MileValue is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

Note: Some of the offers mentioned below may have changed or are no longer be available. You can view current offers here.

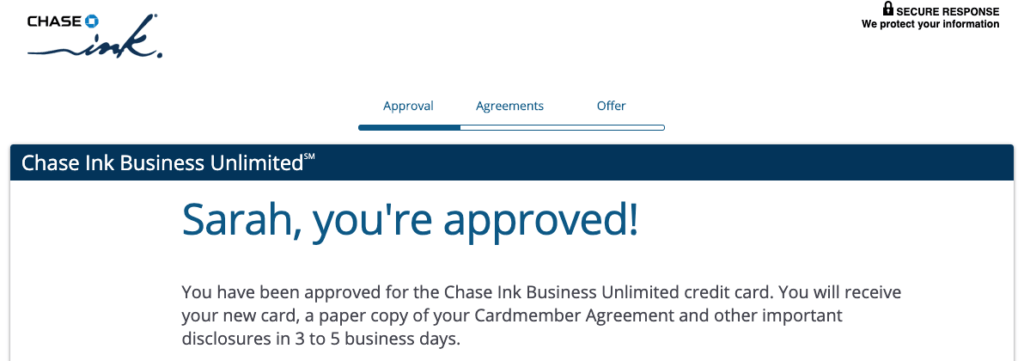

I just applied for the Chase Ink Business Unlimited® Credit Card. And for the first time in a very long time, I was automatically approved!

My inner miles nerd did somersaults when the auto-approval screen popped up.

If you’re new to this blog and/or the world of maximizing travel rewards, this is a big deal to me because I apply for more credit cards than the average Joe and I typically get a pending response when I apply for a new one so the bank can evil eye me first. And for a long time I was shut out completely by Chase bank for being over what’s been dubbed the Chase 5/24 rule. The basic gist is that Chase denies applicants for their credit cards once they’ve opened five consumer credit cards in the prior 24 months. Read Why I Credit Card Fasted to learn a little more about my roots in this hobby, how that led me to get cut off from Chase, and how and why I decided to mend my relationship with them over the last year.

Chase is a finicky institution (I mean really, they all are these days) when it comes to credit card churning, so you have to handle them strategically if you want to pump as much value out of travel rewards cards as possible.

That’s why I wrote the Five Chase Cards to Apply For Series, identifying four different types of consumers/travelers and which five+ Chase cards they should open to maximize their sign up bonus earning potential.

- The Five Chase Cards You Should Apply For: Combo #1: The general top five combination.

- The Five Chase Cards You Should Apply For: Combo #2: Similar to Combo #1 but for those that don’t live/travel to cities served by Southwest.

- The Five Chase Cards You Should Apply For: Combo #3: For those that can’t open small business credit cards.

- The Five Chase Cards You Should Apply For: Bonus Combo for Points Omnivores: For more serious card churners…those that collect any mile or point they can to get more travel.

I’m following the plan outlined in the fourth bonus combo, because I fall squarely in the points omnivore category.

I’m excited to earn the Chase Ink Business Unlimited® Credit Card’s sign up bonus and transfer it to my Chase Sapphire Preferred® Card or Chase Ink Business Preferred® Credit Card Ultimate Reward account, so I can then move the points from there to an airline loyalty program!

Why the Auto-Approval?

I haven’t been automatically approved for a credit card since–I don’t know–2015?

So what gives?

Well, I have slowed down my rate of applications in the last year, partially due to my nine month credit card fast in 2018, and then health issues that kept me a little more grounded in 2019. When you’re not traveling as much, you think less about applying for new cards because you don’t feel the need to replenish balances. Less new credit card accounts is obviously, in the short term at least, better for your credit score and makes you appear less risky to a bank that’s evaluating your profile.

Other Helpful Chase Tips

Chase will always expedite delivery of your new card if you call and ask . You can reach customer service at 888-291-5079. I called myself to request expedition and have various times in the past. That can be a game changer if you have a large expense coming up soon you want to put towards meeting your new card’s minimum spending requirement.

Just getting started in the world of points and miles? The Chase Sapphire Preferred is the best card for you to start with.

With a bonus of 60,000 points after $4,000 spend in the first 3 months, 5x points on travel booked through the Chase Travel Portal and 3x points on restaurants, streaming services, and online groceries (excluding Target, Walmart, and wholesale clubs), this card truly cannot be beat for getting started!

Editorial Disclaimer: The editorial content is not provided or commissioned by the credit card issuers. Opinions expressed here are the author’s alone, not those of the credit card issuers, and have not been reviewed, approved or otherwise endorsed by the credit card issuers.

The comments section below is not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser’s responsibility to ensure all questions are answered.

Sarah

Good for u maybe there’s hope for me . I got my last Chase card like 3 years ago . I got turned down like a year and a half ago so I called . The man was laughing we gave u a card then u opened up cards all over town as in NO !! I need the C1 hotel card I applied 7 months apart as in NO so next apply is Nov. I once got 5 cards in 7 months I think them days are over for me.

It is a Fun “Game ” but interest rates are going to drop so banks will limit the GIVEAWAYS.

CHEERs

I am so jealous! 😉

I actually feel they transmit an electric shock through the keyboard now with any of my new Chase applications…

That’ll learn me to be 135/24.

All kidding aside, thank you for the pointers..

Hahah they probably do.