MileValue is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

Note: Some of the offers mentioned below may have changed or are no longer be available. You can view current offers here.

Update: I used this trick successfully. Here was my experience.

As I led a session at the Chicago Seminars this weekend on “Special Awards,” someone chimed in with an intriguing tip:

There is a simple method to avoid the $75 “close in ticketing fee” on United awards that is triggered when you try to book a ticket within 21 days of departure.

I tested out the proposed method yesterday, and I have some input on how it works. (The trick does work!)

- How can you save $75 per ticket on your next last minute United award?

- What number do you need to call?

Facts

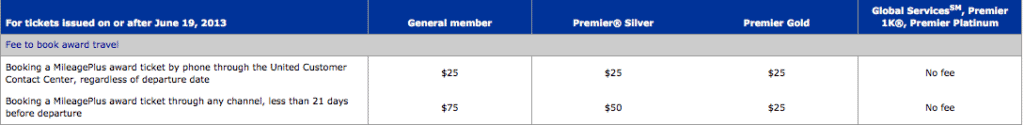

- “Booking a MileagePlus award ticket through any channel, less than 21 days before departure” incurs a fee of $75 per ticket. This fee is reduced or waived depending on your status.

- You can make free changes or cancellations of your United award within 24 hours of ticketing by phone or online. This is designed as a safety valve if you make a mistake in the initial ticketing, but you can use the free changes and cancellations however you’d like.

The Proposed Trick

If you want to book a United award within 21 days of departure, book the same flight for 1+ months in the future, then immediately call in to change it to within 21 days of departure. No close in ticketing fee will be charged.

My Test

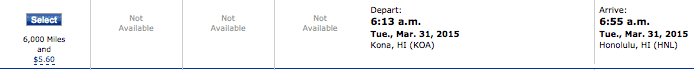

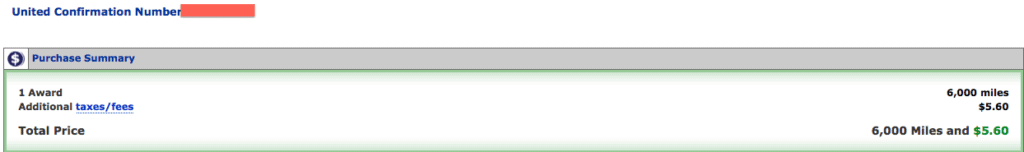

I tested out the trick with a simple one way award from Kona to Honolulu on Hawaiian Airlines. The award normally costs 6,000 United miles + $5.60. Note that there is nothing special that made me choose this award except that it is the cheapest award on the United chart. If this test succeeds, all other awards should be the same.

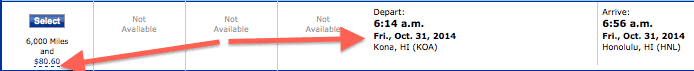

Within 21 days of departure, this award costs 6,000 United miles + $80.60 because of the $75 close in ticketing fee.

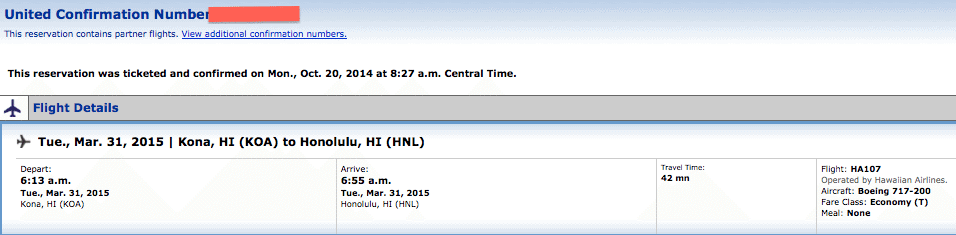

I decided to book the ticket for March 31, 2015 for 6,000 miles + $5.60 and to try to change in to October 31, 2014 without paying the close in ticketing fee. I booked March 31 online in just a few seconds.

Then I called the number for United web support. They can make award changes, I rarely have to wait on hold, and the Houston-based agents are good. In this case, too good.

I told the agent I wanted to change an award and gave her the confirmation number. I gave her the flight information for the October 31 flight, and she quickly made the change. She told me that since I was changing to a flight within 21 days of departure, there would be a $75 close in ticketing fee! Failure!

I thanked her and told her I would prefer to just keep my original itinerary before disconnecting.

From my knowledge of changing United awards, I suspected that agents have to remember to collect this fee on changes. I suspected calling a less competent agent might get me around the fee.

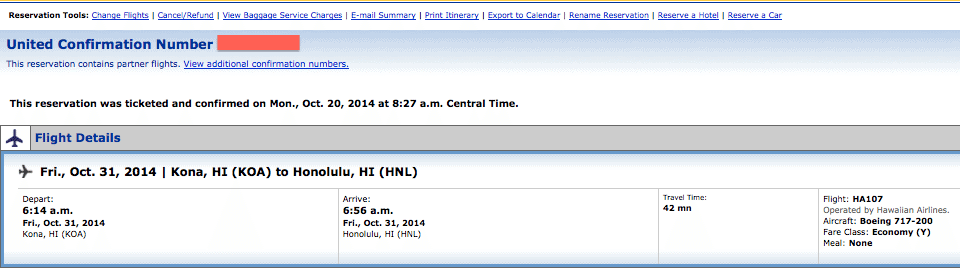

I called United back at its general 800-UNITED-1 number. I asked the next agent to change me to the same October 31 flight.

First she said that there was no award space even though there is award space on over a dozen Kona-to-Honolulu flights on October 31. This was a great sign; she seemed incompetent! I asked her to look again since I could see the space online.

Eventually she found the space and made the change. She noted that I had booked my award within the last 24 hours, so changes were free. She never mentioned any additional $75 charge. Success!

Inside my United account, my ticket had been updated to the October 31 flight.

United agents won’t charge you an additional fee without getting your credit card info again or at least confirming which stored credit card you want to charge, but just to double check that no $75 charge had been snuck onto my credit card, I signed into my credit card account.

A pending charge for $5.60 in taxes on the award was present, but no $75 charge was present.

Aftermath

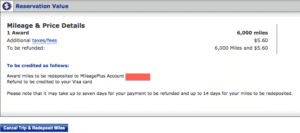

I went into my online account and cancelled the award altogether to get my 6,000 United miles and $5.60 back. The $5.60 will post back to my credit card within a week or two. The miles re-posted to my account instantly.

Bottom Line on the Trick

Bottom Line on the Trick

The trick to avoiding the $75 close in ticketing fee on United awards–booking farther out and changing it close in within 24 hours of booking–works. I wish I had gotten the name of the person who gave everyone the tip.

The trick works because phone agents have to remember to charge you the $75 close in ticketing fee, and only well trained agents will remember to do that. If your agent remembers, thank her for her time, and tell her you have decided not to make the change. I think very few agents at the 800-UNITED-1 number will remember to charge you the $75.

If you liked this post, you will also like:

- Master Thread: Holds on United Awards (a good way to get around the phone ticketing fee)

- Save $100 or More When Cancelling a United Award

Just getting started in the world of points and miles? The Chase Sapphire Preferred is the best card for you to start with.

With a bonus of 60,000 points after $4,000 spend in the first 3 months, 5x points on travel booked through the Chase Travel Portal and 3x points on restaurants, streaming services, and online groceries (excluding Target, Walmart, and wholesale clubs), this card truly cannot be beat for getting started!

Editorial Disclaimer: The editorial content is not provided or commissioned by the credit card issuers. Opinions expressed here are the author’s alone, not those of the credit card issuers, and have not been reviewed, approved or otherwise endorsed by the credit card issuers.

The comments section below is not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser’s responsibility to ensure all questions are answered.

I wanted to fly in F, FRA>BOS (or anywhere in the US) on LH. Of course, I will have to wait until T-3 in order to get such a flight but I’m flexible with my return. My plan was not to purchase any return flight at all and then purchase at the last minute when it opens up. Do you think it’s possible for your trick to work with this itinerary?

Well you can’t book Lufthansa First more than 21 days out, so you won’t be able to book Frankfurt to Boston for 6 months out and then change it to two days out. You can try to book Lufthansa economy for 6 months out and then change it to First for the one day out. I suspect that would work. Worst case: you just cancel the first award. As I said in this post, my miles instantly appeared after I cancelled the award (after I signed out and signed back in.)

It’s a relief to see you’re writing again. Thank you for sharing this tip (and your other contributions at the seminar).

Brilliant tip, love it!

Dude, at least give credit. I showed you this trick and you use it to get some readership.

Have you no shame at all?

I have the email to prove it too. Anyways, you’re not gonna lose anything by losing me as a reader. Have a good life.

Possibly also told to me by Del, guys. It sounded new to me in Chicago, but maybe I am mistaken. As I made clear in the post, I didn’t invent this trick.

Wont this only work if you are flying the next day ie, isn’t there be a cancellation/redeposit fee if you cancel/change it again?

I don’t follow. The example given is for a flight 11 days from now not tomorrow.

amazing! you are the best at #lifehacks, scott!

From my experience this ‘regular’ 1-800 number with their customer reps. is quite difficult to deal with. They either cannot see the availabilities or simply cannot comprehend what I am talking about:) Can you get me their web support number?

ps. I’ve been trying to book some flights from UIO to JFK for January 6 for a party of 4 plus an infant. It’s quite funny but we’d need to spend a night in PTY in order to continue our journey early morning the following day. However, if we look for GIG-PTY-JFK route, we could fly on the same day without any further delays. Any idea why?

I don’t follow your second question.

Web support: 866-211-1861

Scott, searching a return flight from UIO to NYC for January 6, 2105 reveals the following info: UIO – PTY on the 6th (anytime) plus PTY – JFK the day after early in the morning. Now, if we search a return flight for the same day from GIG to NYC, we’ll get such itinerary: GIG – PTY on the 6th and PTY – JFK on the same day, after 6PM. Meaning the second leg gets available ONLY with a flight from Rio while it is unavailable in any other case! Do you know why???

Thanks for the info. I am currently trying to book an award ticket (actually 5) RT from TPE to SYD. I checked United’s website for availability and found some through Thai Airways. Any other options you can think of either with Star Alliance or other programs that may have more seats? Thanks for your help.

Google “Sydney Airport wiki” and you’ll see every airline that flies there. Search each Star Alliance one on the ANA web search tool.

Thanks Scott! I need to figure out how to use the ANA tool now!

In my (unlucky) experience, somehow I always run into competent agents. I guess I should re-try more.

BTW, I thought canceling and redepositing miles back would trigger up to $200 fee. How come you could do it scot-free?

Within 24 hours, free changes and cancellations.

Hi thanks for sharing this trick.

I’ve used this trick on UA 5 times in the last year and can confirm that it works like a charm.

But it doesn’t work on AA. Any trick to get around the 75$ AA close in fee?

Does this work for AA and or Delta?

Delta doesn’t have close in ticketing fees. I haven’t tested it on other airlines.

This trick has been around for ages.

Congrats on being the one to kill it.

I bet you a dinner next time I come through your city that this lasts at least six more months.

Don’t use the wird incompetent next time please.

How about, saying “less knowledgable” instead.

OMG, you’re leading everybody to CALL the airline? What are you thinking? This was definitely an evergreen. If it dies in a year, it’s still your fault.

Great tip Scott!

We are 5 of us and so very hard to get tickets at once. I can use this trick to book 2-3 tickets in advance and then get the rest close-in when they open up, specially during the peak periods (thinking of going to Asia Europe) Dec/June.

Way to go killing a good deal!

[…] MileValue, there’s a trick you can use to avoid paying the close-in booking fee for United Airlines […]

Hey dude… Thanks for trying out my tip! Was great to meet you at the seminars and hope we can stay in touch

There is things you discuss in person and not to be published online,

this deal will now be killed in a matter of time and no one will benefit from it

Scott,

The trick to avoid the $75 closing fee totally works!!! My story…

So, as you may know, I am a huge Alabama football fan. My mother has been doing conferences down in Baton Rouge for a couple of years now, so she’s been getting tickets to the Alabama-LSU game. I’ve been to three Alabama-LSU games and this Nov. 9 will mark my fourth such game.

It wasn’t clear on what the plan was this year, i.e. whether she’d get tickets or not, so I couldn’t book flights until we found out, which ended up being the eleventh hour and within 21 days of the proposed date of travel.

The cost of a flight was crazy, something like over $600 and it was ridiculous. Enter award points!

I saw a saver award going out and a standard returning (had to do Sunday unfortunately), but all-in-all I felt it was worth it considering how much a flight would have otherwise cost. But then the blasted closing fee!

As I always do, I checked your website first and it was like fate – the first article after clicking on your United link was about avoiding the closing fee. I tried to do this once, and the agent immediately mentioned the closing cost. I politely declined to change my itinerary. I called back the second I hung up, spoke to a very friendly agent, who didn’t once mention the closing fee.

I have a picture of my reservation and the fees associated total a whopping $11.20. Thank a lot Scott!

-John

Glad you saved $600, John!

I knew I’d need this one day and finally ended up using it today, saved $150. Worked the first time, very painless. Thanks Scott!

Great Tip! Just saved $75 !

Made the booking online for a week after the intended day ( intended day was less than 21 days from booking)…then called the 1-800-864-8331 number and got lucky with an agent from Manila, Phillipines who didn’t remember the close-in fee!

Wo hooo!

Nice work. Enjoy the free money!

When you change the flight, did you make sure that the flight (award ticket) is still available because what if it is not available anymore. Thanks!

There is about a ten minute lag in this plan between booking the ticket and changing it. If space disappears in that ten minutes, cancel the original award for free for a full refund.

It still works as of today. Just booked a one way flight Tokyo to Denver three weeks out and changed on-line to this Friday. It also let me change the routing and to fly ANA instead of United.

Awesome!

Does it have to be the EXACT same flight? Or can it just be any flight going to the same cities? Some flights seem to be discontinued.

Should be enough between the two cities. There’s no downside to testing this trick. You can cancel your original award within 24 hours of booking for a no-penalty full refund if the change you try to make for free is rejected.

[…] This only works for UA, but one way to get around the close-in booking fee is to ticket an award on the website for much further out and then go back within the first 24 hours (before fees apply) to change it to a flight within 21 days. Keeping it at that, Milevalue has a more detailed walkthrough. […]

[…] I’d personally fly this award in flat bed Business Class for 57,500 United miles + $78. (I would get out of the $75 close in ticketing fee with this trick.) […]

[…] Singapore awards do not have a fee for booking within three weeks of departure like United awards do (though here is how to get out of that fee on United awards) […]

[…] United’s $75 close-in booking fee. This has been chronicled a few times before, originally by Mile Value in October 2014, and again by Well Traveled Mile in […]

[…] Interesting that for the first time Delta admits that it jacks up mileage prices at 21 days before departure. United and American don’t do that–they tend to open more award space at the lowest levels then–but they do charge a $75 redemption fee within 21 days. (You can get around United’s.) […]

Worked! Didn’t have to call. You can do it online

[…] I explained in this post how to get around that fee: Don’t Pay the $75 Close In Fee on United (Trick!) […]

[…] United miles can book United flights. United charges $75 for booking an award within 21 days of departure, but here’s how to get around that. […]

[…] Late Booking Fee: There is a $75 booking fee per person to book an award less than 21 days from the date of departure. This fee is reduced for elites and waived for Platinum and 1K members. Here’s a trick to never pay the late booking fee again. […]

[…] Don’t Pay the $75 Close In Fee on United (Trick!) […]

Worked prefect from the very first time . Just make sure you guys call them , Online did not work for me seems like they have closed the loop for online change of dates !!!

Thanks for the update

I just tried this and can confirm that it still works! Saved me the $80.60 close-in fee. Phone rep didn’t mention the fee at all and quickly processed the change with no problem.

I’ve used a similar trick to get out of a Clarion Hotel reservation without losing my $$. I could change the reservation for the next day, but not cancel it, so I changed it to a week later then called back and cancelled it. It’s a useful hack!

I wonder if this neat little trick works with any other hotel where you have a non-refundable booking?

Maybe it’s a discretionary thing, according to how bust the place is. Jill, I assume you did it by phone?

My non-proof read post above: make ‘bust’ ‘BUSY’ !! 😉

[…] See this post for a potential trick to avoid the close-in ticketing fee (basically, book the same flight more than 21+ days out and then call in and ask to switch it to the date you really want — and hope the agent doesn't charge you): https://milevalu.wpengine.com/dont-pay-th…-united-trick/ […]

Thanks, Scott! Worked a/o 6/17/16 for an online change to a multi-city itinerary for 2 (CLT-MUC-ZRH(23 hr connection)FRA). Saved $150!

Great!

You can never overestimate the incompetence of call center agents, 2 years on!

Well, imagine what it would take United to fix the problem in terms of IT or training investment. Losing $75 each from a few smart people is better from that perspective.

Wohooo! Just used this and worked the first time! Thanks to call centers in Phillipines! Saved me $150 !

[…] $75 close-in award booking fee applies when you book an award within 21 days of the travel date. Here’s a trick to avoid paying United’s close-in booking fee. I used it recently and it worked like a […]

Thank you SO MUCH for finding and posting this trick. I just transfered Chase UR to rebook 5 in-laws on UA after SWA cancelled their flight, and this trick saved me $375!

Is this still working online after the site refresh?

[…] and fees associated with the award booking are $80.60. But wait! Bill’s a ninja and knows the trick to avoid the United close-in booking fee, so his out of pocket cost for the award is reduced to only […]

[…] considered doing a little trick I’ve read about to avoid the $50 close-in ticketing fee, but decided not to bother. Since the flight was no […]

still works. i just did it few minutes ago.

works today

Just did this and it worked like a charm! Thank you so much for the savings!!!

What phone # did you call?

[…] United miles are useful for travel all over the globe, as well as domestically. United doesn’t collect fuel surcharges on awards, their miles give you access to the Star Alliance, the largest out of the three airline alliances with the most prevalent award space. And you shouldn’t ever have to pay a late booking fee because of this trick. […]

[…] You should never have to pay a close-in award booking fee because of this trick. […]

I was able to make this technique work online, just at the moment the United customer service agent answered after a long wait. I wouldn’t bother calling as long as this continues to work.

[…] In Don’t Pay the $75 Close In Fee on United (Trick!), Scott wrote about an easy way anyone can avoid the fee United charges non-elites for booking an award within 21 days of departure. The trick has been alive and well for years, helping last minute travel planners (or those wanting to scoop up award space that becomes available close to departure) save tons over time. […]

[…] You should never have to pay a close-in award booking fee because of this trick. […]