MileValue is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

Note: Some of the offers mentioned below may have changed or are no longer be available. You can view current offers here.

The Hilton HHonors Signature Card’s (the one that earns points) sign up bonus has expired. Click here for the top current sign up bonuses.

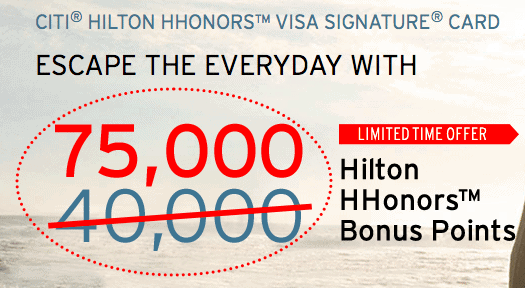

Until 5 PM ET (today, April 1), the Citi® Hilton HHonors™ Visa Signature® Card offers 75,000 bonus HHonors points after spending $2,000 on the card in the first three months. This is enough points for 15-18 free nights at Hilton Category 1 hotels.

Hilton points can be redeemed at all of the following brands.

This is the biggest sign up bonus ever offered on a no-annual-fee Hilton card.

The Citi® Hilton HHonors™ Visa Signature® Card comes with automatic Hilton Silver status, which earns a 15% points bonus on Hilton stays, late checkout, and free access to fitness centers. Plus only folks with Hilton status get the 5th night free on award stays.

Better yet, if you complete four Hilton stays in the first 90 days of card membership, you get bumped up to Hilton Gold status, which earns a 25% points bonus on Hilton stays and maybe a little better treatment at the front desk.

And any year in which you spend $1,000 at Hilton hotels, you will get 10,000 more Hilton points.

After meeting the minimum spending requirement, you’ll have at least 79,000 Hilton points (more if you use the card’s category bonuses discussed below.) Eighty thousand points are enough for 20 free nights in a Hilton Category 1 hotel, 10 free nights in Category 2 Hiltons, or 5 free nights in Category 3 Hiltons. I stayed at an awesome DoubleTree in Kuala Lumpur that was a Category 2 Hilton.

The last big benefit of the card is that it has no annual fee. Very few rewards cards with no annual fee offer so much.

Sign Up Bonus

The Citi® Hilton HHonors™ Visa Signature® Card has a sign up bonus of 75,000 bonus points after spending $2,000 in three months on the card.

Seventy-five thousand points won’t get you even one night at a top tier Hilton, but it will get you up to 15 nights at the bottom categories, which have some gems. Super reader Jeremy has created the most valuable spreadsheet imaginable for the Hilton HHonors program that you can download for free here.

The spreadsheet lists:

- all 34 Category 1 hotels: 5,000 points per night

- all 131 Category 2 hotels: 10,000 points per night

His spreadsheet is sortable by city, state, country, or hotel name (which often starts with the hotel brand.) This can be very useful if you want to know if there is a Category 1 or 2 Hilton on the route of your next trip.

Perks

The Citi® Hilton HHonors™ Visa Signature® Card comes with Silver Status and the chance to earn Gold Status with four paid Hilton stays in the first 90 days.

Spending

There are category bonuses for Hilton stays, supermarkets, drugstores, and gas stations though none of them impresses me much.

- Earn 6 HHonors Bonus Points for each $1 spent at any participating hotel within the Hilton HHonors portfolio.*

- Earn 3 HHonors Bonus Points for each $1 spent on purchases at supermarkets, drugstores and gas stations.*

- Earn 2 HHonors Bonus Points for each $1 spent on all other purchases.*

Plus you get 10,000 bonus points any year in which you spend $1,000 or more at Hilton hotels.

Annual Fee and Foreign Transaction Fee

The Citi® Hilton HHonors™ Visa Signature® Card has no annual fee ever. For a card that gives you ongoing status, that’s unbeatable.

The card does charge a 3% foreign transaction fee, so never use it abroad.

Full Offer

The “regular” Hilton card is not for everyone. It should not be the card onto which you put all your spending. It shouldn’t be the card you get for the biggest sign up bonus.

However it is ideal for folks who want a no-annual-fee card that rewards their loyalty to Hilton.

Just getting started in the world of points and miles? The Chase Sapphire Preferred is the best card for you to start with.

With a bonus of 60,000 points after $4,000 spend in the first 3 months, 5x points on travel booked through the Chase Travel Portal and 3x points on restaurants, streaming services, and online groceries (excluding Target, Walmart, and wholesale clubs), this card truly cannot be beat for getting started!

Editorial Disclaimer: The editorial content is not provided or commissioned by the credit card issuers. Opinions expressed here are the author’s alone, not those of the credit card issuers, and have not been reviewed, approved or otherwise endorsed by the credit card issuers.

The comments section below is not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser’s responsibility to ensure all questions are answered.

Would you consider Hilton a pet friendly hotel in comparison to Marriott Starwood IHG or Hyatt.

No opinion. Never traveled or looked into it.

If the offering is this high it can only mean that a devaluation is not too far behind

They had a big one of those a few years ago. I think for now their devaluations will be small by moving more hotels up a category than down a category. But that’s just my educated guess.

Can these points be combined with the Amex HH offer?

Yes, I will write about that soon.

Wondering how to search the spreadsheet from Jeremy

Does Hilton have black-out dates on using points or can you get any available room? (thinking category 1 and 2) Also do the points expire? Thanks!

Hilton points do NOT have blackout dates. Whenever a standard room is for sale, you can book it with points.

Points expire after 12 months of inactivity. But if you earn or redeem a single point, that 12 month clock restarts, so it’s trivially easy to make sure your points don’t expire.

Does the $1000 spend at Hilton have to be charged on this credit card to get the 10,000 point bonus? It does not say this explicitly, but I have a feeling you do. But then again, they can track the $1,000 via Hilton directly to post the bonus.

Having this card and charging as normal on Prestige for 4th night or Reserve for 10X while getting 10,000 annual bonus points will be nice.

Yeah, I don’t see one way or the other, but I’d guess the $1,000 has to be on the card.

Got denied for this card. Called reconsideration and got denied again. Something about too many applications. I got the Citi Prem. on Jan. 4, Citi Prestige on Feb. 9. Those are 37 days apart. I would have thought that applying in late March for the Citi Hilton would be 85 days after 1st card, but turned down on day 50 after the 2nd card.

My ficos are >800, so I am confused about what I should expect. Any suggestions?

That is surprising. You can call back or write a letter.

Called again today and while it was debatable whether or not I was inside or outside of the 1,9,66 rule they did go ahead and approve the card. The lady on this call today was 10x nicer than the lady the other day. Therefore multiple calls is a good thing. Thanks for the advice.

I got instant approval. Didn’t even have to call.

I’ve got several Hilton stays planned in the next few months so the bonus and Gold should be easily achieved.

Fantastic!

I have two of these already and got an instant approval. :-). Thanks

Enjoy!

Wife calls to see why she was denied. Apparently, they count denied applications as part of the 1, 8, 66 day rules. She was approved early Feb. for Citi Thankyou, but otherwise no recent Citi cards. They said too many applications since then and was denied. She will try another call after school today. I just got approved for the Amex Hilton which is at 100K today.

[…] For more information on maximizing Hilton points–the key strategy is to book hotels in Categories 1-3 because free nights in higher Categories cost a ton of points–see this post. […]