MileValue is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

Note: Some of the offers mentioned below may have changed or are no longer be available. You can view current offers here.

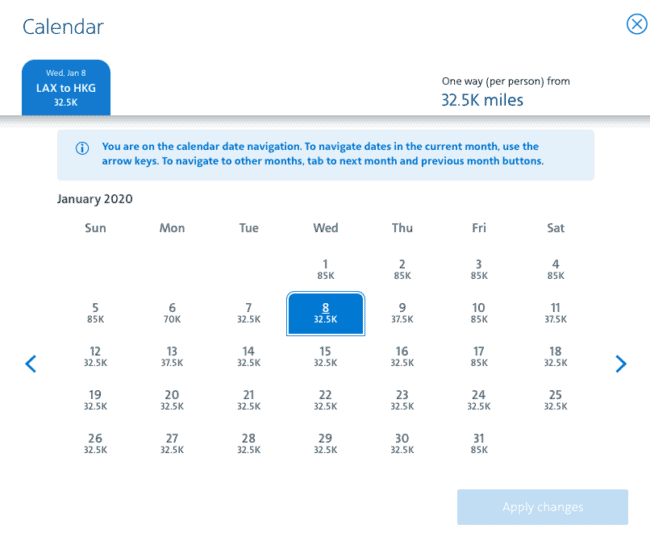

Ugh. American Airlines’ new tool for searching award space is super annoying. The results are in no way displayed in a way that makes it efficient for us to see what’s available.

It gives you no easy option to filter number of stops or cabin. On the week view, it says a filter function is coming soon… but it’s said that for a while now. (Edit 7/18: There are some filter options on the mobile version. I for one rarely search for award space on my phone though, I find doing so to be annoying in itself.)

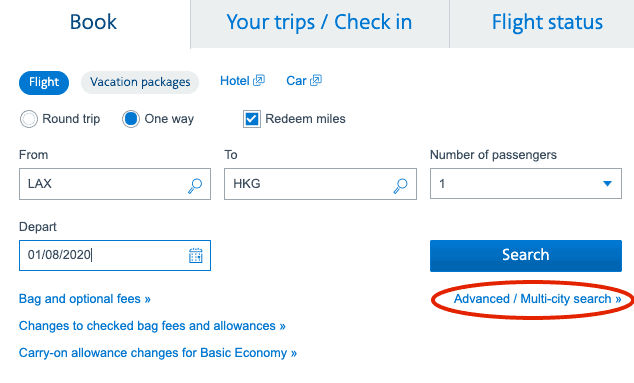

Luckily there’s an easy way to get the old tool to show up. On AA’s homepage, instead of filling out your city pair and travel dates there, click the Advanced / Multi-city search link.

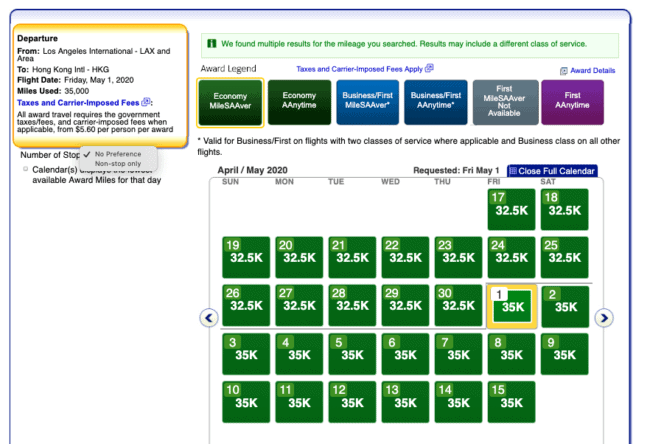

Fill out all your search info on that page (make sure to click Redeem miles at the very top of the page) , and your results will display on the old calendar!

Phew. You once again have the option to filter for only non-stop flights, and easily toggle between Saver Level economy, Business, etc.

And notice that the results displayed from the new award search tool do not distinguish Saver Level award prices like the old calendar does. I agree with Lucky that these changes hint at what’s very likely on the horizon for AAdvantage: a switch to dynamic award pricing. It’s how this industry works. Delta does it first, and the other legacies follow suit. United MileagePlus switches to a dynamic, revenue-based award pricing system in November. The days of AAdvantage’s award charts are numbered.

Bottom Line

If you don’t have any experience or knowledge redeeming foreign loyalty program miles, it’s time to start learning. After the new site is up and running–get excited! Coming soon :)–my next big goal for MileValue is to update/rewrite guides for redeeming miles with all the major foreign frequent flyer programs and write new ones for the programs we haven’t yet covered.

I’m not saying that these switches to revenue-based award pricing are going to destroy the value of the legacy carrier’s loyalty programs. It could very well do good things for the state of domestic award space, and possibly domestic award prices, as explained in United Drops Award Chart November 15… and I have read that the majority of people redeem miles domestically rather than internationally. But for the rest of the us, not having set award prices between regions, especially on premium cabin international awards, could mean rapid inflation. Do you ever redeem Delta miles on premium cabins internationally? You can’t period for First Class. And Business Class prices are totally unaffordable. I don’t want to see that happen with United and American Airlines miles.

Bets on when AAdvantage announces the big shift?

Hat tip to One Mile at a Time for this little trick that helps me avoid extreme annoyance when searching for oneworld award space.

Just getting started in the world of points and miles? The Chase Sapphire Preferred is the best card for you to start with.

With a bonus of 60,000 points after $4,000 spend in the first 3 months, 5x points on travel booked through the Chase Travel Portal and 3x points on restaurants, streaming services, and online groceries (excluding Target, Walmart, and wholesale clubs), this card truly cannot be beat for getting started!

Editorial Disclaimer: The editorial content is not provided or commissioned by the credit card issuers. Opinions expressed here are the author’s alone, not those of the credit card issuers, and have not been reviewed, approved or otherwise endorsed by the credit card issuers.

The comments section below is not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser’s responsibility to ensure all questions are answered.

Yes still works why do they always upgrade to Junk ?

CHEERs

Quit working for me.