MileValue is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

Note: Some of the offers mentioned below may have changed or are no longer be available. You can view current offers here.

The Hilton 75k offer has expired. For the current top offers, click here.

————————————————————————-

The wording of the terms and conditions for Citi credit card sign up offers has changed. Now you are only eligible to earn a sign up bonus if you haven’t opened or closed a card from the same type (brand or co-brand) within the last 24 months. This is significantly different from the prior rule which only restricted you to earning a sign up bonus on a card 24 months after you opened or closed the same card.

Example of New Rule

Let’s say you opened a Citi® Hilton HHonors™ Visa Signature® Card seven months ago. That means for the next 17 months (a full 24 months after you opened it) you are not eligible for the sign up bonus from the Citi® Hilton HHonors™ Reserve Card, the other Hilton co-branded card issued by Citi. If you close that Citi® Hilton HHonors™ Visa Signature® Card, the 24 month clock will start over again and you won’t be eligible for any other Citi Hilton cards for 24 months past the date you closed it.

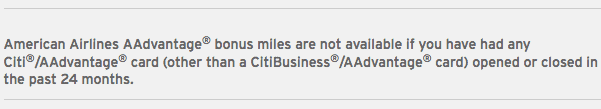

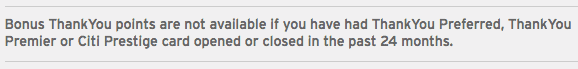

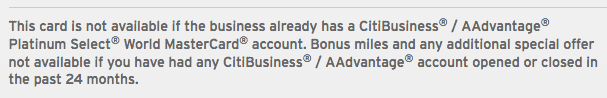

Take a look at the following screenshots from the terms for the various reward earning Citi cards to see further examples of the new rule. If a card earns the same kind of reward currency as another card, then they’re the same type. Click on the screenshots to see any of them enlarged.

Hilton HHonors

Citi Hilton cards:

- Citi® Hilton HHonors™ Visa Signature® Card

- Citi® Hilton HHonors™ Reserve Card

American Airlines (AAdvantage)

Citi American Airlines cards:

- Citi® / AAdvantage® Executive World Elite™ MasterCard®

- CitiBusiness® / AAdvantage®Platinum ® World MasterCard®

- Citi® / AAdvantage® Platinum Select® World MasterCard®

- Citi® / AAdvantage® Gold MasterCard®

ThankYou Points

Citi ThankYou Points cards:

What about business cards?

Thankfully business cards are treated differently by the new rule, at least for now. When you last opened or closed a personal Citi card doesn’t have an impact on your eligibility for the sign up bonus on a business card. When you last opened or closed the same business card does follow the 24 month rule though.

Example: even if you have opened or closed a Citi AAdvantage personal card in the last 24 months, you can still get the sign up bonus on the Citi AAdvantage business card– as long as you haven’t opened or closed the Citi AAdvantage Business card in the last 24 months.

Bottom Line

This is not good news for churners, albeit not too surprising considering the tightening of rules across the board. Citi changed its 18 month clock for repeat sign up bonuses to 24 months back in April, Chase has 5/24, and Amex has the once in a lifetime bonus rule.

If you have signed up for or closed a Citi card in the last 24 months and were considering another, beware if they share the same brand or co-brand. You must wait 24 months after opening or closing a Citi card to be eligible for another Citi card of the same type’s sign up bonus.

Feel free to share your questions and comments below.

Just getting started in the world of points and miles? The Chase Sapphire Preferred is the best card for you to start with.

With a bonus of 60,000 points after $4,000 spend in the first 3 months, 5x points on travel booked through the Chase Travel Portal and 3x points on restaurants, streaming services, and online groceries (excluding Target, Walmart, and wholesale clubs), this card truly cannot be beat for getting started!

Editorial Disclaimer: The editorial content is not provided or commissioned by the credit card issuers. Opinions expressed here are the author’s alone, not those of the credit card issuers, and have not been reviewed, approved or otherwise endorsed by the credit card issuers.

The comments section below is not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser’s responsibility to ensure all questions are answered.

Scott, Within the last year I have opened and closed the Citi Aadvantage Gold card. If I now want to get the Citi Aadvantage Platinum, will I be denied since it falls in the same brand?

If I apply for the Citi Aadvantage Bus. card, will that rule still apply to this card?

They are in the same card family (both co-branded with American Airlines) so you won’t be eligible for the sign up bonus. You could still get approved for the card, this new rule only applies to eligibility for sign up bonuses.

You can still get the sign up bonus on the AAdvantage Business card. When you last opened or closed a personal Citi card doesn’t have an impact on your eligibility for the sign up bonus on a business card.

As you said, not too surprising. I don’t really app new cards at a rate high enough to be affected by this, but with rules tightening across the board, it does make decisions more complicated. The puzzle is getting more and more pieces all the time.

I use news like this to motivate my friends who are sitting on the sidelines to get in the credit card game! It’s not getting any easier, so why wait!

[…] are only eligible to earn a sign up bonus if you haven’t opened or closed a card from the same type (brand or co-brand) within the last 24 months. For example, Let’s say you opened a Citi® Hilton HHonors™ Visa Signature® Card seven months […]

Scott, do you know when this rule will take effect?

We had closed my wife’s AA card several months ago. She kept getting those mailers from Citi showing that if she would sign up using the url they provided she would get 50K added to her total. We applied, she got approved, so time will tell if she does get those points or not. I also applied for the Platinum which I had not had and I am hoping to get those miles added. Planning on going to Copenhagen next June for a Baltic cruise. It looked as if Bus. Saver is wide open and looks like we avoid those nasty fuel charges by flying into Copenhagen even though plane lands in Heathrow and we change to another plane. Would that be your understanding also?

Quynh, it’s already in effect as it’s part of all the cards listed above’s terms and conditions.

[…] to consider Citi’s new sign up bonus rule before applying for this card: you are only eligible to earn a sign up bonus if you haven’t […]

[…] you might already know, the wording of the terms and conditions for Citi credit card sign up offers has changed and now you are only eligible to earn a sign up bonus if you haven’t opened or closed a card from […]

[…] Updated 9/20/16 with consideration of Citi’s new sign up bonus rule. […]

[…] considering Citi’s new sign up bonus rule that you’re only eligible for one sign up bonus per brand per 24 Months, it’s important […]

[…] due to Citi’s new sign up bonus eligibility rule, you cannot pursue both of the strategies outlined above […]

[…] Eligibility: subject to Citi’s new sign up bonus rule […]

So if I already have this Citi Aadvantage card that has been open for a year, is it better to close it (which would reset the 24 month clock for another sign up bonus) OR keeping it open for another year, in which case I would reach the 24 month period sooner, but I would already have this card, so would I be able to apply for another card if I already have this card? I had called to cancel this card to avoid paying the annual fee, but they offered to refund the fee, so I did not close it. This is my dilemma, and I would appreciate any advice.

It seems to me the best strategy for maximizing bonuses on 2 cards in the same family is to open a card, followed immediately after by closing another card…and repeat, every 2 years. For example, if Anne has the Aadvantage Gold for a year, she should keep it for another year, and then open the Aadvantage Platinum, followed immediately after by closing the Gold. Then 2 years later, open the Gold, followed by closing the Platinum.

[…] PROS -> You’re off the hook for another annual fee, and you start the 24 month clock of being able to get the sign up bonus on a Citi ThankYou card again. […]

[…] Eligibility: subject to Citi’s sign up bonus rule […]

[…] are only eligible to earn a sign up bonus if you haven’t opened or closed a Citi card from the same type (brand or co-brand) within the last 24 months. Luckily Business cards are considered separate for the purposes of this rule, so if you’ve […]

[…] Eligibility: subject to Citi’s sign up bonus rule […]

[…] At least closing a Sapphire-branded card does not re-start the 24 month clock like it does with Citi cards, which fall under the jurisdiction of a similar rule. […]

[…] or I recognize…at least for those of cut off by things like the Chase 5/24 rule, Citi’s new sign up bonus rule, or Amex’s one bonus per product per lifetime […]

I have Both cards now so at 11 months Cancel the Bus card and Keep the personal Card .That way u can get the 10 percent Rebate ..CORRECT ?

THANK YOU

CHEERS

Yep, unless you want to get the citi aadvantage personal card again in the future. In that case it would be better to go ahead and close to get 24 month clock running.