MileValue is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

Note: Some of the offers mentioned below may have changed or are no longer be available. You can view current offers here.

I’m bumping this up to the top of the blog roll as a reminder to make a change by TODAY. You must choose the designated airline for any Platinum card (including the Business Platinum), and the Hilton Aspire card (which comes with up to $250 incidental fee credit) by today as well if you want it to be different than last year’s.

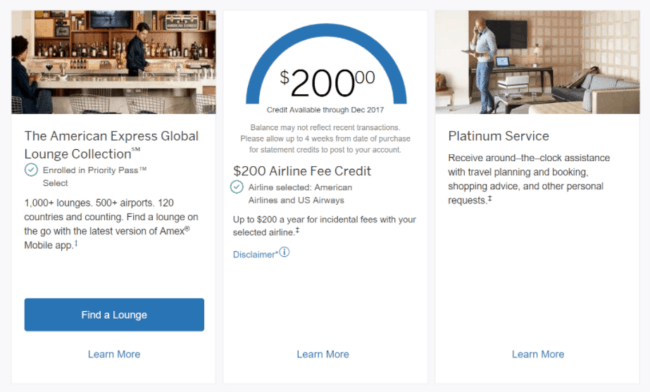

One of the most valuable benefits of the Platinum Card® from American Express is up to $200 in statement credits for incidental fees with your designated qualifying airline every calendar year. (Enrollment required).

In other words, you won’t receive reimbursements on your card statement for incidental travel expenses across the board. You must choose an airline you wish to receive statement credits for, and that is your “designated qualifying airline” all year. You can also the call the number on the back of your card to chose your designated qualifying airline if you prefer.

If you just recently opened the the Platinum Card® from American Express and have not chosen your designated qualifying airline yet, you can do so at any time. If you have had the Platinum Card® from American Express for a while and had a qualifying designated airline set in 2018, the time window to change it is January. That means Thursday is the last day to change or choose your qualifying airline if you want it to be different than last years.

Unfortunately “incidental travel expenses” don’t include just any charge to an airline, hotel, Uber, etc., like the travel statements credits available on a card like the Chase Sapphire Reserve®. You’ll want to be careful about what airline you choose for this reason. More on that below.

How the Travel Credit for the Amex Platinum Cards Work

Amex Platinum cardholders get up to $200 in statement credits for incidental fees with your designated qualifying airline every calendar year. In order to get the up to $200 airline fee credit, you have to choose a single airline on which you will receive credits for fees incurred. Designate that airline from the list of eligible airlines here. Note that this up to $200 credit is a benefit of all the versions of the Platinum card, including the Business Platinum Card® from American Express.

The airline fee credit is supposed to be for “incidental fees” likes change fees, cancellation fees, and bag fees. The fee credit is not supposed to apply to ticket purchases, miles purchases, or gift card purchases.

But American Express’ computers decides whether a certain purchase qualifies for a fee credit, and in the experience of thousands of people, certain airline gift card purchases will result in a statement credit. That makes this benefit like getting $400 in free flights, which almost completely offsets the annual fee in one swoop.

Incidental Fee Statement Processing Time

It can take a few weeks for the offsetting statement credit to appear–though it usually takes just a few days. If yours doesn’t appear after a few weeks, you can call the number on the back of your card or initiate an online chat to get your statement credit.

Bottom Line

Choose your designated airline here or call the number on the back of your Platinum Card® from American Express to speak with a representative. If you just opened a Platinum Card, you can pick your airline at any time. You’ll only be able to choose it once, and once you have, your time window to change it is January of each year. You have until Thursday change your existing Amex designated airline. If you don’t, Amex will set it as whatever your choice was last year.

Just getting started in the world of points and miles? The Chase Sapphire Preferred is the best card for you to start with.

With a bonus of 60,000 points after $4,000 spend in the first 3 months, 5x points on travel booked through the Chase Travel Portal and 3x points on restaurants, streaming services, and online groceries (excluding Target, Walmart, and wholesale clubs), this card truly cannot be beat for getting started!

Editorial Disclaimer: The editorial content is not provided or commissioned by the credit card issuers. Opinions expressed here are the author’s alone, not those of the credit card issuers, and have not been reviewed, approved or otherwise endorsed by the credit card issuers.

The comments section below is not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser’s responsibility to ensure all questions are answered.

Would this also apply to the new Hilton Aspire credit?

Yes it does!

Thanks for the reminder! I needed to switch this year and totally would have forgot.

Thank you for the guidance this is helpful!

Hoe does $200 in gift card purchases equal $400 in free flights?

Quote from above “card purchases will result in a statement credit. That makes this benefit like getting $400 in free flights, which almost completely offsets the annual fee in one swoop.”

Rod

If you cancel before the second annual fee is charged, you can collect $200 in the first calendar year you hold the card and $200 more in the second calendar year. Example: you apply for Amex Plat this month. You get $200 in credit over the course of 2018. You spend $200 on a gift card with your designated qualifying airline in January of 2019 and then cancel before the second annual fee hits in February 2019. That’s $400 in free flights.

So it like the Citi Prestige card only u get $500 in 12 months.Warm by u.

CHEERs

Unbelievably hot right now.

HaHa Fry !!! I’ll be in Maui on the 11th ..Watching weather for BA is a tough one before 1/15 maybe Rainy . I always look @ the Hotels !! in EU never works BECAUSE it’s 3x more then USA so they make no money if it works.

CHEERs

OOP’s the AC that is ..

Enjoy the Beach was -15F last nite in Chicago and Snow today. ..HaHa..

CHEERs