’t look at it from that angle. Those folks will benefit.

[…] Here’s my top 11 list (note that programs #1 and #4 will be combined in the next few years, I’d guess in 2018): […]

[…] and Virgin America have been caught in a competitive flurry ever since Alaska Airlines won the bidding war over JetBlue and announced the planned purchase of Virgin Amer…. The latest play by JetBlue could be very lucrative for you, so read […]

[…] Alaska Airlines bought Virgin America last year. In January, we saw the two companies merge and Virgin America award space started showing up on alaskaair.com. […]