MileValue is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

Note: Some of the offers mentioned below may have changed or are no longer be available. You can view current offers here.

Regarding any information in this post about taxes: this is miles information, not tax advice. Consult a tax professional before paying your taxes with a credit card.

Plastiq is an online bill payment processing system that “empowers you to use your existing debit and credit cards to pay any bill, regardless of acceptance”. The charge for that convenience is 2.5% of each payment on a credit card and 1% on a debit card. At the moment they accept Visa, MasterCard, and American Express. You can pay with Visa, MasterCard, and American Express gift cards as well but the 2.5% credit card fee is applied.

You simply specify who you want to pay, and Plastiq pays them either via check or electronic transfer depending on what the recipient accepts. You are notified once your payment is received.

Who and What You Can and Cannot Pay via Plastiq

Examples of Who and What You Can Pay

- Anyone providing a good or a service

- Tuition and housing fees

- Taxes (income and property)

- Rent

- Utilities

- Insurance

- Mortgages

- Car payments

- Home loan payments

- Home repairs/construction

Examples Who and What You Cannot Pay

- Yourself (cash advances)

- Recipients who have not provided a good or service (i.e. you can’t pay your friend back for lunch)

- Recipients that are located outside the United States or Canada (however the sender can be)

- Payments to savings accounts, trust accounts, retirement accounts, health savings accounts, or similar

- Payments to 529 Education Savings Programs

Plastiq’s Referral Program

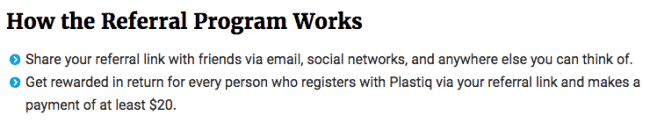

Everyone that signs up on for an account on plastiq.com is given a referral link they can share with anyone new who is signing up. You and the person both receive benefits once they make a payment of $20.

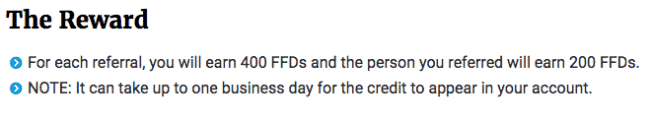

The following screenshots were taken from Plastiq’s blog:

FFDs are “Fee Free Dollars”–basically amounts of payments you can make without the card processing fee. You have 90 days to use the FFDs after you earn them.

If you decide to sign up for Plastiq after reading this article, please consider using my referral link.

Promotions

Previously (like April 2015, for example), Plastiq has charged only 2% for processing MasterCards for promotional spans of time. It also appears that they are charging (at least some people) only 2% for all MasterCards at the moment, despite the website claiming 2.5% for all card types. If anyone else has gotten this rate for a MasterCard let us know in the comments.

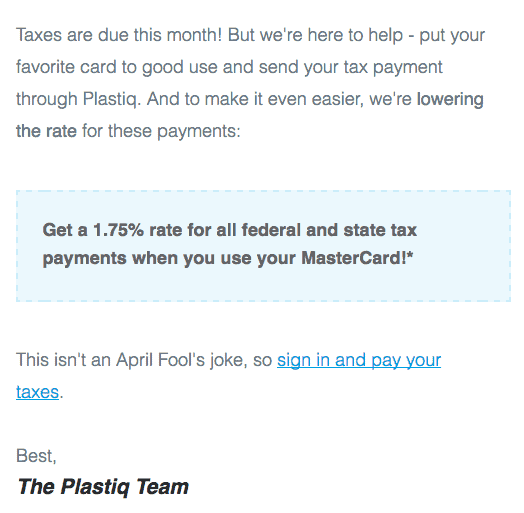

Also, last month they offered a fee of only 1.75% if you paid your taxes with a MasterCard. I believe this was only sent out to people with plastiq.com accounts. I received an email notification about it. Register now and see if you get the same email next year:

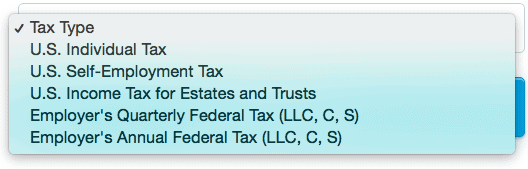

The asterisk after MasterCard signifies that you can’t pay all types of taxes, only these kinds:

The lowest fee I’ve seen in the past is 1.87% for processing taxes on credit cards, so this promotional rate is the best I’m aware of.

The Company’s Reputation Thus Far

The following statement is from plastiq.com’s terms and conditions page:

“Delivery of funds to the Merchant typically takes between forty-eight (48) and seventy-two (72) hours but may take additional time.”

We can all understand that sending a check takes longer than an electronic transfer. But these FlyerTalkers complained of waiting over a week or even longer, which can be a real issue when we’re talking bill payment. The good news is that it appears Plastiq has been improving on this front in recent months, at least on this FlyerTalk thread.

I think a wise move– when paying a bill to a new recipient– would be to send a small amount way ahead of the time the bill is due and wait to see how it long it takes. If it is received in a timely fashion, then send the remaining amount due. This way you’ll know how long it takes for future payments to that recipient and you can schedule accordingly. You can auto-schedule recurring payments on plastiq.com but only if the amount is the same each month.

Is it Worth the 2.5% Fee?

On the right cards and in the right circumstances, yes.

The only cash back card on the market right now that would be worth putting your bills on via Plastiq is the Discover it card, and only if you’ve opened one within the last year. The Discover it® Miles Card earns 1.5% back on all purchases and Discover doubles that at the end of the first year of card membership, meaning you get 3% back. 3% >2.5% processing fee, so you definitely come out on top.

But you can do much better with your returns.

Often the effective rebate on meeting a minimum spending requirement is 20% or more. That means if you pay your large bills via Plastiq that are otherwise not payable on credit cards in order to open more cards and meet more minimum spending requirements, the 1.87% fee can be a drop in the bucket compared to the rewards you’ll earn.

If you’re not trying to reach a minimum spending requirement for a sign-up bonus, I wouldn’t use Plastiq for bill payments on cards that earn 1 mile per dollar as I don’t value any miles at greater than 2.5 cents (for example, my highest valued point is SPG at 2.5 and highest valued mile is Virgin America mile at 2.3 cents each).

Meeting Minimum Spends for Sign Up Bonuses

Ink Plus

The Ink Plus by Chase is a Business credit card offering 70,000 Ultimate Rewards after spending $5,000 in the first three months, but only until May 15, 2016 and only if you apply in a Chase branch. Ultimate Rewards transfer 1:1 to United, British Airways, Singapore, Korean, Southwest, Virgin Atlantic, Hyatt, and more. The annual fee is $95, and it is NOT waived for the first year during this 70,000 point promotion.

If you paid $5,000 of your bills via Plastiq on this card, the processing fee would be $125. I value Ultimate rewards at 2 cents each, so you’d essentially be paying $125 for $1,500 worth of points (75,000 Ultimate Rewards, which you’d earn from the sign up bonus and the 1x on spending it takes to get there).

There is a similar offer with a 60,000 bonus point offer you can apply for online if you can’t make it to a branch. From meeting that minimum spend via Plastiq it’s like paying $125 for $1,300.

While I can not directly link to the current Ink Plus offer, you may find it by clicking below if you decide to apply. (I receive a commission, and your support keeps this blog going.)

But don’t forget the Chase 5/24 rule. If you’ve opened five cards within the last 24 months, you will most likely get denied for this card.

Citi Prestige® Card

This card comes with 40,000 bonus ThankYou Points after $4,000 in purchases made with your card in the first three months the account is open, along with a plethora of benefits that more than make up for the pricey annual fee. You can read all about it in my review of the Citi Prestige Card.

If you opened the Citi Prestige® Card and paid $4,000 worth of your bills with it via Plastiq, you’d be paying $100 for 44,000 ThankYou Points. I value ThankYou Points at 1.9 cents each, so that’s like paying $100 for $836 (44,000 ThankYou points from the sign up bonus and the 1x on spending it takes to get there). But you can stretch their value even more if you redeem on a premium cabin award like Singapore Suites on Singapore Airlines, considered to be the nicest First Class in the world by some people.

Application Link: Citi Prestige® Card

Platinum Card from American Express Exclusively for Mercedes-Benz

Until June 22, 2016, the Platinum Card from American Express Exclusively for Mercedes-Benz comes with 75,000 Membership Rewards after spending $3,000 in the first three months. Membership Rewards transfer to around 20 hotel and airline programs including Delta, Singapore, British Airways, and Virgin America.

The card has a $475 annual fee in the first year. But, like the Citi Prestige® Card, it comes with huge benefits like airline fee reimbursement, airport lounge access, and hotel status. If you paid $3,000 worth of your bills with it via Plastiq, you’d be paying $75 for 78,000 Membership Rewards. I value Membership Rewards at 2 cents each, so that’s like buying $1,560 for $75.

Citi® / AAdvantage® Executive World Elite™ MasterCard®

This card is similar to the Citi Prestige® Card in that in comes with many benefits that help offset the cost of the steep annual fee. If you spend $5,000 in the first three months after you open it, you get 60,000 American Airlines miles. If you paid $5,000 in bills via Plastiq on it, you’d be buying 65,000 American Airlines miles for a processing fee of $125. I value American Airlines miles at 1.5 cents each, so that sign up bonus along with the miles you earn to get it is worth about $975 to me.

While this isn’t the biggest return from a sign up bonus, people with a lot of bills to pay should consider it from the angle of meeting this card’s yearly spending threshold if status with American Airlines is something you’re eyeing. Spend $40,000 in a year and get 10,000 Elite Qualifying Miles, which will send you on your way to earning status with American Airlines.

Application Link: Citi® / AAdvantage® Executive World Elite™ MasterCard®

Bottom Line

Nearly any bill that you couldn’t pay before on a credit card you now have the opportunity to pay via Plastiq.com. It costs 2.5% for any MasterCard, Visa, or American Express payments. I would definitely use Plastiq to help meet minimum spending requirements, as that provides extremely fruitful returns. I would not use Plastiq for everyday spending, since it is difficult to get enough value out of your miles to make up for the 2.5 cent charge on every dollar.

Just getting started in the world of points and miles? The Chase Sapphire Preferred is the best card for you to start with.

With a bonus of 60,000 points after $4,000 spend in the first 3 months, 5x points on travel booked through the Chase Travel Portal and 3x points on restaurants, streaming services, and online groceries (excluding Target, Walmart, and wholesale clubs), this card truly cannot be beat for getting started!

Editorial Disclaimer: The editorial content is not provided or commissioned by the credit card issuers. Opinions expressed here are the author’s alone, not those of the credit card issuers, and have not been reviewed, approved or otherwise endorsed by the credit card issuers.

The comments section below is not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser’s responsibility to ensure all questions are answered.

Hey Scott,

Thanks for reminding us about this service. It is probably one of the best ways right now to get that spend done.

If a few of you wouldn’t mind using my link, I’d be very appreciative.

https://try.plastiq.com/396868

Nice writeup. I have two mortgages, so I love Plastiq for minimum spends as an easy alternative to the busywork of buying gift cards and money orders.

How long have you used it? Is it reliable?

I did sign up but just want to make sure. I agree that this would be a hassle free way to make min. spend on credit cards.

John–I haven’t had any problems. The site is easy to use. The only caveat is that payments can be a little slow. So you need to keep your due dates in mind and initiate the payment at least a week in advance.

Sign up under my link below and you will get $200 of FFD. https://try.plastiq.com/398992

For every person who registers with Plastiq via your referral link and makes a payment of at least $20, you’ll get 400 Fee Free Dollars and that person will get 200 Fee Free Dollars as well.

https://try.plastiq.com/398992

I’ve used the service to pay house painter, tuition, and babysitter? Works with no issues.

Please use my referral link

https://try.plastiq.com/410873

Plastiq service so far is reliable.. the mortgage payment takes about 5-7 days. The utility payments surprsingly takes 4-5 days. I still send the payments 15 days before the payment due date just in case.

The credit card rewards help decrease the fees a lot (using my Citi Double cash back CC 2%!)

If you are a new applicant, I would greatly appreciate it if you’d kindly use my referral link and you will get $200 fee-free dollars.

https://try.plastiq.com/473671

Thank you 🙂

[…] is another way to pay your rent with a credit card, and their everyday fee is 2.5%. This could be worth it sometimes, but if you have an Android device (or a trusted friend who might let you download RadPad and pay […]

[…] making up a portion of minimum spending requirements? I’m sure you’re not the only one. Plastiq, an online bill payment processor, has stepped in turn Radpad’s lemons into their own […]

Just wish I could get a cash back card that worked with Plastiq. I figured today I could put about 76,000$ on Plastiq. Sure would be nice if they gave a discount for more spend using their service.

Thanks for the post. Here is my referral link. I will appreciate it if anyone use mine. https://try.plastiq.com/529417

I would appreciate you using my link. Here is my link for plastiq referral.

https://try.plastiq.com/518063

If you’re looking for a promo that is current and won’t expire with Plastiq use my referral link: https://try.plastiq.com/390735

You will save $200 fee free by signing up. I pay my mortgage, but there are tons of other things you can pay and earn CC rewards and points.

[…] We value them at 2 cents each, so to us, paying a 2% fee to earn them is like breaking even. Read Is Plastiq Worth It? Paying Your Bills Online with Credit Cards to Earn Miles to learn […]

I would appreciate you using my link. Here is my link for plastiq referral. Open an account and get $200 fee free dollars.

https://try.plastiq.com/373722

All the plastiq transactions have gone smoothly except when trying to unload gift cards.

Plastiq is running an American Express cards promo at 2% fee until Feb 28, 2017, good time to try out your first payment.

If anyone interested in signing up, you can use my referral link.

https://try.plastiq.com/453087

Plastiq has been working great for me. So far I’ve payed a few thousand on my mortgage and have also done utilities. right now they’re offering only 2% fees on Amex and 1.75% fee on paying your taxes (that’s cheaper than the IRS’s 1.87%).

Here is my referral link and if you spend at least $20 (they charge a $0.50 fee), you get $200 fee free dollar credit. Here’s the link and feel free to ask me if you have any questions:

https://www.plastiq.com/cardholder_ui/start?referralCode=533212

My code is the number at the end, 533212.

Thank You!

ps I’m trying to satisfy a promotion that if I get 10 referrals, I get $5000 Fee Free Dollars, so I’d be EXTREMELY grateful for everyone who signs up! Thank you in advance!

I’ve used Plastiq to pay my mortgage and rent and have had no issues. Best way to meet credit card spend requirements.

Current Promo: Make a payment of $100 or more in plastiq with my referral and we both get $2500 in no fee payments.

Here is my link https://try.plastiq.com/453087.

Any business cards would qualify for the promotion.

Details:

Refer any business with your unique code, and when they make a payment of at least $100 by March 31, 2017, both of you earn 2,500 fee-free dollars.

That means you can pay $2,500 worth of bills without the Plastiq fee.

I have 6 cards using Plastiq right now for minimum card spend. The fee is just part of the deal when getting 50,000 miles. When not going for a minimum spend I use my ATT More card to get 3x Thankyou points.

New Plastiq Promotion:

Get 2,500 FFDs ($2,500 of payments with no fees, i.e. Fee Free Dollars, FFDs) when you sign up with the link of someone who has been targeted. I was targeted and the requirements are that you sign up with my link and make a payment of at least $100 by the end of March to get the 2,500 FFDs. Referral and details below:

https://www.plastiq.com/cardholder_ui/start?referralCode=533212

My code is the number at the end, 533212.

Info from Rep I chatted with: users must sign up with your code, enter a business credit card for payments and make a payment with that card to earn the credits that will be manually applied within a business day.

[…] Is Plastiq Worth It? Paying Your Bills Online with Credit Cards to Earn Miles to learn who and what you can and cannot pay via […]

Currently Plastiq is running a promo where you will earn $400 in fee-free dollars after making at least $20 in payment.I have recently tried out using the credit card and it works pretty smoothly.

If anyone interested in signing up, you can use my referral link, the promo runs until April 28.

https://try.plastiq.com/400961

There is a new promo from Plastiq where you will earn 500 fee free dollars after making $500 of payments.

If anyone interested in signing up, you can use my referral link.

https://try.plastiq.com/400961

[…] Is Plastiq Worth It? Paying Your Bills Online with Credit Cards to Earn Miles to learn who and what you can and cannot pay via […]

There is a new promo from Plastiq where you will earn 500 fee free dollars after making $500 of payments.

If anyone interested in signing up, you can use my referral link.

https://try.plastiq.com/518063

or Referral code: 518063

I plan to be using this on $50k mortgage payment on a new home. Will let folks know whether it works.

In the meantime, feel free to use my referral so you can get $500 and I can get $1000 off my mortgage fee payment.

Link: https://www.plastiq.com/cardholder_ui/start?referralCode=725416&utm_medium=twitter

Referral Code: 725416

[…] Unless you have a specific issue with Plastiq (let us know in the comments your experiences), I’d say it’s the cheapest and easiest online credit card processor for paying rent and mortgage through. You can also pay other bills on Plastiq. Read more about what you can and can’t pay for in Is Plastiq Worth It? Paying Your Bills Online with Credit Cards to Earn Miles. […]

[…] Read Is Plastiq Worth It? Paying Your Bills Online with Credit Cards to Earn Miles to learn who and what you can and cannot pay via Plastiq. […]

[…] Plastiq offers discounted fees (for example, 1.75%) for paying your taxes with a specific kind of credit […]